On the wide, sun-starved plain where men and machines gnaw at numbers, Bitcoin and its lesser kin staggered and slumped on this bleak August 1. The market, restless as a dog in heat, bit at its own tail as the crypto crash—persistent, sour, maybe even a little hungover—dragged on with all the cheer of dust blowing across a deserted farm.

- Bitcoin couldn’t shake the blues, sliding down Friday like a greased pig at the county fair.

- Top altcoins—SPX6900, Virtuals Protocol, and Pendle—held hands and jumped headlong into the well of market despair.

- Nerves are frayed thanks to trade war jitters—everyone’s favorite after-dinner mint. 😬

Bitcoin (BTC), ornery and red-eyed, dropped below $115,000 with the grace of a broken tractor, a far cry from that July 14th peak when it strutted at $123,000. Top losers, if we must name them (and we must), include SPX6900, Pendle, and Virtuals Protocol—all down ten percent or more. The only thing falling faster is my hope for an early retirement.

Crypto meets Trump’s tariff rodeo (yee-haw!)

Why the glum faces? As the trade war between the U.S. and the rest of the globe lights up like a Fourth of July firecracker, President Donald Trump rolled out tariffs for the unlucky—25% for India, 30% for South Africa, and a massive 39% for Switzerland. (Swiss chocolate now comes with a guilt tax, apparently.)

Sure, trade deals have been whispered with Japan, the EU, and the UK, but the sting of tariffs won’t fade soon. The upshot? U.S. inflation isn’t going anywhere, and Jerome Powell at the Fed gets to keep being the world’s least fun party guest, refusing to cut interest rates. If you thought analysts were optimists before, you should see them now: even their coffee has started to taste like regret.

