-

FTX token, POPCAT, and Wormhole emerged as the week’s biggest winners.

In contrast, Notcoin, Ethena, and Lido DAO topped the losers chart.

As I delve into the intricacies of this week’s market trends, it’s quite evident that fortune favors the bold – or at least those who keep a keen eye on their investments! The cryptocurrency landscape has been a rollercoaster ride, with some coins soaring to new heights while others are plummeting like a stone.

As someone who has closely followed the cryptocurrency market for several years now, I have learned to expect the unexpected. This week was no exception; it brought a whirlwind of volatility, with Bitcoin [BTC] taking a dip. However, despite the general downward trend, there were a few altcoins that bucked the norm and managed to rack up impressive gains. It’s always fascinating to see how the market can surprise us, and it serves as a reminder that diversification is key when navigating these waters.

According to CoinMarketCap’s data, a predominantly bearish mood seems to be present in the market, as only about 10% of the top 100 cryptocurrencies showed positive gains at the end of the day.

Biggest winners

FTX Token [FTT]

2 years following its fall, FTX Token (FTT) once again grabbed attention, starting the week with a substantial increase of more than 57%.

As an analyst, I found myself tracking a particular cryptocurrency that started the week at approximately $1.4009. By Friday’s close, it had surged to around $2.6921, making it the standout performer of the crypto market for the week. This impressive run translates to a staggering 60% gain in just seven trading days.

This recent price action was fueled by speculation surrounding the defunct crypto exchange, FTX, which gained traction on social media. As a result, a significant spike in trading volume was observed.

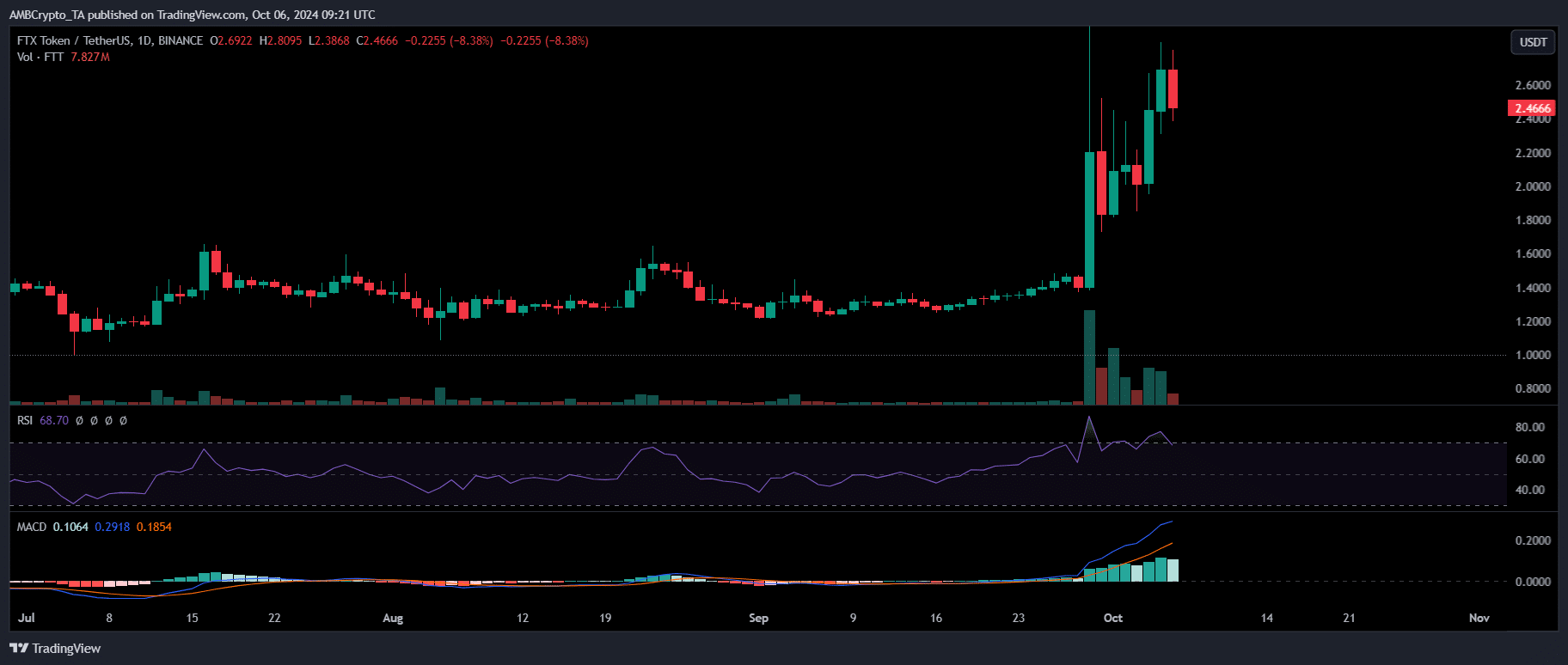

Source : TradingView

The MACD chart shows a bullish situation as the MACD line (which is blue) moves above the signal line (orange). This movement suggests that the bullish energy is growing, and it’s reflected in the histogram moving into areas with positive values, signifying an increase in bullish momentum.

