As someone who has navigated the tumultuous waters of cryptocurrency trading, I can attest to its exhilarating yet treacherous nature. Flipping, as it’s called, is a rollercoaster ride that promises both immense profits and crushing losses.

Ever since people began considering ways to earn money, striking a profitable deal has been something they’ve always kept in mind. Flipping cryptocurrency is another example of a good deal, an investment strategy where individuals buy digital assets with the intention of selling them for a higher price quickly. This method has gained popularity due to the volatile nature of the market, which often leads to significant price spikes.

In this write-up, we’ll delve into the concept of crypto flipping – a process that converts cryptocurrencies into earnings. We’ll provide an in-depth look at the steps involved, along with discussing how to generate income from cryptos. Additionally, we’ll address potential hazards like market volatility, which can lead to financial losses, and the challenges posed by market manipulation.

Key Takeaways:

- Buying digital assets and swiftly reselling them for a profit is known as crypto flipping.

- In an ICO, investors buy tokens at a discount to sell for more money once they are listed on exchanges.

- There are a lot of dangers associated with flipping, including high market volatility, problems with liquidity, and possible regulatory issues.

What is a Cryptocurrency Flip?

An investor might purchase digital assets (such as altcoins) and sell them swiftly for a gain, often referred to as “flipping” cryptocurrencies. This strategy typically occurs after the assets are listed on a cryptocurrency exchange. It’s based on the belief that cryptocurrency values can experience significant increases, particularly when a new coin debuts in the market. The goal is to capitalize on these price surges so the trader can quickly make a profit, unlike long-term investing which focuses on steady growth over time. Flipping cryptocurrencies, therefore, centers around exploiting short-term market volatility.

ICO Flipping

As a researcher delving into the realm of digital currencies, I’ve come across a strategy often associated with Initial Coin Offerings (ICOs) known as “ICO flipping.” In simple terms, this involves early investors purchasing newly minted cryptocurrencies during an ICO, before they are listed on exchanges. The plan is to sell these tokens swiftly after the coin starts trading on secondary markets, profiting from the price difference between the discounted ICO price and the expected market value.

Participating in the initial listing often boosts other traders’ confidence, leading to an increase in the token’s value. This surge in price allows those who invested during the initial coin offering to easily offload their holdings at a profit once trading begins.

Here’s a possible way of rephrasing the text:

Altcoin and Bitcoin Flipping

Although altcoin and Bitcoin flipping follow similar basic ideas, their methods vary because of the traded asset type. Bitcoin flip refers to purchasing a specific amount of Bitcoin and selling it at times of extreme volatility.

Compared to alternative cryptocurrencies (altcoins), Bitcoin generally exhibits a more stable market behavior. The unpredictable nature of altcoins presents opportunities for quick profits through “flipping,” but it also carries higher risks due to the larger price fluctuations they can experience. Since smaller, less-known digital currencies are prone to significant price swings, investing in altcoins for a short-term profit (flipping) can be riskier but potentially more rewarding.

Traders might opt for altcoins instead of Bitcoin to secure more reliable profits, yet they could also make this switch for potentially higher, albeit riskier, yields.

Fast Fact:

During the 2017 cryptocurrency boom, the term “flipping” emerged when Ethereum surpassed Bitcoin’s all-time high. This shift in value was attributed to Ethereum’s growing adaptability due to its ability to develop applications based on smart contracts.

