- US Treasury Secretary Janet Yellen has said that the US economy is healthy and there are no signs of a recession.

- The crypto market has recovered slightly, with Bitcoin reclaiming $54,000.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous economic cycles and bullish and bearish trends. Observing the current state of the US economy and the crypto market, I find myself somewhat cautiously optimistic.

At the moment of reporting, the crypto market is experiencing modest increases. All of the leading ten cryptocurrencies are currently being traded at a profit, but unfortunately, they haven’t yet reached their peak values for this week.

Bitcoin (BTC) has rebounded over $54,000 following a modest 0.6% increase in the past 24 hours. Similarly, Ethereum (ETH) has risen by 1.3%, currently trading at approximately $2,290 as of this writing.

Among the top ten biggest cryptocurrencies based on market capitalization, Dogecoin [DOGE] saw the highest increase at 2.6%.

The recent rebound comes after US Treasury Secretary, Janet Yellen, said the US economy was healthy and “deep into a recovery.”

On the weekend, Yellen spoke at the Texas Tribune Festival, addressing worries stemming from last week’s underperforming employment report. The number of non-agricultural jobs added was lower than anticipated.

As an analyst, I’m reporting back on the recent statement made by Yellen. Instead of “red lights flashing,” she emphasized a sense of caution wasn’t necessary at this moment. The jobs data, according to her, indicates a smooth transition, or what’s often referred to as a soft landing, rather than a full-blown recession.

In my exploration of the cryptocurrency realm, I’ve noticed a significant response sparked by my comments, originating from the crypto community. As per Arthur Hayes, co-founder of BitMEX, it is predicted that Yellen may resort to inflationary practices, such as money printing, to revitalize the economy.

According to Hayes, if the markets continue to decline, Janet Yellen, often referred to as “Bad Gurl,” is keeping a close eye, and it’s likely that she will respond by increasing the money supply. In simpler terms, he suggested that Yellen might print more money to help stabilize the markets.

Engaging in such an activity might lead individuals to invest in high-risk assets, such as cryptocurrencies, due to the heightened risks of inflation associated with increased money printing.

Bitcoin is not out of the woods… yet

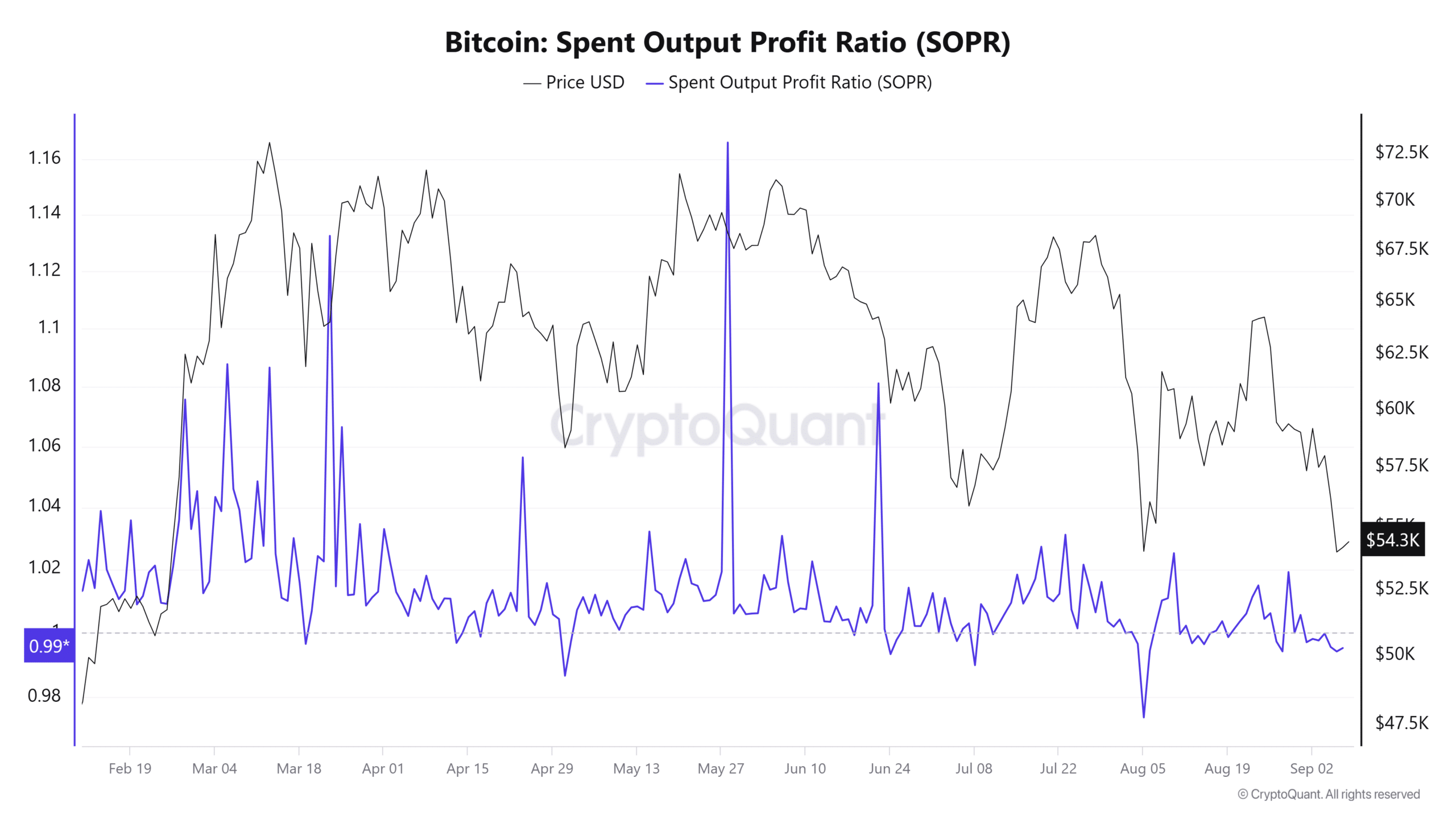

Despite the recent gains, the BTC price still shows signs of struggling. Since the start of the month, the Bitcoin Spent Output Profit Ratio (SOPR) has failed to shift above 1.