Even though there’s been an increase, the Reversal Strength Indicator (RSI) – which peaked at the crossover point – has since started to decline. This suggests that the initial purchasing power could be losing momentum.

As a result, the long-term upside potential could remain elusive for the time being.

Currently, FTT is experiencing a decrease of approximately 3% compared to its closing price yesterday, and the trading volume has dramatically decreased by over 65%, now standing at about 25 million.

Right now, the company’s market cap is valued at approximately $850 million, signifying a 7% growth from the previous week.

Popcat [POPCAT]

This week, the memecoin built on the Solana network, known as POPCAT, has become the second-biggest winner. The coin started off the week with an increase of 7%, reaching a value of $0.9820.

Over these past few days, this upward shift has halted the downtrend, enabling POPCAT to maintain a steady state for four consecutive days.

On October 4th, there was a substantial surge as POPCAT breached the $1 mark, following an impressive 21% increase in value during that day.

To start off the week, POPCAT was trading at approximately $0.9216. By the end of the week, it had climbed to nearly $1.2134, marking an increase of more than 30% according to CoinMarketCap data.

The strong upward trend in POPCAT‘s value has pushed its total market worth up to approximately $1.19 billion, representing an uptick of 0.46% currently.

Wormhole [W]

Last week, Wormhole [W] ranked among the top three performers, witnessing a surge of more than 15%. Kicking off the week at a 4% increase to reach $0.3003.

But it experienced a sudden reversal the next day, marking a 7% drop that wiped out all previous advancements.

On October 2nd, I witnessed an astounding surge in trading volume, jumping from 75 million to a whopping 290 million – that’s a massive 286.67% increase! This daily spike stood out as the most significant of the entire week, with W ending the day at $0.3438.

On the following day, there was a substantial dip down to $0.3180, yet this decline was quickly contested. As a result, W managed to finish the week at $0.3411.

Contrarily to expectations, the trading volume of this entity decreased by 37% over the past day, now sitting at $877 million. This decrease represents a 2% reduction in its market capitalization.

Biggest winners of the top 500

HIPPO (Sudeng), a prominent figure in the wider market, surged ahead significantly by an impressive 135%, currently trading at approximately $0.01442.

Initially trailing behind, DIA experienced an impressive surge of more than 100%, reaching $0.8321. Meanwhile, SPX6900 followed suit, climbing by nearly 100% to about $0.2153.

Biggest losers

Notcoin [NOT]

Notcoin [NOT] hit daily new lows, resulting in a 12% drop, making it the biggest weekly loser. It opened the week with a slight dip and experienced a sharper 8% decline the following day.

Over the last week, the trading volume experienced a substantial decrease, falling from approximately 8 billion to around 3 billion.

