- Virtuals Protocol, Theta Network and Core were the biggest gainers in the past week.

- Stellar, Raydium, and Solana had the highest losses in the past week.

As I delve into this week’s market recap, it’s evident that the crypto world remains as unpredictable and thrilling as ever! With my decades of experience in finance and technology, I can confidently say that this sector never ceases to surprise us.

Notably, some intriguing market movers emerged over the last seven days, with the AI agent token VIRTUALS taking the lead. Contrastingly, Stellar [XLM], initially among the gainers, surprisingly experienced the largest losses for the same period.

Biggest winners

Virtuals Protocol [VIRTUAL]

This week, Virtuals Protocol (VIRTUAL) has taken center stage, showing a remarkable 177% surge in value according to CoinGecko. This significant growth has boosted its market capitalization close to $1.6 billion.

Kicking off the week at approximately $0.55, VIRTUAL initially saw a dip of 5.97%, but then swiftly turned things around. This upturn was fueled by escalating trading activity and growing market excitement.

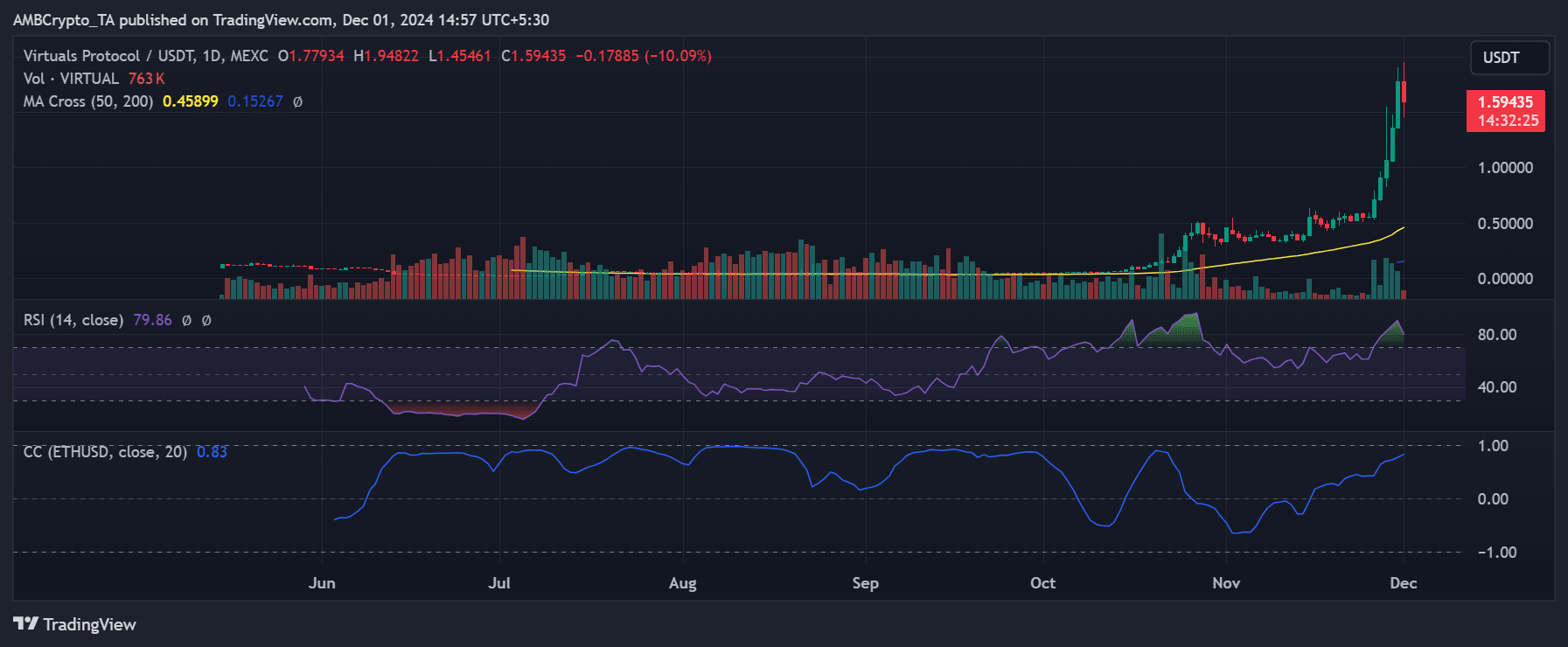

As an analyst, I noticed an impressive surge in the day-to-day chart, where the price reached a peak of $1.94, only to subsequently dip down to $1.59. This spike occurred following a significant jump of over 30% on the 30th of November.

At the moment of reporting, the Relative Strength Index stood at 79.86, hinting towards a potential oversold market situation. However, the robust uptrend suggested that investors’ enthusiasm remains high and unabated.

