-

Bitcoin has held firmly above $60K since mid-July.

Several positive catalysts are lined up. Will BTC climb higher?

As a seasoned crypto investor with years of experience in this volatile market, I have witnessed numerous price swings and catalysts that have shaped Bitcoin’s [BTC] trajectory. The recent holding of BTC above $60K since mid-July has been a relief after the sudden dip below that level due to former President Trump’s attack on Bitcoin.

As a Bitcoin investor, I’ve noticed that after hovering around the $60,000 mark during the first half of July, the cryptocurrency managed to regain the significant psychological level and previous support zone of $60,000-65,000. This rebound can be partly attributed to the market reaction following former President Trump’s comments about Bitcoin being a “disaster” earlier in the month.

The mid-week rebound continued strongly, registering over 8% growth, but encountered resistance just above $65,000. At the time of reporting, the rally had lost momentum and dipped below $64,000.

‘Trump trade’ to boost Bitcoin?

Charles Edwards, the founder of Capriole Investment, a crypto hedge fund, explains that Bitcoin’s price halted around $65,000 due to the decline in NASDAQ’s price. In simpler terms, the drop in NASDAQ’s value is believed to have caused Bitcoin to stop advancing at that level according to Edwards.

Bitcoin has experienced a price decrease lately, following the downturn in the NASDAQ. However, the NASDAQ’s decline is due to anticipated monetary easing and a plateau in AI earnings. The AI earnings trend doesn’t affect Bitcoin, while the monetary easing could potentially be bullish for Bitcoin.

The NASDAQ index places significant emphasis on technology companies’ shares. Yet, there have been indications that investors are shifting their funds from major tech stocks towards small-cap stocks in anticipation of a potential Trump presidency victory. This trend has been referred to as the “Trump trade” by financial analysts.

Based on certain market experts’ perspectives, Trump’s favorable attitude towards cryptocurrencies may strengthen the optimistic outlook for Bitcoin. For instance, QCP Capital analysts considered Trump’s vice presidential nominee, J.D. Vance, as a potential beneficial factor for Bitcoin.

If Trump selects J.D. Vance as his running mate, it could add another encouraging influence. Notably, Vance owns Bitcoin (BTC). We anticipate that he would advocate for favorable crypto regulations should Trump secure the presidency.

The company announced that the imminent debut of the Ethereum [ETH] Exchange-Traded Fund (ETF), slated for the 23rd of July, serves as an additional encouraging factor. Furthermore, on-chain data supports this optimistic perspective.

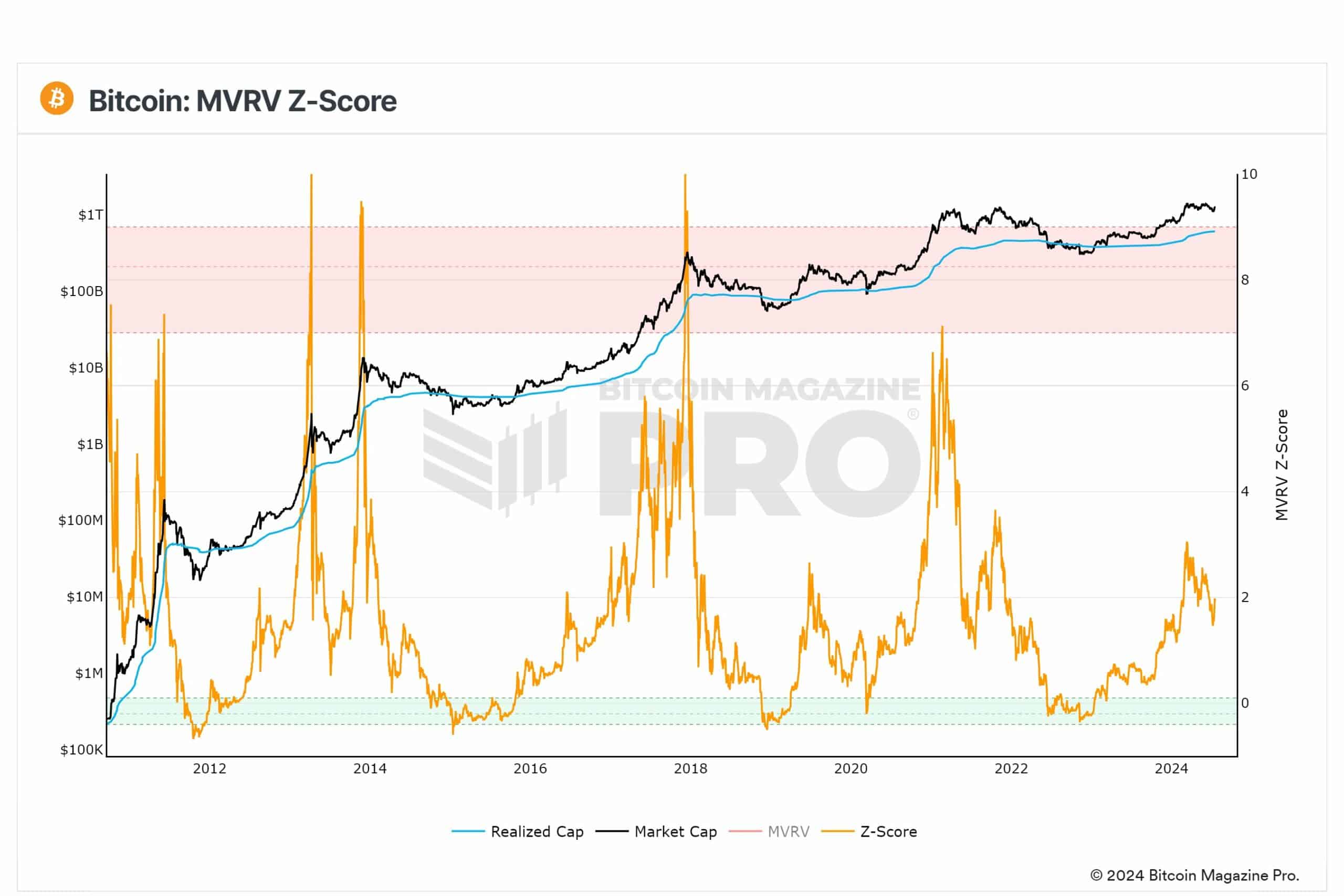

MVRV-Z score signal more upside potential

Philip Swift, the founder of Look Into Bitcoin, now known as Bitcoin Magazine Pro, remarked that Bitcoin skeptics were taken aback as the MVRV-Z score made a comeback.

“The MVRV Z-Score is rebounding, signaling that there’s potentially more growth in this bull market. Surprised bears are taking note.”

As a market analyst, I’ve found that the MVRV-Z score, which compares Bitcoin’s market value to its realized value, serves as an effective indicator for identifying potential market tops and bottoms. Its accuracy is evident in having correctly signaled more than seven market peaks and zero market troughs in the past.

At the moment of reporting, the metric hadn’t signaled a market peak despite not showing signs of heating up. This left ample room for Bitcoin to rise further.

On July 19th, approximately $1.8 billion worth of crypto options will reach their expiration date according to Deribit’s data. The level at which the greatest number of option contracts for Bitcoin and Ethereum are expected to be triggered is $62,000 for Bitcoin and $3,150 for Ethereum.

The overall decline of Bitcoin (BTC) and Ethereum (ETH) towards their maximum pain levels was implied, but it wasn’t completely ruled out that they might experience a rebound. This was due to the anticipated launch of the Ethereum ETF coming up in the next week.

Read More

2024-07-19 09:11