- 2024 was a pivotal year for Bitcoin, with the same setting the stage to tackle the volatility of 2025

- Stablecoins are rising as the new gold, leading a financial revolution as the anti-dollar coalition grows

2024 was a rollercoaster year for me as a crypto investor, but it was also incredibly enlightening. The “Trump pump” was a thrilling ride that showed Bitcoin’s potential as digital gold, and I found myself holding onto my seat during those wild price swings.

2024 saw cryptocurrencies experiencing an exhilarating rollercoaster ride. Economic inflation soared, causing turbulence in conventional markets due to international turmoil, which led an increasing number of individuals to consider cryptos as a potential backup financial strategy.

The “Trump pump” offered Bitcoin a chance to demonstrate its value as digital gold, and it certainly delivered. As we move towards 2025, the crypto community is filled with anticipation, curious about what’s coming next. There’s a lot of speculation, but the potential outcomes are even more significant.

Crypto market remains tangled in the economic thread

It’s not by chance – Bitcoin has seen significant gains, with a triple-digit year-to-date growth, peaking at $108,000 on the charts and currently standing at $98,334 as we speak. In fact, it appears to be ending the year nearly four times stronger than gold.

Every four years, Bitcoin tends to experience a surge in optimism, which continues to influence subsequent years. This trend is driven by a combination of internal and external factors, and true to this pattern, Bitcoin has yet again proven to be a consistent performer.

Nevertheless, the cryptocurrency market continues to be influenced significantly by broader economic factors. The feelings of investors are predominantly swayed by major economic events, shaping their ‘appetite for risk’ – a connection that has grown increasingly evident as the year progressed.

When the Federal Open Market Committee (FOMC) expressed caution regarding economic data and suggested increased volatility, the cryptocurrency market experienced a setback. In a mere three days, the total market value plummeted from an all-time high of $3.77 trillion to $3.13 trillion – a sharp 17% drop.

Simultaneously, the US Dollar reached a peak it hadn’t seen in nearly three years. This strong performance didn’t just affect Bitcoin; even major currencies such as the Japanese Yen experienced difficulties, dipping to their lowest point in the past five months on the trading graphs.

It’s evident that the Federal Reserve’s statement set off waves throughout various worldwide financial markets, either directly impacting or subtly influencing cryptocurrency interest. Upon closer examination of the data, there was a significant change in market dynamics observed.

Bitcoin bucks its usual trend

In June 2022, there was a significant increase in post-pandemic inflation, exceeding 9%. As a result, the Federal Reserve increased interest rates, causing Bitcoin to face its most challenging period. At that time, Bitcoin’s value fluctuated between $20,000 and $25,000 on trading charts.

However, the response this year has been different.