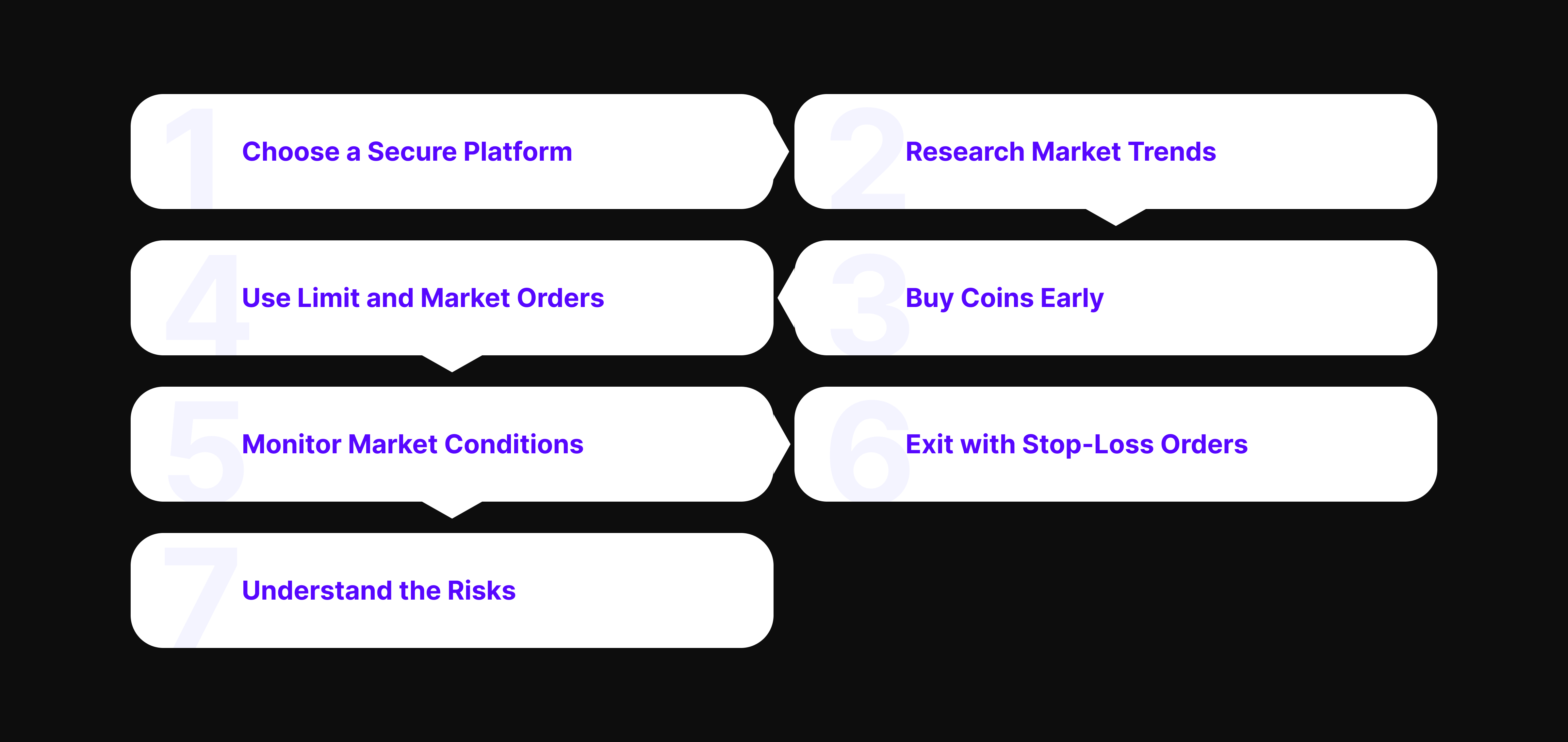

How to Flip Coins: A Step-by-Step Guide

Selecting a reputable trading platform is essential when investing in coin flipping, and this is the first step. You may want to consider platforms that provide a large selection of trading pairings, robust security, and an easy-to-use user interface.

When selecting an exchange, prioritize options that offer secure features such as cold wallet storage for your funds and Two-Factor Authentication (2FA) for enhanced security. Having a diverse selection of trading pairs is essential because it expands the opportunities for asset flipping. A user-friendly design not only streamlines the process but also ensures swift trade execution.

Research and Market Analysis

As an analyst, I always emphasize the importance of conducting thorough research prior to any investment decision. To begin with, I delve into potential price fluctuations by examining market trends. This analysis provides insights that can help predict future movements.

Executing the Flip

Invest in coins during an Initial Coin Offering (ICO) or before they are listed on major exchanges to maximize your profits. By purchasing coins at a cheaper price during their pre-launch stages, investors aim to sell them later at a higher price once they become available on the secondary market. This strategy demands precise timing and a keen understanding of the market to avoid holding onto assets that may depreciate in value.

Types of Orders

As a researcher delving into the world of cryptocurrencies, grasping various order types is essential when it comes to flipping these digital assets profitably. Let’s explore these different order types together.

- Limit orders – These let you specify the price you wish to purchase or sell a coin. For instance, you might create a limit order at $0.30 to sell the coin at that price. This strategy helps to generate profits by selling at your desired price.

- Market orders – They are executed right away at the going rate. Use market orders when you need to purchase or sell quickly, especially in very volatile markets. However, due to market volatility, the actual execution price may differ somewhat from the last traded price.

- Stop-Limit Orders – This is a limit order combined with a stop order. When the stop price is reached, it becomes a limit order. For example, you may set a limit price of $0.18 and a stop-limit order to sell your coins if the price drops to $0.20. This lessens the chance of losing money during unexpected price declines.

