What to know:

You’re reading Crypto Long & Short, the weekly tale of the digital gold rush, packed with gossip, news, and analysis for the brave investor. Sign up if you enjoy riding the crypto rollercoaster every Wednesday.

The world of digital assets has gone from a quirky side show — some folks throwing digital darts in the dark — to a blazing wildfire changing the way we trade, buy, and scroll. In May 2025, the crypto party is worth a hefty $3.05 trillion, growing faster than rabbits in spring, looking suspiciously like the internet boom of the nineties, minus the dial-up noise.

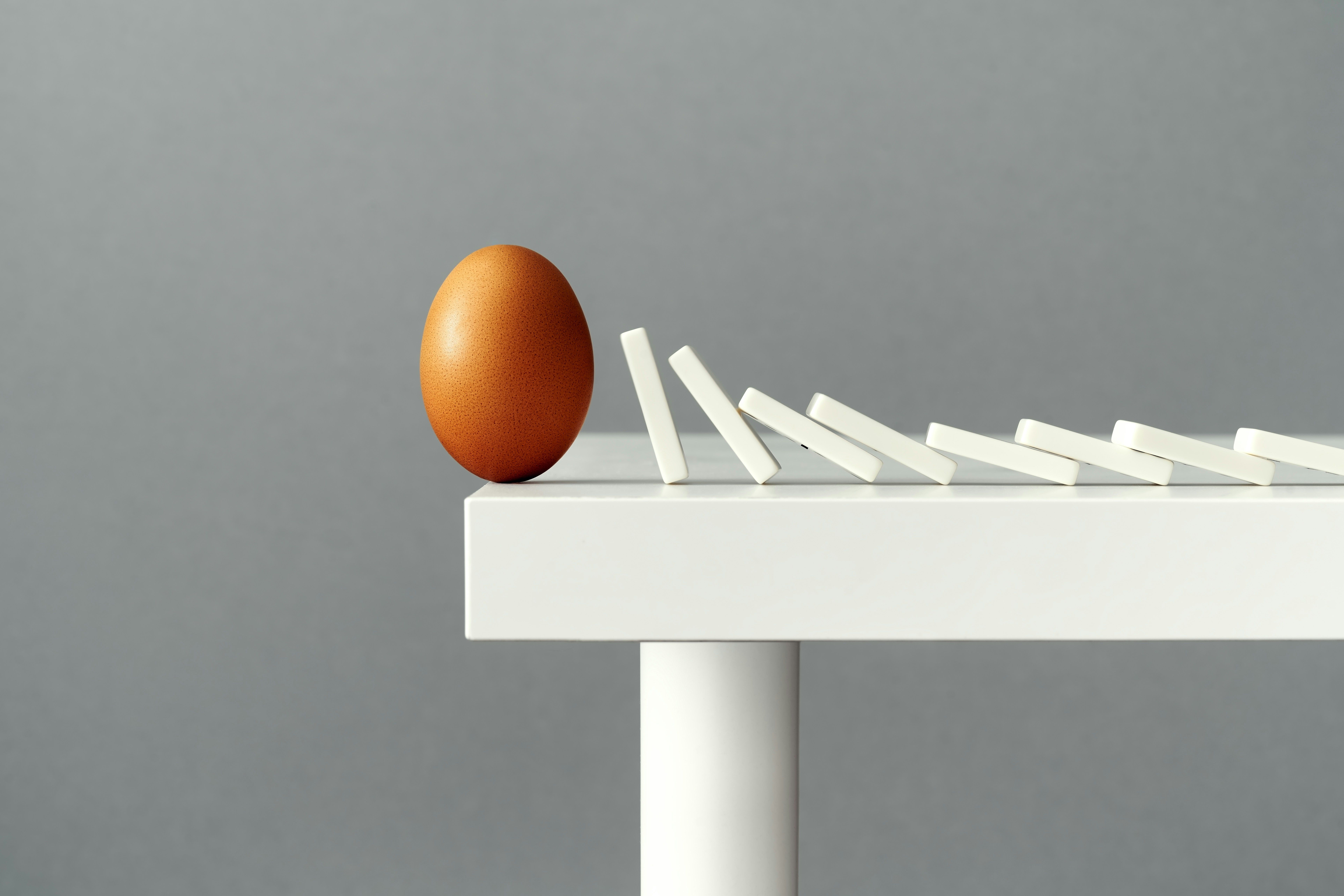

A look at the growth curve

History tells us that when a new tech guest appears at the party — be it the internet or smartphones — about 10% of folks suddenly find it interesting enough to stick around. After that, things get crazy fast; networks form, acceptance blooms, and before you know it, everyone’s talking digital. This year, the crypto scene might hit that magical 10% mark, maybe even 11.02% worldwide, according to some fancy stats. Last year, it was just 7.41%, so things are heating up faster than a summer barbecue.

The chart here compares early crypto love with the internet’s awkward first years. Spoiler: crypto is sprinting while the internet was still limping.

The 10% threshold: the spark that lights the fire

That 10% mark is no random number. It’s like the moment when everyone finally believes the internet isn’t just for nerds or the novelty of smartphones wears off — suddenly, it’s everywhere. Think of it as the point where early adopters (about 13.5%) hand the baton to the huge crowd of folks ready to jump in — the early majority, about 34%. Transition? Complete.

Crossing that line kicks everything into high gear: juice flows more freely, stores start accepting crypto like it’s the latest cool thing, and folks realize they can pay for pizza and rent with digital coins. 📈

By 2025, nearly 28% of Americans — around 65 million folks — will own crypto, doubling the number from a few years back. About 14% of folks who haven’t bought in yet plan to, and lovebirds already holding will buy more. The world’s catching on faster than a viral meme. No longer just a gamble or a quick scam, it’s become part of everyday talk, like the weather or Aunt Sally’s pie recipe.

Crypto is changing lives in Africa and Asia, especially for those who’ve never seen a bank — now they’re sending money, trading, and just plain making it work without a brick-and-mortar bank in sight. ✌️

