Ah, the delightful world of crypto – where fortunes are made, lost, and then made again, all before your morning coffee. A crypto whale, surely one of those mythical creatures we hear so much about, has splashed over $250 million on Bitcoin BTC and Ethereum ETH. All of this, just as a cataclysmic market crash wiped out a staggering $628 million in a display of digital drama worthy of the finest Shakespearean tragedy. 🎭

Massive Whale Move Amid Market Panic

On the ever-reliable blockchain, the wallet “0xd8d0” was spotted transferring a mere $178.36 million in USDC to market makers Wintermute and Coinbase. In return, it received 893 BTC (worth a rather modest $103.5 million) and 20,000 ETH, which one can only assume are the digital equivalent of treasure hoards. It’s hard to feel sorry for a whale with such a big appetite for crypto delicacies.

Whale 0xd8d0 spent 178.36M $USDC to buy 893 $BTC ($103.5M) and 20,000 $ETH ($74.06M) in the past 5 hours.

He transferred 178.36M $USDC to #Wintermute and #Coinbase, then received 893 $BTC ($103.5M) and 20,000 $ETH ($74.06M) from #Wintermute and #Coinbase.…

— Lookonchain (@lookonchain) August 1, 2025

What’s most delightful about this move is the timing—right after US President Donald Trump, in his eternal quest to impose tariffs like a man with a very large hammer, issued an executive order slapping steep tariffs on countries that refused to bow to the mighty US trade terms. South Africa, Switzerland, Taiwan, Thailand… no one was safe. Even the mighty Canada, which is probably crying into its maple syrup, now faces a 35% tariff. Truly, it’s the gift that keeps on giving. 😆

Bitcoin Drops Below Key Support

Ah, Bitcoin. The digital darling that never knows how to sit still. As of now, it is trading at $115,000, a modest 2.5% drop from the previous 24 hours. It’s now a mere shadow of its all-time high of $122,800 from mid-July. But fear not, dear reader, as analysts are eyeing the sacred $111,000 mark as the next potential support level. Hold tight, this rollercoaster is far from over. 🎢

And poor Ethereum. It’s down nearly 5%, now languishing at $3,669. As the market takes a dive, the liquidations are coming in faster than a bad sitcom. A staggering 158,000 traders were wiped out in the past 24 hours, and $186.55 million was flushed from Ethereum’s derivatives market like water down a drain. 💸

Retail Sells, Whales Accumulate

Meanwhile, in a show of poetic irony, retail traders have been unloading their BTC, seeing it as their time to cash out. According to analyst Amr Taha, the short-term holders have increased BTC deposits to Binance from 10,000 to over 36,000 BTC in July alone, a clear signal that they’ve had enough of this volatile digital circus. 🎪

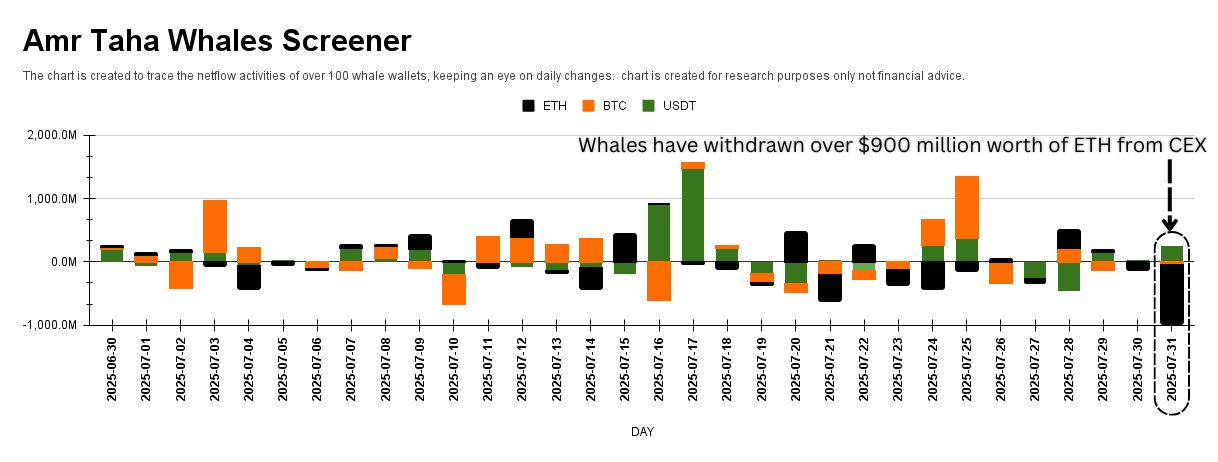

ETH Whale Withdrawals | Source: Amr Taha

On the flip side, the whales, in their infinite wisdom, continue to accumulate Ethereum as if it were the finest wine, with over $900 million worth of ETH withdrawn from centralized exchanges by whale wallets on July 31. Meanwhile, the Federal Reserve holds interest rates steady, while these mighty beasts of the crypto ocean double down like they’re at a poker table in Monte Carlo. 🃏

Bull Rally Not Over Yet?

Though Bitcoin appears to be in the twilight of its current bull market cycle, it is not yet quite ready to exit stage left. In fact, the new investor dominance currently sits at a humble 30%, far from the 65%+ levels we saw at previous peaks in March and December of 2024. It’s almost as if Bitcoin is trying to tease us, just a little bit longer. 😉

Technical analyst Ali Martinez suggests that as long as BTC holds above $105,450, there is still hope for a rally that could push us towards $125,230 or even a cool $141,770. Because why not? Crypto is nothing if not endlessly unpredictable—and that’s what makes it so delightfully entertaining. 🎉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- These Are the 10 Best Stephen King Movies of All Time

- Best Werewolf Movies (October 2025)

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 10 Movies That Were Secretly Sequels

- Goat 2 Release Date Estimate, News & Updates

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

2025-08-01 15:52