- Bitcoin hit a new all-time high, boosting crypto today to $3.2 trillion.

- Large liquidations impacted traders, while macroeconomic factors drove optimism.

As a seasoned crypto investor with battle scars from numerous market cycles, today’s surge in the global crypto market to $3.2 trillion feels like a familiar rollercoaster ride. The thrill of new all-time highs for Bitcoin is always exhilarating, but the slight dip that followed serves as a reminder that this isn’t my first rodeo.

Today, the value of cryptocurrencies has experienced a significant rise, but there’s been a minor dip as well.

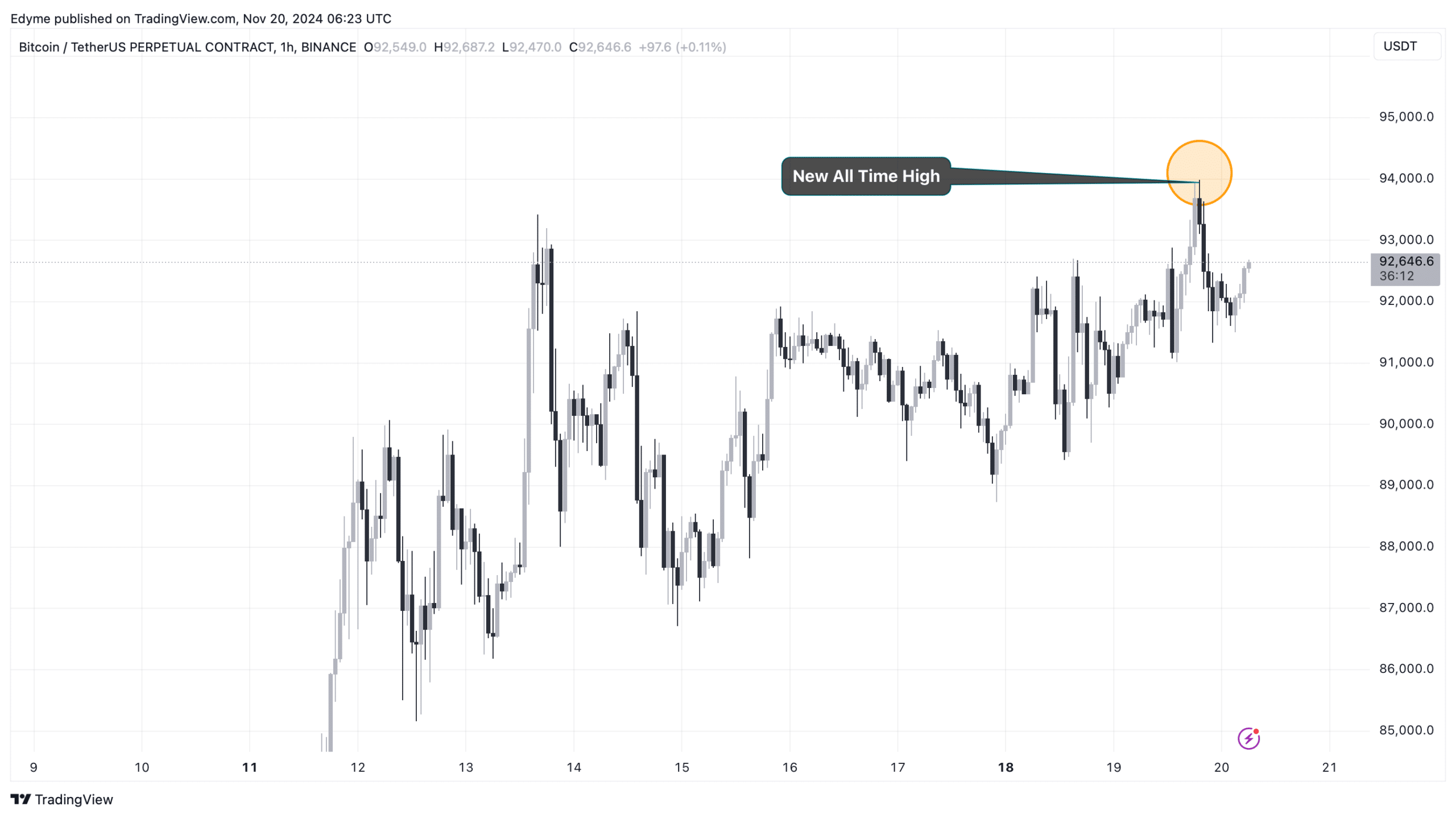

According to CoinGecko’s latest findings, the worldwide cryptocurrency market reached an impressive peak of $3.227 trillion in value today, coinciding with Bitcoin setting a record high price of $94,000.

As I write this analysis, the valuation has dipped slightly, now standing at $3.21 trillion following a 1.7% decrease from its initial figure.

Among various elements contributing to the current surge in the global cryptocurrency market, Bitcoin stands out as the most significant factor.

Previously discussed, Bitcoin (BTC), the digital currency with the highest market capitalization, has recently hit a record high, leading to a 5.9% growth in its value over the past week.

Currently, as I’m typing this, one Bitcoin was being exchanged for approximately $92,460 – a 1% rise from its value over the past 24 hours. This steady upward trend in BTC’s price is bringing it ever closer to a total market capitalization of an impressive $2 trillion.

Currently, the value of this asset’s market capitalization stands at a staggering $1.8 trillion, making it one of the most substantial assets globally.

Currently, the daily trading volume for Bitcoin has significantly increased, climbing from around $50 billion earlier in the week to a current value of approximately $77.11 billion.

Market impact and liquidations in crypto today

Although cryptocurrencies have mostly performed well lately, not everyone who participates in this market has experienced gains.