August: Crypto’s month of sulking

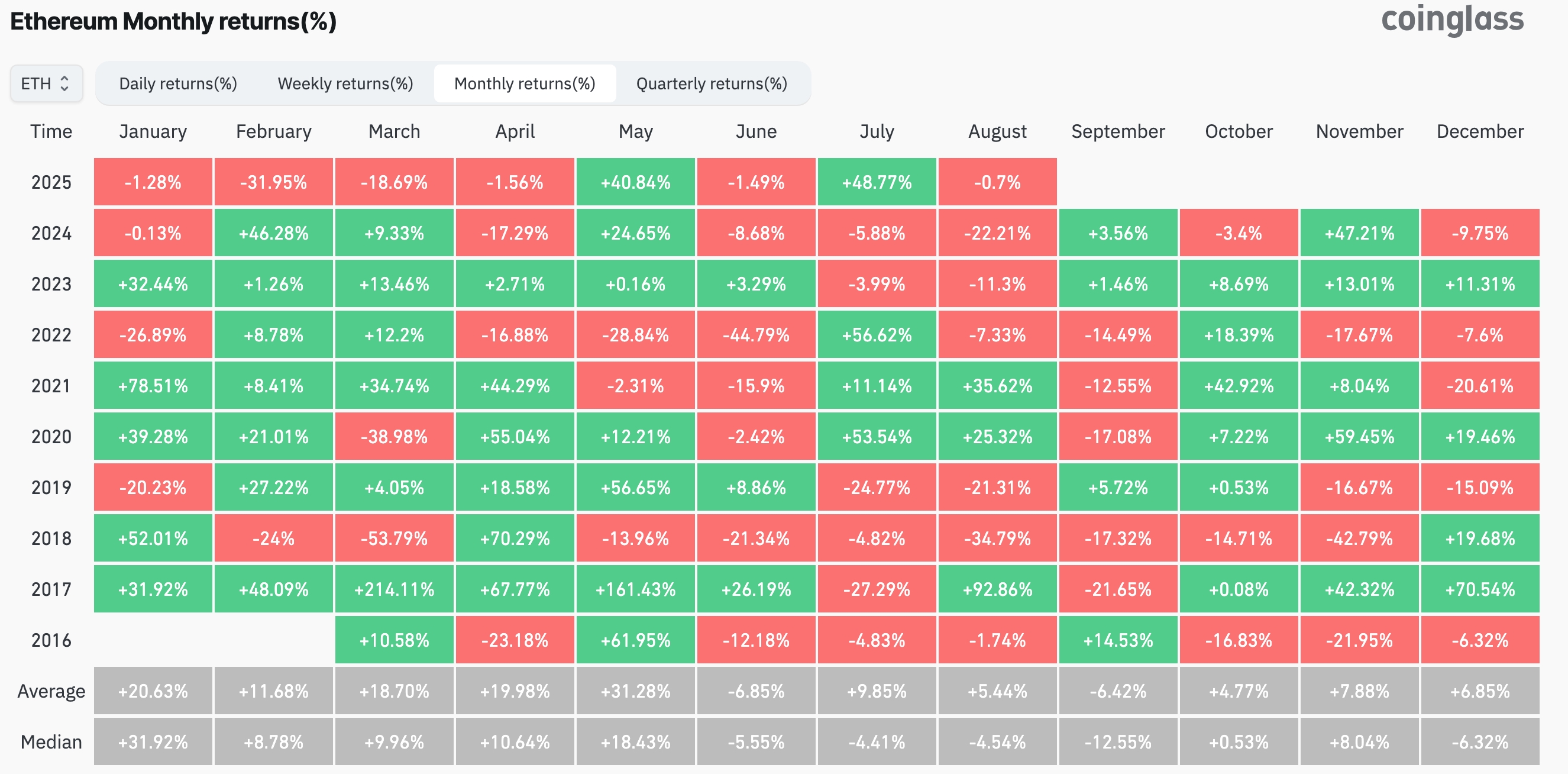

If you think August feels cursed for crypto, you’re not alone. Ethereum regularly weeps into its ledger—down 22% last year, 11% in 2023, and 7.3% in 2022. Average August? A pitiful 5.14%, which is about as comforting as a warm glass of milk left atop a mining rig.

Bitcoin isn’t immune to the summer funk. Down 8.6% this year, 11.2% last, and an unlucky 13.8% before that. Seasonality, however, is as reliable as rain in California—sometimes it happens, sometimes it doesn’t. Remember that March when Bitcoin fell 2.3%? That was after four straight years of springtime cheer. Go figure. 🤷♂️

The Great American Slowdown™

Meanwhile, the U.S. economy appears to be swapping its running shoes for flip-flops. The Bureau of Labor Statistics announced a pitiful 73,000 new jobs and a rising unemployment rate, now standing at 4.3%. A bit reminiscent of that one cousin who spends more time napping than job hunting.

The Fed, never one to sugarcoat disaster, predicted the slowdown as tariffs worm their way through the system. If you thought your crypto wallet felt lighter, try asking Main Street about their pockets. Spoiler: they’re empty, too.

ETF enthusiasm: RIP

This week’s downtrend isn’t just about macroeconomics—turns out, the big money has cooled off, too. According to SoSoValue (a name that inspires great confidence), Bitcoin spot ETFs bled $114 million on Thursday alone. The month’s inflow is a puny $169 million—hardly enough to bribe a congressman—after peaking at $2.7 billion in July’s second week.

Ethereum’s ETFs did no better. They welcomed $306 million, down from $1.85 billion a week prior, and $2.1 billion before that. If institutional interest were a meme, it’d be the one where the dog says, “This is fine,” as his house burns down. 🔥

So, here we are. The market stumbles, investors pocket their winnings like suspicious poker players, and the entire digital gold rush pauses to wonder if maybe, just maybe, they should’ve bought sheep farms instead. But, as with every Steinbeck tale, it’s not over till the dust finally settles—and there’s always the chance of one more twist before the credits roll.

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Inside Prince Andrew and Ex-Wife Sarah Ferguson’s Unusual Relationship

- 🚀 Polygon’s Bullish Revival: Is the Crypto Phoenix Rising from the Ashes? 🤑

- XRP’s Cosmic Dance: $2.46 and Counting 🌌📉

2025-08-01 17:42