- Virtuals Protocol, Aave, and Chainlink were the biggest winners in the past week.

- Dogwifhat, Brett, and Bonk led from the other end of the table as the biggest losers.

Reflecting on this week’s market dynamics, it’s clear that the crypto world continues to be as unpredictable as ever! As someone who has been around the block more than once, I can tell you that the highs and lows we’ve seen are nothing new. But what sets today’s market apart is the sheer number of projects vying for attention – it feels like there’s a new coin or token every other day!

This week, it was Virtual Protocol (VIRTUAL) that stood out among assets, recording a substantial gain of 39.80%. Notably, Aave (AAVE) and Chainlink (LINK) also posted strong performances.

Nevertheless, the week didn’t escape losses entirely. Memecoins, in particular, experienced significant drops and took the brunt of the downturn.

Biggest winners

Virtual Protocol [VIRTUAL]

Last week, Virtual Protocol proved to be the standout performer among assets, experiencing a substantial surge of 39.80%. As reported by CoinMarketCap, this digital asset began the week on an upward trajectory, gaining 2.65%, and was trading near $1.70 at that time.

Between the 11th and 13th of December, the upward trend gathered speed as strong demand propelled the price to reach its highest point at $2.45.

As an analyst, I observed a remarkable spike in the market, which I attribute to robust investor optimism and heightened buying activity. Moreover, this upward trend was significantly bolstered by the escalating trade volume.

By Friday, the price settled at approximately $2.45, showing a small dip of 0.19%, indicating a temporary period where sellers cashed in their profits.

The continuous rise in the trading volume indicates a persistent level of investor enthusiasm. However, it’s currently down by more than 32% from its previous state, standing at approximately $205 million at present.

Aave [AAVE]

Over the last seven days, AAVE saw a significant surge, climbing by approximately 29.5%. Initially, it began the week with a gentle uptick, hovering near $282.85, indicating early bullish tendencies.

On the 12th of December, the trajectory of AAVE’s price significantly changed, experiencing a substantial 21.20% increase that peaked at a weekly high of $367.10. This impressive rise was fueled by robust market demand and escalating trading activities.

Even though AAVE showed robust performance throughout the week, it faced a slight wave of selling near its closing, resulting in a final price of $365.49 – representing a 3.24% decrease.

As a researcher, I’m observing a potential adjustment in price that hints at profit-taking actions, yet it maintains a predominantly optimistic trend. If AAVE manages to stay above the $360 mark, there’s a possibility it could aim for another test of its recent peak. A key level to keep an eye on as potential support is $340.

Chainlink [LINK]

In simpler terms, Chainlink (LINK) ranks as the third-biggest winner over the last week, experiencing a 12.66% surge in value, even amidst volatile market changes.

It kicked off the week with a 5.23% gain, trading around $26.10, signaling early bullish sentiment. However, the price faced a sharp downturn the following day, dropping by 14.57% to a weekly low of approximately $22.

This correction reflected profit-taking pressure but failed to dampen the overall bullish outlook.

On the 12th of December, I witnessed a significant milestone as LINK experienced a noteworthy surge of 21.12%, propelling its value to $29.00.

The swift comeback was also marked by an increase in trading activity, suggesting that investors’ trust and enthusiasm have been restored.

Over the course of the week, the value of LINK settled at approximately $29.11, showing a minor increase and reinforcing its status as one of the leading high-performers in the asset class.

Technically speaking, LINK consistently stays above its 50-day moving average, which functions as a significant foundation point.

As a researcher, I find myself observing the Relative Strength Index (RSI), which currently hovers around 69, indicating it’s approaching overbought territory. This observation prompts a cautiously optimistic outlook towards potential further gains.

The consistent increase in the 20-day Bollinger Bands suggests that market volatility is prolonged, potentially allowing for more upward movement.

Should bulls sustain their push, Chainlink may challenge the $30 psychological barrier as its next potential goal. Meanwhile, the $28 mark serves as a nearby point of support.

Making a strong push beyond the $30 mark might lead to additional profits, but should this level fail as support, it could cause a brief correction.

Top 1,000 gainers

Beyond the first hundred rankings this week, the stock with the most significant growth, Black Agnus [FTW], skyrocketed by an astounding 4,318%. Following closely were Solvex Network [SOLVEX] and Peezy [PEEZY], each experiencing a substantial surge of approximately 3,965% and 2,158% respectively.

Biggest losers

Dogwifhat [WIF]

