- IMF proposes electricity tax hikes on crypto miners

- Per the agency, the levy would help address miners to reduce their carbon footprint.

As a seasoned researcher with a keen interest in environmental sustainability and technology, I find the IMF’s proposal to be a step in the right direction towards mitigating the carbon footprint of crypto mining. The stark reality is that the energy consumption of cryptocurrency mining is comparable to that of small nations, which is a concerning trend if we wish to combat climate change effectively.

Representatives of the International Monetary Fund (IMF) are suggesting a significant increase, approximately 85%, in the tax levied on Bitcoin [BTC] and crypto mining operations as a means to significantly reduce the carbon footprint linked to the process of creating cryptocurrencies.

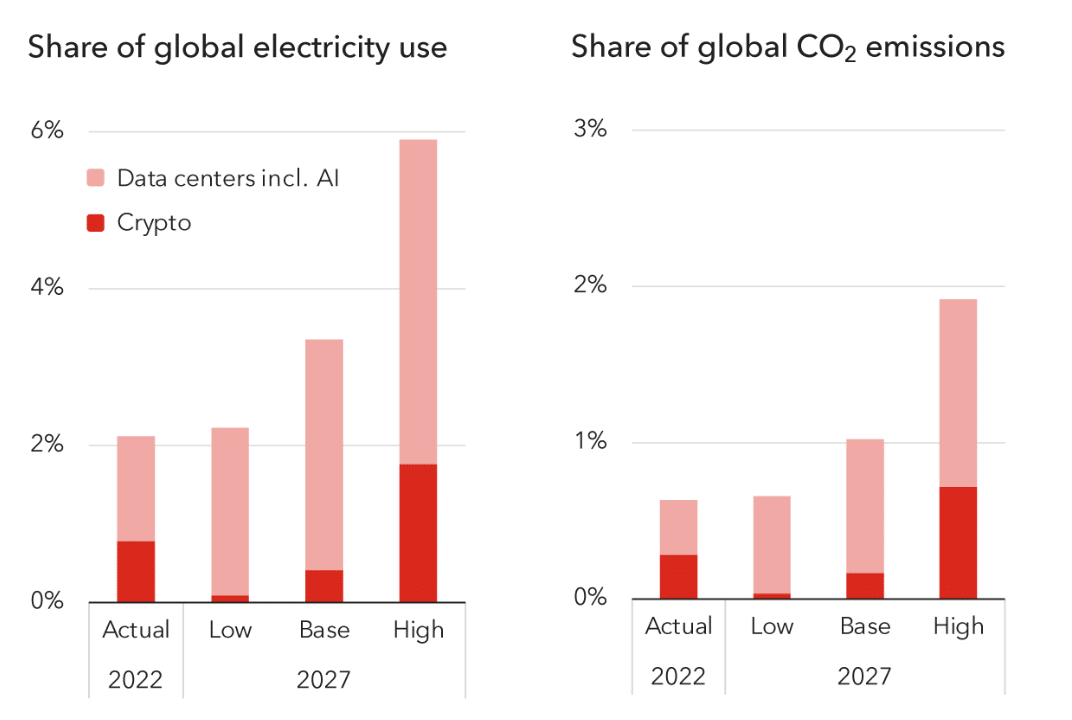

The proposal was based on the climate impact of crypto miners and AI data centers. Per IMF, crypto mining will produce 0.7% of carbon emissions by 2027.

If data centers are included, it would mean 1.5% of world carbon emissions by 2027.

By the year 2027, it’s projected that crypto mining could account for approximately 0.7% of global carbon dioxide emissions. If we include data centers in our analysis (using IEA estimates), their carbon footprint could potentially reach a staggering 450 million tons by the same year, equating to around 1.2% of the total global emissions.

Will the tax hike solve emissions from crypto miners?

The report added that mining a single BTC was equivalent to 3-year electricity consumption by an average person in Ghana or Pakistan.

By 2022, it’s been estimated that crypto mining and data centers collectively used about 2% of the world’s total electricity consumption. However, according to a report from the International Monetary Fund (IMF), this figure could surge to approximately 3.5% by 2027, potentially matching Japan’s current electricity demand levels.

1. Solution Proposed: To help with this issue, the agency suggested a tax of $0.047 per kilowatt-hour on directly purchased electricity for miners as an incentive to control their emissions. Additionally, the IMF recommended increasing that tax by 85% specifically targeting miners to tackle air pollution.

As a researcher studying the effects of air pollution on local health, I can say that if we factor in this influence when determining the tax rate, it would escalate to approximately $0.089. This equates to a significant 85% rise in the average electricity price for miners, a cost that directly reflects the increased environmental responsibility we are assuming.

The agency also criticized current tax regimes with ‘generous tax exemptions,’ stating that the benefits of current tax regimes on miners were unclear.

As a researcher examining this proposal, I can express that, according to the International Monetary Fund’s estimates, increasing the levy is projected to decrease our annual carbon emissions by an amount equal to current Belgian emissions – approximately 100 million tons.

Recently, Russia warned that cryptocurrency mining could potentially strain the nation’s electrical supply. Yet, they have now enacted legislation allowing for regulated cryptocurrency mining within their borders.

In countries such as China and Venezuela, there is an outright prohibition on cryptocurrency mining. Whether other nations will follow suit with similar proposals is yet to be determined.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-17 01:11