- Bitcoin has appreciated by over 4% in the last seven days.

- Most market indicators hinted at a price correction soon.

As a seasoned cryptocurrency analyst with years of experience observing and studying market trends, I have seen my fair share of bull runs and corrections. While Bitcoin (BTC) and Ethereum (ETH) displayed impressive gains in the last seven days, with BTC up by over 3% and ETH by about 2%, I remain cautiously optimistic about their upcoming trajectory.

Over the past week, Bitcoin (BTC) and Ethereum (ETH) have shown strong gains, with their weekly charts now displaying a positive trend. Let’s delve deeper into these leading cryptocurrencies to gain insights on what the coming crypto week might hold.

Bitcoin and Ethereum’s target

As a researcher studying cryptocurrency market trends, according to CoinMarketCap, Bitcoin’s price experienced a rise of more than 3% within the past week. Similarly, the leading altcoin followed suit with a price growth of approximately 2%.

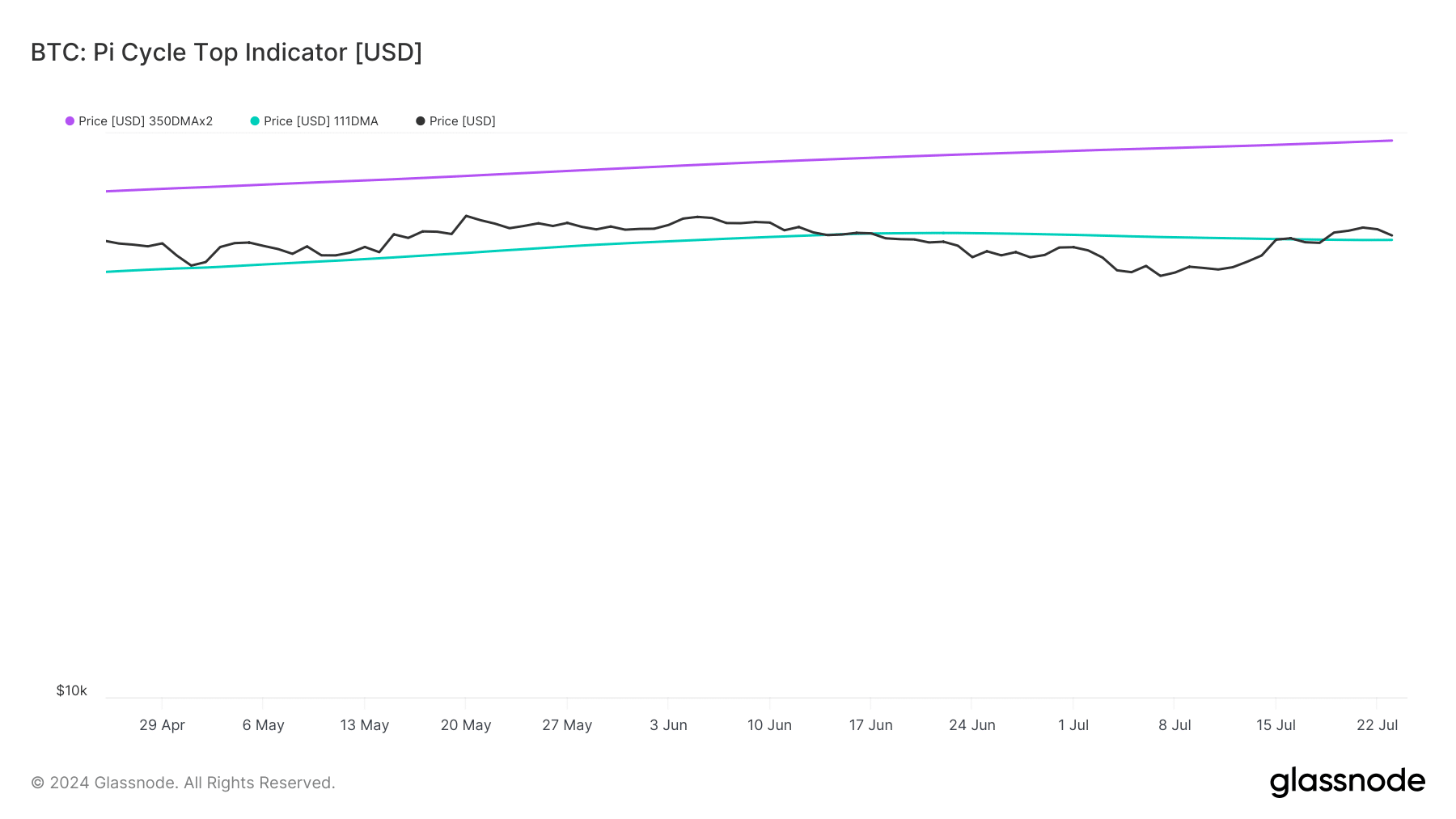

Currently, Bitcoin was priced at $64,000 in the markets, while Ethereum was being traded at $3,500. An analysis conducted by AMBCrypto using Glassnode’s data indicated that Bitcoin was significantly undervalued based on previous market trends. According to the data, Bitcoin’s potential market peak was estimated to be around $97,000.

As a crypto investor, I’ve noticed Ethereum’s price showing signs of bearish momentum recently. According to the Pi cycle top indicator, Ethereum’s price could potentially reach a market top around $5,200.

If the week ahead goes bullish, then these two top tokens might reach their targets.

What to expect from BTC and ETH

Instead of “AMBCrypto then planned to have a look at both of these coins’ metrics,” you could consider paraphrasing it as “AMBCrypto intended to examine the metrics of these two coins in order to determine if the coming week would be bullish or bearish.”

