- MARA climbed following the announcement of JD Vance, a known Bitcoin advocate, as Donald Trump’s running mate.

- The outcome of the election could influence the future outlook as analysis showed that the token could hit $30.

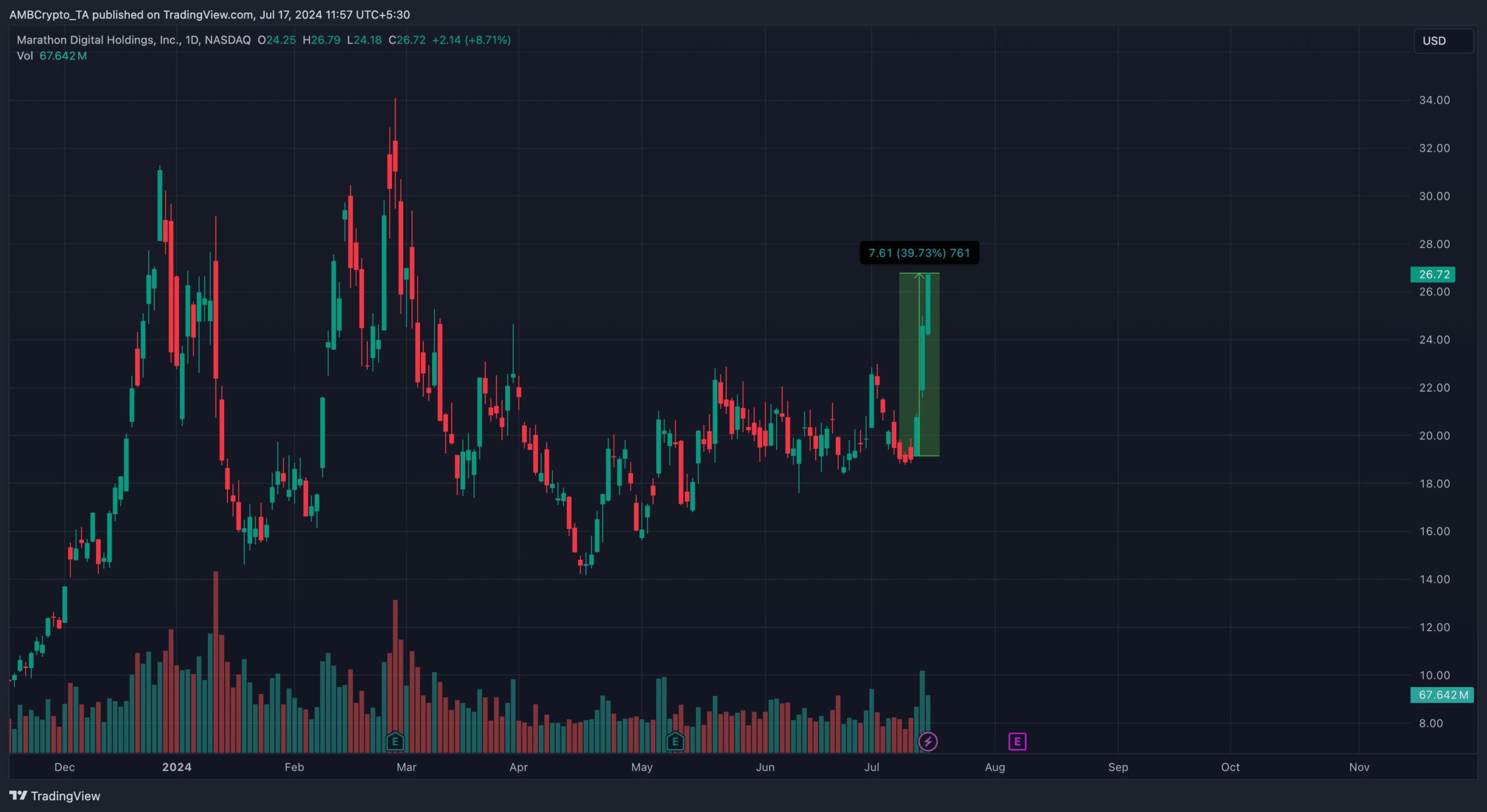

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely monitored Marathon Digital Holdings (MARA) and its stock price movements. Over the past few days, MARA has experienced a remarkable surge of 39.73%, reaching a price of $26.72 at press time.

From the 12th to the 16th of July, Marathon Digital Holdings’ (MARA) crypto stock experienced a significant surge in value, with its price rising by an impressive 39.73%. Currently, the MARA stock is priced at $26.72.

In the past month, the value of the asset hovered near a 30-day low of $18.80 before experiencing a significant price increase. This uptick was not without explanation, as AMBCrypto pinpointed the reasons behind it.

Trump and Vance join hands in MARA’s favor

Based on our analysis, the price of MARA stock rose due to Donald Trump’s selection of a pro-cryptocurrency figure as his vice presidential nominee.

On July 16th, the preceding American president and contender for the November elections announced his selection of James David Vance as his vice presidential nominee. This individual hails from Ohio and holds a seat in the United States Senate.

Vance is well-known for his passionate support of Bitcoin and the cryptocurrency market as a whole. It’s been estimated that he holds a stake worth between $100,000 and $250,000 in Bitcoin [BTC].

Following the announcement, MARA stock joined other stocks and Trump-themed memecoins in rallying.

Additionally, the remarkable increase in the stock’s value may continue. This is due to the significant impact the cryptocurrency industry is having on this year’s election results.

As a crypto investor, I’ve noticed that the regulatory attitude towards cryptocurrencies has evolved significantly. For instance, former President Trump initially expressed skepticism about digital assets but later showed leniency. Currently, President Biden’s administration has adopted a more measured approach compared to their initial stance on cryptocurrencies.

