- More than $238 million was liquidated from the crypto market in 24 hours after prices plunged.

- Next week’s US elections and upcoming FOMC meeting could cause a surge in market volatility.

As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I find myself braced for a rollercoaster ride in the coming days. The upcoming US elections and FOMC meeting have the potential to send shockwaves through the market, as history has shown us that these events can significantly impact the crypto landscape.

This week could be pivotal for the cryptocurrency market, with many significant events expected to transpire. The anticipation surrounding these events appears to have caused a drop in prices. At present, all the top 50 cryptocurrencies by market capitalization, excluding Celestia [TIA], are experiencing price decreases.

During the weekend, the value of Bitcoin (BTC) decreased from approximately $71,000 to around $68,380 as of the current news update. Similarly, Ethereum (ETH) was trading at roughly $2,440 following a 2% decline.

As a researcher examining recent trends, I’ve noticed a significant downward shift in prices, leading to extensive liquidations within the derivatives market. According to Coinglass data, over $238 million was offloaded from the market within the past 24 hours.

Over 104,000 traders were impacted by the liquidations, with the highest liquidation transaction valued at approximately $9.9 million taking place on the OKX platform.

Over the past few days, the shifts in prices may be influenced not just by normal weekend fluctuations, but also potentially by changes in US election polls on Polymarket. The election is quickly approaching, and over the last three days, former President Donald Trump has seen a 6% drop in the polls.

A Trump victory could likely bring about a generally favorable effect on the cryptocurrency market, given his supportive stance towards digital currencies during his campaign.

Upcoming FOMC meeting

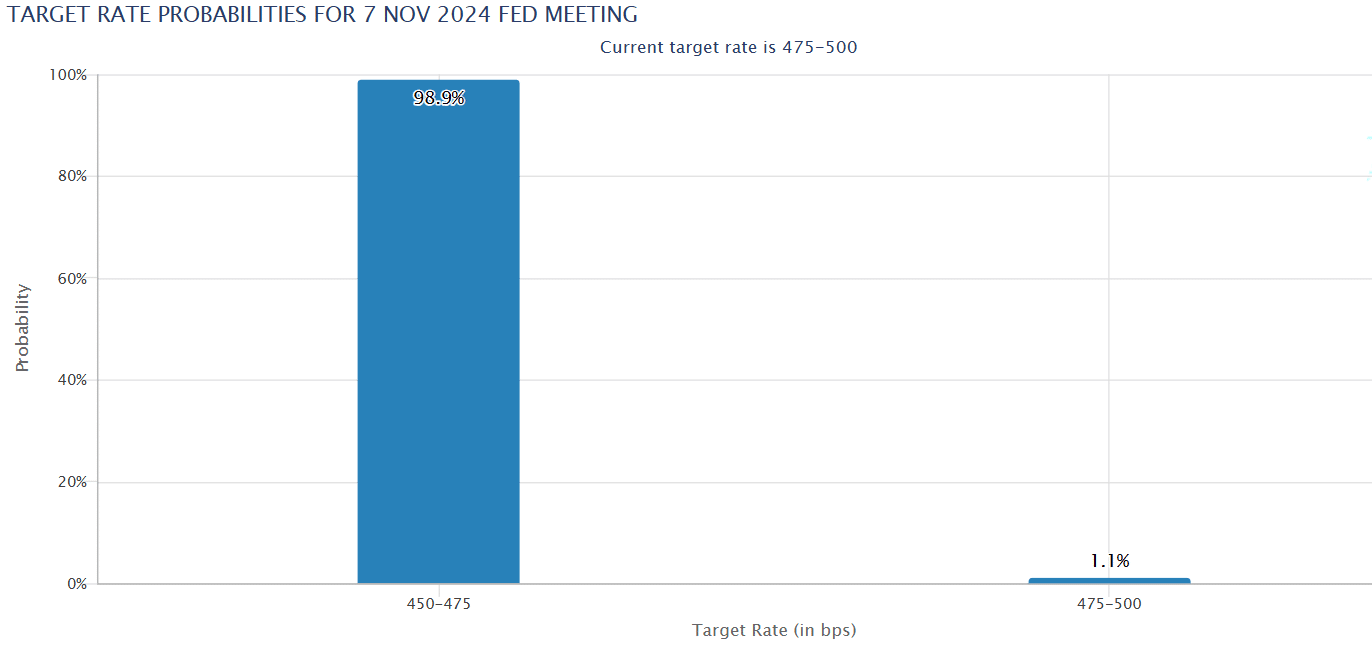

The Federal Open Market Committee (FOMC) is scheduled to convene its upcoming session on the 7th of November. At their last gathering, the committee reduced interest rates by 0.5%, potentially paving the way for a resurgence in speculative investments like cryptocurrencies.

According to data from the CME FedWatch Tool, a vast majority, or 98%, of investors expect the Federal Reserve to lower interest rates by 0.25 percentage points at their meeting in November.

If the Federal Reserve lowers interest rates according to market predictions, it’s likely that cryptocurrency prices will rise. This is due to the fact that a more lenient monetary policy tends to increase investor risk tolerance, leading to increased demand for assets like cryptocurrencies.

According to a recent report by AMBCrypto, the U.S. inflation rate for September was 2.1%, edging nearer to the Federal Reserve’s desired level of 2%. This trend lends credence to the idea that additional interest rate reductions might be justified.

Following our September gathering, Bitcoin experienced an approximately 8% increase over the course of a week. If we see a comparable surge, this digital currency may reach new peak levels since, as things stand, it’s roughly 7% below its all-time record price.

Crypto market sentiment is still bullish

Regardless of the current decline in prices and increased market turbulence, there’s an optimistic outlook within the crypto community, as indicated by the Fear and Greed Index, standing at 74 at the moment.

Currently, this index indicates that the market is characterized by excessive optimism or enthusiasm, often leading to increased purchasing actions and potential price increases.

It’s evident that cryptocurrency traders remain optimistic about further profits, even following the latest market dip. The upcoming FOMC meeting and the traditional strong performance of cryptocurrencies in the fourth quarter are key factors fueling this positive outlook.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Lady Gaga’s ‘Edge of Glory’ Hair Revival: Back to Her Iconic Roots

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-04 03:03