- Per Senator Lummis, a 30% tax on Bitcoin mining could push the industry outside the country.

- She cited the Laffer Curve to warn of reduced tax revenues from increased mining taxes.

As a researcher with extensive experience in the intersection of technology and public policy, I strongly agree with Senator Cynthia Lummis’ stance on the potential consequences of a 30% excise tax on Bitcoin mining.

On July 23rd, Senator Cynthia Lummis released a critique questioning the Biden administration’s proposed 30% tax on the energy consumption of Bitcoin [BTC] mining operations.

In his report entitled “Powering Down Progress: The Adverse Consequences of a Bitcoin Mining Tax for America,” Lummis underscored the potential downsides.

Making this move poses a risk to America’s esteemed role as a leader and the potential future of Bitcoin mining within its borders.

Senator Lummis contended that imposing a 30% excise tax on Bitcoin mining energy in America could potentially halt the burgeoning development of this sector.

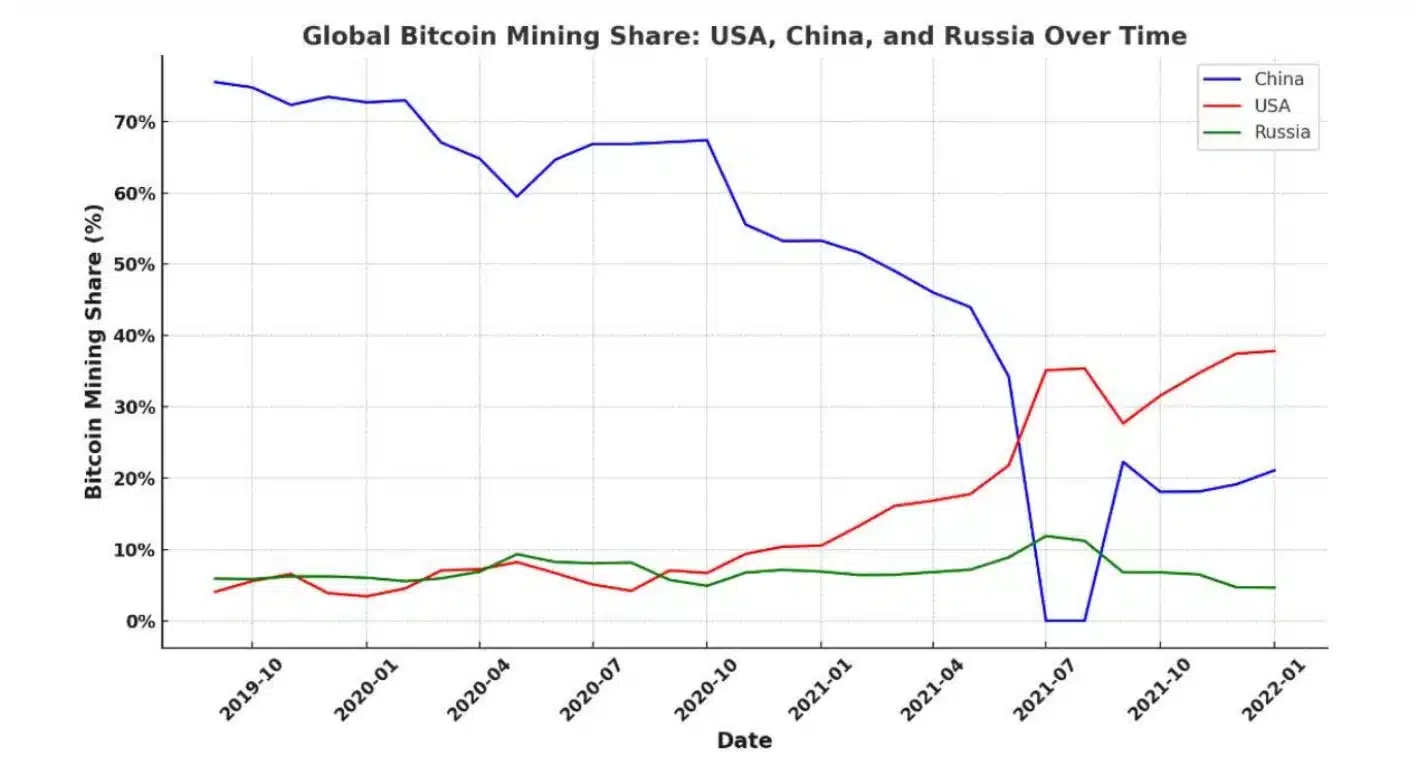

As a analyst, I would express it this way: With China’s 2021 prohibition on Bitcoin mining, the US seized the chance to draw substantial investments and human capital. Leveraging our robust energy sector and favorable legal framework, we have become an attractive destination for cryptocurrency miners.

As a result, many major Bitcoin mining operations are now based in the U.S.

