Key Highlights:

- AAVE shot up a staggering 118% — from a modest $121.75 to a fancy $265 — in just six weeks. Yep, really. 📈

- The geniuses behind the scenes launched Aave v3 on Aptos yesterday (May 19), bringing their crypto crusade to a non-EVM Layer 1. Talk about expanding horizons! 🌍

- Technical charts show a parabolic rally, which is fancy talk for “it’s skyrocketing,” but that prudish thing called momentum indicators are starting to cool — like a July heatwave in England. ☀️❄️

- AAVE’s TVL hit $40.3 billion, and Chainlink SVR coverage jumped from 3% to 27% — because who doesn’t love a security upgrade? 🔒

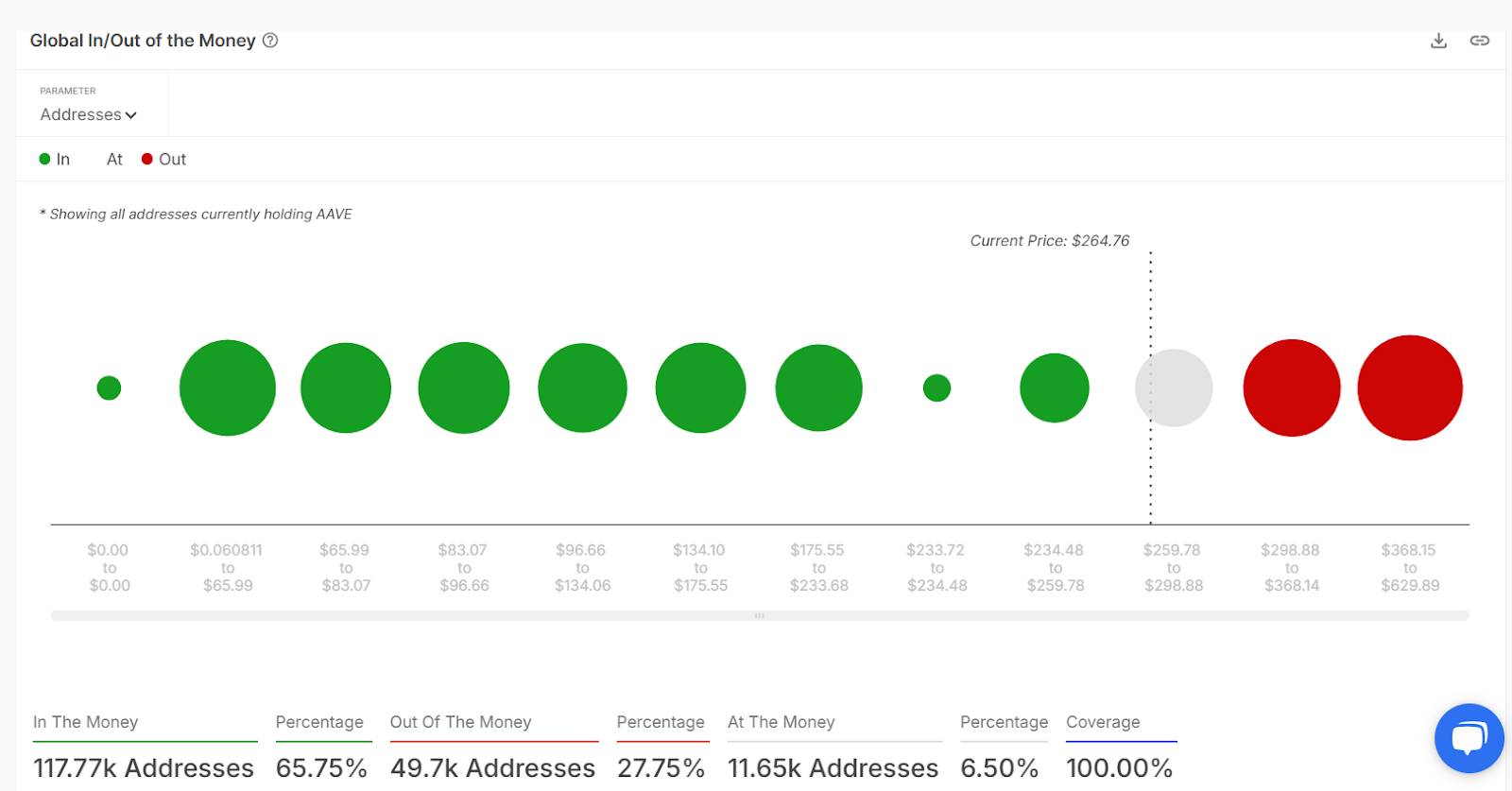

- On-chain metrics tell us over 80% of tokens and active users are in the profit zone — supporting the wonderful, euphoric rally. 🤑

With AAVE climbing over 118% in just six weeks, we’re now staring down the barrel of week seven — is this momentum for real or just a spectacular mirage? Time will tell. But hold on to your hats; this ride might be reaching a peak. 🎩🚀

Recent Developments: Ecosystem Growth Reinforces Rally

In the past couple of weeks, Aave has been busy making itself even more impregnable. On May 12, the Aave DAO gave the green light to expand Chainlink’s Secure Value Recovery (SVR). The result? TVL coverage jumped from 3% to over 27%. It’s like giving the protocol a shiny new suit of armor. 🛡️

This move beefs up risk mitigation and cements Aave’s position as the ‘Fort Knox’ of decentralized lending platforms. Because who doesn’t want a fortress? 🏰

Then, on May 19, Aave v3 finally landed on Aptos — a non-EVM chain. Because, evidently, Ethereum isn’t enough of an exclusive club. Now everyone gets a turn! 🎉 This means more liquidity, more users, more money, and probably more headaches too. 🙃

