-

The crypto market cap has declined by over 4% in the last two days.

BTC and ETH could fall below key support levels.

As a seasoned crypto investor with years of experience navigating the tumultuous seas of digital assets, I must say that the recent market turbulence has me treading cautiously. The sharp decline in BTC and ETH has brought about a sense of deja vu – reminding me of previous bear markets and their subsequent recoveries.

As a market analyst, I’m navigating through one of the toughest phases in the cryptocurrency market right now. Notably, we’re seeing substantial drops in key players like Bitcoin [BTC] and Ethereum [ETH]. This current trend casts a shadow of uncertainty over the forthcoming crypto week, making it crucial to keep a close watch on the market dynamics.

What the current market is saying

presently experiencing considerable volatility, as there’s been a substantial drop in the overall value of all cryptocurrencies combined during the past 48 hours.

Based on information from CoinMarketCap, it appears that the total market value of cryptocurrencies has dropped more than 4% due to significant decreases in well-known digital currencies like Bitcoin and Ethereum.

A comprehensive examination found that Bitcoin plunged more than 26% dramatically, whereas Ethereum dropped even more significantly by over 30%.

1. These significant declines play a substantial role in the broader market’s drop. Additionally, Bitcoin holds more than half (55%) of the total market share, with Ethereum leading at around 16%.

Considering the current downtrend and market turbulence, the upcoming crypto week is shrouded with uncertainty.

Currently, Bitcoin is being traded at roughly $50,800, marking a drop of more than 12%. Similarly, Ethereum is being sold for about $2,260, showing a decline of over 15%.

By employing the Fibonacci retracement levels, we can forecast possible price fluctuations over the coming week and estimate the chances of additional downward trends.

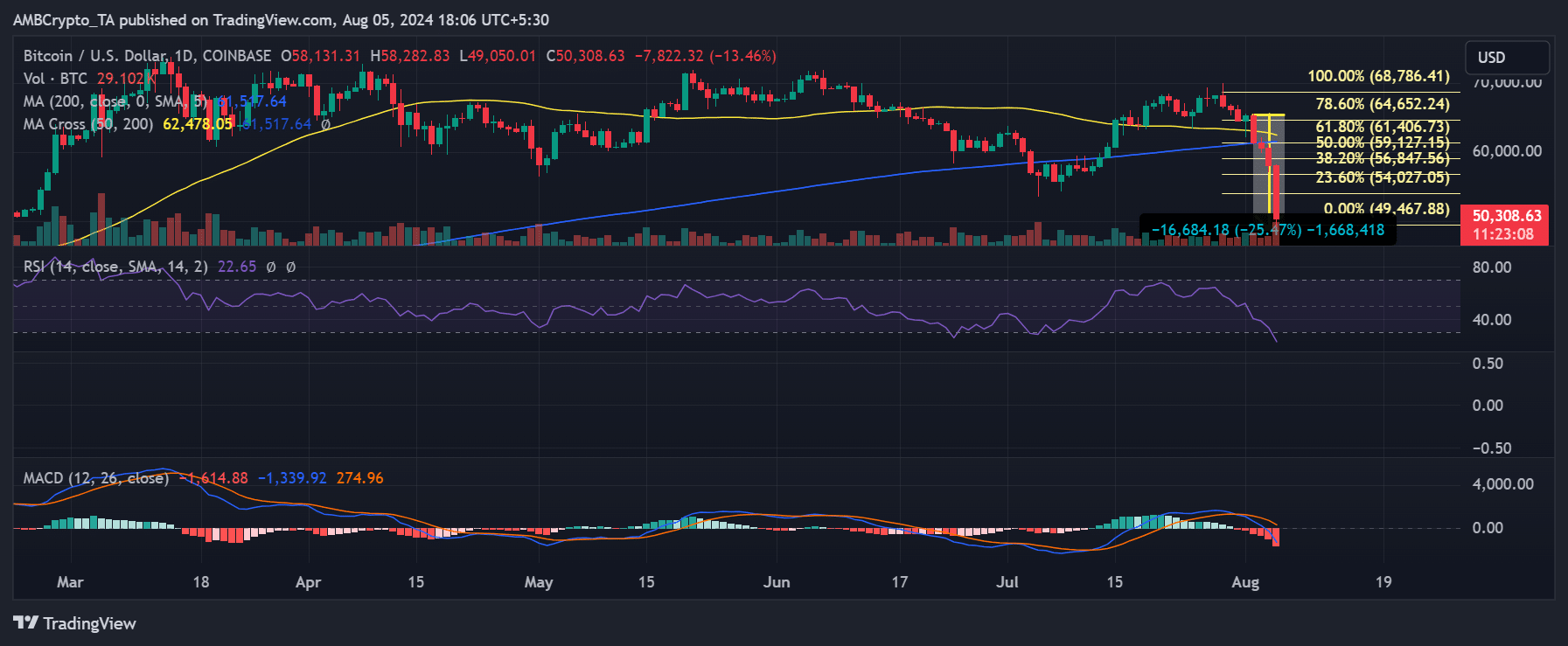

Crypto week ahead for Bitcoin

According to recent findings, Bitcoin’s current value hovers slightly beneath the 23.6% Fibonacci retracement point, which could potentially impede its upward momentum if it tries to recover. The next potential support can be found at the 0% retracement level, approximately $49,467.88.

