- Mogcoin, Aave, and Ronin were the biggest winners of the past week.

- Render, dogwifhat, and Akash Network had the biggest losses in the past week.

As a researcher with extensive experience in the cryptocurrency market, I have closely monitored the performance of various digital assets over the past week. Based on the latest data from CoinMarketCap, Mogcoin (MOG), Aave (AAVE), and Ronin (RON) were the biggest winners, while Render (RNDR), Dogwifhat (WIF), and Akash Network (AKT) suffered the most significant losses.

This week, a memcoin featuring cats took the lead in price growth amongst top performers, whereas a memcoin representing dogs saw a downward trend. However, the market as a whole registered more increases than decreases, suggesting a predominantly favorable development during this timeframe.

Biggest winners

Mog Coin (MOG)

As a researcher studying the cryptocurrency market, I’ve discovered that MOG Coin [MOG] outperformed all other digital assets during the past week based on CoinMarketCap’s rankings. By the week’s end, it had achieved an impressive gain of 32.51%. Consequently, MOG Coin secured the title as the week’s most successful gainer.

Although Mogcoin had a rocky beginning, with its price starting at around $0.0000013 and dropping until the 9th of July, there was a noticeable shift in its fortunes afterward. The value of Mogcoin started to rise from the 9th of July onward, ending the week at approximately $0.0000015.

At present, Mogcoin is priced approximately at $0.0000019 per token. The total value of all existing Mogcoins surpasses $683 million, representing a significant growth of 18% within the past day.

Aave (AAVE)

Last week, based on CoinMarketCap’s data, Aave (AAVE) was the second-biggest price mover, reporting a substantial 25.30% rise.

As a researcher, I’ve observed that the market trajectory for Aave wasn’t straightforward. The downward trend started off with a nearly 6% decrease on the first day, reaching around $78.27. However, the very next day brought about a remarkable rebound of over 4%. This positive momentum continued throughout the week, culminating in an ending price of approximately $99.26 – representing a daily increase of around 1.8%.

Through a closer examination with the help of the Relative Strength Index (RSI), it is clear that the positive growth trend in Aave’s price is further reinforced. The RSI readings started at approximately 37 at the beginning of the week, but subsequently rose to 62 by its end, unequivocally signaling a robust bullish phase.

Furthermore, the moving averages of Aave (represented by the yellow and blue lines) that previously functioned as barriers for the price, were breached by it in both the short term and long term.

At present, Aave is priced approximately at $100. The market value of this cryptocurrency has expanded beyond $1.5 billion, signifying a growth of more than 3% within the past day. Notably, an impressive trading volume of over $108 million has been recorded.

Ronin (RON)

Ronin displayed a remarkable surge, jumping to the third-position of weekly gainers with a significant rise of more than 22%, based on CoinMarketCap’s latest statistics. The beginning of the week saw Ronin starting at approximately $1.7, only to dip slightly to around $1.6 the next day.

Starting the third day of the week, the price saw a steady increase, peaking at around $2.12 by the time the week came to an end.

At present, Ronin is priced approximately at $2.15 and boasts a substantial market value exceeding $721 million. However, its trading activity has noticeably diminished, with the volume dropping by more than 50% within the past 24 hours, now hovering above $9 million.

Biggest losers

Render (RNDR)

Last week was tough for RNDR as indicated by the data from CoinMarketCap, revealing a weekly loss of 8.85%, making it the largest decliner among the cryptocurrencies tracked.

The opening of the week saw RNDR trading at around $6.7. However, its value declined steadily throughout the week. The lowest point was reached on July 12th when it dropped to $5.7. By the end of the week, it had rebounded slightly to finish at roughly $5.9.

At present, the price of Render was approximated at around $6.16. The company’s market value stood approximately at $2.4 billion, experiencing a minor reduction. Notably, the trading volume for Render dropped substantially by over 31% in the past 24 hours, reaching nearly $96 million.