Monitoring Market Conditions

Keeping tabs on market trends is crucial when it comes to flipping, especially during periods of high volatility. Cryptocurrency markets can change rapidly – sometimes within minutes. Tools like price alerts and live charts can assist you in reacting promptly to fluctuations by lowering the risk of financial loss. For instance, a sudden increase in buying activity might signal an upcoming price surge, making it a good time to sell.

Exiting the Trade

Timing your trade exit is crucial for successful flipping. Set your desired selling point by examining market trends and applying your trading approach. Sell promptly when the price reaches your goal to secure your profits. Additionally, employ stop-loss orders to safeguard against sudden price decreases. For example, if you bought a coin at $0.10 and it rises to $0.25, you might set a stop-loss order for $0.20. This ensures that you’ll still realize a profit even if the price drops.

Risks and Challenges of Flipping

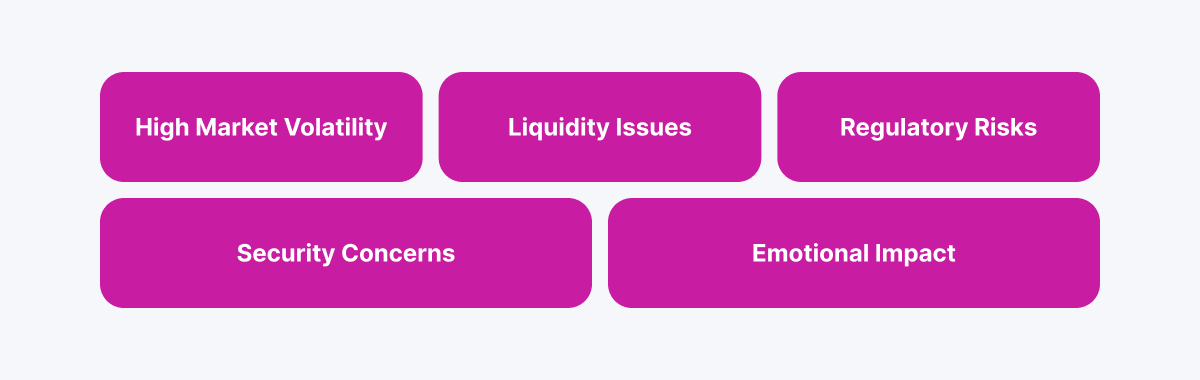

In the thrilling realm of cryptocurrency, I’ve learned firsthand about its notorious unpredictability, a trait that can either bring swift gains or setbacks. The prices here tend to fluctuate frequently, and these variations might be triggered by news announcements, substantial trades, or shifts in market opinion.

For example, a dollar coin could decrease in value to fifty cents by midday. Given this unpredictability, caution is essential. Investing in cryptocurrencies in a rapidly changing market carries a high risk of losing capital, yet there’s also potential for earning profits.

Liquidity Issues

The ability to quickly and easily buy or sell an asset without affecting its value is referred to as liquidity. However, this can pose challenges, especially with lesser-known cryptocurrencies, known as altcoins. When it comes to selling, a trader might find there aren’t enough buyers available for the specific quantity of these digital currencies they wish to offload. This could force them to sell at a lower price or sooner than intended, potentially leading to reduced profits or even losses.

Regulatory and Security Concerns

Since cryptocurrency markets currently operate with minimal regulation, there’s a heightened risk of fraud, market manipulation, and exchange hacks. For instance, without regulatory oversight, certain coins could be artificially inflated in price by one party to attract unsuspecting investors (price manipulation). Moreover, due to the lack of oversight, cryptocurrency exchanges might not implement the same security measures as traditional financial institutions. Regrettably, history has shown that hackers can exploit these vulnerabilities and steal all your assets if they are stored on an exchange.

Emotional and Psychological Factors

Engaging in cryptocurrency trading challenges both your emotional resilience and market knowledge. Given the unpredictable nature of this market, there’s a strong temptation to act impulsively, which can lead to hasty, emotionally-driven decisions influenced by either greed or fear.

Here’s one way to rephrase the given text in a more natural and easy-to-read manner:

Conclusion

It’s important to proceed with care and understanding when it comes to flipping. Thorough research is essential, and employing effective risk management strategies is crucial. While there are potential financial gains in this unpredictable market, only those who are well-prepared and disciplined can navigate the challenges that may arise. Stay informed, monitor the market closely, and be ready to adjust your investment strategy as needed.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-28 16:56