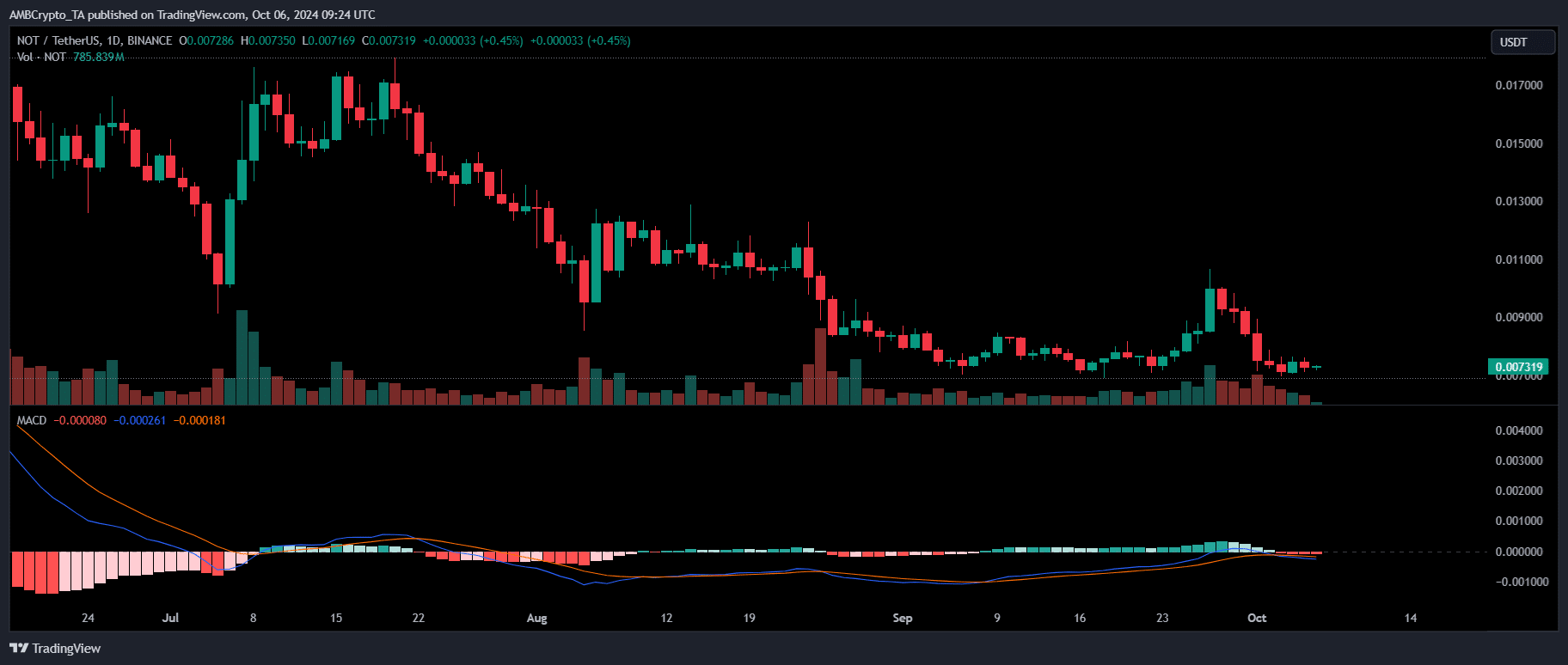

Source : TradingView

In October, the MACD line (represented by blue) didn’t start above the signal line (represented by orange), indicating a bearish trend. Yet, an increase in trading activity on the 4th of October halted a more significant dip.

As an analyst, I’m observing a minor uptick to $0.007305 for NOT at the moment. However, it’s concerning that its trading volume has significantly dropped by about 25% within a day, reaching approximately $69 million. Furthermore, its market capitalization stands at $748 million currently, representing a decrease of 2.5%.

Ethena [ENA]

Based on information from CoinMarketCap, it appears that Ethana (ENA) is nearing the title of the upcoming largest weekly decliner in the cryptocurrency market.

Initially, ENA started the week at $0.3389, experiencing a 6% increase. However, it subsequently suffered a significant devaluation, leading to a decline of more than 20% throughout the week, ending the period at $0.2750.

ENA’s trading volume has experienced a substantial decrease of approximately 50%, currently at around $49 million. At the moment, its market capitalization is valued at roughly $789 million, representing a decline of about 5%.

Lido DAO [LDO]

Following closely behind the largest two weekly losers, we find Lido DAO [LDO]. Similar to them, Lido DAO experienced a drop exceeding 20%, earning it the position as the third-biggest decliner for the week.

Just like NOT, LDO experienced a difficult week marked by persistent dips, notably a downward MACD crossover occurring on the initial day of October.

Initially, the coin started the week priced at about $1.334, but it closed the week significantly lower at approximately $1.051. A small increase was observed a day before this closing price. The trading volume experienced a substantial decrease of around 43%, landing around $44 million. Additionally, its market capitalization decreased by 2% to nearly $942 million.

Biggest losers of the top 500

In the list of the top 500, Aleo (ALEO) suffered the most significant loss, plummeting approximately 40% to reach $3.90. Not far behind, Moo Deng (MOODENG) experienced a decrease of nearly 38%, ending trades at $0.137.

BinaryX (BNX) also faced a setback, recording a 31% decline and trading at approximately $0.7117.

Conclusion

This week’s recap highlights the biggest gainers and losers in the cryptocurrency market. It’s essential to remember the market’s volatile nature, where prices can fluctuate rapidly.

To ensure you have all the necessary information and reduce potential risks, it’s essential to investigate thoroughly any investment choices prior to making a decision.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-06 22:17