So, crypto VC deals took a nosedive in January, huh? Big whoop. But hey, the money’s still flowing like Larry David at a free buffet. BitGo, Fireblocks, Ripple-they’re all cashing in while the rest of us are still trying to figure out if our NFT of a pixelated monkey is worth the gas fees.

- Deals? Down 15% MoM, 42% YoY. Who cares? Funding’s up 61% MoM, 497% YoY to $14.57b. That’s right, billion. With a B. Like my ex-wife’s alimony demands.

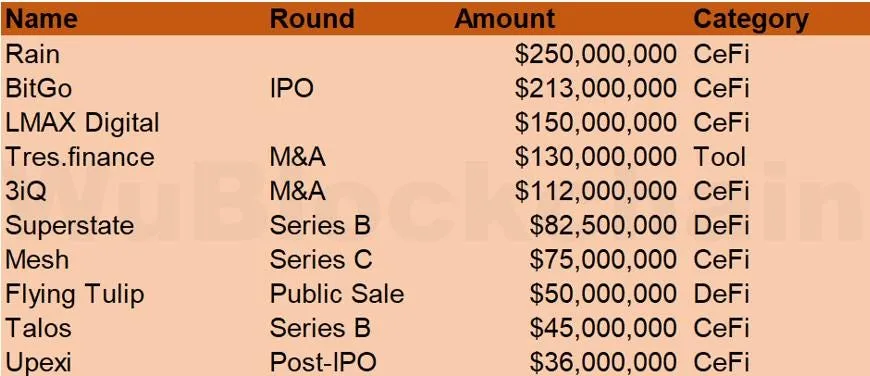

- BitGo’s $212m IPO? Nice. Fireblocks’ $130m TRES buyout? Sure. Ripple’s $150m RLUSD thingamajig? Whatever. Money’s flying around like I’m at a bar mitzvah.

- Coincheck-3iQ, SOL-backed Upexi notes-sounds like a bunch of acronyms had a baby. But hey, if it’s institutional-grade, it’s gotta be good, right? Right?

Fewer deals, bigger checks-because who has time for small fries?

RootData says there were only 52 crypto VC deals in January 2026. Down 15% from December, 42% from last year. Yawn. But funding? $14.57 billion. Up 61% MoM, 497% YoY. That’s like me finally getting a raise after 10 years, but instead of a pat on the back, I get a gold-plated toilet seat. CeFi, DeFi, NFT/GameFi-who’s keeping track? Not me. I’m still trying to figure out why my Netflix password doesn’t work.

Institutionalization, they say. BitGo going public, Fireblocks buying stuff-it’s like the crypto world is growing up. Or at least pretending to. Next thing you know, they’ll be asking for a 401(k) and dental.

Flagship deals: IPOs, acquisitions, and stablecoins-oh my!

BitGo’s IPO? $213 million. Goldman Sachs and Citigroup underwrote it. Fancy. Fireblocks bought TRES Finance for $130 million. Because why not? Ripple’s $150 million RLUSD deal? Sounds like a mouthful. But hey, if it keeps the lights on, who am I to judge? I once paid $12 for a salad. A salad.

Strategic bets: Exchanges, DeFi, and SOL-backed credit-because why not?

Coincheck buying 3iQ? $112 million. Flying Tulip raising $25.5 million? Sure. Upexi’s $36 million SOL-backed notes? That’s a lot of SOL. I mean, I’m still trying to figure out how to pronounce “DeFi,” but these guys are out here collateralizing their collateral. Respect.

Macro tape: Bitcoin’s still king, and I’m still confused

Bitcoin’s at $78,500. Ethereum’s at $2,320. Solana’s at $104. Who cares? I’m still trying to figure out why my coffee costs $7. But hey, if the big guys are doubling down on infrastructure and regulation-friendly stuff, maybe it’s time to stop betting on meme coins. Or not. I’m not your financial advisor. I’m just a guy who thinks $14.57 billion could buy a lot of soup.

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Resident Evil Requiem cast: Full list of voice actors

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- Best Shazam Comics (Updated: September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- PS5, PS4’s Vengeance Edition Helps Shin Megami Tensei 5 Reach 2 Million Sales

- American Dad Drops First Look at 2026 Return to Fox: Watch the Trailer

2026-02-03 16:14