Based on data from Checkout.com’s study, over 15,000 businesses globally accepted Bitcoin payments by the year 2023. With the growing trend of businesses adopting cryptocurrencies, various governments and tax agencies have become increasingly aware. At present, most nations mandate reporting of crypto income and payment of taxes on them.

Despite the intricacy and perplexity that crypto taxes present for some, in this article we’ll clarify the fundamentals. We’ll cover the essentials of crypto taxes and what you should be aware of when it comes to filing them.

Key Takeaways

- Most countries treat cryptocurrencies as assets or property for tax purposes, meaning any gains or losses from crypto transactions are taxable.

- Exchanging crypto assets for fiat, using crypto to buy goods or services, and receiving digital assets as income are common instances of taxable crypto events.

- Some non-taxable cryptocurrency events include gifts, donations, transfers between personal wallets, and HODLing.

- Failure to report crypto taxes can result in serious consequences, including back taxes, penalties, and even criminal charges.

The Basics of Crypto Taxes

Is it necessary to pay taxes on cryptocurrencies such as Bitcoin, Ethereum, and Solana? These digital currencies are subject to taxation in two ways:

- capital gains tax

- income tax

In simple terms, each nation handles the taxation of cryptocurrencies differently. However, a widespread practice is to consider cryptos as assets or property for tax purposes. Consequently, any income derived from their sale or trade, including profits and losses, is subject to taxation.

Capital Gains Tax

How much tax do you pay on your earnings?

Most countries adopt the capital gains tax method to impose taxes on cryptocurrencies. Under this system, people are required to include their crypto earnings in their tax filings and pay taxes at a specified rate. The tax percentage for short-term gains (less than one year) is typically greater than that for long-term gains (more than one year).

