- Sui, Helium, and Zcash were the biggest winners in the past week.

- Lido DAO, Aave, and Maker made up the top losers’ list.

As a seasoned analyst with a knack for deciphering market trends and a penchant for riding crypto rollercoasters, I must say this past week has been nothing short of exhilarating. The dance between Sui, Helium, Zcash, Lido DAO, Aave, and Maker has kept me on my toes!

Some specific digital currencies have significantly deviated from the general pattern during a volatile and bearish week in the overall crypto market.

Switzercoin (SUI) shone brightly amidst the crypto market, bouncing back robustly following several days of downward trend, in contrast to Lido DAO (LIDO) and AAVE, which faced substantial losses recently.

Biggest winners

Sui (SUI)

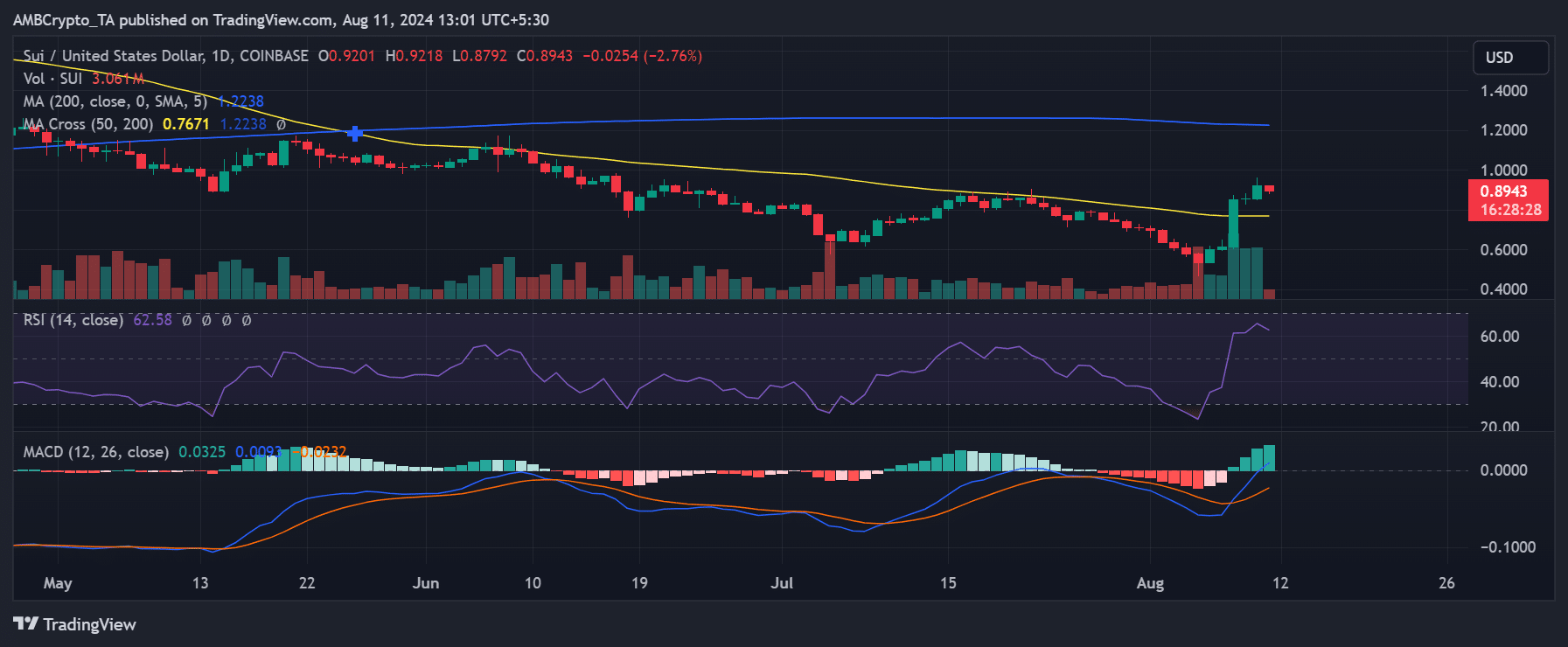

As a crypto investor, I’ve been closely watching the daily fluctuations of Sui (SUI). After an extended period of decline, it seems like there’s a notable shift in its trajectory. The beginning of this week saw the downward trend persist, with SUI dropping by approximately 5.39% on Monday, and then dipping over 7% the following day. However, things appear to be looking up now.