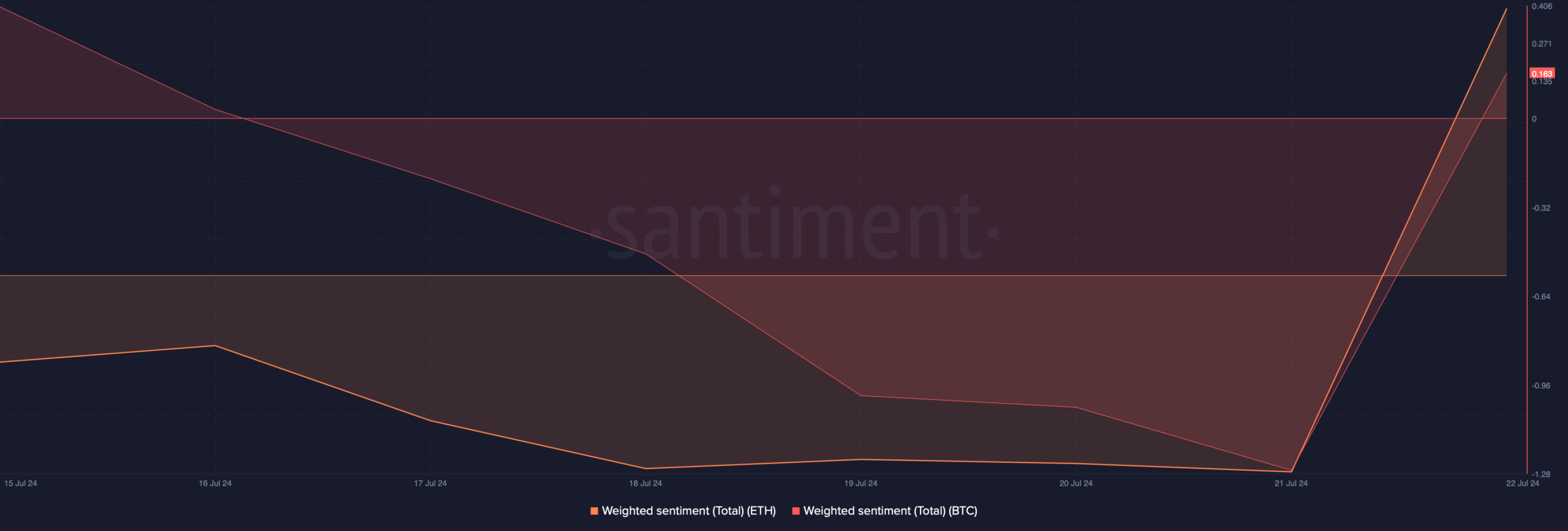

Based on our examination of Santiment’s statistics, the mood towards Bitcoin and Ethereum shifted to optimistic. The sentiment scores for both cryptocurrencies moved into the favorable territory, signifying that positive attitudes outweighed negative ones within the marketplace.

