- There was a positive move in the traditional market on 15th July.

- Crypto stocks had a more positive start to the week.

As a seasoned researcher with extensive experience in financial markets and cryptocurrencies, I have closely observed the recent developments in both traditional stocks and crypto-related investments. The positive move in the traditional market on 15th July was indeed noteworthy, but my attention was particularly drawn to the more promising start of crypto stocks during this period.

As a researcher studying the cryptocurrency market, I’ve observed an impressive increase in the value of crypto stocks over the past 24 hours. This upward trend mirrors similar gains in Bitcoin [BTC] and other digital currencies. Notably, this surge in crypto-related stocks can be attributed to recent events, specifically the assassination attempt on Donald Trump, who is known for his favorable stance towards cryptocurrencies.

Good day for crypto stocks?

In recent times, crypto-connected stocks in the stock market have shown impressive results, indicating a healthy trend for this sector. Notable companies like Riot Platforms, Coinbase, and MicroStrategy ended their latest trading day with substantial double-digit increases.

The impressive showings by these corporations, deeply connected to the cryptocurrency sector, highlight the increasing clout and incorporation of digital currencies into traditional investment portfolios.

How key crypto stocks trended

As an analyst, I’ve observed MicroStrategy’s (MSTR) shares demonstrating remarkable strength in recent trading. The week commenced with a substantial uptick, pushing the stock price upwards. Specifically, on July 15th, the share opened at around $1,515 and concluded the day at approximately $1,611. This translates to an impressive weekly gain of over 15%.

MicroStrategy, with its substantial Bitcoin holdings making it the largest corporation in this regard, has experienced a significant surge in stock value, exceeding 150% growth during the current year. This uptick underscores the effectiveness of its investment approach, thriving within an advantageous crypto market landscape.

As a crypto investor, I’ve noticed that Coinbase (COIN) displayed impressive gains on July 15th. Specifically, the stock price surged by approximately 11.42%. This uptick brought the share price from around $229 to above $242 by the end of the trading day.

In the first quarter, roughly one-third (33%) of all trading volume on Coinbase came from Bitcoin transactions, and Ethereum transactions comprised about one-seventh (13%).

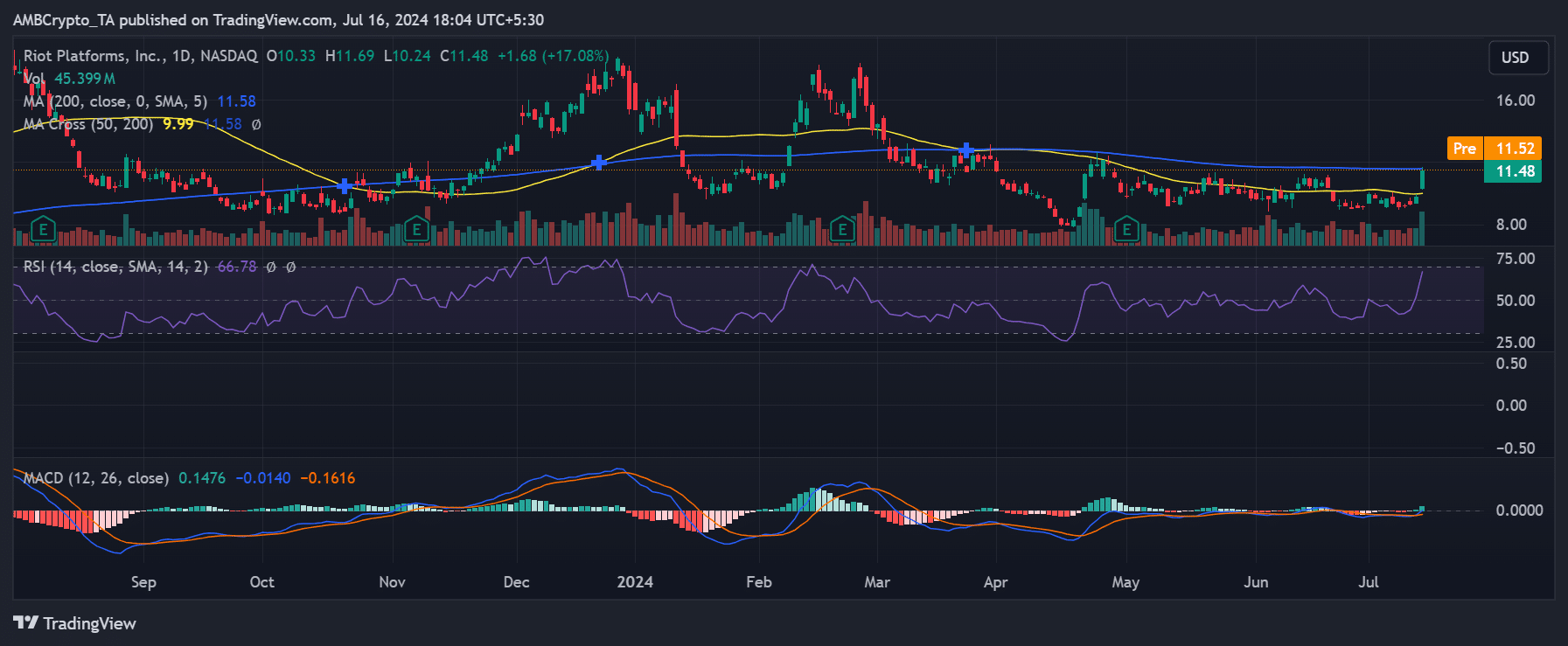

Riot Platforms, a Bitcoin mining firm, experienced a significant gain in its share value. The stock price rose more than 17% and went from around $10.3 to above $11.4.

Mining companies like Riot Platforms gain from Bitcoin’s price surge since it raises the worth of the Bitcoins they extract, thereby boosting the financial success of their mining activities.

Bitcoin moves the rest of the market

On July 15th, an examination of Bitcoin’s daily price trends uncovered a noteworthy surge. The digital currency experienced a growth of around 6.49%, lifting its value from roughly $60,804 up to $64,747.

The price of Bitcoin is back up to where it was on June 22nd, which was approximately $64,235 per coin.

The RSI reading for Bitcoin (BTC) currently sits above the neutral threshold, suggesting robust buying power and a bullish market trend.

As a market analyst, I would interpret an RSI (Relative Strength Index) value exceeding 50 as a sign of buying power dominating over selling pressure, thereby reinforcing an uptrend in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-17 09:11