The cost consistently stayed higher than its 50-day and 200-day moving averages, while a ‘bullish golden cross’ indicated a robust uptrend. In simpler terms, the price was persistently higher than two key indicators, suggesting a strong and positive trend in the market.

The 0.83 correlation between Ethereum [ETH] suggests a wider market trend that is boosting its upward momentum.

The consistent volume spikes underscored sustained buying pressure, with key support at $1.40 and resistance at $1.94.

Although VIRTUAL has made significant strides, temporary adjustments due to investors cashing out have caused a minor fluctuation in its path, making it vulnerable to brief setbacks for now.

Theta Network [THETA]

As a crypto investor, I’ve found myself riding high this week with Theta Token [THETA]. This digital asset has been on a roll, surging an impressive 52.2%, catapulting it into the second position among the week’s biggest gainers. This growth spree has also propelled its market cap to a staggering figure close to $3 billion.

To kick off the week, THETA started at approximately $1.95 but experienced a decrease of 3.88%. However, it made a significant comeback, surpassing crucial resistance thresholds due to increased trading activity and an overall optimistic market mood.

The chart showed that, like VIRTUAL, THETA spiked in the last trading session. It spiked by almost 28%. The daily chart showcases a clear uptrend, with THETA peaking at $3.14 before consolidating near $2.98.

The intense curiosity of investors is highlighted by a significant boost in trading activity, which currently stands at approximately $703 million – a staggering 411% rise from previous levels.

Core [CORE]

In simple terms, CORE (Core DAO) climbed up to become the third-largest weekly winner, recording a significant jump of more than 48%, which boosted its total value to roughly $1.6 billion.

To start off, the price was approximately $1.07 on Monday. After experiencing a 3.19% decrease, CORE showed an upward trend, particularly on the final two days of the workweek.

Upon examining the price, I observed an impressive increase of more than 35% on the final day of the week. A closer inspection of the daily chart reveals a robust upward trend, with the token reaching beyond $2, only to subsequently pull back slightly to $1.96.

As an analyst, I’ve noticed that the Relative Strength Index (RSI) for CORE has climbed up to 78, indicating that the stock might be overbought. This could potentially mean some short-term profit-taking may occur. Furthermore, I’ve observed a substantial increase in its volume – more than 84% – within the past 24 hours, with a trading volume exceeding $430 million.

Top 1,000 gainers

This week, Thena (THE) experienced a staggering growth of approximately 1,280%, making it the largest gainer outside the top 100. Not far behind were GAME by Virtuals (GAME) with a rise of over 659% and Human Protocol (HMT) with an increase of more than 391%.

Biggest losers

Stellar [XLM]

Last week was particularly rough for Stellar’s XLM token, as it saw the most significant drop compared to other prominent digital currencies, resulting in a 10.1% fall.

Initially priced around $0.53 last Monday, the token experienced a modest 2% increase initially, only to later yield to strong selling forces. Moreover, XLM posted the most significant growth the previous week, peaking at its highest point.

However, XLM’s daily chart highlighted a pronounced downward movement after reaching recent highs.

The significant drop in prices was also followed by a decrease in trading activities, implying that investors’ enthusiasm may have been dwindling during the period of market correction.

According to CoinGecko, the trading volume decreased nearly 50% within the past 24 hours, reaching approximately $1.95 billion as of now. Moreover, the market capitalization experienced a drop of over 5%, currently standing at around $15.27 billion.

Raydium [RAY]

Raydium [RAY] emerged as the second-biggest loser this week, shedding 9.4% of its value.

Initially, the value of the token was approximately $6.12 during the start of the week. It demonstrated a minimal rise of almost 1%, but soon after, it started moving in a steady decline.

The graph showed a notable decline following a robust surge in November, during which RAY experienced considerable positive growth.

Yet, the recent downturn seems to indicate that investors are cashing out their profits and pausing the ongoing bullish trend for now.

Towards the close of last week, RAY’s stock price hovered approximately at $5.45, representing a drop of more than 4%. Currently, as we speak, it’s being traded close to $5.39. Important resistance is anticipated around the $5.00 mark.

Additionally, the market value of this entity currently stands at approximately $1.57 billion, having dropped by more than 3%.

