- ETH could rally to $10K, per crypto VC partner at Moonrock Capital.

- There was solid traction for ETH, including renewed staking interest, which could boost prices.

As a seasoned cryptocurrency researcher with over a decade of experience in this dynamic field, I have to admit that the bullish calls for Ethereum [ETH] are indeed intriguing. The prediction by Simon Dedic, founder and partner of Moonrock Capital, of ETH potentially reaching $10K per token is certainly noteworthy, especially considering the current market landscape.

A crypto VC projected that Ethereum’s [ETH] price could eye a $10K cycle high, despite lagging major cap altcoins and Bitcoin [BTC].

As per Simon Dedic, the founder and partner at crypto venture capital firm Moonrock Capital, investing in Ethereum (ETH) might present a ‘safer threefold’ chance currently.

Given the present market conditions, Ether ($ETH) seems to offer the most straightforward and secure threefold return potential at the moment.

According to the current price, one ETH is roughly equivalent to $10,000. There’s growing optimism towards ETH, as asset manager Bitwise foresees a comparable bullish prediction for ETH by October 2024, suggesting a contrarian investment strategy.

Is ETH’s lag an opportunity?

Although Ethereum [ETH] has shown somewhat slower growth compared to major players like Solana [SOL] and Bitcoin [BTC], it has experienced steady and robust progress following the U.S. elections.

