As a seasoned trader who has navigated the tumultuous seas of cryptocurrency markets for years, I can attest to the importance of understanding and adapting to various trading strategies. My journey has taught me that no single strategy is foolproof, but a well-informed approach can make all the difference between sailing smoothly and capsizing in rough waters.

Achieving success as a trader necessitates considerable effort and commitment, a pursuit not suited for everyone. A quick glance at the numbers reveals that about 40% of day traders quit within the first month, while around 80% call it quits within two years. Leaving only 13% who persevere past the three-year mark. To survive and thrive in this field, a sound trading strategy is crucial.

Having a well-structured trading plan is crucial for navigating market fluctuations effectively and maximizing earnings. Effective trading methods not only yield profits but are also vital for risk mitigation and enhancing decision-making skills. A robust trading strategy serves as a guide for informed decision-making, minimizing risks, and capitalizing on market chances.

In this piece, we’ll share top-notch cryptocurrency trading techniques, spot patterns, and discuss factors influencing coin values and shaping market attitudes.

Key Takeaways:

- Ensuring optimal profitability and minimizing market volatility requires a well-defined trading strategy. Effective trading strategies are essential for reducing risk and enhancing judgment.

- Keeping up with news and market developments is essential to successful trading. Provide crucial information on geopolitical and economic trends by using credible sources.

- Price movements in the market are driven by market sentiment, which is impacted by news, social media trends, and trading volumes.

- Because every trading method has pros and cons, traders must use risk management strategies that work for them, such as diversification, stop-loss orders, and limited leverage.

How to Identify Trends for Effective Trading

As a trader, one crucial factor for success lies in my grasp of current knowledge and insights about the market. To trade efficiently, it’s indispensable to stay abreast of the latest market trends and news. This requires me to keep tabs on reliable sources that provide real-time updates on both traditional markets and crypto sectors. Financial news websites like CoinDesk, CNBC, Bloomberg, and others serve as valuable resources, offering information on geopolitical events, economic indicators, and market conditions that can influence price fluctuations. By staying updated with the latest developments in these areas, I can make informed trading decisions.

Analysing Authoritative Sources

Throughout my years of investing and trading, I’ve come to rely heavily on technical analysis charts and instruments as they are indispensable tools for identifying market trends. Here are some key elements that I find most valuable:

- Drawing trend lines on price charts helps identify a trend’s strength and direction. Connecting higher lows creates an uptrend line; connecting lower highs creates a downtrend line. Horizontal lines joining flat price changes indicate sideways tendencies.

- Price data is smoothed out by moving averages to show the underlying trend. SMA and EMA are two examples of types. Possible purchase or sell signals might be inferred from the relationship between various moving averages, such as the short-term vs. long-term ones.

- The Relative Strength Index (RSI) and other price momentum indicators may point to overbought or oversold situations. The ADX and MACD are also helpful for determining trend strength and possible reversals.

- Understanding patterns like head and shoulders, double tops, and flags can help predict future price changes. These patterns show possible shifts in trends and the psychology of the market.

Understanding Market Sentiment

The overall feeling or perception of people involved in the market, known as market sentiment, influences price fluctuations. This sentiment can be gauged through various methods such as analyzing news, social media trends, and trading activities. Essentially, this analysis looks at how traders and investors behave collectively. When the public’s opinion is optimistic, prices tend to increase; however, when the public sentiment is pessimistic, prices might decrease.

Employing these methods and tools can enhance your ability to spot patterns and make astute trades. Regardless of whether you prefer automated, swing, or day trading, the creation of profitable trading strategies hinges on identifying trends effectively.