Crypto mining not a threat: Lummis

Lummis issued a caution that imposing this fresh tax might push the industry beyond our borders, implying that the Treasury’s reasoning behind the levy appears antiquated regarding modern energy usage and technological advancements.

Approximately one-third of the total bitcoin mining processing power worldwide is currently being contributed by the United States.

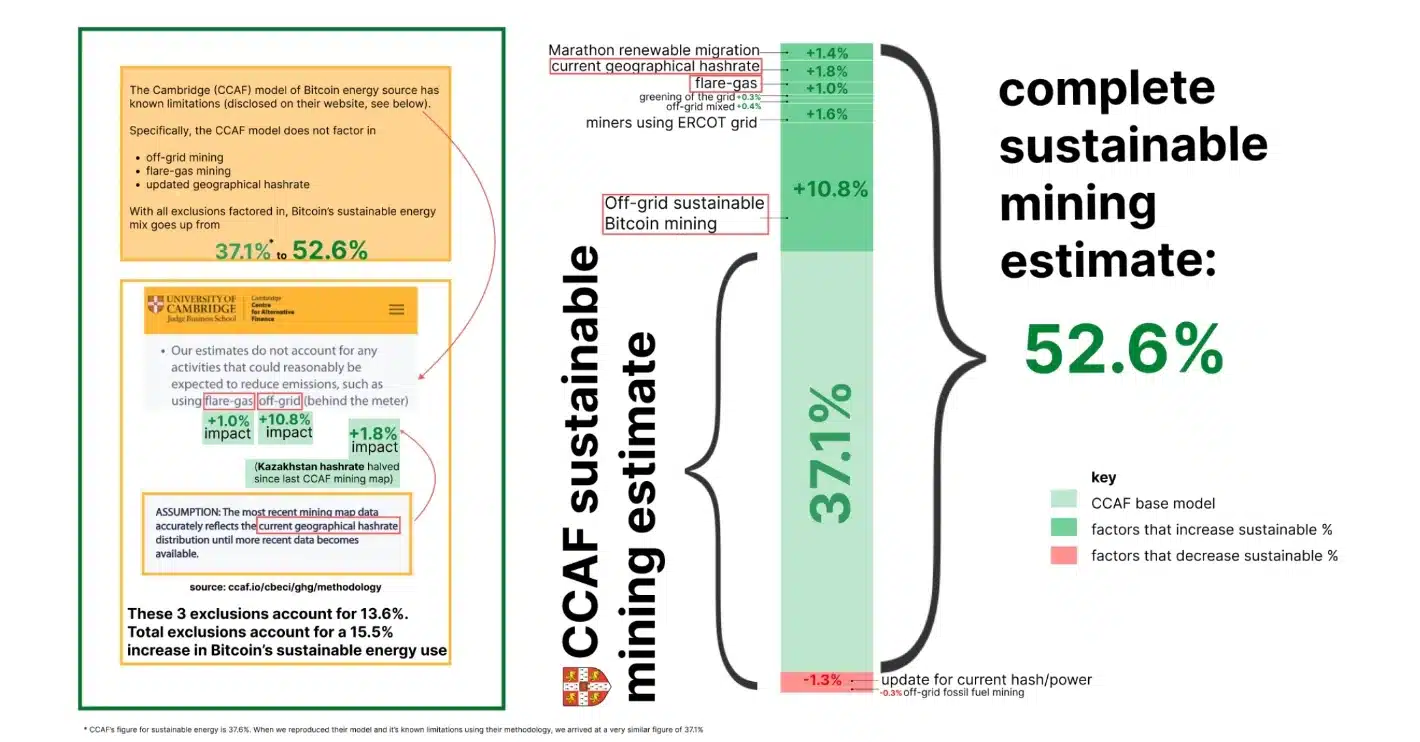

Despite the common perception, Lummis pointed out that the Bitcoin Energy and Emissions Sustainability Tracker demonstrates that Bitcoin mining may be less harmful to the environment than generally believed.

Based on the data from the tracker, approximately half of Bitcoin mining – around 52.6% – can be carried out with little to no carbon footprint.

She further added,

The administration’s proposition asserts that Bitcoin mining poses “risks” to local utility grid functions. Yet, it fails to back up these assertions with any substantiating evidence. In fact, real-world data demonstrates that Bitcoin mining actually fortifies the resilience of America’s energy grids.

The Laffer Curve analysis

In the final part of her report, Lummis emphasized the key concepts of the Laffer Curve demonstration. According to this theory, increased tax rates may result in reduced total tax revenues due to a decrease in economic activity caused by the higher taxes.

Reiterating the same, Lummins, aptly summarized the situation with her comment when she said,

As a crypto investor, I recognize the significance of a supportive and stable environment for Bitcoin mining. If America fails to provide this, we could lose our current edge in this space and find ourselves lagging behind in the global race to lead in Bitcoin mining technology. It’s crucial that we don’t let our advantage slip away.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-07-24 17:12