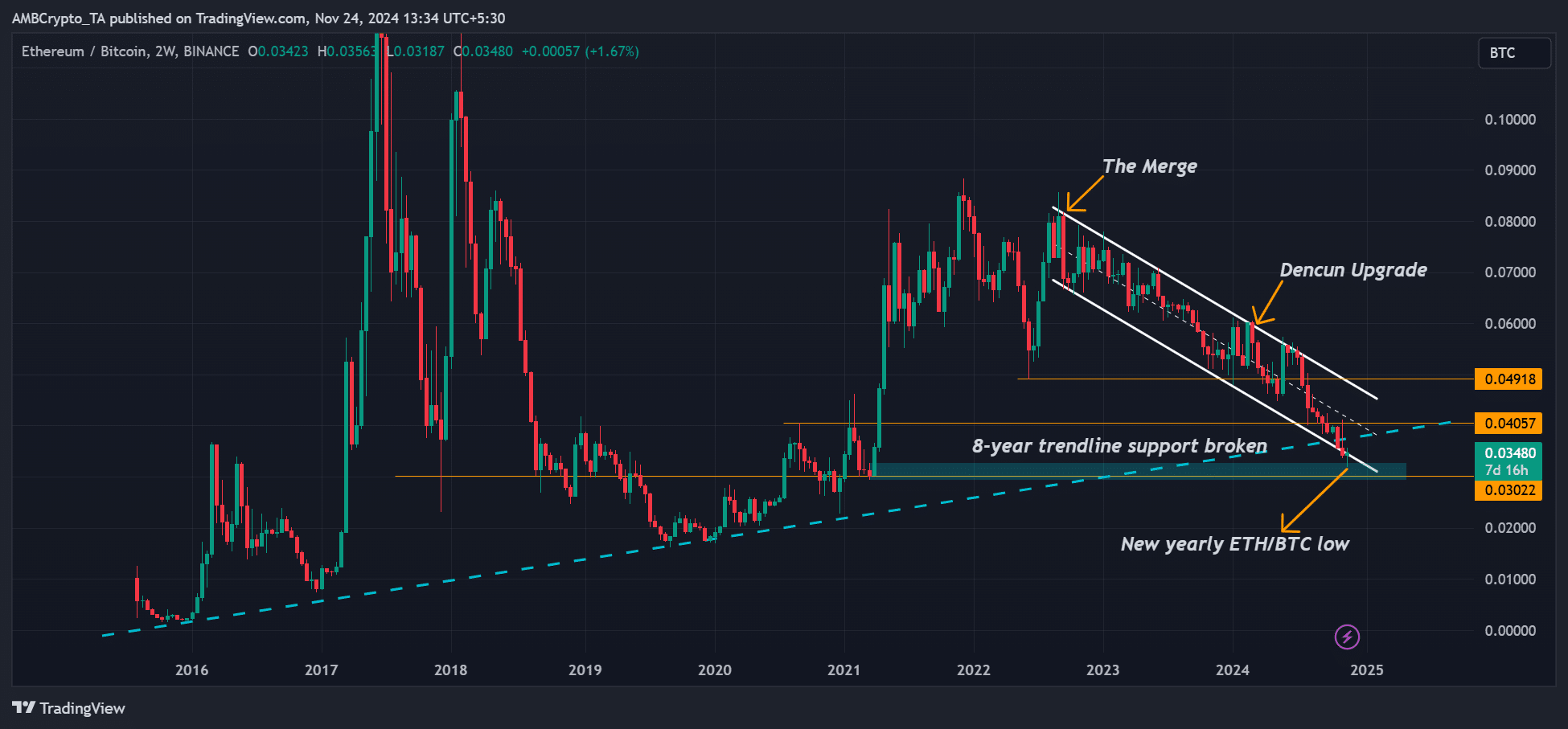

As a crypto investor, I’ve found myself grappling with the challenging market conditions lately, as the persistent pessimism seems to have exacerbated the sluggish progress in the Ethereum-Bitcoin ratio. Recently, this ratio has hit fresh yearly lows of 0.031, which is quite a setback for me and other ETH investors.

This means that ETH has been underperforming BTC, a trend that goes back to 2022 after The Merge.

In simpler terms, compared to Bitcoin and other major cryptocurrencies, Ethereum’s price growth was less noticeable due to the fact that more investors favored BTC and others.

