Bitcoin ETFs, at long last, stirred from their slumber on Monday, managing a meager inflow of $1.4 million. A veritable drop in the ocean, wouldn’t you say? 🌊 Still, it was enough to halt a week-long exodus. Ether ETFs, however, continued their mournful procession towards the abyss, with a $5.98 million farewell parade. Fidelity’s FETH, bless its heart, led the charge in this exodus.

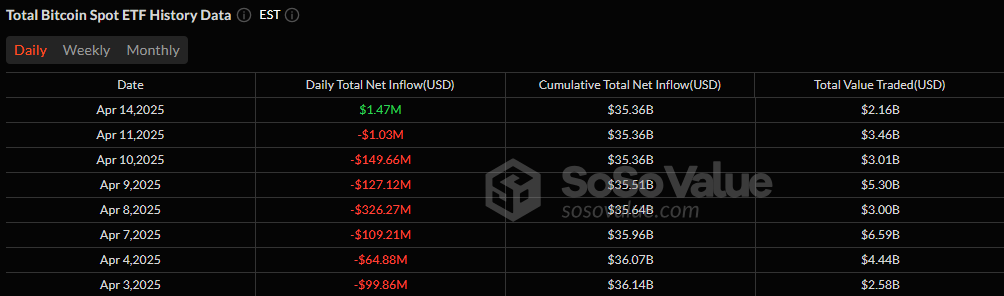

After seven long, dreary days of redemptions, like a patient waiting for a cure, bitcoin ETFs finally posted a reversal. A much-needed, if rather modest, reversal. Monday, April 14 – a day that will surely be etched in the annals of financial history (or perhaps not) – saw a net inflow of $1.47 million. A temporary sigh of relief, perhaps, after a week of capital flight that could make a seasoned gambler weep. 😭

The day’s activity, you see, was concentrated in just two funds. Blackrock’s IBIT, ever the optimist, led the charge with a $36.72 million inflow. Fidelity’s FBTC, in a contrasting mood, saw $35.25 million flee its coffers. The remaining ten spot bitcoin ETFs, those quiet, unassuming souls, remained silent, like statues in a forgotten garden. No recorded flows. Still, total trading volume, a rather robust $2.16 billion, and net assets, a respectable $94.69 billion. One wonders, of course, what it all truly means. 🤔

While bitcoin ETFs, those darlings, found their footing, like a tipsy dancer regaining balance, ether ETFs weren’t as fortunate. The segment, poor things, recorded another $5.98 million in outflows, driven primarily by Fidelity’s FETH, which lost $7.78 million. A financial tragedy, one might say, if one were prone to exaggeration. 🎭 The bleeding was slightly cushioned by a $1.80 million inflow into 21shares’ CETH, but it wasn’t enough to lift the spirits, or the numbers, into positive territory. A mere band-aid on a gaping wound. 🩹

Total value traded for ether ETFs stood at $285.64 million, with total net assets settling at $5.47 billion by the end of the session. Figures, figures, everywhere. What do they truly signify? Perhaps nothing at all. 🤷

As both markets, those capricious beasts, start the new week, all eyes will be on whether bitcoin’s return to inflows can gain traction. And if ether, poor, beleaguered ether, can finally break its persistent outflow cycle. Will it be a comedy, a tragedy, or merely a tedious drama? Only time, and the whims of the market, will tell. ⏳

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-04-15 17:57