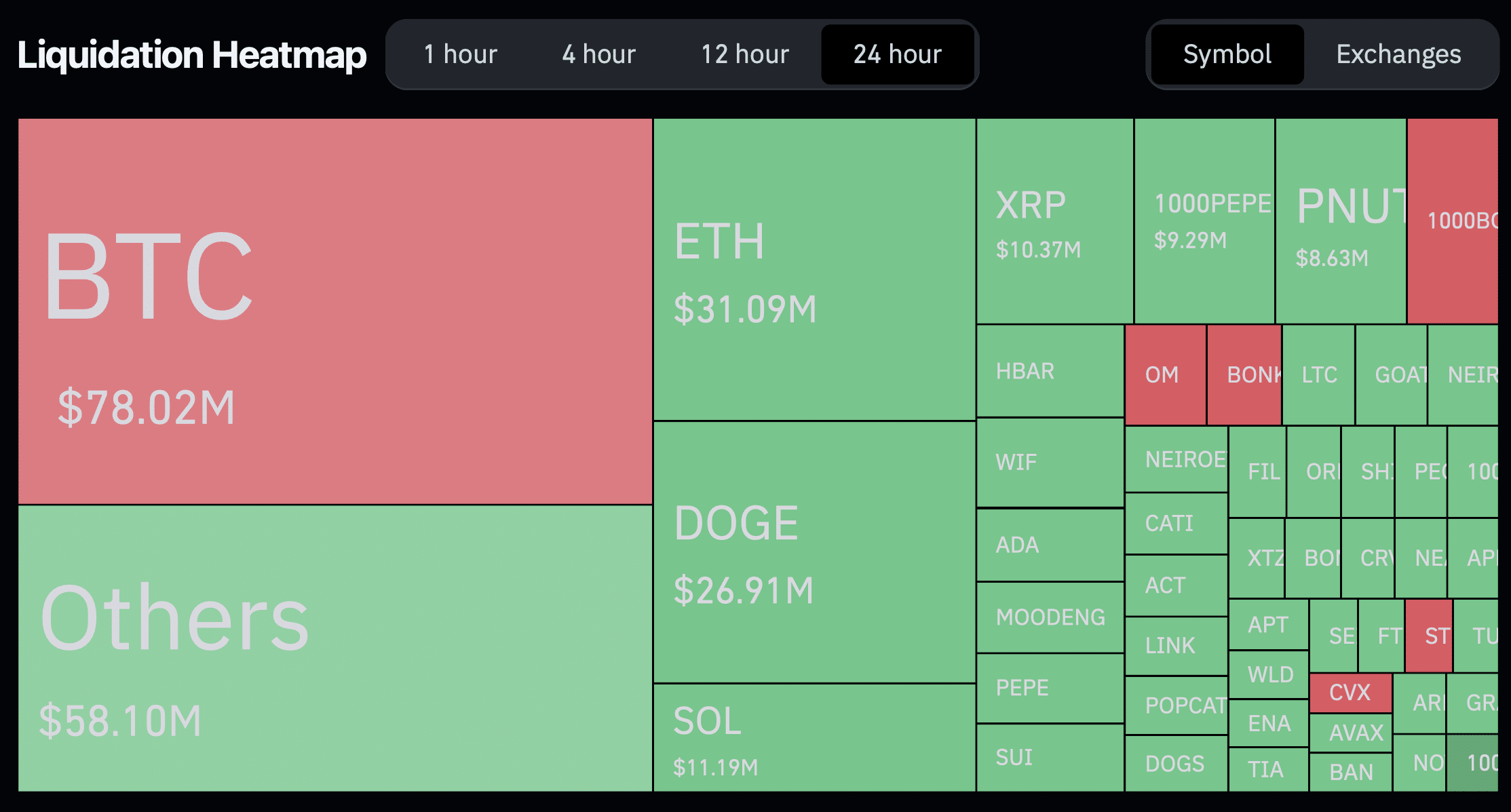

According to data from Coinglass, over the past 24 hours, around 119,717 traders had their positions closed forcibly (liquidated), amounting to roughly $317.33 million in total.

Liquidation happens when a trader’s open position is automatically closed by the trading platform because they don’t have enough money in their account to keep up with the margin requirements of a leveraged trade.

In periods of significant market fluctuations, it’s common for prices to shift oppositely to a trader’s chosen position, which can lead to potential losses or challenges.

Among all the liquidations, a sum of $78 million was linked to Bitcoin, primarily impacting short traders who faced losses amounting to approximately $47 million.

Nonetheless, long traders also suffered losses, collectively contributing approximately $31 million to the total Bitcoin liquidations.

In other digital currencies, significant coins such as Ethereum [ETH] saw a surge in open short positions being closed out or “liquidated.

Such liquidations indicate that, although Bitcoin’s increase has been remarkable, not every asset within the market has mirrored this growth.

In spite of the hurdles experienced by many, certain digital currencies demonstrated strong performance. For instance, Cardano [ADA] witnessed a 4.8% growth, whereas Pepe [PEPE] and Bonk [BONK] posted gains of 1.1% and 12.5%, respectively.

Macroeconomic drivers

Several macroeconomic factors have contributed to the performance of crypto today.

As a researcher, I’d like to highlight an interesting development: I recently observed that MicroStrategy, under the leadership of Michael Saylor, executed its most significant Bitcoin purchase yet, acquiring approximately 52,000 Bitcoins, valued at more than $4.6 billion.

High-profile purchases frequently boost market trust, strengthening Bitcoin’s position as a significant investment asset.

Additionally, interest in crypto today received a boost from Rumble, a competitor to YouTube.

The head of our platform suggested they might consider including Bitcoin as part of their assets, potentially accelerating its acceptance by a wider audience.

By the close of the third quarter, Rumble had amassed a cash reserve totaling $131 million, indicating their ability to undertake substantial investments in cryptocurrencies.

Even though many are hopeful, experts have emphasized the need for prudence. Cypress Demanincor, a market analyst at X (previously known as Twitter), offered insights into the overall cryptocurrency market graph, advising: “Proceed with caution.

As an analyst, I’d rephrase it as follows: “If the value drops below $3-$2.9 trillion and we close the day there, it could indicate a change in trend. This might prompt investors to sell their positions, leading to a ‘risk-off’ response or a correction of this recent bullish surge.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-11-20 13:12