Bitcoin surged past the $110,500 mark on Monday, like a man who found a $100 bill on the street—too good to be true, but it happened. Yet, just as quickly as it climbed, Bitcoin fell back, losing nearly 2% as the once-strong bullish momentum fizzled like a forgotten firecracker. Meanwhile, crypto-linked stocks in the US decided to keep the party going, riding the coattails of Bitcoin’s brief glory, and are now huddling alongside the mighty coin in a state of indecision.

In the past month, crypto stocks have posted some impressive double-digit gains—while Bitcoin itself barely eked out a 4% increase. So, as we wade into this financial swamp, let’s compare the performance of these stocks, Bitcoin, and altcoins, and see if these crypto stocks are the golden goose in a trader’s portfolio or just another chicken that got lucky.

Table of Contents

US crypto stocks vs. Bitcoin performance

The week began with a crypto stock rally, as US crypto-linked stocks joined the Bitcoin parade. BTC flirted with resistance above the $110,500 level before deciding to rest—because why keep climbing when there’s so much comfy consolidation to enjoy? In the meantime, stocks of mining companies and crypto firms decided to follow suit, only to wipe away their gains like a miscalculation on a tax return by Tuesday.

Meanwhile, more corporations have jumped on the Bitcoin bandwagon, with Saylor’s strategy of adding Bitcoin to corporate treasuries becoming a trend. Circle made a splash with its stellar IPO debut on Nasdaq last week, driving Bitcoin’s rise and giving a boost to US crypto stocks. A rare moment of corporate wisdom, we suppose. But wait, Circle Internet Group (CRCL) saw a sudden 8% dip, as if the IPO had a one-night stand with reality. The stock nearly erased all its gains from Monday.

In the world of crypto mining stocks, the game was a bit more stable: Core Scientific Inc. (CORZ) slipped by 0.12%, CleanSpark Inc. (CLSK) crept up by a tiny 0.10%, and MARA Holdings Inc. (MARA) inched up by 0.25%. Riot Platforms Inc. (RIOT), however, had a good day, with a modest gain of 0.60%.

Bitcoin, meanwhile, slid closer to its support at $108,000, while crypto stocks did their best imitation of consolidation. As Bitcoin’s correlation with the S&P 500 weakens, it seems more equity investors are opting for the “safe” route—buying crypto stocks instead of dealing with the risky business of holding actual tokens. Who wants to worry about custody and security, right?

The decline in stocks like CRCL, Coinbase (COIN), KULR Technology Group Inc. (KULR), and Robinhood Markets Inc. (HOOD) presents a golden opportunity for buyers who’ve been sitting on the sidelines, waiting for a good chance to diversify. Perhaps it’s time to consider adding crypto stocks to your portfolio and balance them against your precious crypto tokens. After all, it’s not the first time people have hedged their bets on the next big thing.

If Bitcoin’s correlation with the S&P 500 continues to weaken, it’s entirely possible that crypto stocks might outshine BTC and altcoins this cycle. Go figure.

Nasdaq newcomer takes a hit this week

Circle’s stock, fresh from its debut on Nasdaq, is taking a nosedive faster than a kid at a water park. After reaching a high on Monday, CRCL plunged throughout Tuesday’s early trading hours. It’s like the stock got a dose of reality after its IPO-induced adrenaline rush. Still, CRCL is managing to stay afloat with an impressive all-time performance—up by over 50%. Let’s see if it can pull itself back together.

US crypto stocks are attracting inflows and interest

While Bitcoin funds are still scrambling for institutional capital (according to the latest CoinShares report), the combined market value of US crypto companies has passed $300 billion—because, of course, there’s always room for more zeros in the crypto kingdom. The demand for exchange stocks, Bitcoin mining stocks, and Circle’s CRCL is rising steadily as Bitcoin consolidates. Who knew that mining crypto could become a bigger business than some small countries?

Bitcoin’s rising hashrate has cranked up the competition among miners, while friendly regulations like the GENIUS Act are fostering a more pro-crypto environment. What a time to be alive! Analysts from 10xResearch believe Robinhood’s crypto revenue rise and Coinbase’s undervalued stock suggest a major shift in the market. Retail investors are eyeing crypto stocks, likely drawn by the increasingly clear regulatory landscape for holding and taxing cryptocurrencies.