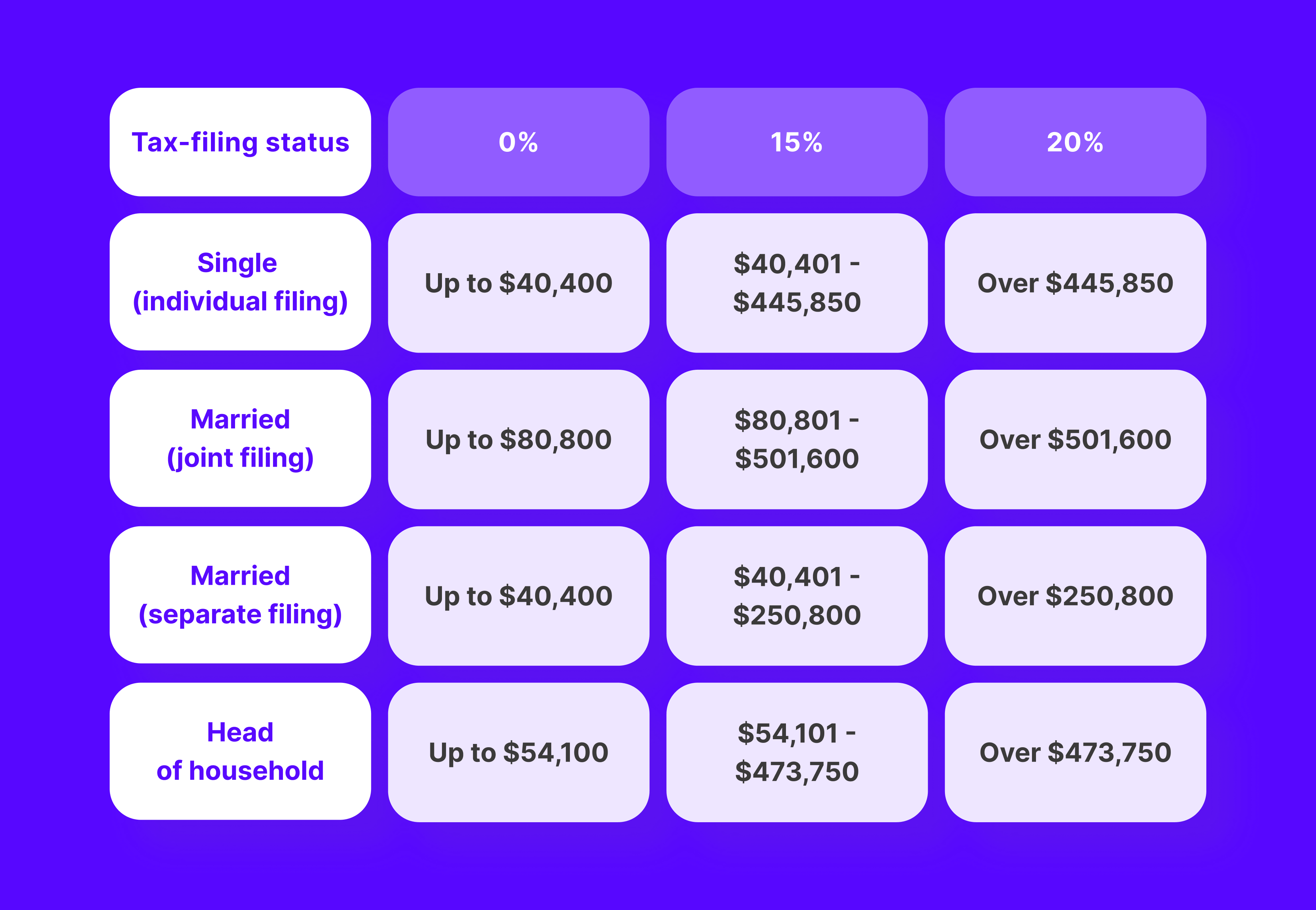

In the United States, the IRS classifies cryptocurrencies as property for taxing capital gains. The tax rates for short-term gains are between 10% and 37%, while long-term gains fall into a range of 0% to 20% based on your income level.

In the UK, just like in other countries, the HM Revenue & Customs (HMRC) considers cryptocurrencies as a form of property. Therefore, when individuals sell or swap their digital currencies, they become liable for capital gains tax. The tax rate can range from 10% to 20%, based on their overall income level.

Income Tax

People might have to pay income tax on their cryptocurrency earnings as well. This typically applies when someone routinely receivescrypto through mining, staking, or rendering services. The tax rate depends on the overall income and can differ from one nation to another.

