Following the FOMC meeting, which is basically the crypto market’s version of a parent-teacher conference, Bitcoin BTC is sitting at $109,943. 24h volatility: 0.2% (aka “meh”). Market cap: $2.19T (because why not?). Vol. 24h: $68.07B (still more than your student loans). And altcoins have seen selling pressure, which is just a fancy way of saying “the market is throwing a tantrum.”

Bitcoin Price Cracks Under $110K Ahead of $13.5 Billion Options Expiry

On the weekly chart, Bitcoin price action shows strong movement from the highs of $116K to the lows of $106K. Furthermore, the flows into spot Bitcoin ETFs have moved into the negative territory, showing waning institutional sentiment. Like, “we’re not even mad, we’re just… disappointed.”

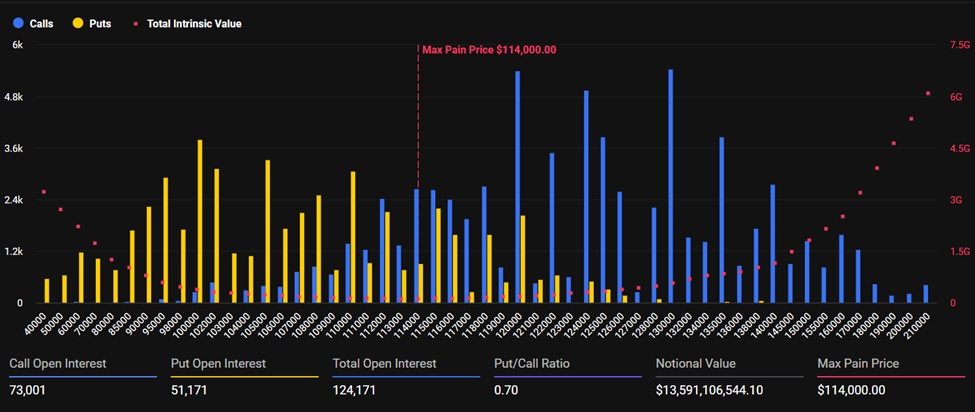

In the last 24 hours, BTC price has scooped the downside liquidity at $106K and surged from there onwards, again closer to $110K. According to the data from crypto derivatives platform Deribit, a total of 124,171 Bitcoin options contracts, valued at $13.59B, are set to expire in the upcoming cycle. Because nothing says “excitement” like a $13.5B bet on a coin that’s basically a digital banana.

Bitcoin options expiry data | Source: Deribit

Data from Deribit shows a put-to-call ratio of 0.70, signaling a mildly bullish market sentiment. Of the total open interest, 73,001 are call options and 51,171 are put options, reflecting stronger trader positioning on the upside. Because nothing says “confidence” like betting on a coin that’s basically a digital banana.

The max pain point is positioned at $114K. Historically, the BTC price moves to the max pain point as the expiry approaches. However, it first needs to break some important resistances in the mid-way. Because why would anything go smoothly?

Crypto analyst Ali Martinez has identified $112,340 as the key resistance level currently facing BTC. Martinez noted that breaching this level could determine the next major directional move for the leading cryptocurrency. Or it could just crash harder. We’ll see.

$2.5 Billion of Ethereum Options to Expire on Oct. 31

Ethereum price has slipped under $4K level amid continuous selling pressure as bears take the upper hand. As of press time, ETH price is trading at $3,837 levels with 646,902 contracts worth $2.49B set to expire. Because Ethereum is the crypto version of a “I’m fine, really” friend who’s clearly not fine.

The max pain level is positioned at $4,100, slightly above the current spot price. Similar to Bitcoin, Ethereum’s put-to-call ratio stands at 0.70, signaling a mildly bullish market sentiment. However, data from Deribit indicates a more defensive tone among traders. Like, “we’re not betting on a miracle, but we’re not giving up either.”

Ethereum options expiry data | Source: Deribit

Call open interest totals 381,462 contracts, exceeding the 265,440 put contracts. This suggests that while traders maintain upside exposure, others are simultaneously hedging against potential downside risks. Because nothing says “cautious optimism” like a 30% chance of a crash.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Gold Rate Forecast

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- Best Werewolf Movies (October 2025)

2025-10-31 15:15