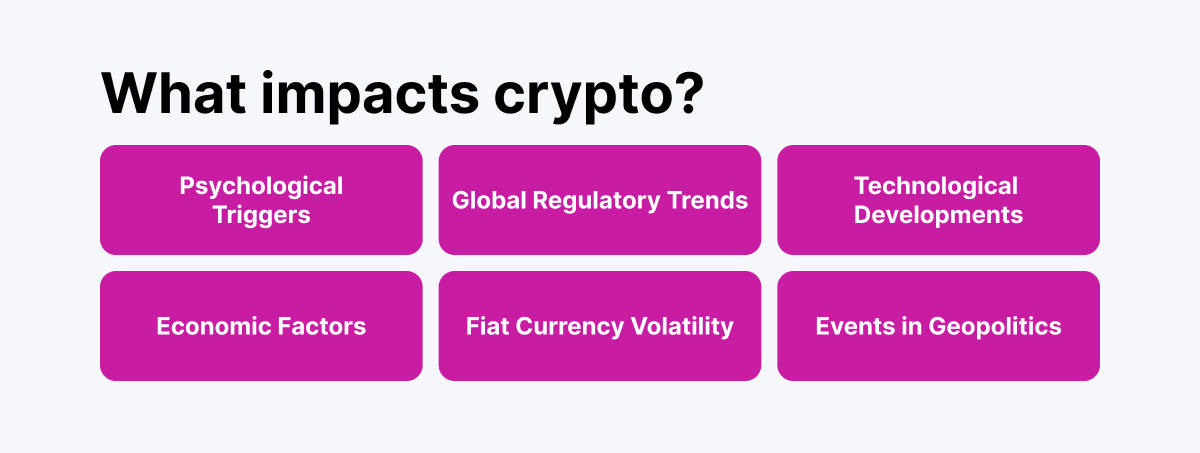

Beyond the Charts: What Impacts Crypto Trading?

The overall attitude investors have towards a specific cryptocurrency or the crypto market in general is called “market sentiment.” This sentiment is influenced by news, occurrences, and overall perceptions of the market. A favorable outlook can boost demand for cryptocurrencies, causing their prices to increase. Conversely, negative feelings may decrease demand and lead to a price drop. The emotions of investors significantly impact this collective mood; the market can be influenced by either optimism or pessimism, which in turn can drive its movements.

Psychological Triggers

As an analyst, I’ve observed that investor psychology plays a pivotal role in shaping cryptocurrency values. The primary drivers of trading behavior are fear and greed. Fear of losing money can prompt individuals to offload their assets during market downturns, while the fear of missing out (FOMO) might motivate them to invest in a thriving market. Additionally, the herd mentality among traders, where they mimic each other’s actions, significantly influences price volatility. Given the impulsive reactions of traders to news and market fluctuations, these psychological factors can lead to substantial swings in the market.

Global Regulatory Trends

In various parts of the world, regulations can differ significantly and influence markets uniquely. To enhance market stability and clarity, new rules have been established. Recently, regulatory scrutiny has grown more thorough. For instance, countries might pass legislation aimed at combating fraud or enforcing stricter trading practices. Understanding these trends helps traders forecast potential market reactions and adjust their strategies accordingly.

Technological Developments

Advances in blockchain technology could substantially reshape the cryptocurrency market. For instance, novel consensus mechanisms or improved scalability solutions could enhance the efficiency and security of blockchain networks, making them more attractive to investors. Consequently, the worth of cryptocurrencies that capitalize on technological progress might rise.

Economic Factors

As a crypto investor, I’ve come to understand that the value of digital currencies is influenced by a variety of economic factors. For example, if inflation starts to climb, it might prompt me to consider cryptocurrencies as a protective measure against the potential devaluation of traditional fiat money. Conversely, changes in interest rates can sway my investment decisions; lower interest rates often make riskier assets like cryptocurrencies more appealing because they offer higher potential returns.

Fiat Currency Volatility

The worth of traditional paper money (fiat money) can change, and this could impact the cost of digital currencies like Bitcoin or Ethereum. When a major conventional currency such as the US dollar weakens, investors might move their funds into cryptocurrencies, boosting their value. Conversely, if traditional currencies become stronger, there might be less demand for cryptocurrencies, causing their value to drop.

Events in Geopolitics

As a crypto investor, I’ve learned that geopolitical events and political stability can significantly impact my investment decisions and the overall market’s stability. Political turmoil or shifts in governmental policies might stir up market volatility. For example, the emergence of new rules or disagreements could undermine market confidence and potentially sway cryptocurrency price fluctuations.