If the cost consistently surpasses the 23.6% mark, it might challenge higher Fibonacci retracement thresholds, like the 38.2% one around $56,847.56 or the 50% one at $59,127.13. On the flip side, if the price keeps falling, it could potentially find stability near the 0% level, which is approximately $49,467.88.

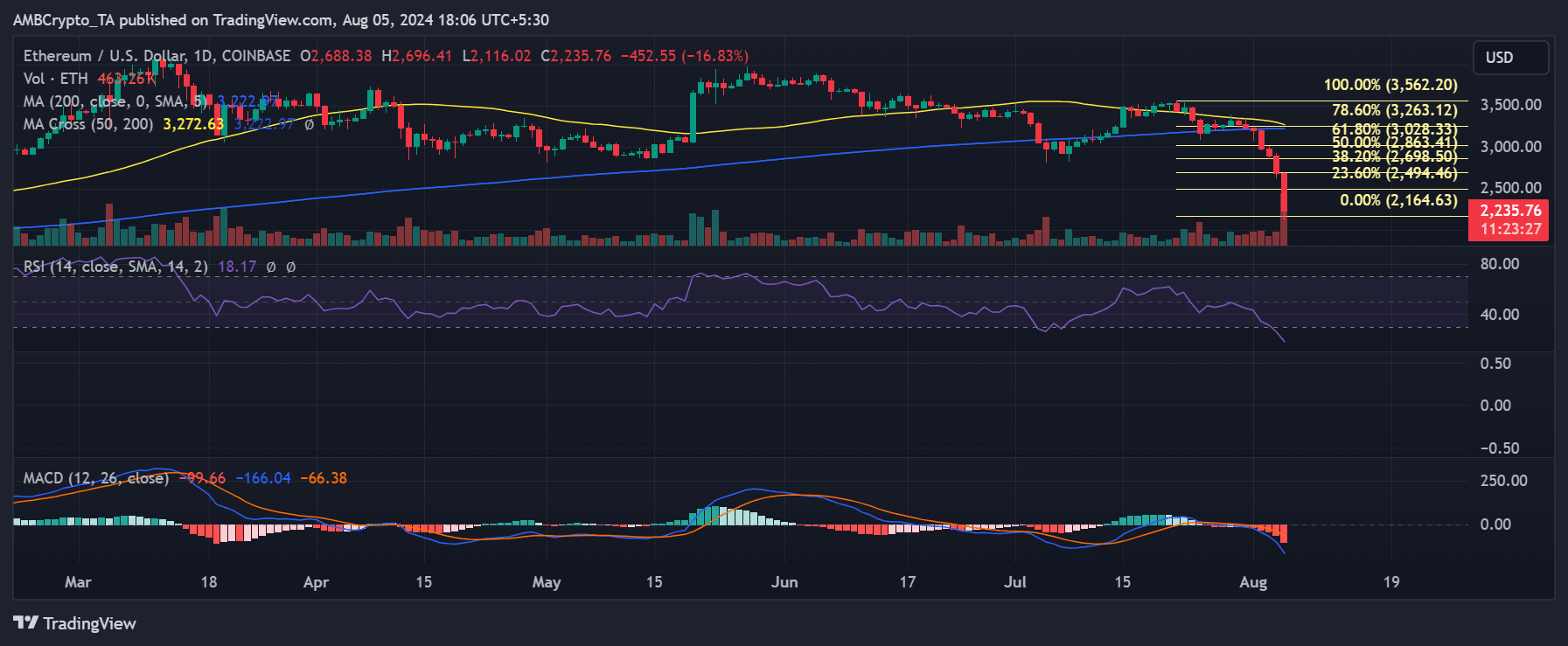

What about Ethereum

According to analysis, the Ethereum price is slightly higher than the point where it should theoretically retrace to zero based on Fibonacci ratios. If the price falls below this level, it might suggest a possible continuation of a downtrend.

Instead, if the price remains above 0%, there could be an effort to rebound towards higher Fibonacci levels. The first significant barrier might be encountered at the 23.6% Fibonacci retracement level, which is approximately $2,494.46.

This level could act as a key resistance point if the price moves up.

Read More

2024-08-06 06:15