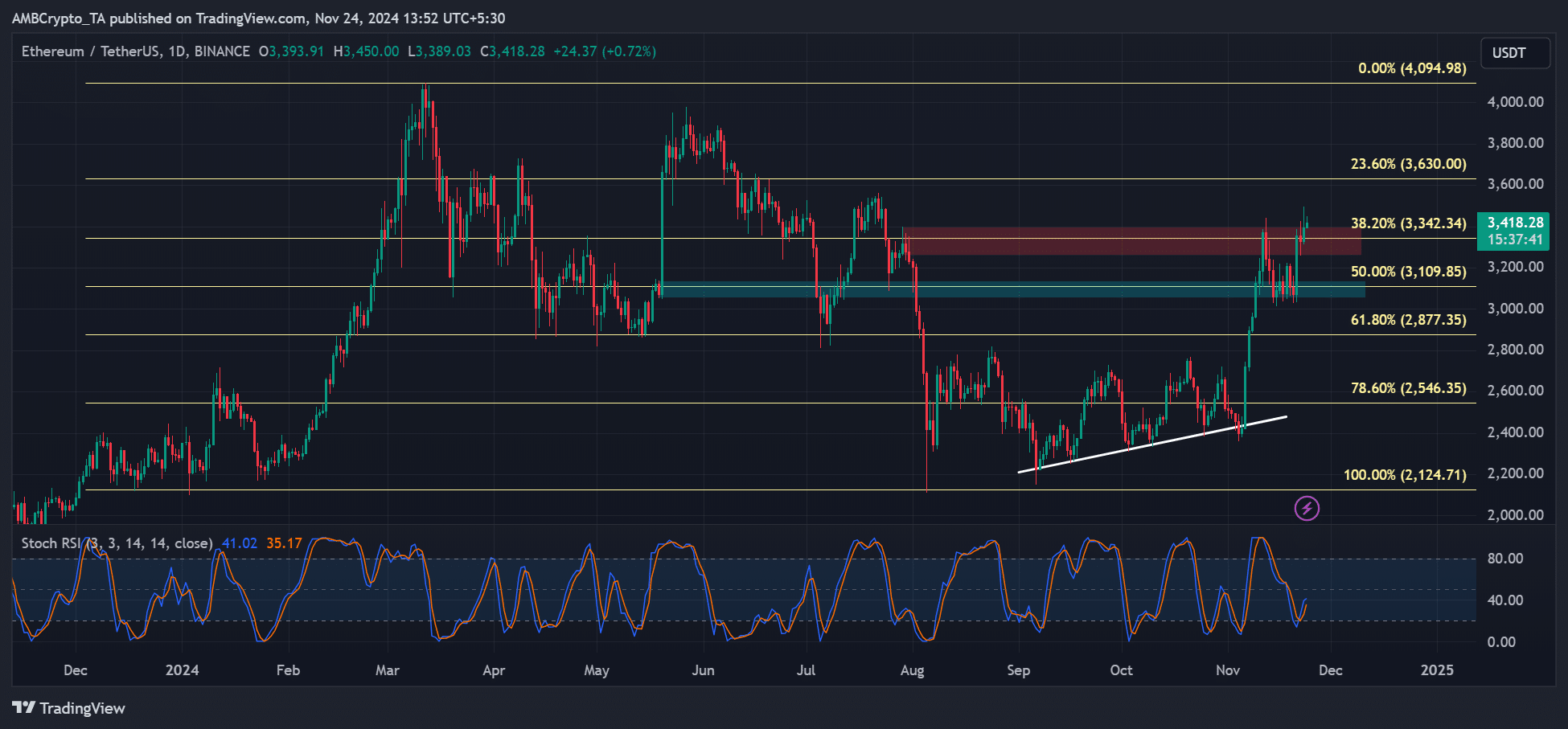

However, the situation may shift for the leader among altcoins, Ethereum (ETH). At the time of this report, ETH has surged beyond 40% since its November lows. Moreover, it has made an attempt to surpass the resistance at $3,300, which could potentially propel it towards higher targets such as $3,600 and even $4,000.

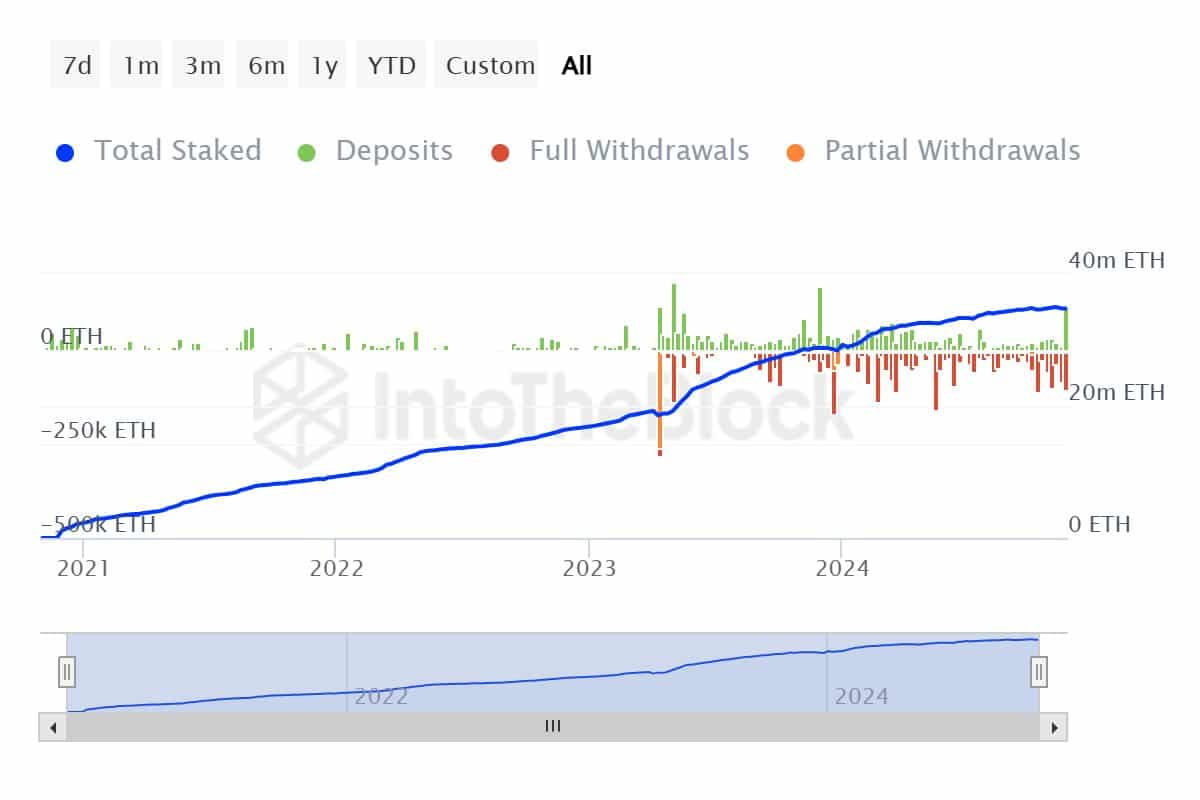

Another bullish signal, as noted by CryptoQuant’s JA Maartunn, was increased Ethereum staking.