Fast Fact:

By the year 2024, it’s expected that an average of approximately $1.30 will be generated per user within the cryptocurrency industry. Globally, the United States is projected to lead with the highest revenue, totaling around $23,220 million.

Advanced Crypto Trading Strategies in 2024

Once we’ve pinpointed the patterns and understood how outside influences impact cryptocurrency values, let’s delve into optimal trading tactics for crypto that follow.

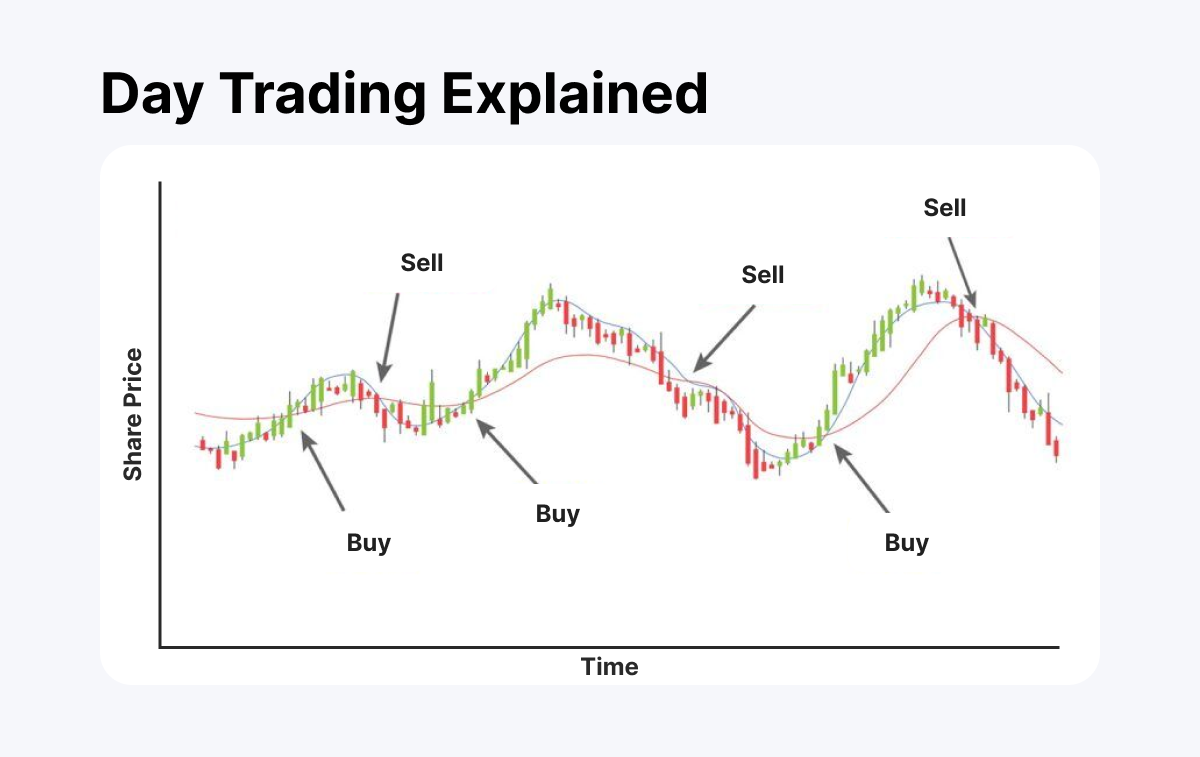

Day Trading

Within the scope of a regular trading day, a strategy known as cryptocurrency day trading comes into play. This approach aims to capitalize on quick fluctuations in prices. Day traders often resort to technical analysis and various methods to generate profits by riding the waves of intraday price variations.

Day traders utilize various tools like technical indicators, advanced trading systems, and live market information. Common tactics encompass range trading where the focus is on purchasing at support points and offloading at resistance points, as well as momentum trading that seeks to capitalize on swift price fluctuations.

Engaging in day trading cryptocurrencies carries the promise of swift profits, but it also comes with considerable risks. Day trading is an intense, high-speed endeavor involving constant market scrutiny and immediate decision-making. Due to the high volatility, this can lead to substantial gains or losses, and transaction costs can accumulate rapidly.