This metric shows that the average investor has been selling BTC at a loss over the past week. Such loss-taking activity indicates a bearish sentiment and market distress as investors panic and trim losses.

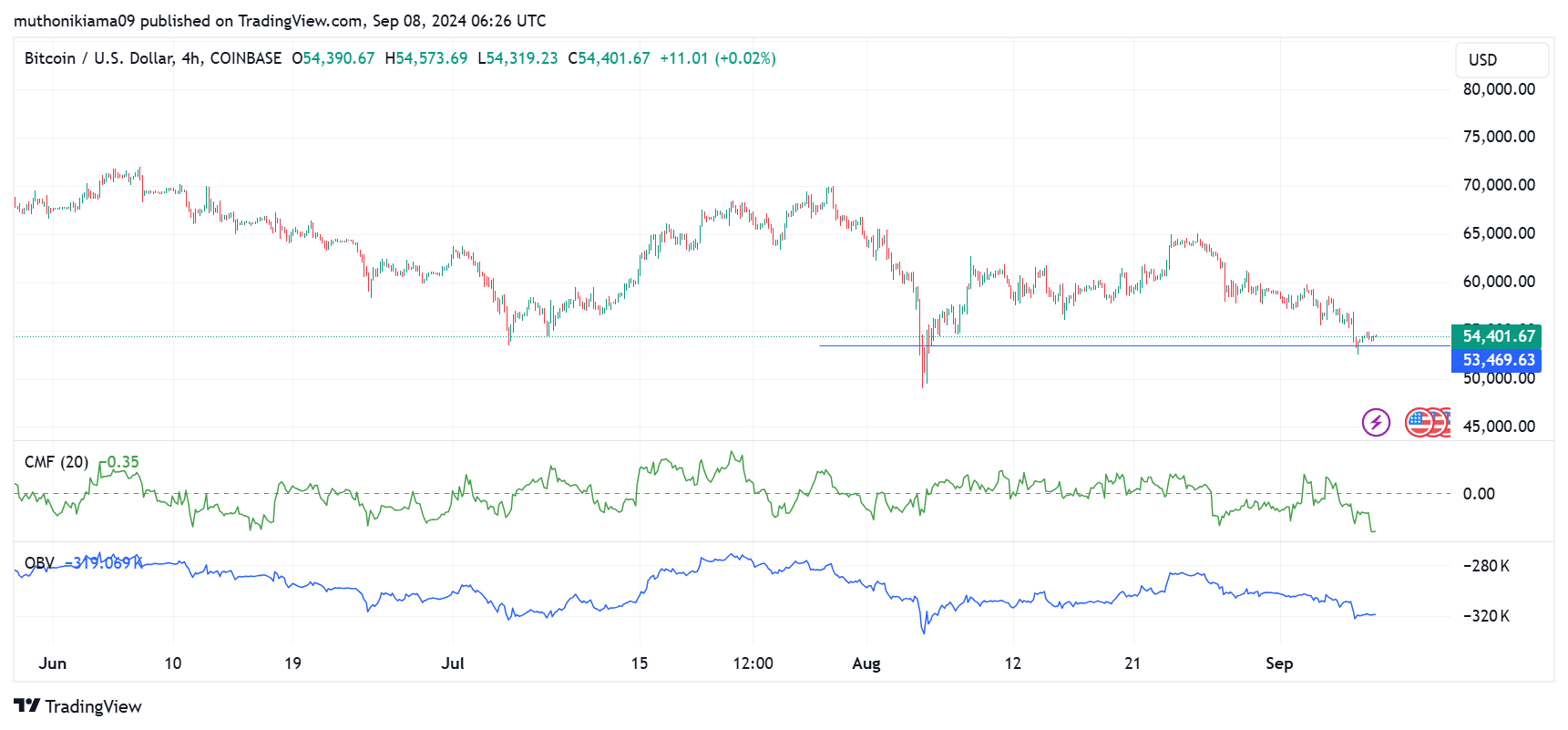

The buying momentum stays weak, as indicated by the Chaikin Money Flow (CMF) indicator, which was showing a negative value currently. Furthermore, this index has been forming lower lows and is now at its lowest point since June, according to the four-hour chart.

The prevailing bearish sentiment was also seen in the On Balance Volume (OBV), which remains predominantly negative. This trend shows market weakness as selling volumes dominate, exerting downward pressure on BTC prices.

Despite that, Bitcoin (BTC) could potentially offer a great opportunity for entry if it has indeed touched the strong support level of $53,469. Previously, when BTC reached this support level, it saw a 8% increase in value.

It is crucial to note that buyers might remain hesitant as they await the release of the US Consumer Price Index (CPI) data on 11th September.

As an analyst, I’m anticipating that the August inflation rate will likely be around 2.6%. If the Consumer Price Index (CPI) aligns with or falls below this projection, it could signal a potential upturn for the crypto market. On the flip side, if the data continues to suggest a struggling US economy, we might observe further declines in crypto prices.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-08 15:03