- The recent crypto crash will likely have the same effect as that of Covid-19 crash.

- Will the FED reduce rates as many analysts have anticipated?

As a seasoned analyst with over two decades of experience navigating various financial crises and market cycles, I find the recent crypto crash reminiscent of the tumultuous times we faced during the Covid-19 pandemic. History has shown us that such periods often present unique opportunities for long-term gains if one remains calm and strategic in their approach.

Kyle Chasse, a well-known market expert at X, recommends investors to remain calm amidst the recent collapse of the cryptocurrency market.

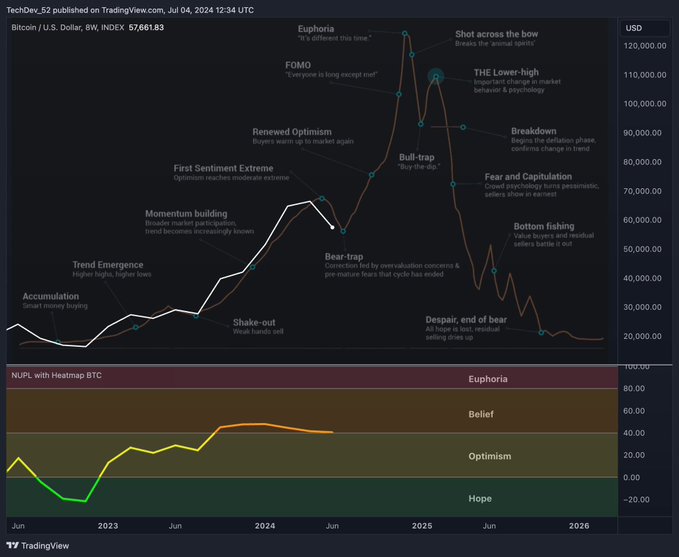

He pointed out that the NUPL indicator, which tracks Bitcoin [BTC] sentiment, still shows the market is in the belief stage, indicating we haven’t reached the exit point.

Chasse underscored that investors should not shy away from prospective long-term profits, as the current market situation merely constitutes a bear trap. He suggested that the recent market plunge might pave the way for an imminent upturn.

Will the latest crypto crash have the same effect as that of Covid 19?

In the last day alone, the recent market downturn has resulted in approximately $1 billion being wiped out from the value of cryptocurrencies, making it one of the most challenging days for investors in this sector.

The recent incident bears a striking resemblance to the one observed in 2019-2020, which unfolded amidst the COVID-19 pandemic and subsequently led to a bull market in 2021. The parallels are notable, suggesting a possible investment opportunity for keen observers.

Another factor that suggests now is the right time to buy bitcoin and other cryptocurrencies.

Big players capitalize on Fear and Greed Index

As a crypto investor, I’ve noticed that the uncertainty surrounding potential global conflicts has indeed stirred up instability within traditional financial markets. However, within our crypto community, there’s a growing belief that the recent market downturn might be primarily driven by concerns about an impending recession rather than geopolitical tensions.