As a seasoned trader with years of experience under my belt, I can attest to the effectiveness of using moving averages as a tool in determining potential entry and exit points for trades. Among all the moving averages, the 50-day moving average has proven itself to be a reliable one for me.

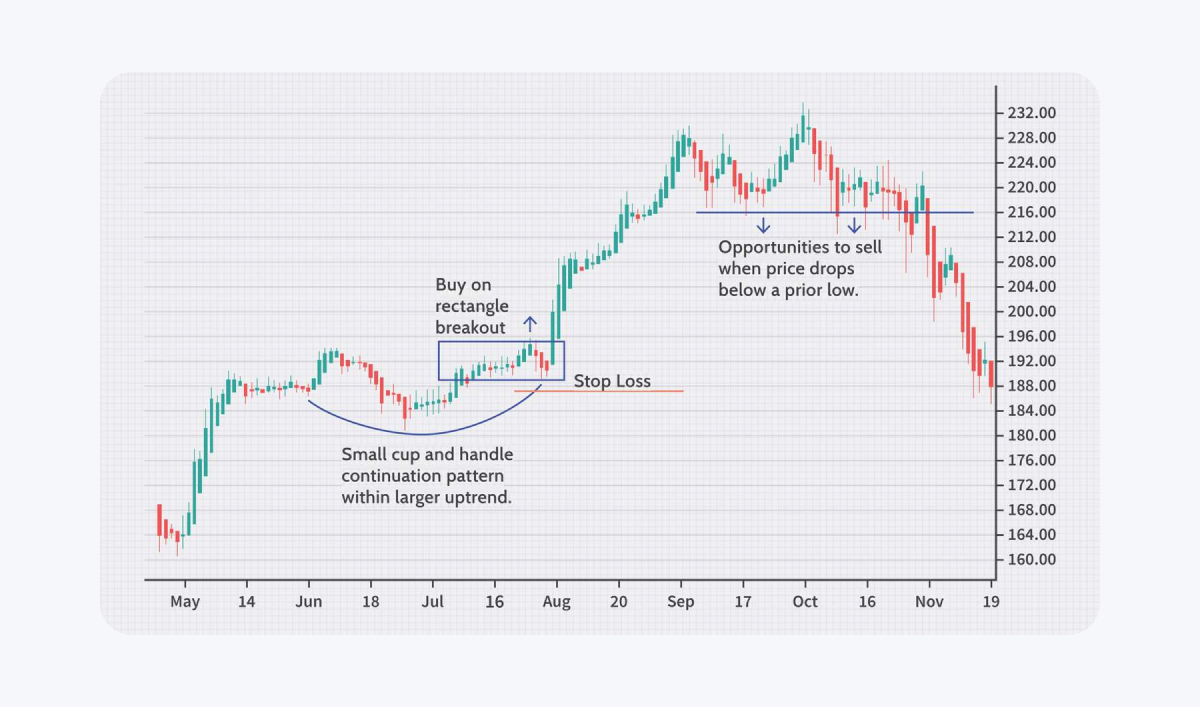

Swing Trading

To capitalize on market fluctuations, swing traders keep their investments for a brief period, typically a few days to several weeks. They employ technical analysis as a means of identifying patterns and potential points for entering or exiting the market. Furthermore, they might use fundamental analysis to reinforce their decisions.

Swing traders employ tools such as stochastic oscillators, relative strength index (RSI), and moving averages to help them identify potential turning points and instances of assets being excessively bought or sold. The RSI serves to gauge the speed of price changes and signals when an asset may be undervalued (below 30) or overvalued (above 70). A swing trader might view a significant decrease in a cryptocurrency’s price, causing the RSI to drop below 30, as a potential buying opportunity.

Instead of being tied to the markets round-the-clock like day traders, swing traders have a more flexible schedule due to their strategy’s shorter time frame. However, this approach carries risks during off-hours (nights and weekends) when market-moving news or events may occur. While swing trading has the potential for greater profit from larger price fluctuations, it demands patience and self-discipline to hold onto positions over an extended duration.