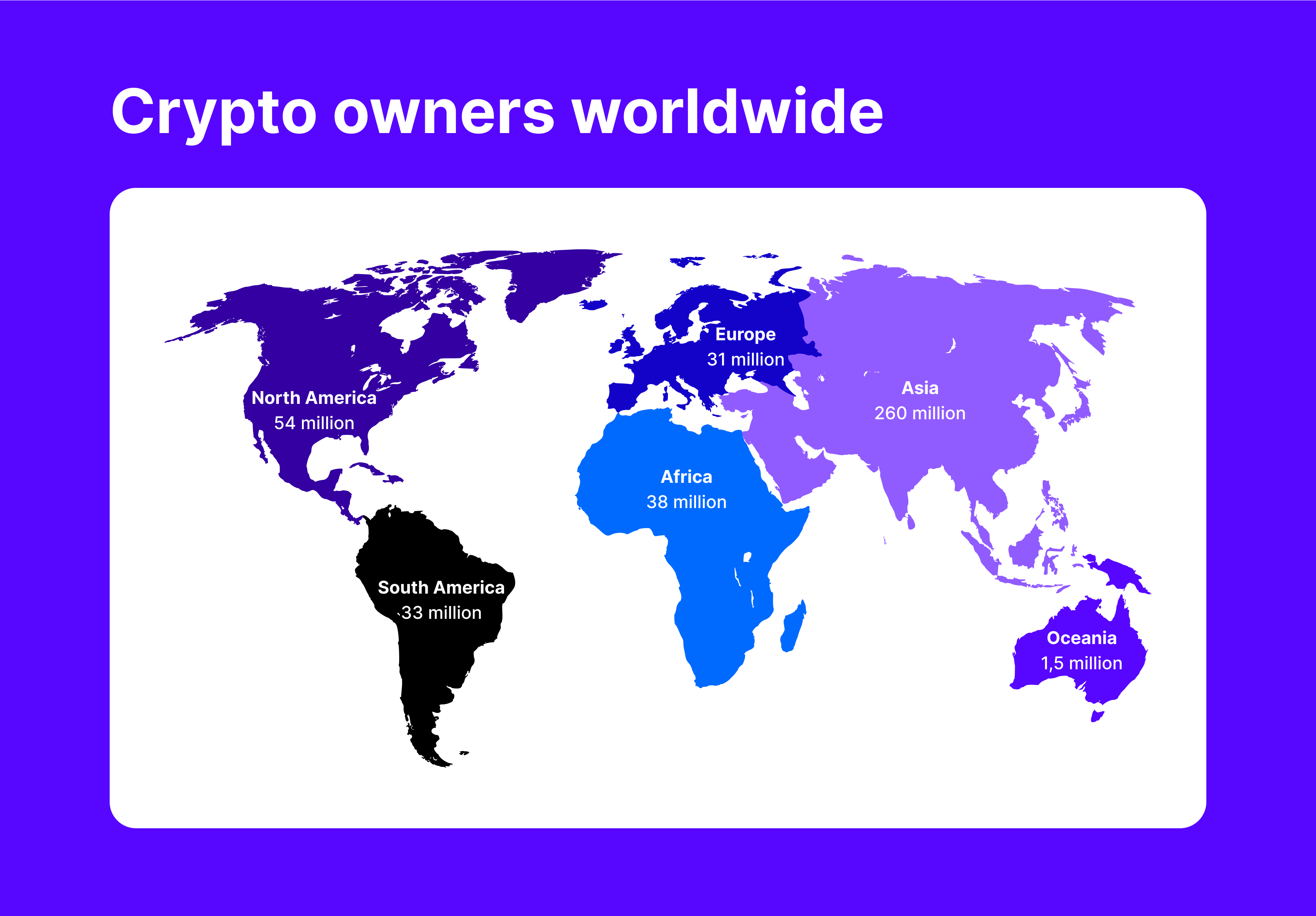

Crypto Taxes Around the World

In simpler terms, different nations impose various degrees of taxation on cryptocurrencies. Many advanced economies have established some kind of tax system for these digital assets.

In these nations, including Australia, Ireland, France, and Japan, people can use cryptocurrencies as valid methods for making transactions. However, it’s essential for individuals to declare their cryptocurrency earnings when filing their tax returns.

Instead, certain developing nations have taken strong measures against the usage of cryptocurrencies, such as outright bans or strict limitations. It’s crucial for individuals considering any crypto-related actions in these places to thoroughly investigate the local legal frameworks first.

Fast Fact

Approximately 99.47% of the world’s cryptocurrency users do not report taxes on their transactions, revealing a significant non-compliance issue and highlighting the importance of increasing public understanding and strict implementation of crypto tax laws.

Taxable Events in Cryptocurrency

Any interaction or occurrence with cryptocurrencies that triggers tax liability is referred to as a taxable event. Examples of such events are acquiring, disposing, swapping, or getting crypto in exchange for products or services.

In many nations, the tax rules for these taxable cryptocurrency transactions are akin to selling real estate: The profit or loss is determined by calculating the gap between the original acquisition cost and the price at which it was sold.

Note: Always consult a tax professional regarding your tax circumstances, as the regulations can vary depending on your location.

Let’s take a look at instances of crypto-taxable events in the US.

These particular events are taxable as capital gains:

Selling Crypto for Fiat Currency

Selling cryptocurrency for traditional money like US dollars is the most frequent situation where crypto investors incur taxes. Any profits earned during these transactions are taxable.

If you spent $50,000 to acquire 1 Bitcoin and later sold it for $55,000, you’ll have made a profit of $5,000 which is taxable income.

The tax you pay on profits from selling cryptocurrencies depends on your earnings level and how long you held the digital asset before selling it.

Previously discussed, the duration of crypto asset ownership impacts taxation. A holding period under one year results in short-term gains, taxed at your ordinary income tax rate. Conversely, if you have held it for over a year, those gains are categorized as long-term capital gains and subject to a reduced tax rate.

