-

BTC retested $66k following better-than-expected August inflation data

U.S labor market update could set the next market direction

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the recent developments in the cryptocurrency market. The retest of $66k by Bitcoin following the better-than-expected August inflation data is a clear indication that the market is closely watching key economic indicators for clues about future direction.

On Friday, Bitcoin [BTC] climbed higher and reached approximately $66k, as a lessened Core PCE Index (Personal Consumption Expenditure) report from the U.S Federal Reserve caused some softness. The Core PCE Index is a measurement of U.S inflation that excludes fluctuations in food and energy prices.

The August Core PCE index reading came in better than expected, with a YoY (year-on-year) hike of 2.6%. This was contrary to market expectations of 2.7%.

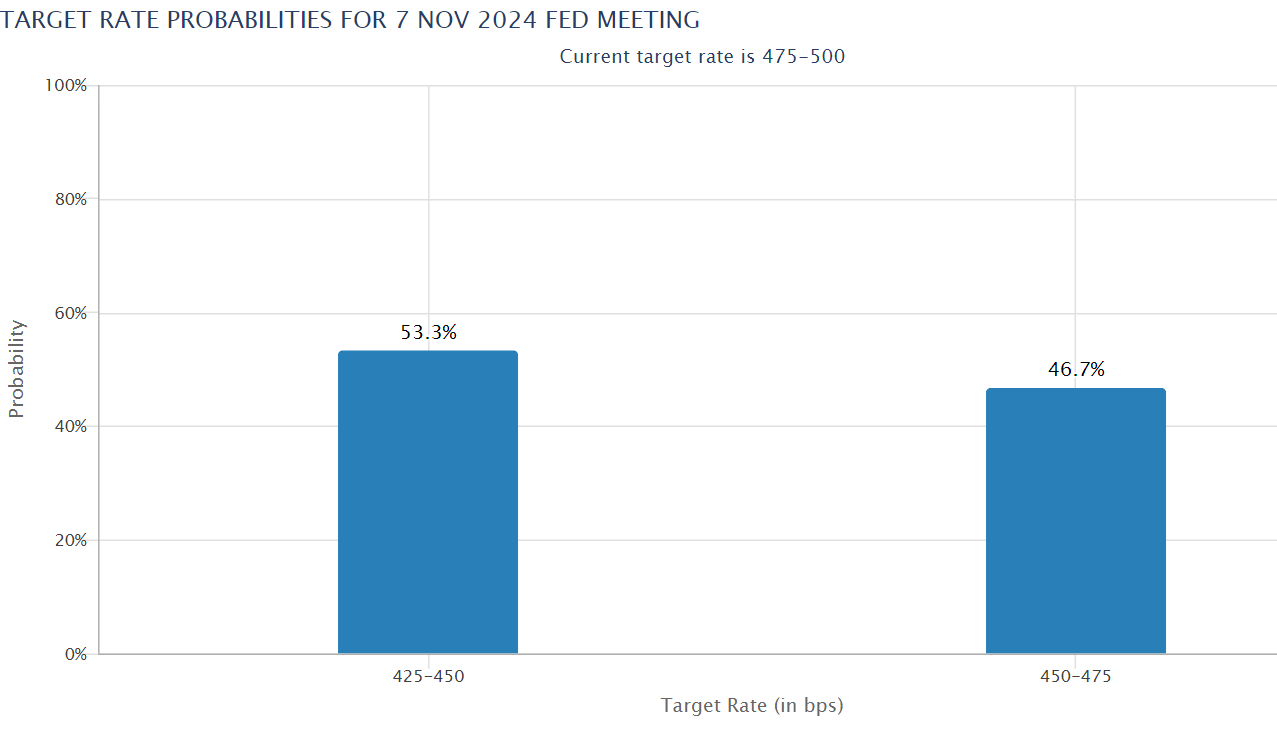

The low inflation data boosted the markets as speculators priced higher odds of another 50 bps (basis points) Fed rate cut in November.

Next market catalyst

Due to the low inflation figures, the Federal Reserve will now pay closer attention to the condition of the U.S. job market, particularly the unemployment rate, as they determine the speed at which they adjust their policy on interest rate reductions.

As a researcher, I’ve observed that the forthcoming changes in the U.S. labor sector are likely to influence the trajectory of the financial markets, according to insights shared by trading firm QCP Capital.

Part of the firm’s weekend brief on 28 September read,

Looking ahead to the coming week, our main attention will shift towards significant employment sector markers such as JOLTS, ADP, and the U.S. jobless rate.

As a researcher, I’m keeping a close eye on two crucial updates: the Job Openings and Labor Turnover Survey (JOLTs), due on November 1st, and the employment situation report, scheduled for November 4th. Anticipating their potential effects on the market, QCP Capital has weighed in, offering insights on how these updates might shape our financial landscape.

A robust showing in these key indicators may significantly strengthen the argument for reducing interest rates by 0.5 percentage points in November, thereby potentially boosting high-risk investments even more.

If that is the case, BTC could edge even higher towards $70k after the recent bullish market structure shift. Especially after it reclaims the 200-day MA (Moving Average).

The lift-off could also benefit Ethereum [ETH]. In fact, ETH has been outperforming BTC since the Fed’s pivot.

Thus, a strong additional momentum, or tailwind, might further boost Ethereum’s impressive comeback in the price charts. Notably, market expert Benjamin Cowen predicts that Ethereum could potentially reach the significant milestone of $3000 as well.

In other words, there’s been a resurgence of interest in leading digital assets among American investors. Notably, Bitcoin Exchange Traded Funds (ETFs) based in the U.S have experienced an influx of $1.11 billion this week, marking the highest weekly inflows since 19th July.

A similar, but limited investor appetite was also observed in ETH ETFs. The products attracted $84.6 million inflows, the largest weekly demand since 9 August. If the trend continues, the $3k per ETH and $70k per BTC price targets could be feasible.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-29 06:15