Scalping

A scalping strategy involves capitalizing on small changes in prices. These traders look for numerous opportunities throughout the day to seize minor profits through frequent trades, requiring swift and focused decision-making due to the high frequency of transactions.

For a profitable scalping strategy, it’s essential to have compact price differences (tight spreads), immediate access to trading interfaces, and up-to-the-moment market information. Scalpers often employ techniques like exploiting temporary price fluctuations (trading breakouts) and maximizing the difference between bid and ask prices (leveraging bid-ask spreads). Moreover, they frequently utilize swift trading algorithms designed for high-frequency trades. The key to success lies in minimizing market exposure and executing transactions swiftly.

One key benefit of scalping is the potential for consistent, smaller earnings. This method allows traders to lessen the influence of market fluctuations by limiting their exposure time. However, it’s important to note that trading frequently can lead to substantial transaction costs. Furthermore, scalping requires a significant amount of dedication, stress management skills, and quick decision-making abilities.

A robust approach to managing risks is crucial in any crypto trading endeavor. This entails setting safety measures like stop-loss orders to limit potential losses, spreading investments across various assets to reduce vulnerability, and avoiding excessive leveraging. To devise a solid cryptocurrency trading strategy, traders should take into account their personal risk appetite, perform technical and fundamental analysis, and stay updated on crypto market trends.

