- Crypto-related stocks decline amidst global market turmoil.

- Companies like MARA, MSTR, Coinbase hit hard by market decline.

As a seasoned crypto investor with a few battle scars from the volatile world of cryptocurrencies, I can say that this recent market turmoil has been quite the rollercoaster ride. The crash on 5th August sent shockwaves across the globe, leaving no stone unturned – not even the seemingly invincible crypto-related stocks.

😱 EUR/USD Under Siege: Trump’s Tariffs to Ignite Chaos!

Prepare for unpredictable market swings triggered by new policies!

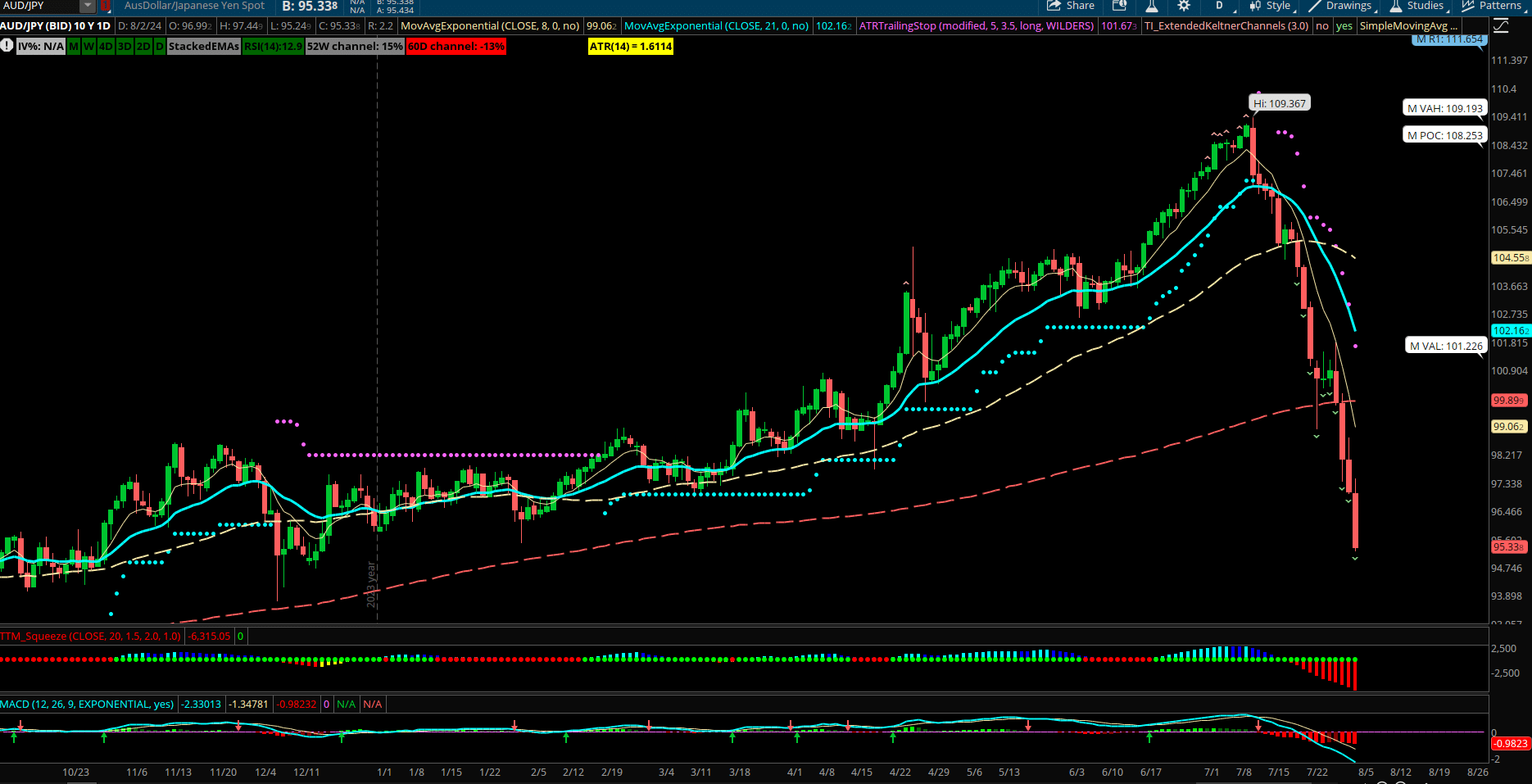

View Urgent ForecastOn the 5th of August, a major collapse occurred in many international financial markets, marking one of the most substantial falls in recent memory. This global stock plunge impacted both Japan and Taiwan particularly severely.

As a crypto investor, I personally experienced a significant ripple effect when the U.S. stock markets took a dive by 4.5%, with my crypto-related investments taking a hit as well. Companies like MSTR, Coin, and even crypto mining firms such as MARA were not immune to this adverse impact on the stock market downturn.

The report suggests that the stock market drop in Asia fueled worries about a potential U.S. economic downturn due to lingering market instability.

Crypto-related stocks plummet amid market turmoil

During a significant downturn in global stock markets, it was the cryptocurrency sector that suffered the heaviest blow. The value of cryptocurrencies dropped by approximately $300 billion, and there were around $1.2 billion worth of liquidations. This tumultuous event had a profound effect on stocks associated with cryptocurrencies.

Following the collision, businesses involved in handling cryptocurrencies or employing them as a medium of exchange, like Bitcoin (BTC), saw a dip in performance. To give an example, firms such as MicroStrategy, which own Bitcoin through open market acquisitions, experienced a drop of about 11%.

Based on Google Finance’s data, Microsoft Corporation (MSTR) saw a decrease of about 22.32% over the last five days. This drop follows a 11% decline that occurred on August 5th.

Remarkably, MicroStrategy’s situation was impacted since they possess Bitcoin (BTC) and the value of their BTC holdings significantly influences their balance sheet and stock price.

Just like many other crypto companies, Coinbase experienced a setback due to the cryptocurrency market downturn, with its shares falling approximately 7.32% – not far from the magnitude of the Japanese stock plunge in 1989 (8%).

Based on the market data, Coinbase’s shares have dropped by approximately 19.10% in the last five days. This decrease occurred amidst a 48-hour period of significant market turbulence across the globe.

Similarly, just like other crypto mining firms such as Marathon Mara, they’ve experienced a drop too. The value of MARA stocks has decreased by approximately 17.84% during the recent period.

The decrease in MARA’s performance is due to the falling values of Bitcoin (BTC) and Kaspa (KASPA), the primary cryptocurrencies that MARA focuses on. Since the overall crypto market has been experiencing a downturn, MARA has suffered this setback because it ties its value to cryptocurrency, which serves as a significant investment and store of value for them.

What’s causing market meltdown

Since last week, the stock market has been turbulent due to the absence of interest rate cuts from the Federal Reserve. Anticipating potential rate reductions in the coming month, investors became anxious after a significant event occurred in the Japanese stock market, causing a ripple effect on global markets.

In the realm of my crypto investments, I can’t help but feel a ripple effect as Japan’s stock market plunged a staggering 8%, marking one of its most dismal days ever. This turbulence was mirrored by Taiwan, where they experienced their worst day in over half a century. To mitigate potential repercussions, South Korea has taken decisive action to safeguard its own markets.

During the worldwide economic slump, over $63 billion worth of assets were sold off, impacting not just traditional investments but also digital assets such as cryptocurrencies.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-06 23:04