Exchanging One Cryptocurrency for Another

Trading one cryptocurrency for another, such as swapping Bitcoin for Solana, is still considered a taxable event even if you’re not converting it into fiat currency. The difference between what you paid for the initial crypto and its current market value will be subject to capital gains taxes.

Using Crypto to Purchase Goods and Services

Buying goods or services with cryptocurrency might appear as routine business, but the IRS views it as a taxable occasion. This is comparable to exchanging cryptocurrency for traditional money and could necessitate reporting any profits derived from the deal.

These events are taxable as capital gains as income:

Receiving Cryptocurrency as Income

When you get paid in cryptocurrency for the services you provide, you’ll need to report it as part of your taxable income. This applies whether the payment comes from an employer or as compensation for freelance work. The amount will be subjected to your respective income tax bracket.

Mining Cryptocurrency

Verifying transactions on a cryptocurrency’s blockchain using your computer’s power is known as mining, and you can earn new coins as a reward for your efforts. These rewards count as income that needs to be reported in your taxes. The value of the mined coins when they were acquired will establish the taxable income amount.

Staking Rewards

Paraphrasing: Earning crypto through staking is an alternative method, which means keeping a specific cryptocurrency amount in your wallet for a defined term to gain rewards. This process shares similarities with mining, and the rewards’ value on the day they were received will establish the tax liability.

Receiving Crypto from Hard Forks

If a cryptocurrency experiences a hard fork leading to the creation of a new coin, any coins obtained in this process are viewed as taxable income. The tax liability is determined by the fair market value of the new coins when they became accessible to you.

Receiving Airdrops

Companies or projects give away free cryptocurrency directly to users in an event called an airdrop. The received crypto is regarded as taxable income and should be declared on your tax returns with the market value at the time you received it.

Other Incentives and Rewards

In addition to the listed occurrences, there are numerous alternative methods to acquire or obtain cryptocurrencies. For instance, you can get rewarded by taking part in educational initiatives or receive incentives for bringing new friends to join a cryptocurrency trading platform.

Non-Taxable Events in Cryptocurrency

Cryptocurrency transactions that don’t trigger income tax or capital gains taxes are called non-taxable events. Such activities may involve giving away cryptocurrencies as gifts, making charitable donations with them, or transferring cryptocurrencies between your own digital wallets.

Cryptocurrency gifts worth less than a specified amount according to your country’s tax regulations usually don’t trigger taxes. Likewise, certain charitable donations made using cryptocurrencies might be exempt from taxes based on the receiving organization and purpose of the donation.

Let’s take a closer look at these non-taxable events:

Gifts in Crypto

In the United States, giving cryptocurrencies as gifts up to a value of $18,000 per recipient annually is generally not subject to gift taxes according to IRS regulations, effective in 2024.

Transferring cryptocurrency directly to another person for reasons other than buying goods or rendering services could be considered a gift. In such situations, it’s essential to record the transaction details, including the value and date, for possible tax reporting purposes.

Donations in Cryptocurrency

Giving cryptocurrencies directly to a legitimate tax-exempt charity or non-profit organization could allow you to claim a charitable tax deduction. This can be financially beneficial as you reduce your tax liability, all while making a positive impact on a worthy cause.

Keep in mind that not every organization or person is eligible for tax-exempt status when it comes to cryptocurrency donations. Therefore, it’s essential to check with the Internal Revenue Service (IRS) beforehand to confirm the recipient’s eligibility for tax deductions.

Transfers Between Personal Wallets

Transacting cryptocurrencies among your own wallets or accounts doesn’t trigger tax liability. The initial cost and purchase date remain unchanged, exempting you from tax duties.

HODLing

Owning cryptocurrency itself doesn’t trigger taxes. Taxes only come into play when you sell your crypto or engage in other taxable actions like staking.

How Do You Calculate and Fill Out a Report on Your Cryptocurrency Taxes?

Determining your crypto taxes means calculating your profit or loss from buying and selling cryptocurrencies. A straightforward method for this is as follows:

Fair Market Value (sale price) – Cost Basis (purchase price) = Capital Gain/Loss.

