- Bitget Token, XDC Network, and XRP emerged as this week’s biggest gainers

- AI16Z, ThorChain, and Virtuals Protocol had the biggest losses over the past week

This past week in the world of cryptocurrencies was filled with excitement as various digital assets saw remarkable gains, while some encountered intense selling activity. Given the growing influence of institutional investors on market trends, we’ll delve into the key price fluctuations that significantly impacted this week’s trading environment.

Biggest winners

Bitget Token (BGB)

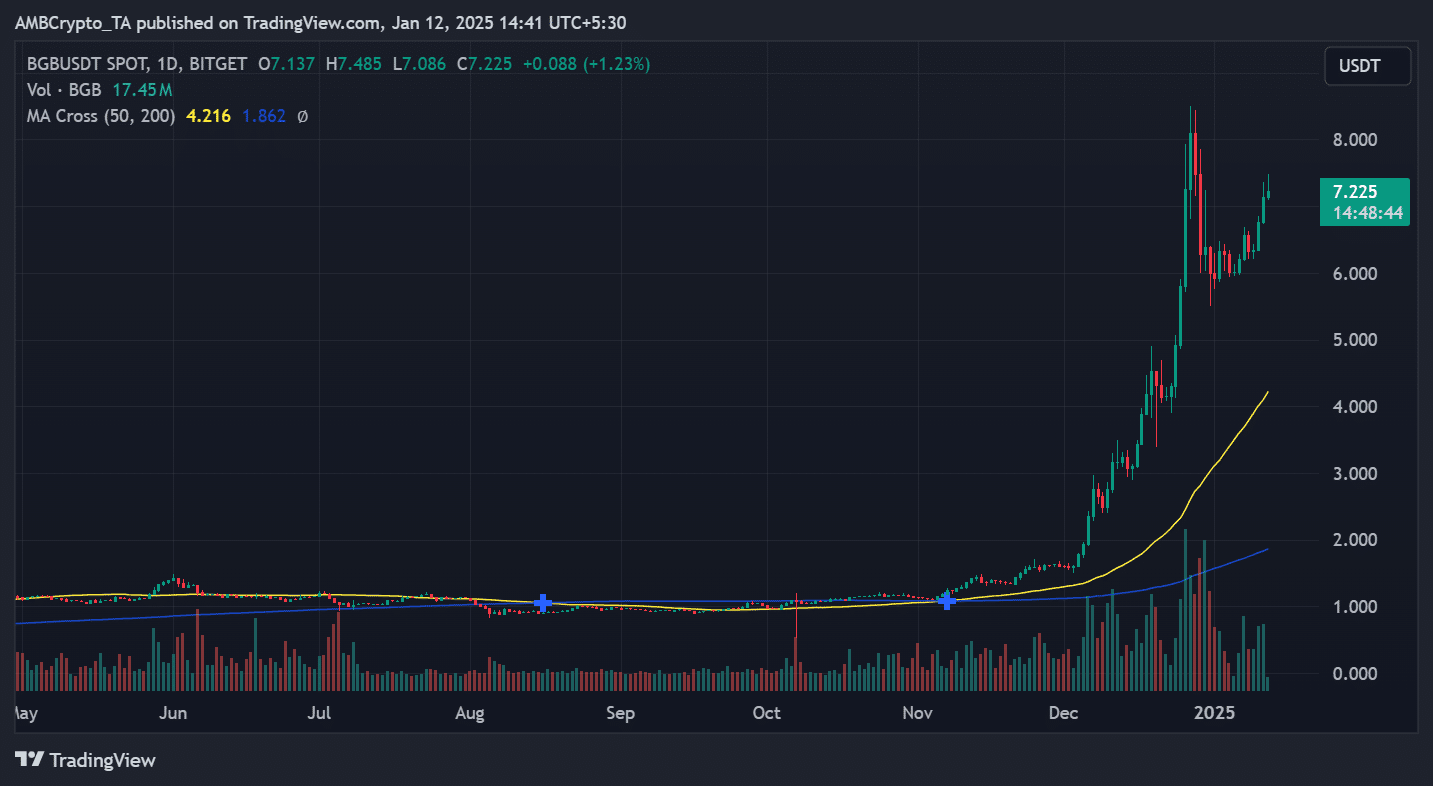

This week, BGB outshone all others, significantly exceeding predictions as it climbed from $6.011 to $7.137. The token’s trajectory has been particularly noteworthy since its breakthrough in November, consistently establishing new lows and shattering past resistance levels.