These declines marked the 10th consecutive day, bringing its price down to $0.53.

On the 5th of August, there was a significant change in the trend for SUI as it saw a 12.55% jump, pushing its value up to approximately $0.6. The largest increase occurred on the 8th of August, where SUI experienced a surge of 38.58%, raising its price to around $0.8.

The week concluded with a 7.42% increase, pushing the closing price to approximately $0.9.

In this week, SUI experienced a series of upward movements, culminating in a total increase of more than 44%. As a result, it emerged as the week’s leading performer, as reported by CoinMarketCap.

From my analysis, it’s evident that the current market cap of SUI now exceeds a staggering $2.3 billion. Moreover, within the past day, the trading volume has experienced a significant surge, reaching approximately $319 million – an increase of over 16% from the previous 24 hours.

Helium (HNT)

As someone who has been following the cryptocurrency market for several years now, I must admit that this week has been particularly challenging for me, and perhaps for many others, as Helium (HNT) experienced a significant decline of around 7%. This dip brought its trading price down to approximately $4.2. It’s always disheartening to see a coin I’ve invested in take such a hit, but it’s important to remember that the market is volatile and these fluctuations are part of the ride. I’m keeping my eyes on the long-term potential of Helium and remain hopeful for its future growth.

In spite of an initial disappointment, Helium soon turned things around, reporting continuous growth every day for the entire week. Furthermore, this positive trend was marked by a couple of days where its value increased by more than ten percent.

To wrap up, there was a minimal 3.98% drop during the week’s end. Despite this, the price of Helium persisted at its high point, finishing the week near $6.5. This growth positioned Helium as the second-largest weekly winner, surging more than 34%.

Based on current figures from CoinMarketCap, Helium’s market value exceeded $1 billion, but there was a minor dip in the previous day. Moreover, the trading volume decreased significantly by more than 50%, amounting to around $13.7 million.

Zcash (ZEC)

At the start of the week, Zcash followed a descending trend, starting at roughly $31. Similar to other high-performing cryptocurrencies, though, Zcash saw considerable upward surges throughout the week. By Friday, it was being traded around $41, reflecting a notable comeback.

Based on recent figures from CoinMarketCap, it’s clear that Zcash has been one of the top performers this week, experiencing a substantial growth of more than 27%. This significant price hike has propelled its market value to exceed $672 million.

Despite this strong performance in price, the trading volume for Zcash showed a significant reduction, declining by over 40% in the last 24 hours to around 80.9 million.

Biggest losers

Lido DAO (LIDO)

Last week was tough for Lido DAO (LIDO), ending up on the list of top losers. The journey started with LIDO priced approximately at $1.2, but it took a turn for the worse, ending the week around $1.1. This translates to a nearly 18% drop in value over the course of the week.

In a downward trend, LIDO’s total market value, approximately $988 million, experienced only minimal decreases, even with a fall in its asset’s price.

Moreover, the trading volume for LIDO saw a decline during the week, dropping by around 7% to roughly $70.3 million.

Maker (MKR)

Last week was challenging for Maker (MKR), initially trading above $2,200 but subsequently experiencing substantial drops. By Friday’s close, the price of MKR had dropped to around $1,961. This downward trend placed MKR as the second-largest weekly decliner, with a fall exceeding 13%, based on data from CoinMarketCap.

1) In the past day, the trading volume for MKR dropped significantly, falling over 30% to approximately $45 million. Additionally, Maker’s total market capitalization was impacted by unfavorable price changes, standing at about $1.8 billion.