For the first time in months following continuous outflows, ETH staking saw the largest weekly inflows on record. Marrtunn further commented. (Paraphrased)

In the last seven days, there has been an increase of approximately 10,000 Ether in Ethereum staking, due to 115,000 Ether being deposited and 105,000 Ether being withdrawn. The graph showing total staked Ether (represented by the blue line) is on an upward trend once more, indicating that people are becoming increasingly optimistic about staking as a long-term investment strategy.

The rising trend in Ethereum (ETH) might be fueled by increased confidence in the Trump administration’s potential greenlight for US-listed ETFs trading in spot Ether. This optimism could potentially lead to a scarcity of ETH supply, which would generally boost ETH prices.

Read Ethereum [ETH] Price Prediction 2024-2025

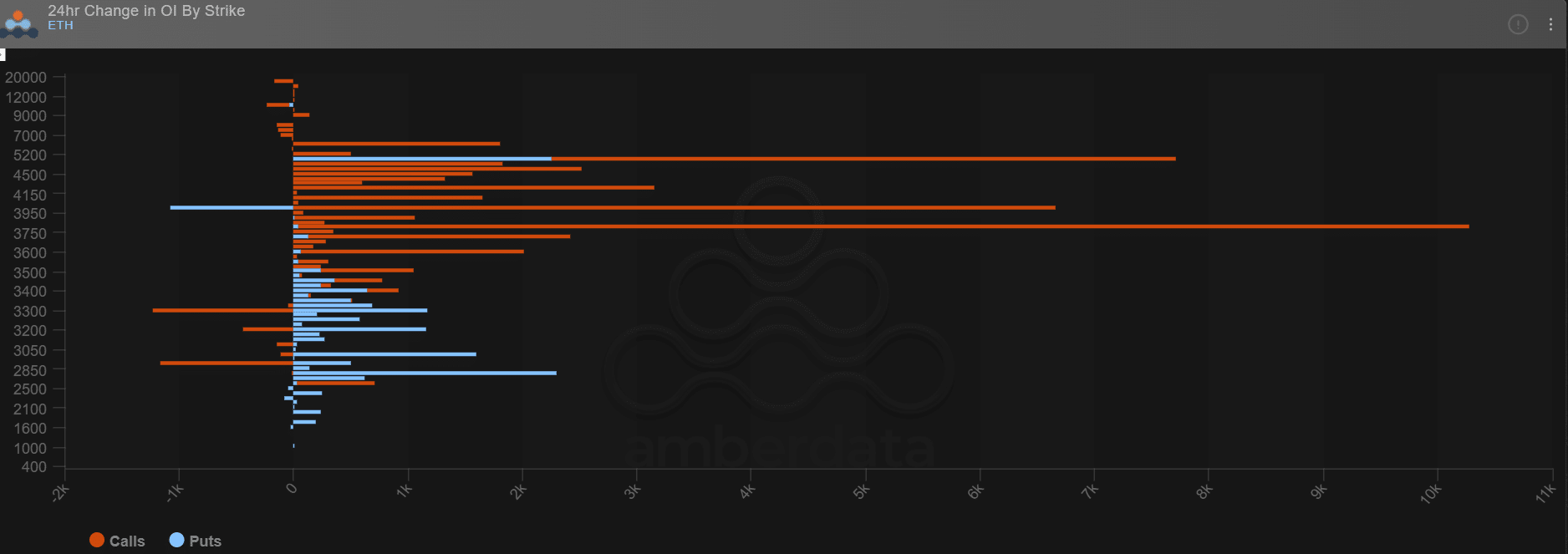

There’s a noticeable optimism among options traders on Deribit as they’ve been increasingly betting on Ethereum to rise in value. Over the past 24 hours, significant investors have made more bullish wagers (which resulted in an increase in Open Interest, indicated by the orange lines), aiming for price targets at $3.8K, $4K, $5K, and even $6K.

Moreover, they had plans in place for a potential reversal, as there was an increase in the purchase of put options (a bearish strategy) approaching the price levels of around $3,000 and $2,800.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-11-24 21:12