What’s pushing this ol’ ship forward?

- Blockchain: Like a very transparent and secure ledger, helping folks send remittances, track stuff, and keep fraud in check. Ethereum alone handles over 1.5 million transactions a day, enough to make a really busy diner jealous.

- Financial inclusion: Crypto gives the unbanked a shot at the big game, especially in Africa and Asia, through phone apps and fintech magic.

- Regulations: Countries like the UAE, Germany, and El Salvador waving the crypto flag make it easier, but the big giants — India and China — are more like the grumpy neighbor who might shut the door.

- AI & Crypto: Nearly 90 tokens in 2024 tangled with AI, making blockchain smarter, neater, and maybe even more trustworthy. 🤖

- Economic chaos: During times of turbulence, folks turn to crypto for safety. Brazil and Argentina, for example, have tons of stablecoin transactions, like a digital safety net.

Big players and daily life

Institutions aren’t just sitting back—they’re jumping in with both feet. Giants like BlackRock and Fidelity are launching crypto ETFs, and the SEC is playing hard to get with approval (more waiting than in line for concert tickets). Meanwhile, stores and online giants like Burger King in Germany serve up Bitcoin and crypto payments as casual as a cup of coffee. PayPal is pairing with MoonPay to make buying crypto easier in the U.S., and the whole ecosystem is gearing up for the future.

In regions like Sub-Saharan Africa, Latin America, and Eastern Europe, decentralized finance is booming — over a third of crypto there eaten right up by DeFi channels, growing faster than weeds after rain.

The road ahead: bumpy but promising

What’s holding crypto back? Well, it’s wild, unpredictable — like a mule on a mountain trail. Volatility scares off the big investors; hacks and lost passwords haunt the dreams of traders. Plus, governments are still figuring out whether crypto is a friend or foe, like a cat eyed suspiciously by the dog park.

But don’t count it out. The mood’s bullish, regulators are warming up, and with ETFs and better payment systems, the train has left the station. If these digital outlaws can find a way to keep their act clean, they’ll follow the internet and smartphones’ footsteps — and maybe outpace them because they do love a good race.

Note: The views expressed are solely those of the writer — not necessarily CoinDesk’s or anyone’s really — so don’t bet the farm on it.

Read More

2025-05-21 19:16