Bitcoin price analysis

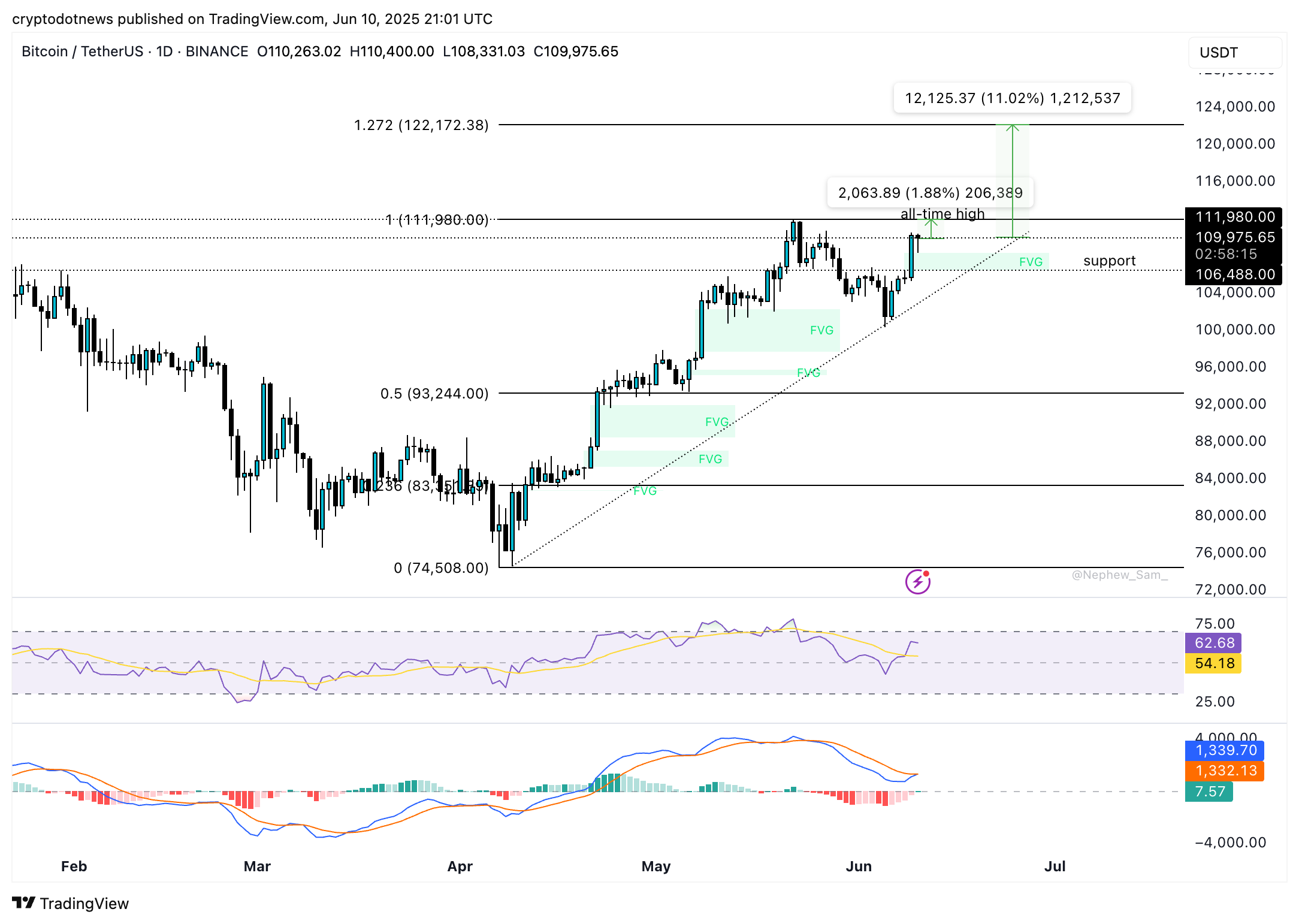

Bitcoin is now less than 2% from its all-time high of $111,980. The big question remains: will Bitcoin break its previous record and launch into uncharted territory, or is it destined for another wobbly detour? The BTC/USDT chart suggests that $122,172 might be the next target—thanks to the magic of the 127.2% Fibonacci retracement level. Never underestimate the power of a good chart pattern.

Technical indicators like the RSI (62) and MACD seem to back the idea that Bitcoin could keep rising. RSI is above average, but not quite in the “overvalued” danger zone. Meanwhile, the MACD is flashing green histograms, which is basically code for “things are looking positive.”

Bitcoin is now just 11% away from that magical Fibonacci retracement level of $122,172. But it might find some support at $106,488—at least until it decides to go on its next wild ride.

Ruslan Lienkha, Chief of Markets at YouHodler, weighed in with a note that Bitcoin hitting a new all-time high is a very real possibility. Lienkha added, “The S&P 500 is still around 3% below its own peak, so the financial markets aren’t exactly in crisis mode.”

“All eyes are now on tomorrow’s U.S. inflation report. While markets are pricing in a moderate uptick, a higher-than-expected reading could trigger increased volatility across risk assets, including cryptocurrencies.”

Read More

2025-06-11 21:59