- BTC’s pump towards $70K stalled ahead of earnings season and US economic data.

- Analysts evaluate whether BTC will breach the $70K psychological level this week.

As a researcher who has closely followed the crypto market since its inception, I find myself intrigued by this week’s developments. The stall of BTC at $70K and the subsequent sideways action could be a prelude to significant moves in the coming days.

On the 21st of October (US time), following a strong advance to nearly $70,000, Bitcoin [BTC] experienced a setback and dropped slightly below $67,000.

In simpler terms, the dip in the U.S. stock market at the start of the week seemed to reflect a sense of anxiety, as major companies were about to release their earnings reports for this week.

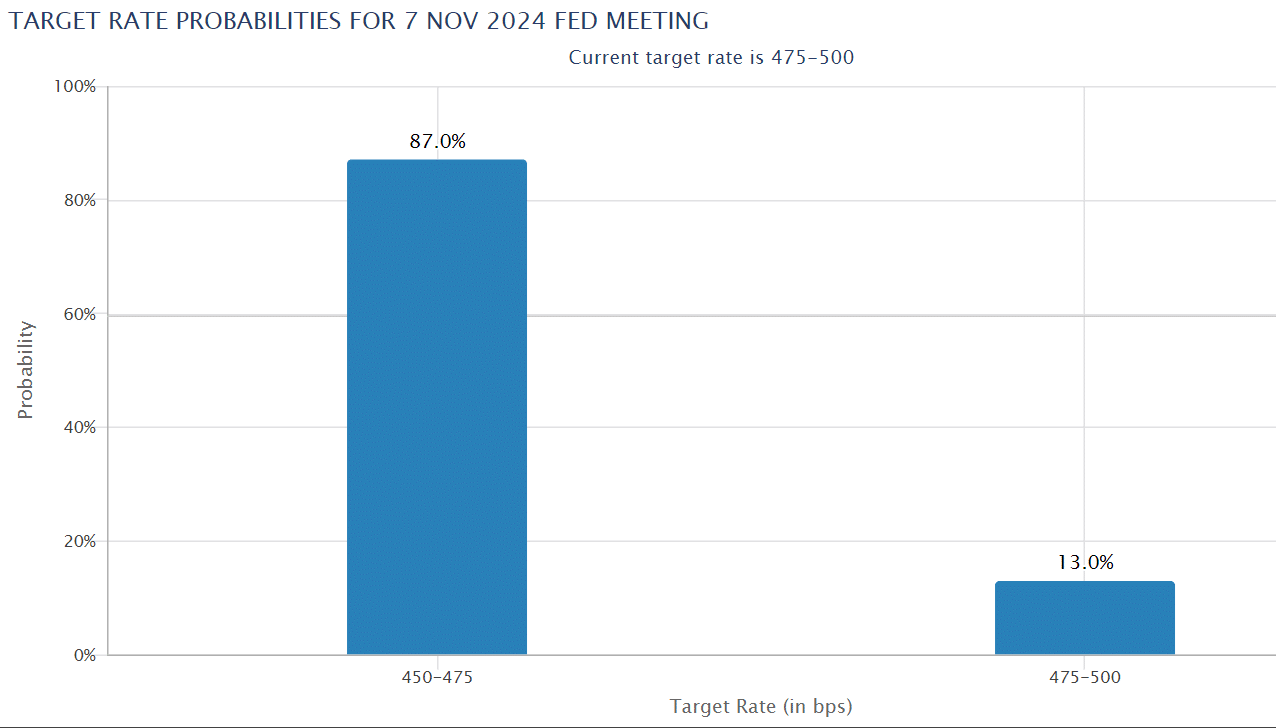

However, Bitcoin may continue within a price range over the weekend, as the anticipated shifts by QCP Capital could occur once the market has a more defined Federal Reserve interest rate trajectory.

The trading firm said,

We’ll likely see some shifting trends in the market until we get the PMI figures due on Thursday. These numbers could provide insights into the direction of interest rates set by the Federal Reserve.

To provide some background, the Purchasing Managers’ Index, or PMI, serves as a significant benchmark for assessing the overall health of the U.S. economy, and it may influence the Federal Reserve’s interest rate decision in November.

Crypto week ahead: Will BTC hit a new ATH?

Currently, the markets anticipate a 0.25 percentage point reduction in the Federal Reserve’s interest rate during their November meeting. The impact of this week’s Purchasing Managers’ Index (PMI) data on Bitcoin prices is yet to be determined.

It’s worth noting that the U.S. elections played a significant role in Bitcoin’s price fluctuations. In anticipation of these elections, we sought the perspective of Maria Carola, CEO of cryptocurrency exchange StealthEX, regarding Bitcoin’s future prospects.

Carola informed AMBCrypto that the growing likelihood of Donald Trump’s victory has contributed to the latest Bitcoin price surge towards $70K. Nevertheless, she is convinced Bitcoin will reach a new all-time high in November, but not within this current week.