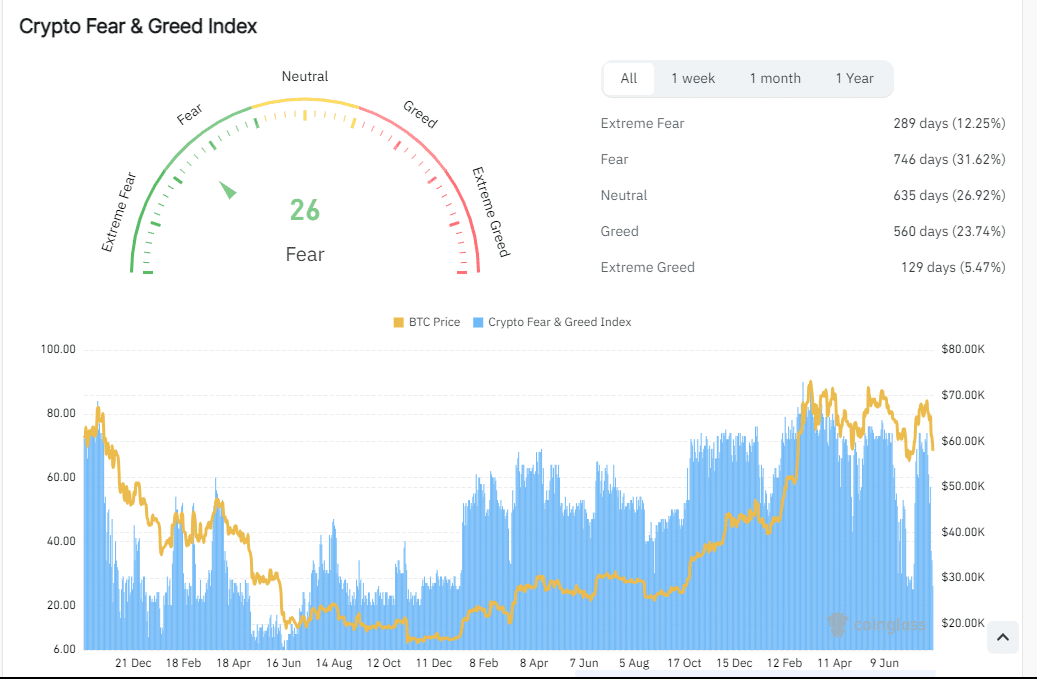

At the point of this writing, the Fear & Greed Index stood at 26, suggesting that large financial entities might be buying stocks at current low prices, planning to sell once the market reaches its peak.

In simpler terms, this implies that this opportunity might be your final chance to add investments in your cryptocurrency holdings, as prices are expected to rise.

Impact of FED cutting interest rates

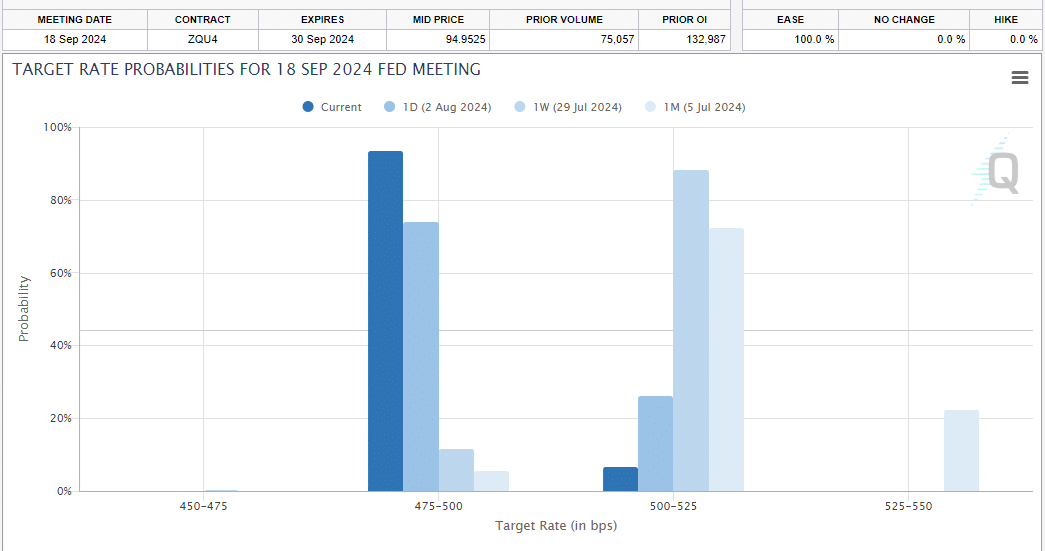

As a crypto investor, I’m keeping an eye on the upcoming decision by the Federal Reserve in September. Based on the data from Fedwatch, there’s a high probability of around 93.5% that interest rates will be reduced then. This potential move could have significant implications for my investment strategies, so I’ll be monitoring the situation closely.

Based on a substantial decline in Japan’s stock market, this forecast implies that if the Federal Reserve reduces interest rates, it might bring stability to the financial markets and potentially boost assets such as cryptocurrencies.

In this market cycle, investing now could mean significant future profits because the current state might be nearing the bottom, paving the way for a potential rebound.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-08-06 14:15