Bitcoin (BTC), that whimsical creature, lingers just beneath the lofty sum of ninety-four thousand dollars, all while appearing quite the nervous spectator to those curious American economic pronouncements. This very week’s data, no less full of portent, might well stir a tempest in the crypto market’s teacup.

From the fickle moods of consumer confidence to the bustling vigor of the labour market, these economic revelations may well sway the sentiments—and consequently, the prices—of cryptographic treasures.

The Week’s Most Anticipated American Economic Missives

Pray, cast your gaze upon the indicators that might dictate the fortunes of crypto adventurers and investors alike.

“Allow me to unravel the enigma: Tariffs run amok, consumer confidence in free-fall, whispers of recessions, and markets trembling on fragile legs—such is the economic theatre that directs the affairs of your humble life,” remarked Mr. Justin Wolfers, economist of some renown.

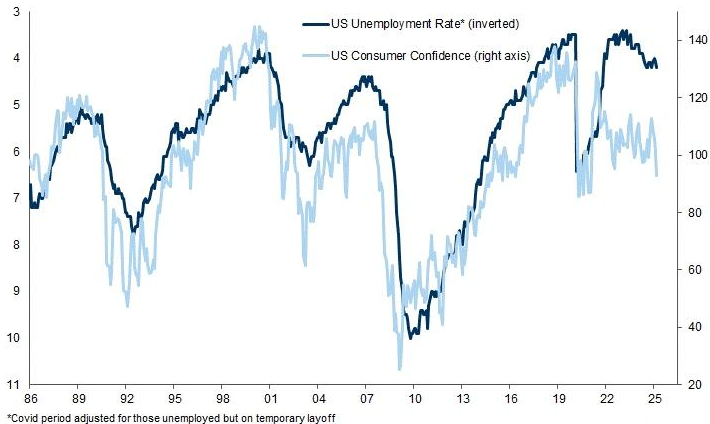

Consumer Confidence

First upon our list is the Consumer Confidence report, due Tuesday, April’s edition from that venerable board. Will the good folk of this nation blink hope upon their fiscal futures, or descend once more into gloom? March bore an index of 92.9, a decidedly sober countenance to economic prospects or personal coffers alike.

MarketWatch suggests a median forecast at 87.4; hope springs eternal yet carries the risk of folly. Should this figure dip beneath expectation, expect a hasty retreat amongst dealers seeking to secure their gains—no doubt causing tremblings in faith toward economic fortitude.

Given the current rancours of global trade, a further slip might well provoke a stampede to Bitcoin’s hallowed halls—despite the ever-present risk of tempestuous swings.

“The soft data portends the hard: If Consumer Confidence continues its downward dance, we face unemployment numbers around 6% or worse,” prognosticated Markets and Mayhem, ever the harbingers.

JOLTS Job Openings

The ever-watchful JOLTS report—chronicler of job demand—will next take its turn. The preceding letter, penned on April 1st, reported 7.6 million opportunities with 5.4 million hires. Tuesday will reveal March’s anticipation, medianed at 7.4 million.

Should listings rebound beyond 7.6 million, it would hint at economic vigour, sending risk-seeking hearts toward Bitcoin and its ilk. Yet a shy tally might kindle fears of a looming gloom, beckoning the wise towards crypto’s safer harbours.

With the Federal Reserve (that grand puppeteer) watching employment signs to decide on interest rates sitting between 4.25% and 4.5%, robust labour keeps cuts at bay and pressures those speculative digital assets.

ADP Employment

The midweek unveiling of the ADP Employment Report, chronicling private-sector vigour, showed March’s 155,000 job creations outpaced gloomy forecasts. Should April heed this call and break 160,000, bullish cheers for the crypto sphere are not unlikely.

Yet a stumble below expectations might fan whispers of an economic chill, driving tremulous investors into Bitcoin’s embrace or stablecoins for a less adventurous repose.

This missive excludes government toil, offering a more refined lens on private employment—a curious insight before Friday’s NFP unveiling.

Q1 GDP

Wednesday heralds the first estimate of Q1 2025’s GDP, a critical yardstick of growth. The fourth quarter’s modest 2.4% growth, tempered by trade deficits and revised imports, sets a cautious backdrop.

Should the economy surprise with a vigorous 3% or beyond, Bitcoin’s admirers might swell in optimism. Yet, any hint of a limp will invigorate hopes for easier monetary policy, sending speculative cryptos into frolic.

PCE

The Core PCE, that arbiter of inflation’s subtle dance much favoured by the Fed, reports on Wednesday. Expectations lean to a gentle fall from February’s 2.5% to 2.2% in March—a modest reprieve from price pressures, if true.

A reading beneath 2.5% might spark dreams of interest rate cuts, flooding the crypto isle with newfound cheer. Conversely, a hotter figure could bring stern Fed prudence, tempering the exuberance.

This index excludes the tempestuous prices of food and energy—much like a stoic gentleman omitting scandalous topics at tea.

“March’s PCE shall whisper 2.1%, April brings 2.0%. Tariffs do strut as lords, yet this measure rules the Fed’s ballroom. Perhaps, politics aside, it is time to cut—who can say?,” quipped hedge fund manager Ophir Gottlieb, with a wink.

Initial Jobless Claims

Thursday’s tally of Initial Jobless Claims offers the freshest insight into weekly labour woes or wins. The recent number, a steady 222,000, suggests a labour market undeterred by tariff troubles.

Claims lower than this hint at burgeoning employment, lifting spirits and Bitcoin alike. Should claims climb, the spectre of economic softness will nudge investors toward more cautious crypto corners.

Non-farm Payrolls

Lastly, the grand NFP report, out Friday, revealed March’s commendable 228,000 new jobs and a 4.2% unemployment rate—better than many dared hope.

A vigorous result tends to invigorate markets, whereas a figure below the forecast of 130,000 sends shivers of recession fear through capital, which then flees to Bitcoin’s fortress or the stable coin’s moorings.

This report covers a grand 80% of those who labour for America’s bounty, making it a veritable oracle for traders.

As of this moment, BeInCrypto informs us that Bitcoin waltzes at $94,154, climbing a modest 0.29% in the last day—just enough movement to keep the market gossip lively. 🕺💰

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How to Get to Frostcrag Spire in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2025-04-28 09:03