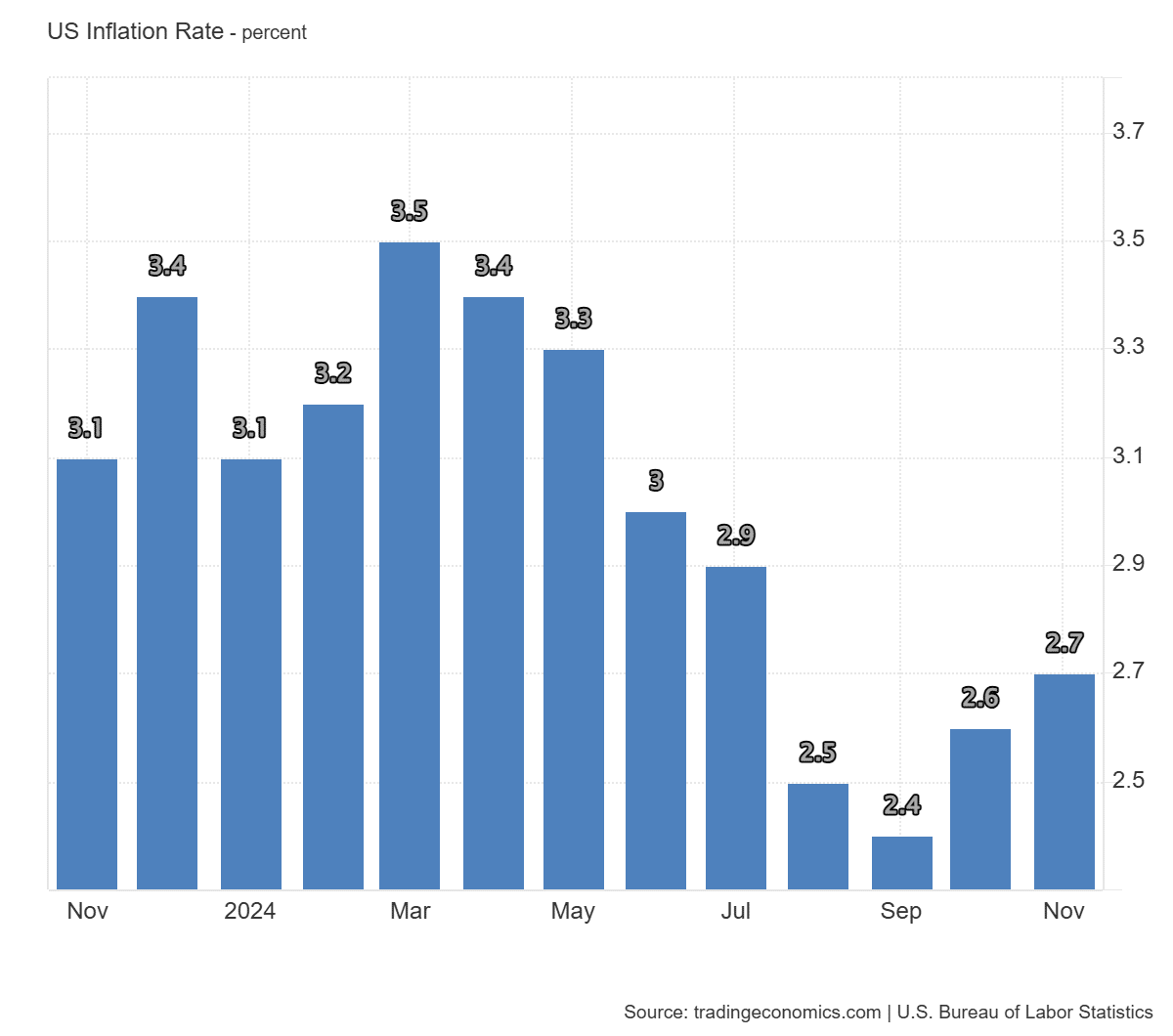

Source : Trading Economics

Despite inflation peaking at 3.5% annually in March due to escalating oil costs, Bitcoin remained unfazed and even surged, achieving an unprecedented peak of $73k.

It’s truly remarkable to see Bitcoin surpass traditional assets by a significant margin this year. With a Year-to-Date (YTD) growth of approximately 140%, Bitcoin has outrun prominent indexes such as Gold (+27%), S&P 500 (+33%), and NASDAQ (+33%) like they were standing still.

Despite a challenging year characterized by soaring war material expenses, disrupted supply lines, political turbulence, and intensifying trade restrictions, Bitcoin stood firm.

What’s the significance here? During periods of financial strain, investors tend to shun risky investments. Instead, they flock to banks for safety, either by increasing their savings or borrowing less due to higher costs. This mass movement results in reduced liquidity and drives investors towards traditional assets that offer guaranteed returns.

Even amidst stricter personal spending and general market volatility, Bitcoin has been recognized as a “safe refuge,” reinforcing its status as the “digital equivalent of gold.” This significant transformation in perception suggests that Bitcoin might shape the financial landscape dramatically by 2025, potentially marking a pivotal turning point.

So, is this the beginning of something new?

It’s clear that Bitcoin has emerged as a significant player compared to traditional investments like gold, traditionally considered a safe haven. This shift towards Bitcoin marks the beginning of an exciting new chapter in global investing.

Under a government favorable towards cryptocurrencies and an increasing focus on Bitcoin by mainstream society, it appears that Bitcoin’s power will remain robust. Yet, the journey forward is filled with obstacles.

New tariffs, tax reductions, and stricter government expenditure in China might prompt the Federal Reserve to maintain elevated interest rates, potentially causing difficulties for various markets, including Bitcoin.

What’s primarily influencing this? Inflation. These policies are geared towards increasing self-reliance domestically, but they come with economic hazards that might spread to international markets.

Read Bitcoin’s [BTC] Price Prediction 2025-26

In light of these emerging difficulties, Bitcoin’s robustness may come under closer examination once more, while the supremacy of the US dollar could be tested. It’s evident that the changes we’ve witnessed this year are anything but typical – they’re revolutionary, paving the way for Bitcoin to navigate the volatility it encounters in the future.

Currently, stablecoins are establishing a distinct sector for themselves. For instance, Tether (USDT), the leading dollar-linked stablecoin, recently reached a record market capitalization of $140 billion.

As an analyst, I find it intriguing to observe how digital currencies like Tether are increasingly challenging traditional fiat currencies in practical applications. A prime example is the October 2024 transportation of 670,000 barrels of Middle Eastern crude oil, valued at $45 million, which was enabled by Tether. This demonstrates the growing potential and real-world usability of digital currencies in global trade and commerce.

With stablecoins becoming increasingly popular as inflation protectors and viable alternatives to conventional fiat currencies, the opposition to the U.S. dollar is gaining momentum. This development might signal the beginning of a new financial chapter, characterized by Bitcoin and stablecoins taking the front line.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-27 19:04