As I write this, AAVE is trading at roughly $264.71, up by a hefty 20.35% in just 24 hours. Daily volume? Oh, just a casual $808.39 million, up nearly 67%. This thing’s not just riding a wave — it’s surfing on a tsunami. 🌊

AAVE/USDT: The Parabolic Party Nears the $300 Door

Ever since April 9, AAVE’s price has been sprinting like a caffeinated squirrel, leaping from $121.75 to over $265 — a hefty 118% increase that has chart watchers adjusting their glasses. The story of a rocket that’s breaking all the rules and heading straight for the $285–$300 obstacle. 🚀🧱

It’s just broken past a pesky resistance line, and now it’s eyeing that juicy resistance zone around $285–$300, reminiscent of that awkward January breakout. Currently trading near the upper Bollinger Band, it’s like the party’s gotten a little too wild — extended, overbought, and ready for a breather. 💃🕺

Momentum Indicators — The Saboteurs of the Party

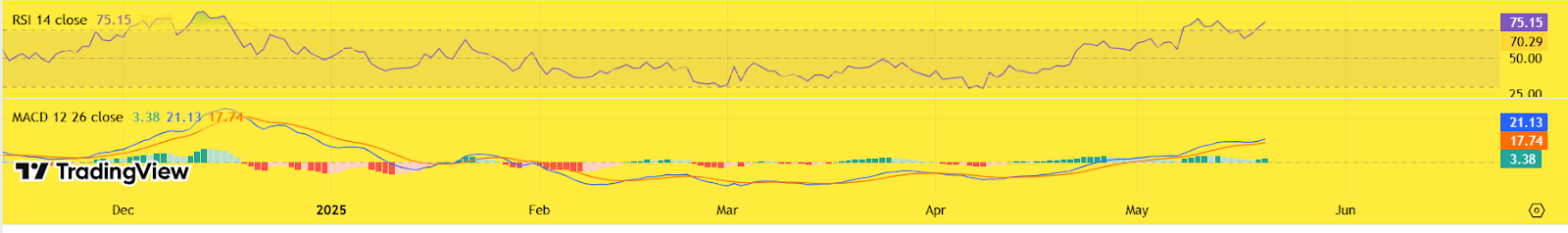

The RSI hit 74.88 — comfortably overbought territory — which means buyers are feeling confident, or perhaps just a little bit overexcited. The MACD? Still bullish but the histogram is narrowing, so the wind in the sails might be weakening. Meh. ⚓️

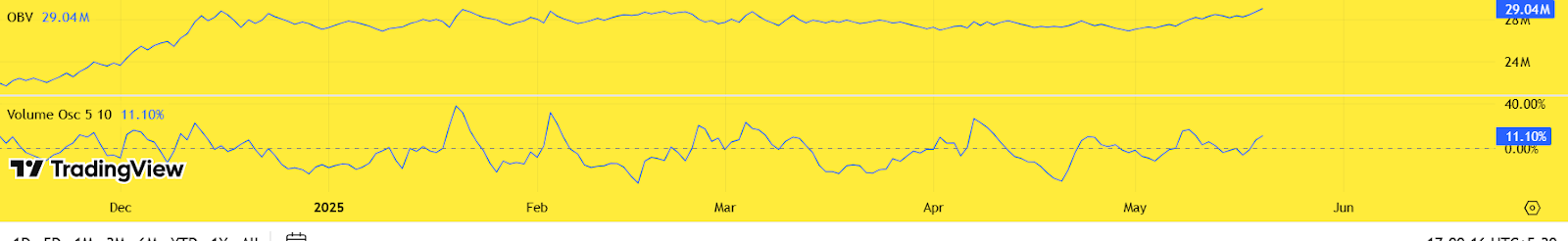

Meanwhile, the OBV (which tracks volume versus price) has flattened at around 29 million, signalling that the buying fervor might be cooling off. The Volume Oscillator? Still in positive territory but weaker than earlier — like a runner who’s lost a step. 🏃♂️💨

All in all, the indicators hint that we might be near a pause or pullback — like a rollercoaster that’s just reached the peak and is waiting to go down. But if prices rocket past $300 with volume to back it up, we’re in for a sequel. 📉📈

If the price stalls or pulls back, support levels around $240 and $210 come to the rescue, just in case. For now, traders should be watching the $285–$300 zone like hawks — because the next move depends on whether bulls can push through or get deflated. 🦅

Holder Confidence: The Loyal Few Still Trust the Ride

- 81.92% of AAVE tokens are comfortably “in the money,” based on volume-weighted breakeven data. 💰

- Only about 12% are in the red, meaning most holders prefer a ‘wait and see’ approach rather than panic selling. 🤷♂️

- The “Active Addresses by Profitability” chart reveals a hefty 13.41 million AAVE tokens worth $3.55 billion held profitably. 💸

- And a cheerful 83.44% of active users are in profit — meaning traders don’t seem desperate to dump their gains just yet. 🎉

most holders are laughing all the way to the bank. Short-term dips? Probably just blips, unless the market throws a tantrum. 😉

Final Verdict: Bulls or Bears, We Still Watch $300

Six weeks of relentless gains have made the case that AAVE is a force of nature. But the volume is waning, and the $285–$300 threshold is looming like a cautionary sign. If bulls push through with volume, it could easily dash toward $340–$360. But if they falter, the bears might take a bow at $240 support first. 🐂🐻

All signs point to a bullish bias — but beware the exhaustion, folks. Keep a keen eye on that $300 mark, because the next chapter hinges on whether buyers can keep the party going or call it a day. 🍿

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

2025-05-20 16:16