Dogwifhat

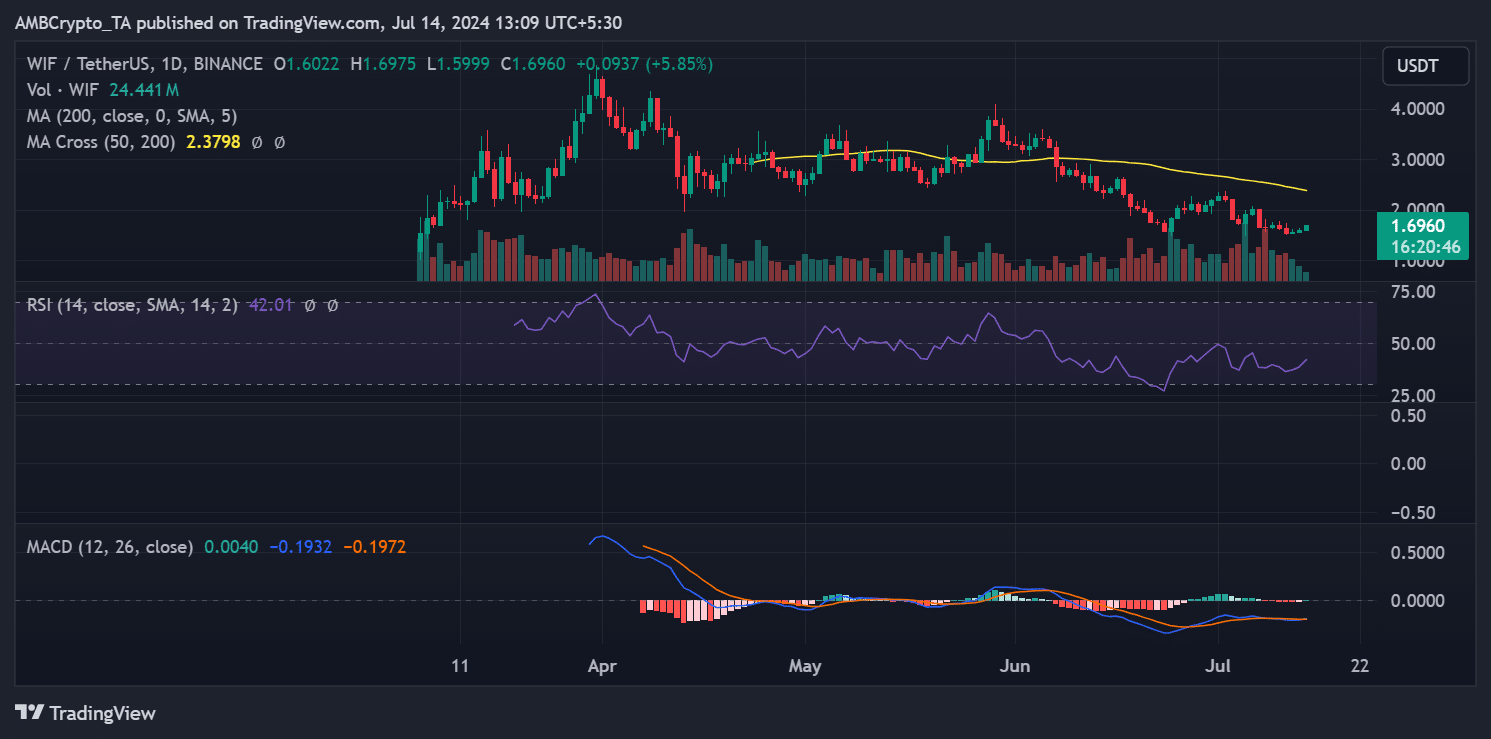

As a crypto investor, I’ve noticed that Dogwifhat (WIF), the canine-themed memecoin, didn’t have a great week in the market. According to recent data from CoinMarketCap, it was among the coins with the most significant losses, dropping by approximately 8.15%.

As an analyst, I’d describe the coin’s price trend at the start of the week as experiencing a significant decline, nearly 17%, causing its value to dip from approximately $2 down to roughly $1.6.

Despite some small increases during the week, these gains weren’t enough to counteract the larger downward trend.

I’ve analyzed the stock market trends and found that by the end of the week, WIF managed a slight bounce back, ending its trading at approximately $1.60 with a daily growth rate of 2.2%. At the moment of writing this analysis, WIF was displaying additional gains, trading around $1.67 – representing an increase of more than 4% compared to its previous price.

As a crypto investor, I would interpret a Relative Strength Index (RSI) reading of around 40 as a sign that the asset is still in a downtrend. The RSI is a popular technical indicator used to determine overbought and oversold conditions in an asset’s price action. A reading below 30 typically indicates an oversold condition, while a reading above 70 suggests an overbought condition. With an RSI of 40, the asset is neither overbought nor oversold, but still trending downward.

As a crypto investor, I’ve noticed that the market capitalization of WIF coins hovered near the $1.6 billion mark the other day. However, there’s been a noticeable decrease in trading activity over the past 24 hours, with a total volume of approximately $219 million being traded off – representing a decline of over 9%.

Akash Network (AKT)

As an analyst, I’d rephrase that sentence as follows: The price of Akash Network (AKT) dropped by 6.19% during the past week, making it one of the three biggest weekly decliners in the cryptocurrency market based on CoinMarketCap data.

The price of AKT started the week at around $3.6, but it gradually decreased throughout the week. By the close of business on the last day of the week, the price had fallen to roughly $3.4.

At present, the price of AKT was approximately $3.45. The company’s market value exceeded $842 million. Notably, there was a substantial decrease in trading activity, with the volume dropping by almost 40% to around $14 million.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-14 22:16