It’s unlikely that Bitcoin will hit a fresh record high this week…However, by November, Bitcoin is predicted to exceed its current all-time high, paving the way for a continuous climb towards the significant goal of $100,000 per coin.

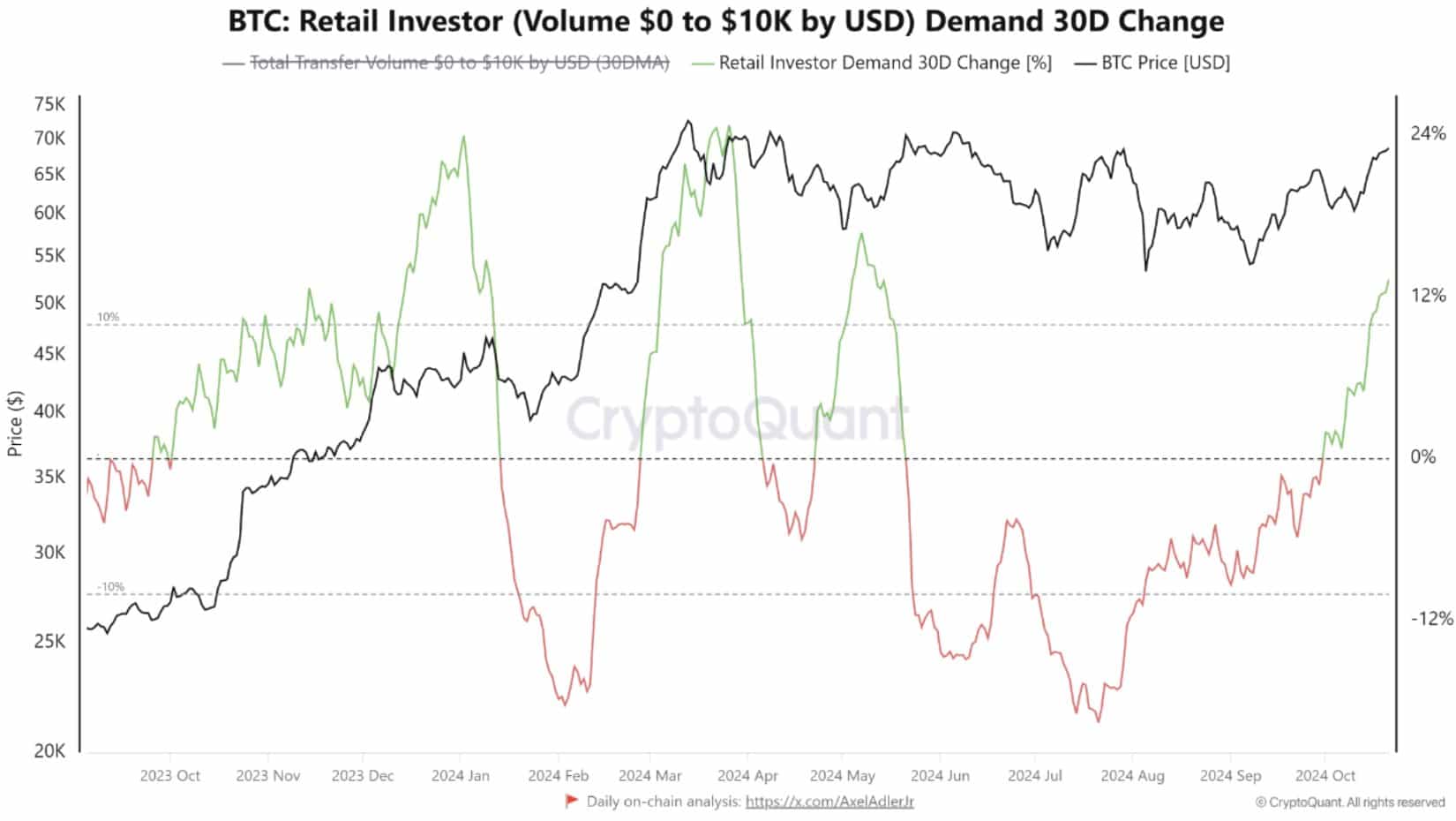

In the meantime, the recent pump towards $70K triggered renewed retail interest in BTC.

As CryptoQuant indicates, this pattern appears to have followed a similar path seen in March, preceding Bitcoin reaching a fresh all-time high.

Over the past month, retail demand increased approximately 13% – a situation similar to what we experienced in March, approaching our previous all-time high.

Will the renewed retail interest push the rally forward like it did in March?

QCP Capital said more retail players could jump in if BTC breached the $70K resistance.

Approaching significant resistance levels – around $70,000 for Bitcoin (BTC) and $2,800 for Ethereum (ETH) – may ignite a surge of interest from retail investors.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-10-22 15:04