-

Bitcoin whale to potentially face liquidation of $28M WBTC.

The price action shows price is set for further decline.

As a seasoned researcher with a keen eye for market trends and a hearty appetite for risk, I find myself cautiously watching the Bitcoin [BTC] market unfold. The recent price action has been nothing short of tumultuous, and it seems that the “king of crypto” is once again testing our collective mettle.

The current movement in Bitcoin’s (BTC) pricing has persistently confounded traders, given the prevailing doubt surrounding its status as the “cryptocurrency king.

While other cryptocurrencies faced similar declines, BTC was especially affected by whale activity.

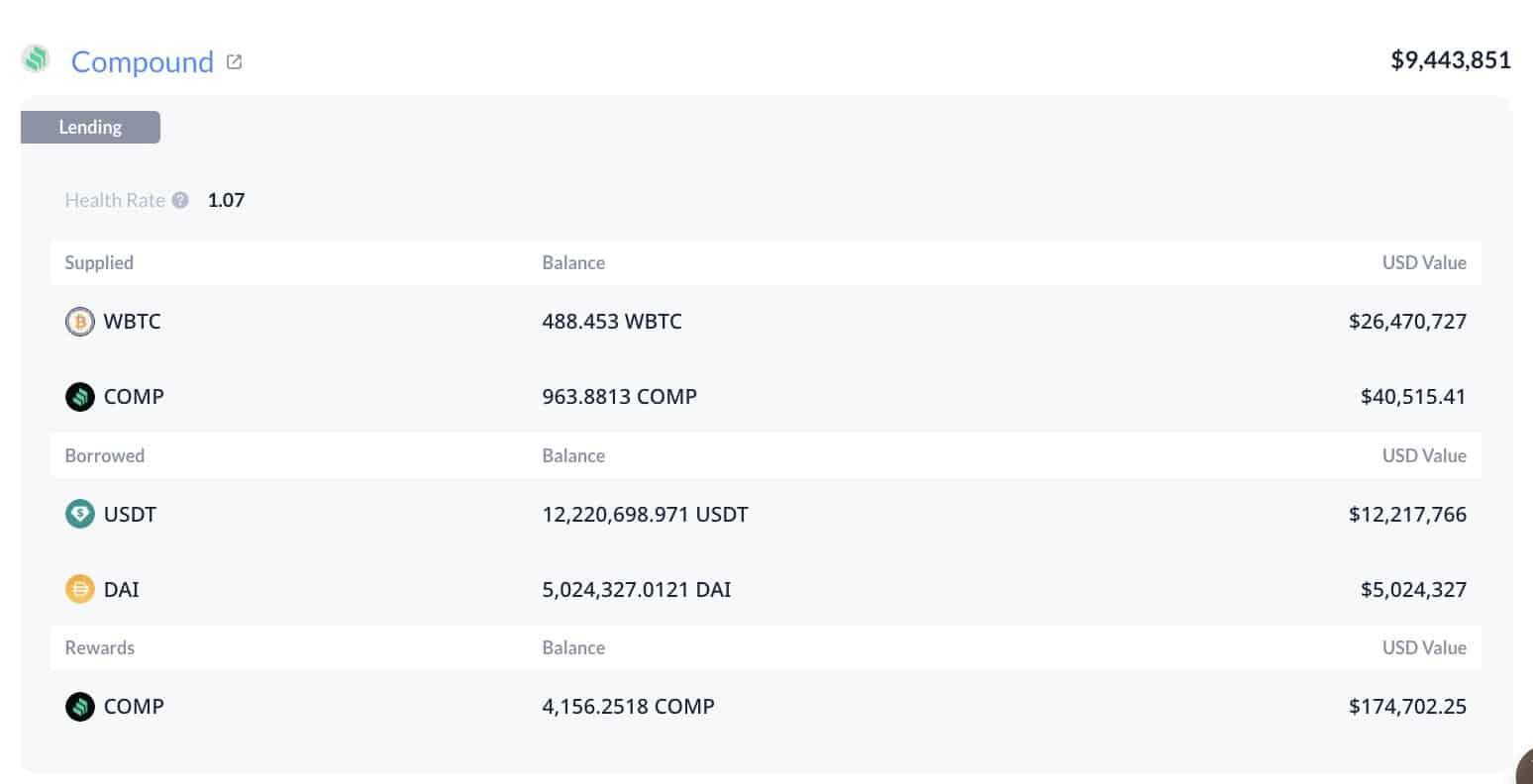

A notable whale stands on the brink of forfeiting approximately 488.45 Wrapped Bitcoin Tokens (WBTC), valued at around $28 million, from Compound [COMP], with a health factor of 1.07 and a liquidation price set at $50,429.