Aave (AAVE)

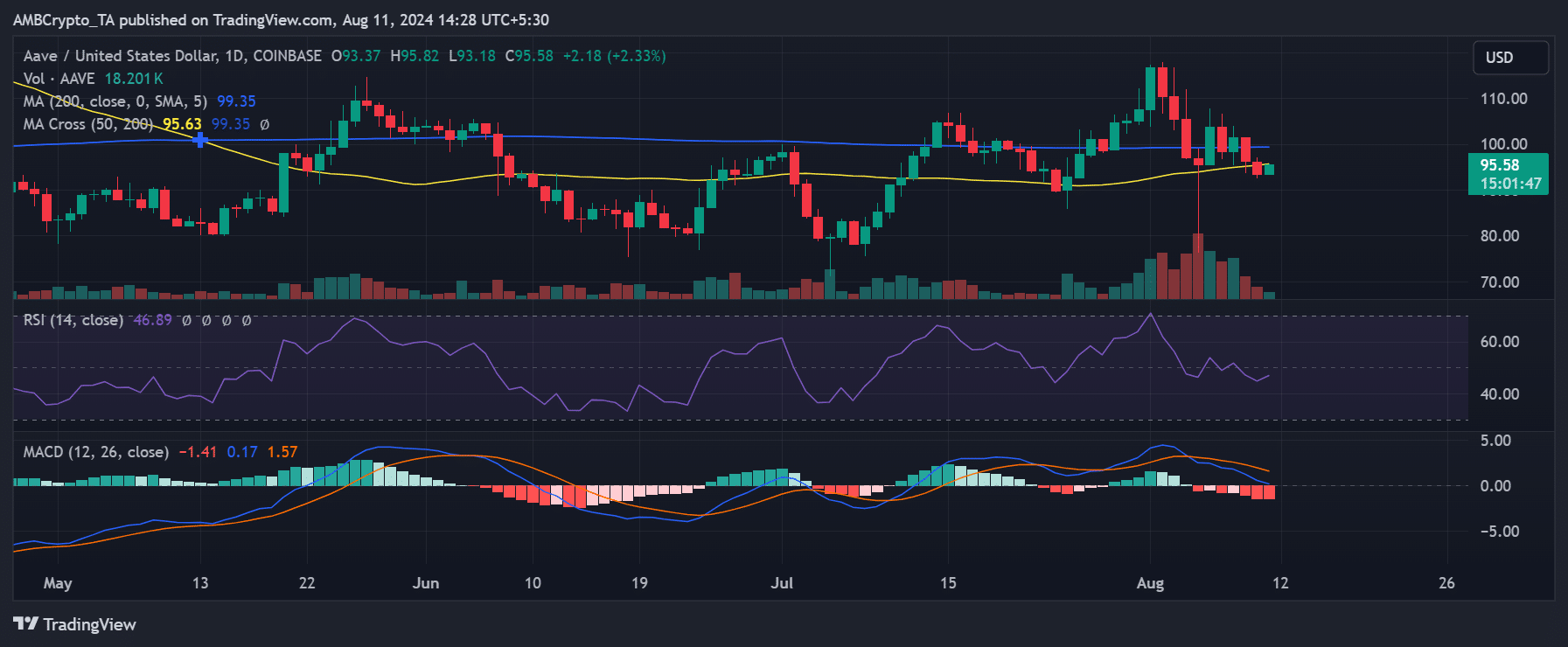

As an analyst, I’d rephrase that statement like this: Last week, I witnessed a significant shift in Aave’s (AAVE) performance, transforming it from the top weekly winner to one of the largest losses in the recent period.

As a seasoned investor with over two decades of experience in the crypto market, I have seen my fair share of ups and downs. This week, I found myself closely monitoring Aave’s price trend, a token I have been following for quite some time. After starting the week with an 8% decline, falling from around $105 to approximately $97, I was intrigued by its potential recovery. However, despite some uptrends throughout the week, the price of Aave never managed to reach the $100 range again. This experience serves as a reminder that even in the fast-paced world of cryptocurrencies, patience and careful analysis are key to successful investing.

By the week’s end, Aave was trading at around $93, marking a further decline of over 2%. This culminated in a total weekly loss of over 12%, according to data from CoinMarketCap, making it the third-biggest loser of the week.

Moreover, the Relative Strength Index (RSI) stood at 46, suggesting a downward trend. Simultaneously, Aave’s market cap was approximately $1.4 billion.

Additionally, the trading volume saw a substantial decrease, falling by more than 18% to roughly 87.2 million units.

Conclusion

Below is a summary of this week’s top performers (gainers) and underperformers (losers). Keep in mind that the financial market is highly dynamic, with prices frequently changing swiftly due to various factors.

Thus, doing your own research (DYOR) before making any investment decisions is best.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-11 22:16