In December, there was a significant increase in trading action, as volume and prices both soared – Indicating a rise in market confidence. BGB’s trading remained robustly above its moving averages at $7.225, demonstrating consistent bullish energy that translated into a 20% weekly profit. The graph showed a classic golden cross pattern, often seen as a reliable predictor of continuous upward trend.

Despite the rising prices causing some surprise, the consistent increase in trading activity suggests a genuine market interest instead of mere speculation.

Yet, it’s crucial for traders to closely monitor any signs of consolidation periods, typically occurring after such intense price surges. The exceptional behavior of this token is further accentuated when considering the current market circumstances, making it one of the strongest performers amidst the existing trading environment.

XDC Network

XDC’s impressive surge in value has caught everyone’s attention, solidifying its place as the second top performer this week with a strong 12% increase. The token successfully breached the significant $0.10 barrier, rising from $0.0968 to $0.101 – Demonstrating remarkable resilience in an unpredictable market.

820,550 units of XDC are consistently being traded, indicating a continued market appetite instead of brief, speculative activity. At this moment, the data indicates a trading volume of approximately $53.7 million, marking a more than 5% increase within the past day. Additionally, the graph demonstrates an upward trend, supporting the bullish movement.

XDC appeared to hold a stable position that surpassed both its 50-day and 200-day average lines, suggesting a generally strong standing. However, the day’s slight decrease of -0.66% hinted at some brief selling activity.

XRP

This week, XRP managed to secure a place among the top performers by experiencing a significant late-week increase, despite initially struggling around $2.3. The altcoin’s trajectory took a sharp turn for the better on January 11, as a 10% rise propelled its price towards $2.5. As of the press time, it was undergoing a slight retreat at $2.4953 (-3.13%).

As an analyst, I observed a robust trading volume of approximately 52.94 million XRP, signifying substantial market participation during the recent rally. The price of XRP was found to be steadily hovering above its crucial moving averages – the 50-day average at 2.2409 and the 200-day average at 1.0037. This positioning suggests that XRP continues to uphold its long-term bullish structure, demonstrating resilience amidst the recent market volatility.

Additionally, the graph indicated a remarkable bounce back following the consolidation period in November, paving the way for the current upward trend.

Biggest losers

AI16Z (AI16z)

AI16Z suffered a major setback this week, falling from $1.8 to $1.1 in a steep sell-off that wiped out approximately 37% of its worth. After initially giving investors hope with a significant 20% surge that raised the price above $2, the token was met with persistent selling pressure for the rest of the week.

Currently priced at $1.1688 and experiencing a slight increase of 0.76%, the token is being actively traded with a volume of approximately 239 million. The data indicates a significant drop of more than 29% in the past 24 hours, suggesting high market activity during the recent downturn.

As a crypto investor, I’ve been observing a rollercoaster ride in our token’s chart, with prices swinging drastically – a telltale sign of a market that’s yet to find its footing. The absence of solid support levels after the sharp downturn suggests we might be in for more turbulence down the line.

ThorChain (RUNE)

As a researcher, I’m observing a persistently tough sell-off for RUNE this week, placing it among the most affected tokens with an alarming 33% drop. Initially valued at approximately $4.90, the token has been under intense selling pressure that intensified as the days went by, culminating in a price reduction to $3.395 (-1.48% daily).

3.71 million units of RUNE were traded recently, indicating the strength of this downward trend. The technical outlook is bleak as the token plummeted below its 50-day and 200-day moving averages (at 5.496 and 4.734 respectively), effectively wiping out several months’ worth of growth in just a few days.

Ultimately, the dramatic drop from the highs reached in December suggested a major change in investor attitudes, and falling beneath crucial support lines could pave the way for more declines.

Virtual Protocol (VIRTUAL)