As an analyst, I can share that a particular whale’s holdings were liquidated on three separate occasions during the 2022 market crash, amounting to approximately 74,426 cWBTC or around $32.82 million. If current liquidation orders continue to be executed below the price point of $50,429, it could potentially push the Bitcoin price towards this level.

More BTC levels to be liquidated

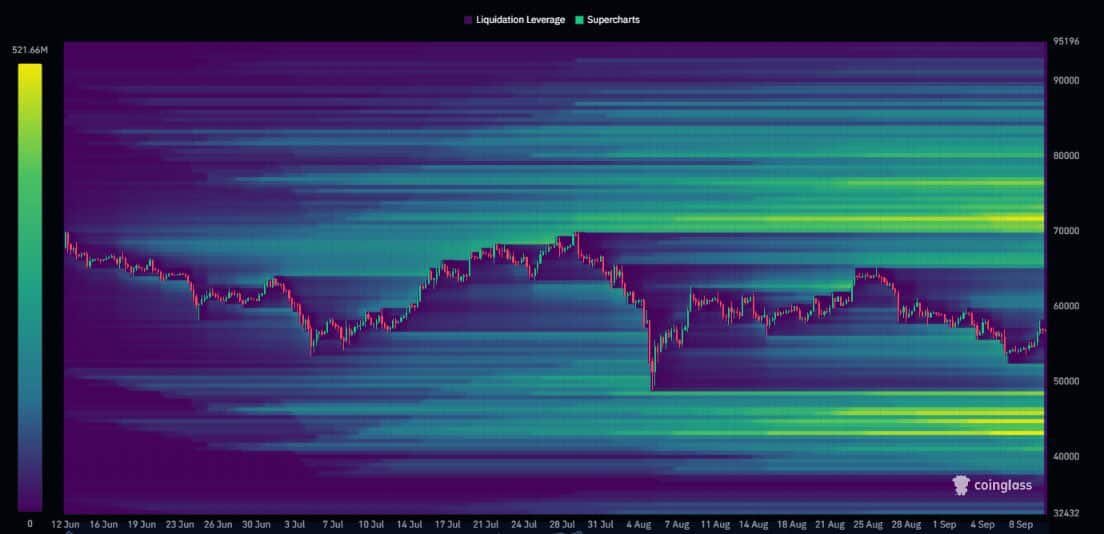

In simpler terms, if Bitcoin’s price reaches or drops below certain levels, a significant amount of selling could occur, potentially leading to further decreases in its market value. Specifically, it’s predicted that sell-offs totaling around 1.07 billion dollars might happen near the $50,000 mark, and an additional 500 million dollars could follow if Bitcoin falls below $55,000.

For a period of three months, the market showed ample liquidity on both buying and selling sides, as seen in the heatmap. Liquidation of long positions occurred approximately at $45K, while short positions were liquidated roughly at $72K.

Investors ought to steer clear of high-leverage trades since sudden, significant changes in the market can occur, potentially draining resources due to swift shifts in liquidity.

If Bitcoin doesn’t hold above the $60,000 mark, it could continue dropping in value. However, should it find buyers around the $50,000 level, there’s a possibility that it might bounce back and head towards an increase again.

What’s next for BTC?

In the last few weeks, Bitcoin’s attempts on the 4-hour chart to surpass its 200-day exponential moving average (EMA) have consistently been unsuccessful.

This implies that Bitcoin might encounter more downward force. Prices usually get pulled towards points where significant liquidity is available, either above or below critical thresholds.

Analyzing whether Bitcoin (BTC) trades above or below its moving averages provides a clue about the market’s power or vulnerability.

To spark an upward move, bulls must retake these shifting averages, yet market feeling suggests that the price could fall even lower because a significant amount of liquidity is accumulating around the psychological $50,000 mark, hinting at further declines.