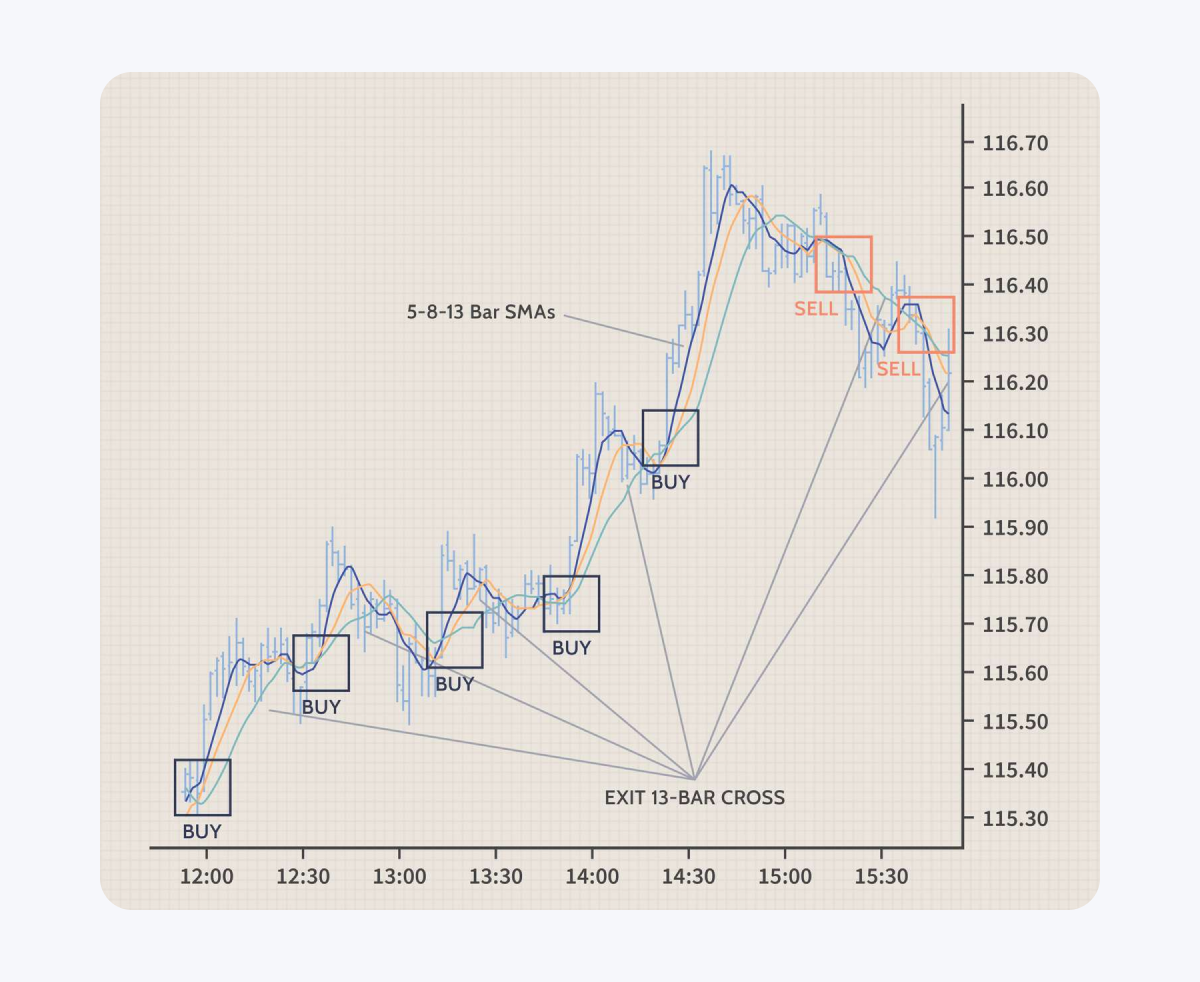

Trend Following

As a crypto investor, I prioritize maximizing my profits by keeping a keen eye on market trends and swiftly capitalizing on them. This strategy is crucial in the unpredictable world of cryptocurrency trading due to its volatile nature. To spot these trends, I rely on various tools such as momentum indicators, trendlines, and moving averages. For instance, a trader may use the 200-day moving average to identify potential trends and make informed decisions.

As a crypto investor, I keep a close eye on the 200-day moving average of the cryptocurrencies in my portfolio. If the price consistently hovers above this average and starts to climb, it might be a good time for me to jump in with a long position, hoping that the upward trend continues and I can reap the rewards. Conversely, if the price dips below the 200-day moving average and shows signs of a downward trend, I might consider short selling – borrowing the asset and immediately selling it, aiming to buy it back later at a lower price and make a profit from the difference.

Investors can profit from trading by buying (going long) during periods when a coin’s value is steadily increasing (uptrend), or selling short (selling before actually owning the asset) during declines (downtrend). Accurately identifying trends and effectively managing risk through the use of stop-loss orders are essential factors that contribute to successful trading.

It can be challenging to distinguish between temporary market fluctuations and genuine trends. To effectively follow market trends, it’s crucial to continually monitor the market and adjust trading decisions according to the latest information.

Range Trading

A commonly used method is called range trading. In this approach, traders focus on a specific price range, using resistance and support levels as boundaries. They buy assets when the price reaches the support level and sell them at the resistance level. By examining historical price trends and employing indicators like RSI to confirm oversold or overbought situations, they aim to spot markets that are bound within a particular range. The main benefits of this strategy include its simplicity and ability to predict price fluctuations within the defined range. However, it’s important to note that there is a risk of significant losses if the price suddenly breaks out of the established range.

Arbitrage

Arbitrage trading involves capitalizing on differences in the prices of the same asset across various markets. For instance, buying a cryptocurrency at a lower cost on one platform and immediately selling it at a higher price on another is an example of arbitrage. To make this strategy successful, quick action and careful consideration of transaction fees are crucial to ensure profitability.

While it’s generally considered a low-risk activity, arbitrage trading requires swift transaction execution and continuous market surveillance due to its nature. Earnings can be affected by sudden price changes and variations in liquidity among exchanges. To minimize these risks, traders can employ high-frequency trading (HFT) strategies and automated crypto trading systems that facilitate rapid and efficient trade completions.

For novice crypto traders, basic strategies often involve methods such as trend following and range trading that are easy to grasp. As one becomes more experienced, complex trading techniques like arbitrage and scalping, which require a thorough understanding of market fluctuations, become important.

Fundamental Analysis

Analyzing a cryptocurrency’s essential worth involves scrutinizing various fundamental factors. These elements encompass the team behind it, the technology powering it, its market potential, and how widely accepted it is in the project. Analysts delve into key documents like whitepapers, partnerships, development progress, and community engagement to make informed assessments.