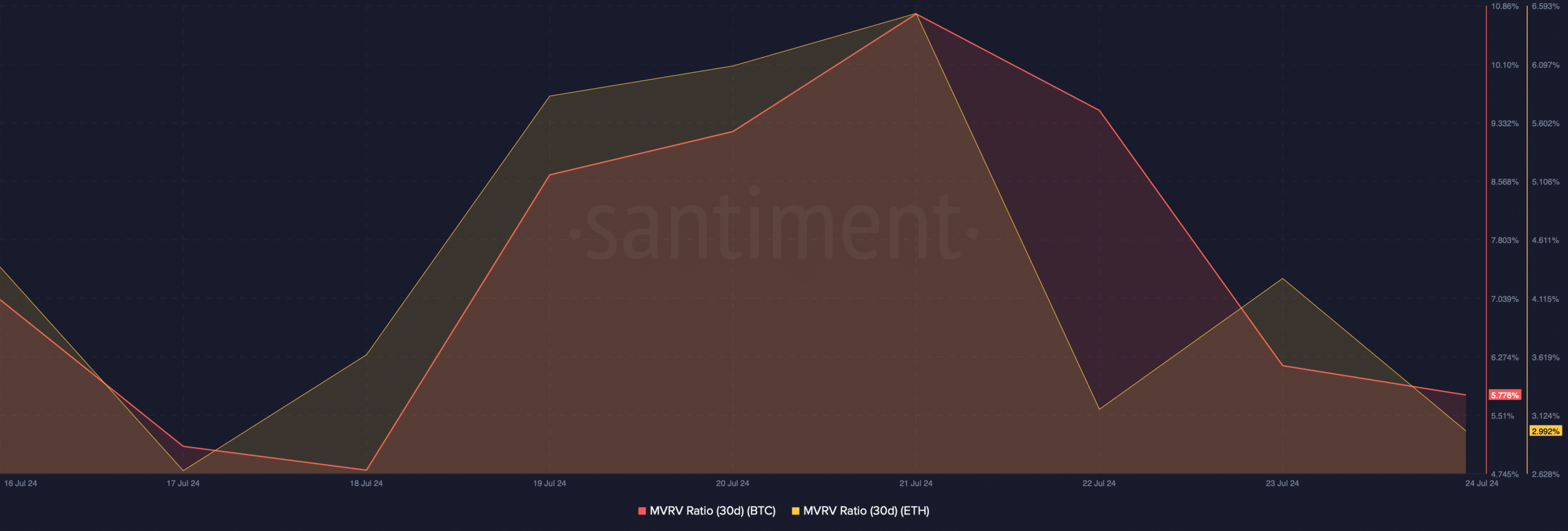

An optimistic indicator was the MVRM ratio’s recent increase over the past week. This signifies a higher probability of a bull market.

To gain a clearer perspective on the upcoming trends for Bitcoin (BTC) and Ethereum (ETH), let’s examine their daily price charts.