Solana [SOL]

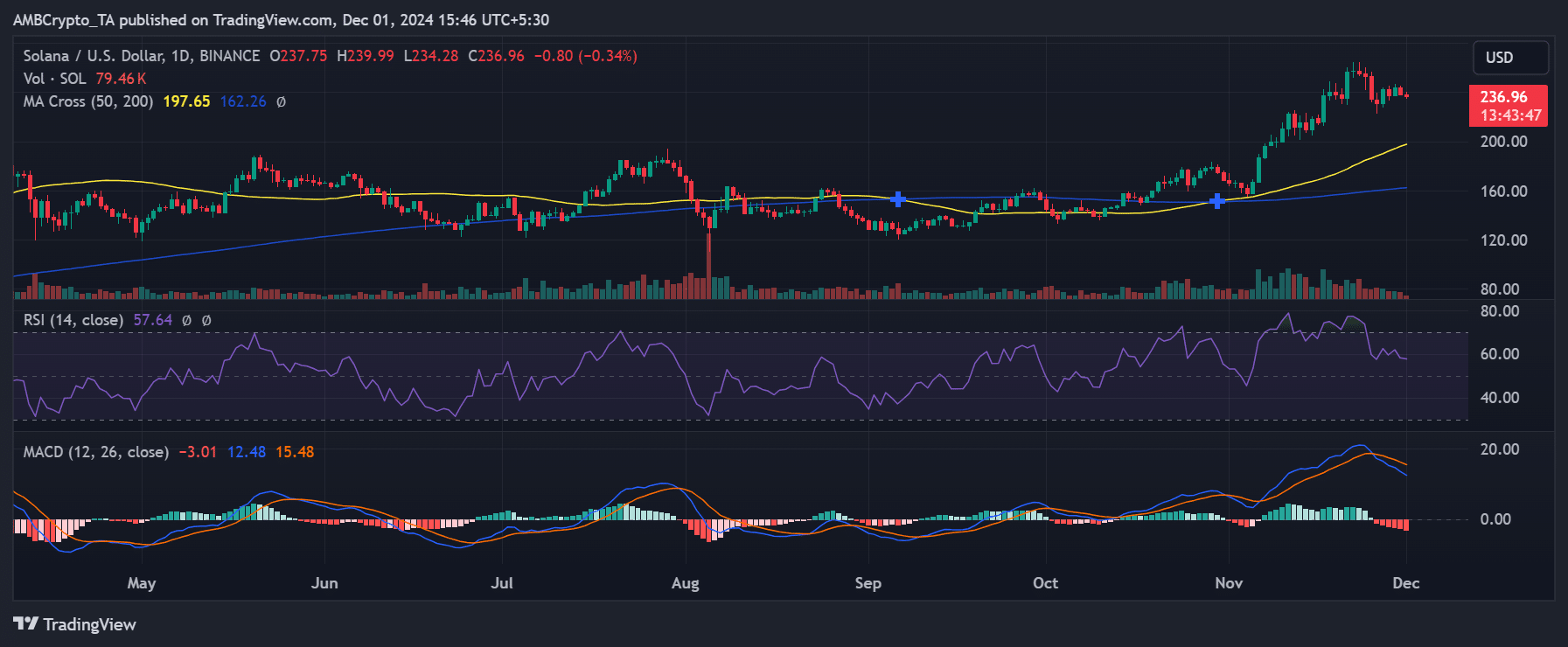

During the past week, Solana (SOL) ranked as the third-largest dropper, experiencing a decrease of approximately 6.7%. Initially priced at roughly $254 at the start of the week, Solana’s value trended downward and closed at around $237 by the end of the week.

At the time of publication, it was being traded around $237. Initially, there was a sense of stability, but as selling intensified, there was a noticeable drop or retreat in the price.

Over the past fifty days, the moving average has been holding steady at approximately $197.65, significantly higher than the moving average from the last two hundred days which stands at around $162.26. This suggests a strong upward trend in the market for the long term, or in other words, it indicates that the market is expected to continue rising.

On the other hand, the Relative Strength Index (RSI) has decreased to 57.64, indicating a cooling off following the overbought conditions seen in previous weeks. The Moving Average Convergence Divergence (MACD) histogram suggests bearish momentum, as the MACD line now sits below the signal line.

Currently, the immediate level where Sol’s price might find strong backing is approximately $230. On the other hand, a ceiling around $260 persists, preventing any significant price increases at this moment.

The pullback aligns with broader market corrections, although Solana’s robust network fundamentals have cushioned steeper declines.

Regardless of its recent drop, Solana’s overall outlook continues to be optimistic, reinforced by consistent trading activity and robust investor confidence.

If the price surges past $260, it could rekindle the bullish trend, potentially reaching $280. But if the support at $230 is not maintained, it may lead to a continued drop in value.

Top 1,000 losers

Outside the top 100, this week’s top loser was We Love T*ts [TITS], with an over 58% decline.

Hasbulla’s cat (Barsik) and the first convicted raccoon (Fred) experienced significant losses, with Barsik seeing a 50% decrease, and Fred experiencing a 46% decline.

Conclusion

Let’s review this week’s summary of stocks with the largest gains and losses. Keep in mind that markets are dynamic, so prices can change swiftly due to their inherent volatility.

Thus, doing your own research (DYOR) before making investment decisions is best.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-01 22:17