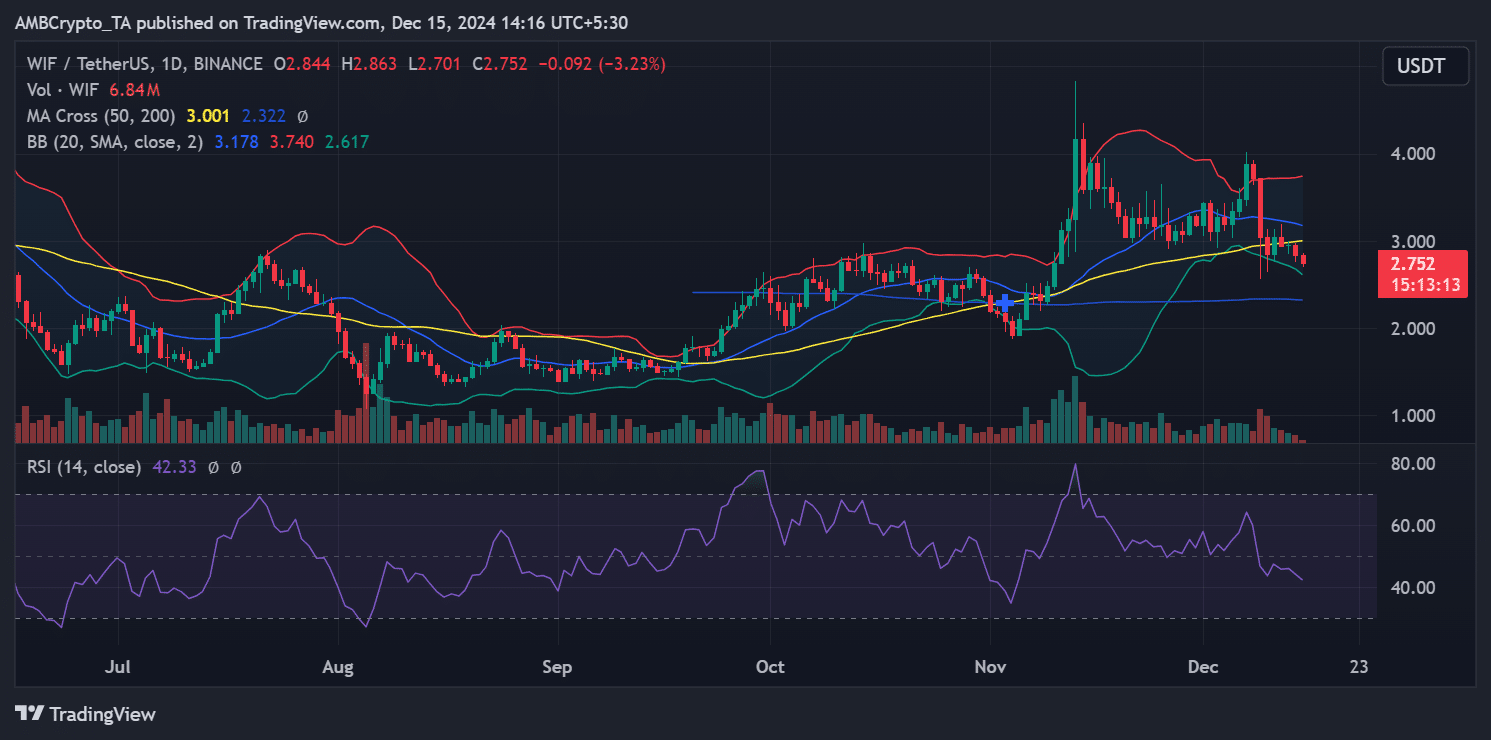

Over the last seven days, I’ve found myself in the red as WIF took the hardest hit among my investments, plummeting by a substantial 27.07%. The bearish trend started off strong, with a 4.18% dip on Monday, causing its value to drop down nearly to $3.717.

On December 9th, the significant drop of WIF became more pronounced, falling by approximately 18%, which brought it close to its crucial support level, around the $3 mark.

Regardless of sporadic efforts to strengthen, there was continuous downward momentum in trading all through the week. Finally, by Friday’s close, WIF stood around $2.844, marking a further 3% decrease and concluding its lackluster run of results.

Additionally, the cost has fallen under the 50-day moving average, which is around $3.00 at present, suggesting a potential shift to a downward trend. If the price continues to drop, the 200-day moving average at approximately $2.32 will be the crucial level of support to watch out for.

Currently, the Relative Strength Index (RSI) stands at approximately 42.33, suggesting that the WIF stock might be nearing oversold conditions, though it hasn’t quite reached a point where a substantial turnaround could be expected.

According to the Bollinger Bands analysis, there seems to be an increase in market volatility. The stock (WIF) appears to be hovering near the lower boundary of these bands, indicating a continuous downtrend or bearish trend.

Should the downward trend persist, it’s possible that WIF may revisit its support level around $2.50. For a potential short-term improvement, a rise above $3.00 is essential.

Brett [BRETT]

BRETT ranked as the second-biggest loser of the past week, posting a notable 23.79% decline.

The downtrend began on a muted note, with a minor 0.79% drop on the first day of the week, leaving the price hovering near $0.20.

On the 9th of December, I observed a significant increase in selling activity that caused a substantial 17.81% decline in price, dropping it down to a crucial support level approximately at $0.17.

Regardless of short-lived efforts to balance things out, negative influences held sway for the rest of the week. By the time Friday rolled around, BRETT dropped down to about $0.16, representing a further decrease of nearly 3%.

As of this writing, BRETT’s market capitalization was around $1.6 billion, with an over 8% decline.

Bonk [BONK]

BONK closed the week as the third-biggest loser, recording a substantial 23.32% decline. The bearish momentum started with a minor 1.40% drop, placing its price near $0.00004590.

Consequently, similar to many other meme tokens, it saw a significant drop of roughly 15% the following day, reaching around 0.00003902 USD.

By the close of the week, the demand for BONK decreased significantly, causing its price to fall even more. It ended up at $0.00003645, marking a decrease of 6.15%.

The technical analysis suggests a pessimistic perspective, as the indicators point towards a downward trend for BONK’s current pricing. At this moment, the value of BONK is lower than its 50-day moving average, which hints at a temporary loss in strength.

Yet, it continued to stay above the 200-day moving average, suggesting a possible long-term backing up. The volume statistics show high levels of selling, which correlates with the ongoing downward trend.

Top 1,000 losers

This week, the digital currency HarryPotterObamaSonic10Inu 2.0 [bitcoin-usd/”>BITCOIN] ranked outside the top 100 but experienced a dramatic drop of more than 99.91%. Following closely were trumpwifhat [TRUMP] and MICHI, both suffering over 99% declines.

Conclusion

Here’s a summary of this week’s top performers and underperformers. Keep in mind that the market is inherently unpredictable, with prices often changing swiftly.

Thus, doing your own research (DYOR) before making investment decisions is best.

Read More

2024-12-15 22:17