BTC and ETH price chart analysis

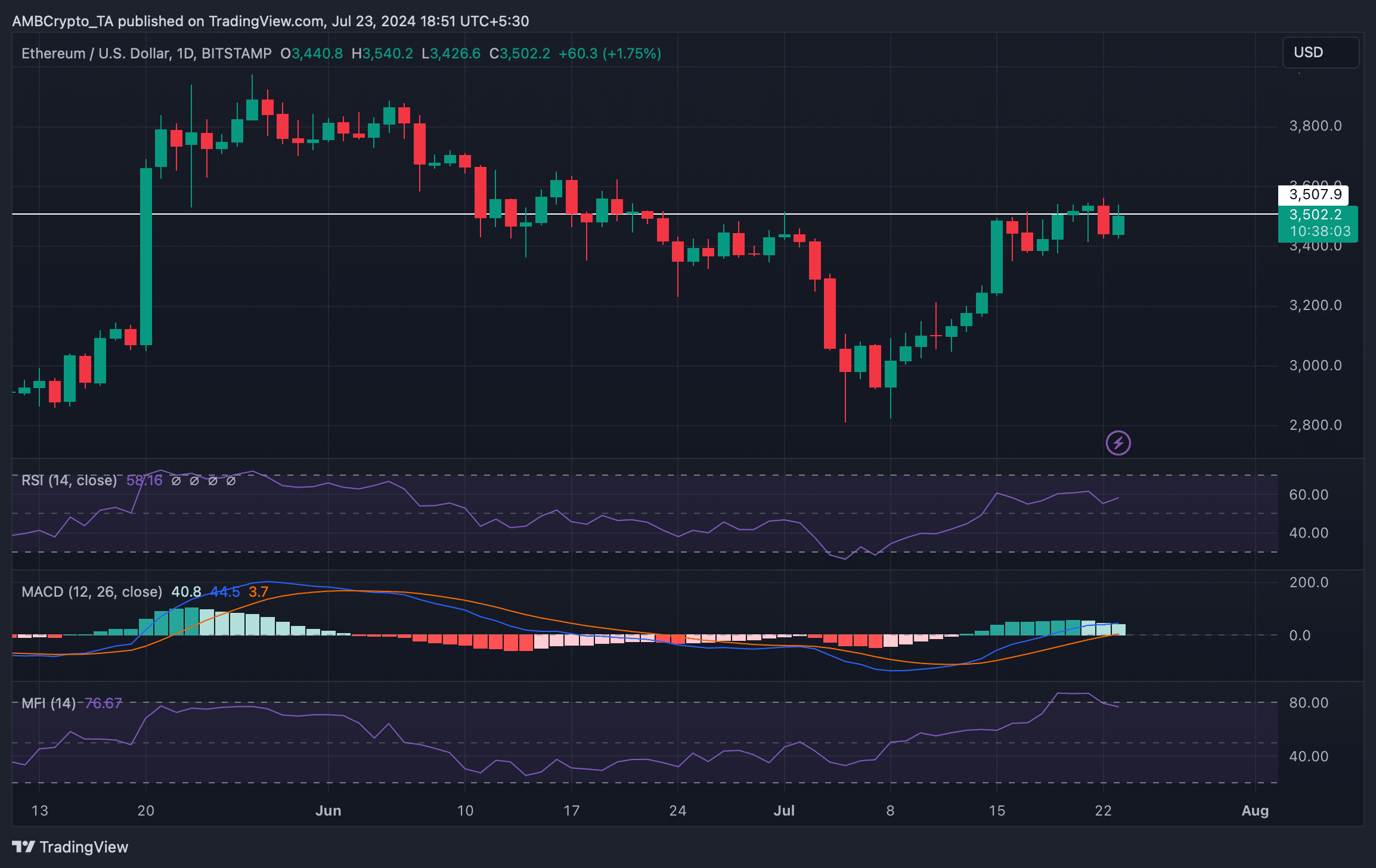

Based on our examination, the MACD signal line for Ethereum showed a positive position in the market. Yet, other market indicators pointed towards a downturn.