MARA stock price to $30 is possible

If Marathon Digital Holdings is fortunate enough to experience further growth in the coming elections, there’s a strong possibility that the value of MARA stocks will escalate even higher. This upward trend could potentially lead the crypto stock back towards its Year-To-Date (YTD) peak of $31.80 for another test.

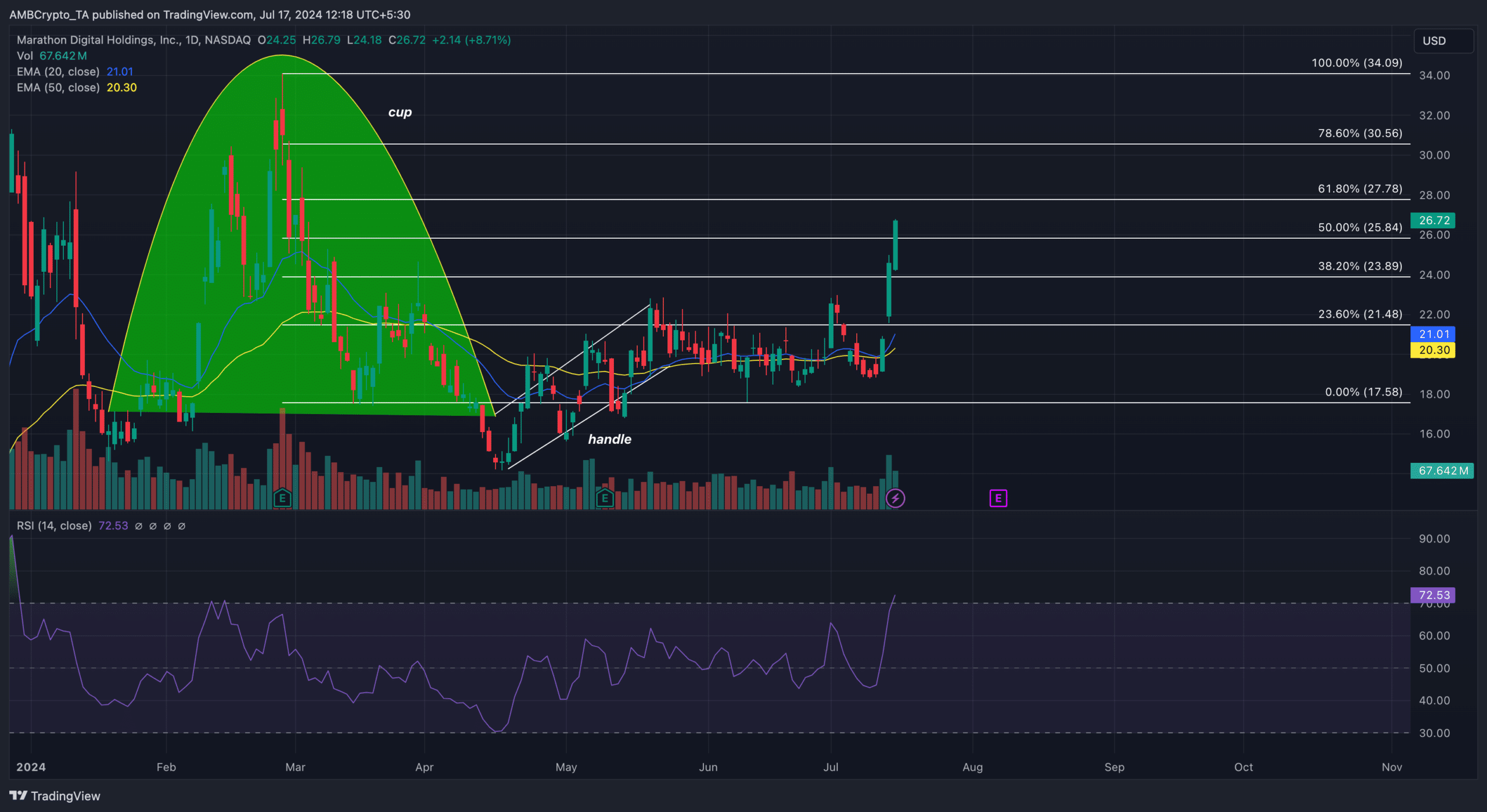

From a technical standpoint, it’s worth considering the potential implications of this situation. Based on the daily price chart, MARA displayed an inverted cup and handle pattern during the period from January to May.

The technical pattern we’re discussing is a bearish sign, implying that MARA’s stock price may keep declining, following a downtrend. This possibility emerged during late May through early June when the share price reached $18.70.

The aforementioned advancement played a crucial role in bringing about the turnaround. In addition, AMBCrypto analyzed the Relative Strength Index (RSI) as part of their examination.

The Relative Strength Index (RSI) employs variations in speed and magnitude to gauge market momentum. A rising RSI signifies a bullish trend, while a declining RSI suggests a bearish momentum.

Another interpretation: The RSI value for MARA stock stood at 72.53, signifying that the asset was overbought based on the Relative Strength Index (RSI) indicator’s criteria, where readings below 30.00 indicate oversold conditions and values above 70.00 suggest overbought conditions.

As a market analyst, I would interpret the situation as follows: The cryptocurrency’s stock price surpassed both the 20-day moving average (represented by the blue line) and the 50-day moving average (signified by the yellow line). If the price were beneath these indicators instead, we would label the trend as bearish.

Is your portfolio green? Check the Bitcoin Profit Calculator

Consequently, this outlook indicates a bullish market trend for MARA. As a result, its price may disregard the oversold status and continue rising.

Based on current trends, MARA’s stock price may reach $30.56 in the near future. In the longer term, there is potential for further growth, potentially significantly so, if Donald Trump wins the upcoming U.S. elections.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-07-17 20:08