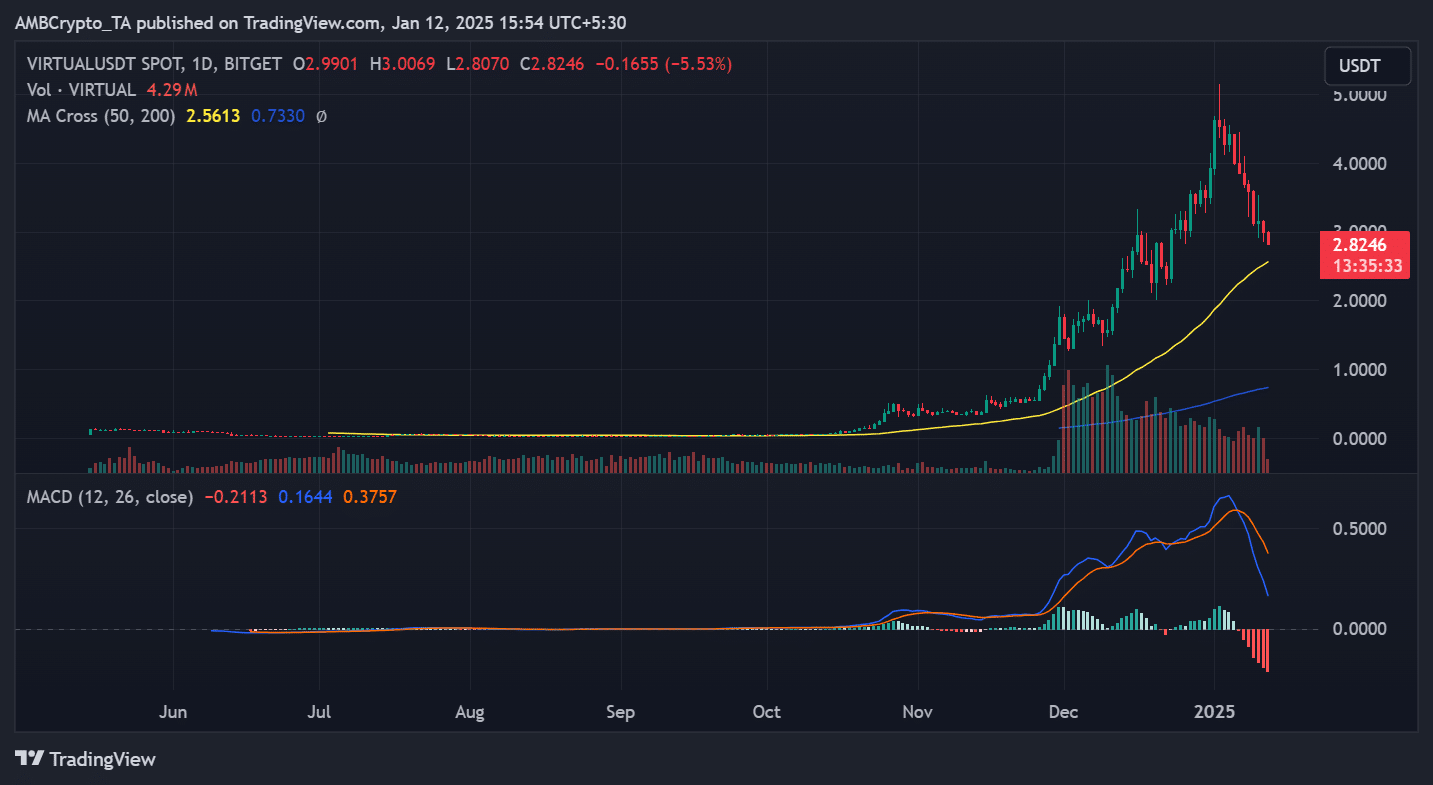

This week, VIRTUAL’s price movement demonstrated a significant drop in market trust, resulting in a sharp 31% decrease in value. Initially listed at around $4, the token encountered immediate resistance and tumbled by approximately 9% during its initial trades. The day’s trading saw an additional 5.53% decline, leaving VIRTUAL priced at $2.8246. This downward trend in the charts suggests persistent selling activity.

Currently, the technical arrangement seems quite troubling because the price has dropped below multiple important support points.

The MACD line (which is currently at -0.2113) has significantly shifted to a negative value, signaling a powerful downtrend. In other words, this negative cross-over on the MACD suggests a possible prolonged period of declining prices in the coming days.

Based on the analysis of its moving averages, VIRTUAL is currently trading significantly below both its 50-day (2.5613) and 200-day (0.7330) averages. However, its long-term upward trend continues as it remains above the 200-day moving average. Notably, there has been a rise in selling activity, especially in recent trading sessions, as indicated by the volume profile during this decline.

The drop in prices since their peak in December hints at a possible ‘giving up’ stage, but the absence of a definite bottoming pattern makes it tricky to pinpoint strong levels of support. The price movement from November to December resembles an extreme rise (blow-off top), and the current fall could be the corrective phase that follows this pattern.

To ensure a possible recovery, the token should regain its 50-day Moving Average (MA) as a support level. The current market trend indicates that a period of stabilization or sideways movement might occur first, prior to any significant price increase.

Conclusion

In this update, we’ve summarized the top performers (gainers) and underperformers (losers) for the past week. Keep in mind that the market is unpredictable, as price fluctuations may occur swiftly due to its volatile nature.

Thus, doing your own research (DYOR) before making investment decisions is best.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-01-12 21:44