- The crypto week ahead presents a possible spike in volatility for AI cryptos, thanks to Nvidia’s Q3 earnings

- S&P Global’s manufacturing and services PMI data could also drive volatility for various cryptos, including memecoins.

As a seasoned analyst with over a decade of experience in the financial markets, I can confidently say that the upcoming crypto week promises a rollercoaster ride for traders and investors alike. The potential spikes in volatility, particularly for AI cryptos ahead of Nvidia’s Q3 earnings, and the ongoing surge of memecoins, make this an exciting time to be in the market.

The price of Bitcoin [BTC] reached a new peak surpassing $94,000 following the activation of Bitcoin ETF options by financial giant BlackRock.

Currently, Bitcoin’s recovery has led to a slight dip in the overall cryptocurrency market value. At this moment, the total market cap stands at approximately $3.09 trillion, representing a decrease of 0.06%.

Regardless of this minor drop, the upcoming week offers fresh possibilities for cryptocurrency traders due to various important occurrences that might boost market volatility.

AI cryptos rally ahead of Nvidia earnings

On November 20th, semiconductor company specializing in artificial intelligence (AI), Nvidia, is set to announce its third-quarter earnings. Historically, these financial reports from Nvidia have been known to spark significant activity throughout the crypto market. The greatest fluctuations are typically observed in cryptocurrencies that focus on AI technology.

In simple terms, RNDR, a leading AI-focused crypto with a market value of $4.1 billion, is responding to recent updates. Within the past day, RNDR has seen an increase of 7%, currently trading at $8.09 as we speak.

The artificial intelligence and cryptocurrency known as GRASS, boasting a market capitalization of $600 million, was also seeing an increase, climbing by 4% over the past 24 hours to be priced at $2.45 at the moment of reporting.

Anticipation runs high that Nvidia will report robust figures, given its stock surged by 4% prior to the announcement. Such positive results might stimulate growth in the AI, Big Data, and cryptocurrency sectors this week.

Memecoins outperform the broader market

In simpler terms, meme coins are currently outshining many alternative coins, and should the optimistic mood in the overall crypto market persist throughout the coming week, this specific sector may see further growth.

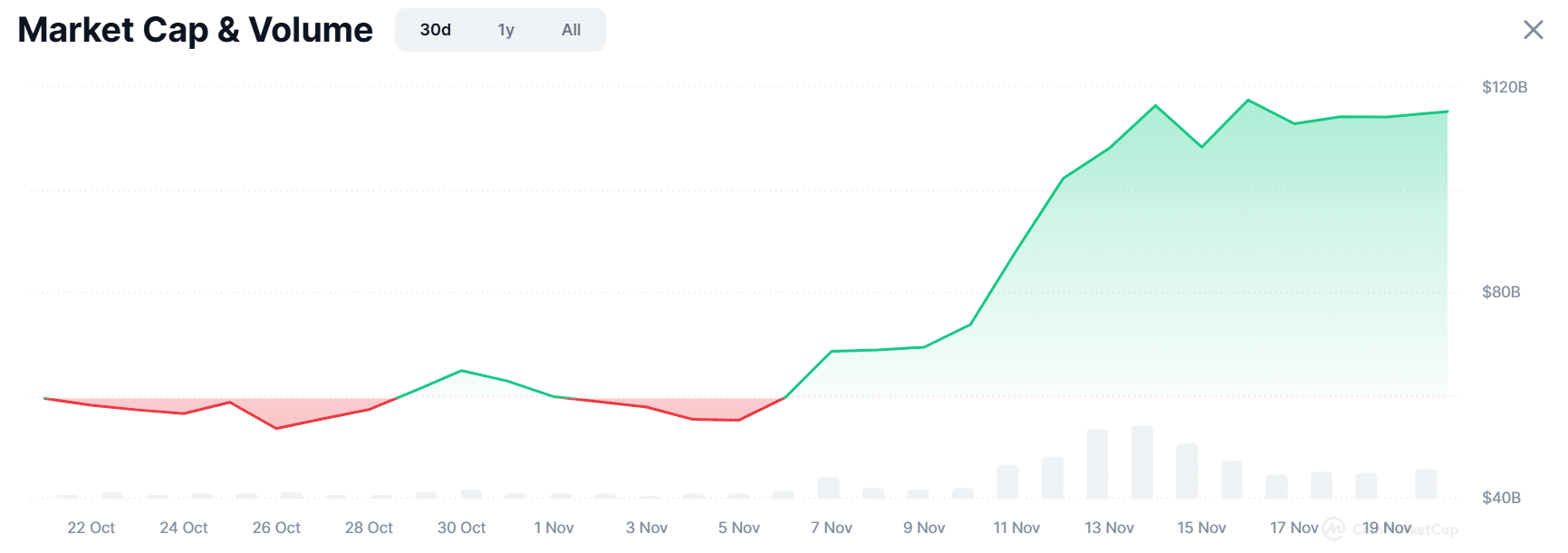

According to CoinMarketCap’s data, over a span of 30 days, the cumulative value (market capitalization) of the memecoins sector has almost doubled, rising from approximately $59 billion to around $115 billion as we speak.

Currently, Solana-based meme tokens are showing significant growth. Specifically, BONK has experienced a surge of 12% over the past day, placing its current trading price at $0.0000556. Earlier on November 20th, BONK reached an all-time high of $0.000059, but then dipped to find support.

Goatseus Maximus (GOAT) experienced a surge, climbing approximately 10% within the past 24 hours and a substantial 35% over the last seven days. This uptrend serves as an indicator of the expanding memecoin market.

In contrast, the surge of meme coins is frequently influenced by Bitcoin’s price trend. If Bitcoin maintains an upward momentum, this market segment may experience additional growth in the short term.

U.S. economic data

Over the coming week in the world of cryptocurrency, there might be periods of price fluctuations as a result of the publication of Manufacturing and Services Purchasing Manager Index (PMI) reports.

Later this week, S&P Global will make public some data that emphasizes the recent trends within the U.S. manufacturing and service industries.

In October, the data was better than expected and portrayed a strengthening U.S. economy.

As a crypto investor, I’m always keeping an eye on the Performance of Management Index (PMI). A robust PMI could potentially fuel a further rise in cryptocurrency prices, signaling economic strength and increased investor confidence. Yet, if there are indications of weakness, it might lead to a temporary dip in the near future. It’s all about staying informed and adaptable in this dynamic market.

Overall market outlook is positive

In the upcoming days, as the cryptocurrency market prepares for various upcoming events, it appears that traders are being swayed by a sense of excitement or overconfidence, according to the Fear and Greed Index.

Currently, the index is at 83, indicating high levels of greed among investors. But it’s worth noting that this figure has decreased from 90 within a day, implying that the market might be starting to cool down and potentially moving towards price equilibrium.

Read More

2024-11-20 21:44