Ah, the theater of the absurd! The crypto stage was set for a dramatic act as Bitcoin and Ether ETFs, those proud prima donnas, stumbled under the weight of outflows. Yet, in the wings, Solana and XRP, the mischievous jesters, pranced with pockets full of fresh capital. A market rotation, you say? Nay, it was a carnival of caution, a masquerade of selective greed! 🎭💰

A Risk-Off Farce Strikes Bitcoin and Ether ETFs, While Solana and XRP Steal the Spotlight

Behold, a somber mood descended upon the crypto exchange-traded funds like a fog over Moscow. Investors, those fickle souls, trimmed their sails, abandoning Bitcoin and Ether like yesterday’s news. But fear not! The altcoin funds, those sprightly upstarts, received their due. The result? A divergence so clear, even a blind cat could see it. 🐱✨

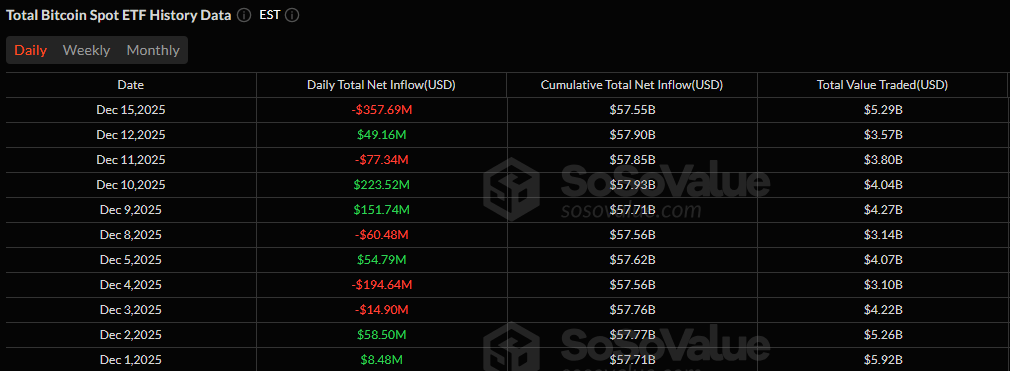

Bitcoin ETFs, poor dears, bled $357.69 million, with Fidelity’s FBTC taking the brunt-$230.12 million! Bitwise’s BITB and Ark & 21Shares’ ARKB followed suit, their coffers lighter by $44.32 million and $34.49 million, respectively. Grayscale’s GBTC and Vaneck’s HODL joined the lament, shedding $27.51 million and $21.25 million. Yet, the show went on, with $5.27 billion in volume and assets slipping to $112.27 billion. The curtain must never fall! 🎬

Ether ETFs, not to be outdone in this tragedy, mirrored Bitcoin’s woes with $224.78 million in outflows. BlackRock’s ETHA led the retreat, shedding $139.09 million. Grayscale’s ETHE and its Mini Trust followed, losing $35.10 million and $20.18 million. Bitwise’s ETHW, Fidelity’s FETH, and Vaneck’s ETHV joined the chorus, contributing $13.01 million, $10.96 million, and $6.43 million to the lament. Yet, $2.10 billion traded, and assets held steady at $18.27 billion. The show must go on, after all! 🎭

Solana ETFs, those cheeky upstarts, attracted $35.20 million, with Fidelity’s FSOL leading the charge at $38.72 million. Grayscale’s GSOL and 21Shares’ TSOL added their two kopecks, pushing assets to $898.56 million. Bravo, Solana, bravo! 👏

XRP ETFs, not to be outshone, pulled in $10.89 million. Franklin’s XRPZ led with $8.19 million, while Canary’s XRPC and Grayscale’s GXRP chipped in. Assets crossed the $1 billion mark, ending at $1.12 billion. A standing ovation for XRP! 🎉

In the end, it was a rotation of sorts-Bitcoin and Ether faced the cold shoulder, but Solana and XRP danced in the spotlight. Investors, ever selective, sought growth narratives with a sharper eye. Ah, the crypto circus never sleeps! 🌪️💫

FAQ📊

- Why did Bitcoin ETFs see large outflows today?

Bitcoin ETFs lost $357.69 million as investors, like nervous cats, reduced risk exposure in this cautious market. 🐈⬛ - What caused Ether ETFs to decline alongside Bitcoin?

Ether ETFs recorded $224.78 million in outflows as BlackRock’s ETHA led the tragic retreat. 🎭 - Why are Solana ETFs attracting inflows during a risk-off day?

Solana ETFs gained $35.20 million as investors chased the altcoin dream. 🌟 - How did XRP ETFs perform compared to Bitcoin and Ether?

XRP ETFs added $10.89 million, pushing assets above $1 billion despite the market’s somber mood. 🎉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Best Members of the Flash Family

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Dan Da Dan Chapter 226 Release Date & Where to Read

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

2025-12-16 15:58