Assessing a cryptocurrency’s long-term viability involves grasping several key aspects. While fundamental analysis is useful, it has its drawbacks. It can be time-consuming and may not always accurately predict short-term price fluctuations. However, it provides valuable insights into the practicality and prospects of various cryptocurrencies.

Technical Analysis

In simpler terms, technical analysis aims to forecast future price fluctuations by examining historical data such as volume and previous prices. Key indicators used in this process include moving averages, support and resistance levels, and momentum indicators. Additional significant chart patterns are triangles, head and shoulders, and double tops. Traders use these indicators to strategically decide when to enter and exit the market based on market trends. While technical analysis can be beneficial for short-term trading, it has its limitations – relying heavily on past data may not always accurately predict future price changes. Additionally, unstable markets can sometimes produce misleading signals. Despite these drawbacks, technical analysis remains a valuable tool for cryptocurrency traders.

Algorithmic Trading

Automated trading, frequently referred to as algo-trading, involves using computer programs to carry out trades according to predefined conditions. Factors like time, cost, and quantity are some of these conditions. Benefits of such automated methods include the ability to execute trades at speeds and frequencies beyond human capabilities. These systems can ensure optimal trade prices, reduce emotional trading biases, and minimize overall trading costs.

While algorithmic trading offers benefits in managing transactions within the volatile cryptocurrency market, it’s essential to acknowledge its challenges as well. Technical glitches such as software malfunctions or network interruptions can impact trading decisions. Moreover, over-reliance on historical data may not account for unexpected market fluctuations. Nonetheless, these issues haven’t deterred the effectiveness of algorithmic strategies in crypto trading, making it a valuable tool for navigating the unpredictable nature of cryptocurrency markets.

Hedging in Crypto Trading

In the crypto world, hedging functions much like an insurance policy, helping to minimize the impact of unfavorable changes in market prices. Traders can use hedging strategies to safeguard their investments from significant losses during turbulent market periods. Essentially, when a trader hedges, they are attempting to offset potential risks associated with other assets in their portfolio through strategic trading. Although it doesn’t completely eliminate risk, hedging helps mitigate its potentially damaging consequences.

Employing derivatives such as options and futures can prove to be an efficient method of risk management in crypto trading. Unlike crypto futures, where traders commit to buying or selling a commodity at a future date and price, options grant traders the flexibility to buy or sell a coin at a predetermined price. To safeguard against potential drops in the value of a coin, a trader with significant investments in cryptocurrency may choose to acquire put options. In such a case, the profits from these options would offset the losses on the investment if the coin’s price were to decrease.

One common risk management strategy is setting up stop-loss orders, which automatically sell a cryptocurrency once its price falls below a predefined level. This helps to minimize losses and protect traders from further decreases. Inverse Exchange Traded Funds (ETFs) that move opposite to the crypto market trend are another tool traders might use. By doing so, they can maintain balance in their portfolio when the market goes down, as the value of inverse ETFs rises during such times.

Conclusion

As the article has shown, selecting an appropriate trading strategy is essential and should be in line with personal objectives and risk tolerance. It is crucial to keep learning new things and changing tactics to comply with the market. Crypto trading is always changing, so traders need to be aware and updated. In this case, traders will be able to make more informed judgments and traverse the market’s complexity more effectively.

FAQs

1. Which trading method is the best?

The “Buy and Hold” approach is commonly employed when trading cryptocurrencies. Essentially, it involves purchasing cryptocurrency assets and maintaining ownership over them for an extended period, expressing trust in their potential growth and returns.

2. Is it hard to trade crypto?

For successful trading, it’s crucial to be thoroughly prepared, develop a robust strategy, maintain a positive mindset, utilize effective resources, and exercise emotional control.

3. What cryptocurrency is best for day trading?

To effectively day trade cryptocurrencies, prioritize choosing coins that have a high volume of trading (liquidity). Look for traders who are consistently active in the market, as their frequent involvement signifies an active role and enables swift transaction entries and exits.

Read More

2024-08-07 19:40