If the current value of an asset is more than what you originally paid for it, then you have realized a capital gain. Conversely, if the asset’s value is lower than your initial cost, you have experienced a capital loss.

The tax you pay on your cryptocurrency profits or losses hinges on how long you’ve owned it: if it’s a short-term holding, short-term capital gains taxes apply; for longer-held assets, it’s considered a long-term gain and subject to different tax rates.

Example of Calculation:

If you had purchased 0.5 Bitcoins for $40,000 on New Year’s Day and later sold them for $45,000 on May 1st, the profit from this transaction would amount to $5,000. Due to the fact that your holding period was under a year, these gains are classified as short-term and subjected to taxation at your ordinary income tax rate.

If you had purchased 0.5 Bitcoins for $40,000 on New Year’s Day and then sold them for $60,000 the following February, your capital gain would amount to $20,000. Given that you owned the BTC for over a year before selling it, this profit is classified as a long-term gain and subjected to a lower tax rate.

What Information Do You Need to Calculate Crypto Taxes?

To accurately calculate your crypto taxes, you need to have the following information:

- The date and time of every transaction (including trades or swaps).

- The cost basis or purchase price of each cryptocurrency.

- The fair market value or sale price of each cryptocurrency.

- Any transaction fees associated with buying, selling, or trading cryptocurrencies.

Obtaining this data can be achieved by meticulously recording your transactions, employing the aid of cryptocurrency tax programs, or seeking guidance from a tax expert.

