-

Coinbase projected a positive market shift, cautions about US CPI impact.

QCP Capital supported the bullish outlook for BTC.

As a seasoned researcher with a decade of experience navigating the tumultuous waters of global financial markets, I find myself intrigued by the latest developments in the cryptocurrency arena. The optimistic outlook from Coinbase and QCP Capital analysts hints at a potential bullish trend for Bitcoin and other major digital assets in the short term. The ‘cleaner positioning’ following the recent market correction could indeed be a positive technical indicator, as suggested by Coinbase.

Based on predictions from analysts at Coinbase, it’s possible that the cryptocurrency market may continue its rebound soon, following a significant sell-off occasioned by Bitcoin‘s drop to around $49,000 on August 5th.

According to the analysts’ recent analysis, the market drop forced out long-term investors, resulting in a more streamlined market setup that may lead to market growth.

From my perspective as a researcher, I believe that an improvement in the cleanliness of the cryptocurrency market might signal a favorable technical indicator. This potential enhancement could suggest that the market has reached a point where it is no longer factoring in pessimistic views.

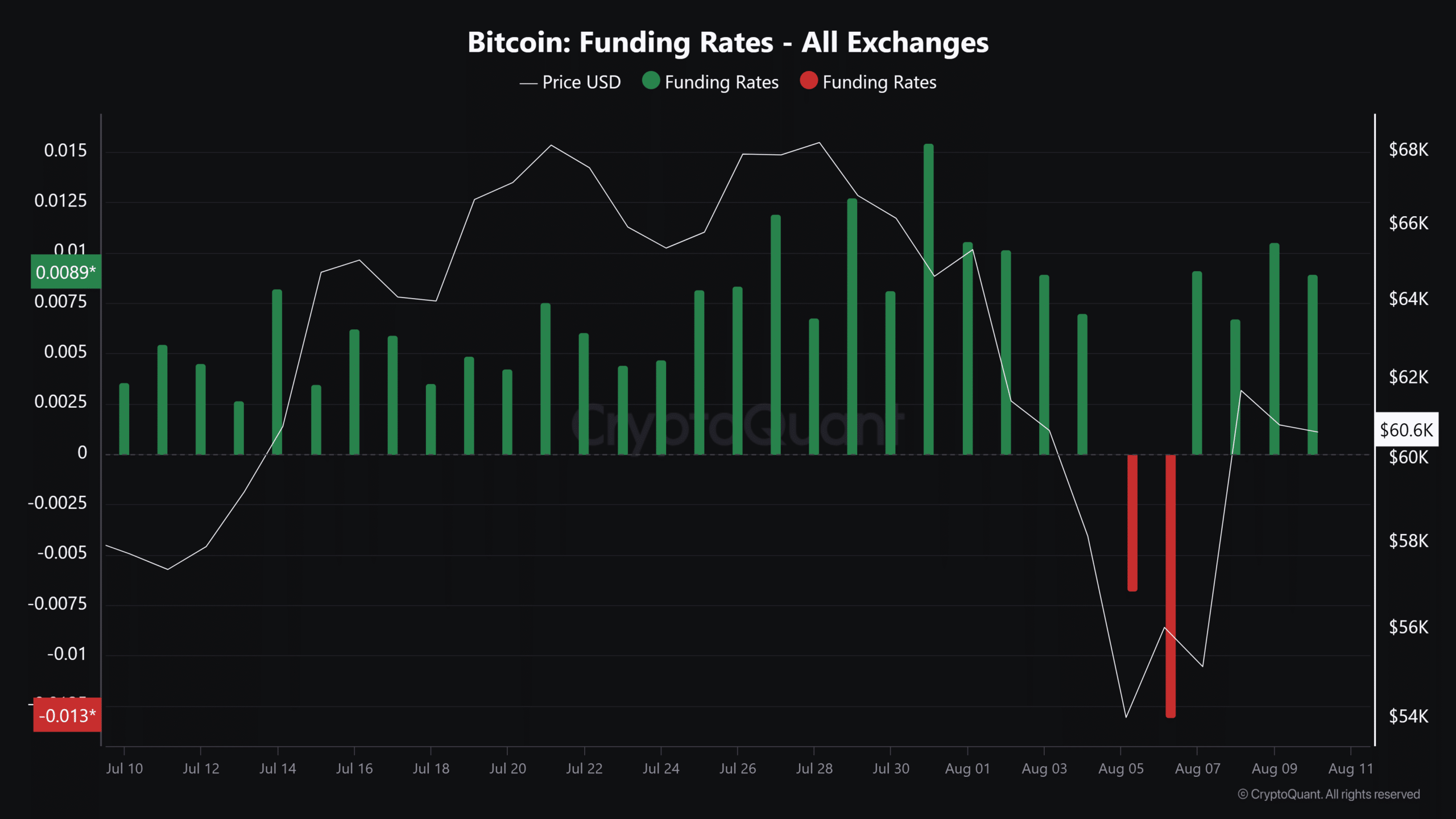

At the moment of reporting, the feelings among traders in the futures market appear to be optimistic, suggested by the high positive funding rates. Simultaneously, Bitcoin has experienced a recovery, moving back up from $49K to its earlier price range around $60K.

The same bullish outlook was reiterated by QCP Capital analysts in their weekend brief.

As a confident crypto investor, I’ve noticed a substantial and enduring bullish sentiment towards Bitcoin (BTC). Even amidst the week’s wild volatility, there’s been a steady appetite for Bitcoin call options, specifically those expiring in 2025 with strike prices around $100,000. This trend suggests optimism that BTC could reach these heights in the coming years.

US CPI data to set the next BTC direction?

According to Coinbase analysts, there’s a possibility that the short-term fluctuations in Bitcoin (BTC), Ethereum [ETH], and Solana [SOL] may persist.

However, broader trends will influence the decisions of investors, with particular attention being paid to the upcoming US Consumer Price Index report set for release on August 14th, which they consider a crucial factor to monitor closely.

Anticipating a decrease in the current selling pressure, as we believe the broader economic trends might persist. Notably, next week’s inflation report, scheduled for August 14, is expected to receive extra attention due to recent developments.

Alternatively, Coinbase mentioned that traders and investors might start adjusting their positions based on Producer Price Index (PPI) data, which can provide insights into potential CPI results. The PPI offers a viewpoint of inflation from producers’ standpoints.

Instead, let’s discuss that the Consumer Price Index (CPI) determines inflation by monitoring consumer expenditures on essential commodities and services. The Federal Reserve utilizes this information, along with other data sets, to formulate decisions about interest rates. On August 13th, we will receive the Producer Price Index (PPI) data.

As someone who has spent years working in financial markets, I can attest to the importance of keeping a close eye on Producer Price Index (PPI) data. This index offers valuable insights into inflationary pressures and helps predict future Consumer Price Index (CPI) trends. I’ve seen firsthand how market performance can be significantly impacted by these indicators, so it’s essential to stay informed. To get a head start on market fluctuations, many traders and investors scrutinize PPI data the day before, using it as an early guide for potential CPI directionality. This practice can help them make more informed decisions and adjust their strategies accordingly.

Simply put, we can anticipate another spell of market instability starting from August 13th, which is likely to influence Bitcoin’s and overall market trends throughout the following week.

Over the course of the weekend, Bitcoin’s value surpassed $60,000 in trades, Ethereum was swapped at rates above $2500, and Solana traded at prices over $150.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-11 09:12