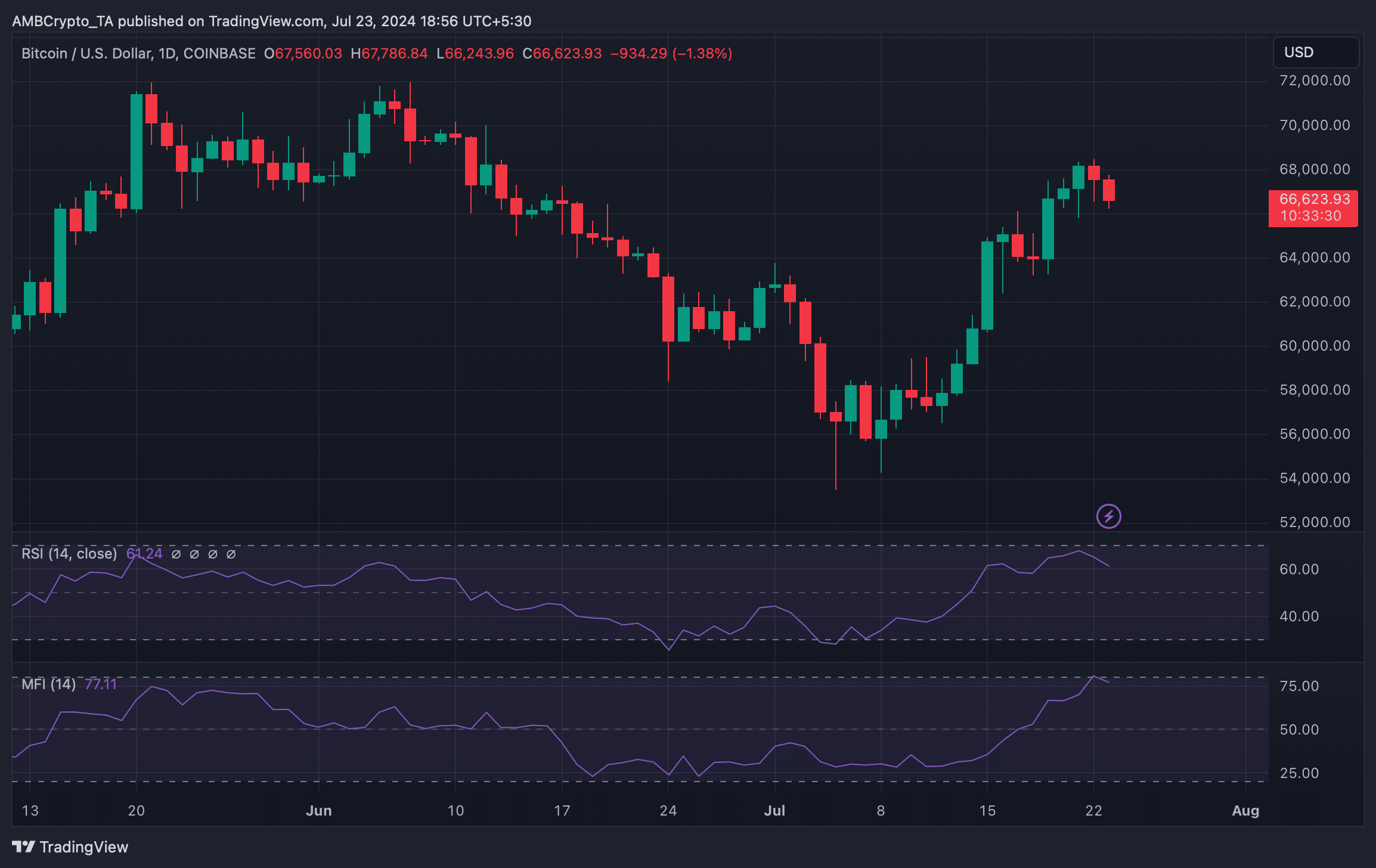

The Relative Strength Index (RSI) and Money Flow Index (MFI), indicators used in trading, were approaching the threshold for being considered overbought. This could potentially lead to an increase in sellers in the Ethereum market, which may result in a decrease in its price.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In a parallel development, the RSI and Money Flow Index of Bitcoin’s price chart exhibited decreases.

This meant the upcoming week might be bearish for top cryptos like ETH and BTC.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-07-24 10:15