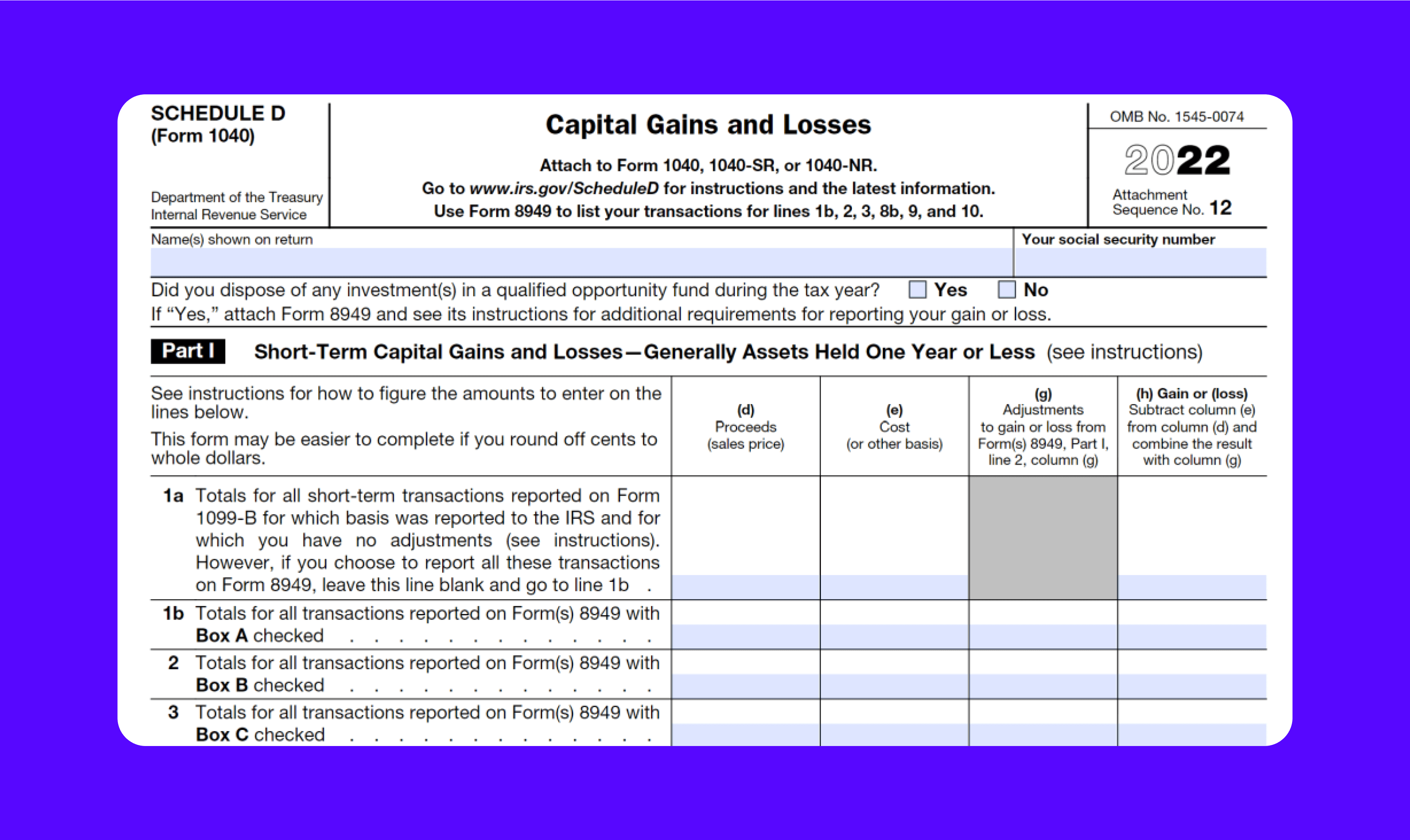

Cryptocurrency Tax Forms

In the USA, when filing your personal income tax, you report crypto taxes using Form 8949 and Schedule D. Conversely, in the UK, you include any profits or losses from digital currencies in the Capital Gains Tax portion of your tax submission.

Tips for Accurate Crypto Tax Reporting

- Keep a detailed record of all cryptocurrency transactions.

- Use cryptocurrency tax software or work with a tax professional to ensure accuracy.

- Be aware of any changes in tax laws regarding cryptocurrency.

- Report all transactions, even small ones, to avoid any potential penalties.

What Happens If You Don’t Report Your Crypto Taxes?

Neglecting to file crypto tax reports could lead to significant penalties, much like disregarding tax obligations for other income. In the United States, the Internal Revenue Service (IRS), and in the United Kingdom, Her Majesty’s Revenue and Customs (HMRC), have the power to scrutinize individuals under suspicion of evading crypto taxes through audits.

If someone hasn’t declared their cryptocurrency taxes, they could face having to repay overdue taxes, additional interest, and penalties. The specific repercussions hinge on why they failed to report in the first place.

If someone unintentionally makes an error in their taxes or is unsure of their tax obligations, they may encounter less severe penalties compared to those who deliberately attempt to avoid paying taxes. Intentional tax evasion is a criminal offense that carries significant consequences, such as hefty fines reaching up to $250,000 and imprisonment for a maximum term of five years in the United States.

Bottom Line

Navigating the taxes related to cryptocurrencies can be intricate, yet essential for participating in this digital economy. Regardless if you’re an occasional investor, a dedicated crypto trader, or a small business owner, it’s crucial that you familiarize yourself with your tax responsibilities.

In the ever-changing world of cryptocurrencies, taxes are also subject to development. Staying informed about your tax responsibilities and taking action accordingly can greatly improve your experience with crypto.

Disclaimer: The information contained in this article is for informational purposes only and should not be considered financial or tax advice. Always consult with a qualified tax professional to understand your specific tax circumstances.

FAQ

Is sending crypto to another wallet taxable?

Transferring cryptocurrency between wallets doesn’t trigger taxes because it doesn’t entail selling or exchanging the digital currency. You remain in control of your asset during the transfer process.

Do big crypto exchanges report to tax authorities?

Certainly, the majority of prominent cryptocurrency trading platforms based in the US are required to share specific transaction data with taxing authorities, such as the Internal Revenue Service (IRS). To illustrate, exchanges like Binance and Coinbase are obligated to disclose their customers’ transactions.

What is the best way to avoid cryptocurrency taxes?

Despite your desire to bypass taxes on your cryptocurrency transactions, it’s important to note that any profits earned through usage, trade, or sale of digital assets are taxable under capital gains tax.

What countries are the best for cryptocurrency tax treatment?

In various places around the world, cryptocurrency investors have benefited from lenient tax regulations. Notable examples are El Salvador, Singapore, Belarus, and Portugal.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-11 15:18