History shows a return to a balance zone

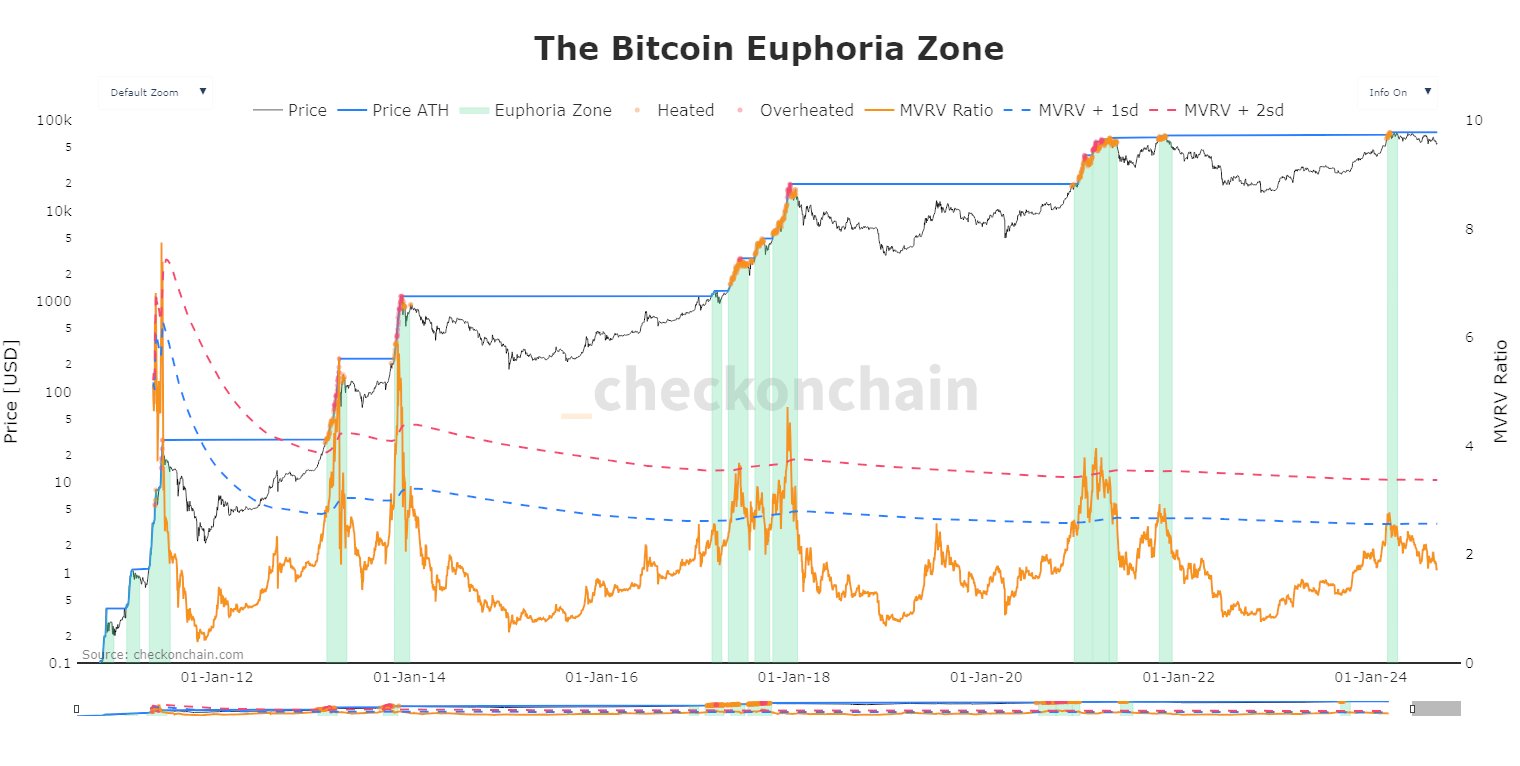

Previously, the price of Bitcoin has often stabilized within a particular range, suggesting possible opportunities for further price increase in the future.

In simpler terms, the Euphoria Zone indicator proposes that the peak of the past market cycle often serves as the bottom during the subsequent upward trend.

Other metrics like the market value/realized value (MVRV) ratio show BTC is heading toward a balance zone, a critical level from which price historically bounces.

It’s been forecasted that Bitcoin might drop below $50K, accumulate more resources, and then soar to unprecedented peaks, potentially as early as the last quarter of 2024 or the first quarter of 2025 – if these predictions hold true.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The behavior of Bitcoin’s price and ongoing market exits suggests that there might be significant fluctuations ahead. With accumulating liquidity beneath crucial thresholds, it’s possible that Bitcoin could drop more before a strong recovery occurs.

As a researcher studying the dynamics of Bitcoin, I’m observing that if past trends hold true, we might expect a recovery in its value. This potential rebound could pave the way for an uptrend, with increasing liquidity serving as a catalyst for higher prices.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-12 04:08