In the ebb and flow of crypto, like a restless river that refuses to be tamed, CoinShares whispers of gentle inflows—merely six million dollars—drifting into the market’s turbulent embrace this past week.

The landscape remains shrouded in a fog of doubt, investor hearts oscillating between hope and hesitation. Here and there, across continents and currencies, moods flicker like wavering candle flames, while the grand puppeteer of US economic signs tugs at the strings, unsettling the dance.

America’s Wallet Tightens, Europe Spills a Few Coins, and Canada Waves Tentatively

James Butterfill, the prophet of fund flows, narrates a tale of unexpected US retail vigor mid-week—the kind that sends investors scrambling, yanking $146 million from the fray, wiping out the week’s earlier gains with an impatient hand.

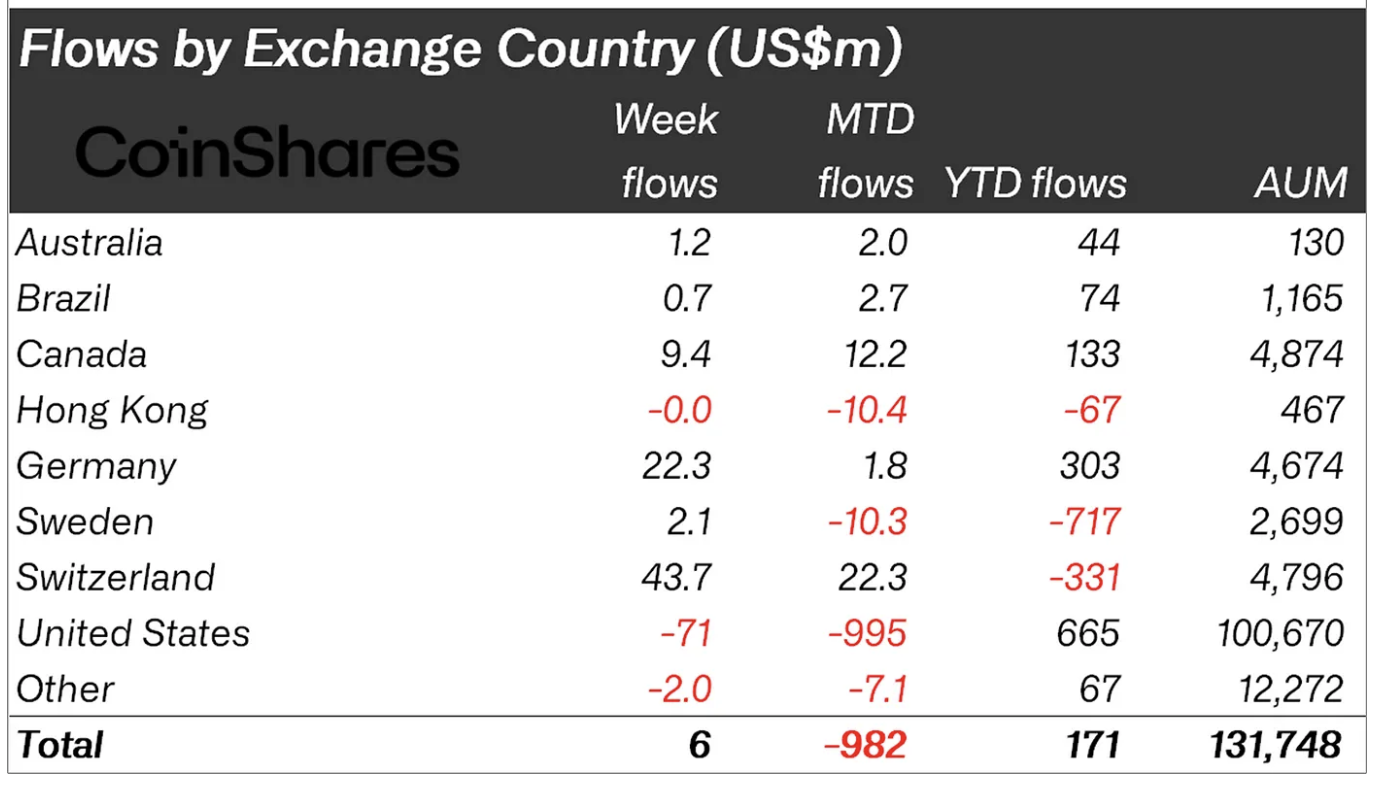

Regions play their own game: the United States, like a miser clutching his purse, sees $71 million vanish from domiciled investment products, while Europe, in a bout of generosity or folly, welcomes in Swiss francs to the tune of $43.7 million, Germany tosses in $22.3 million, and Canada chimes with a modest $9.4 million.

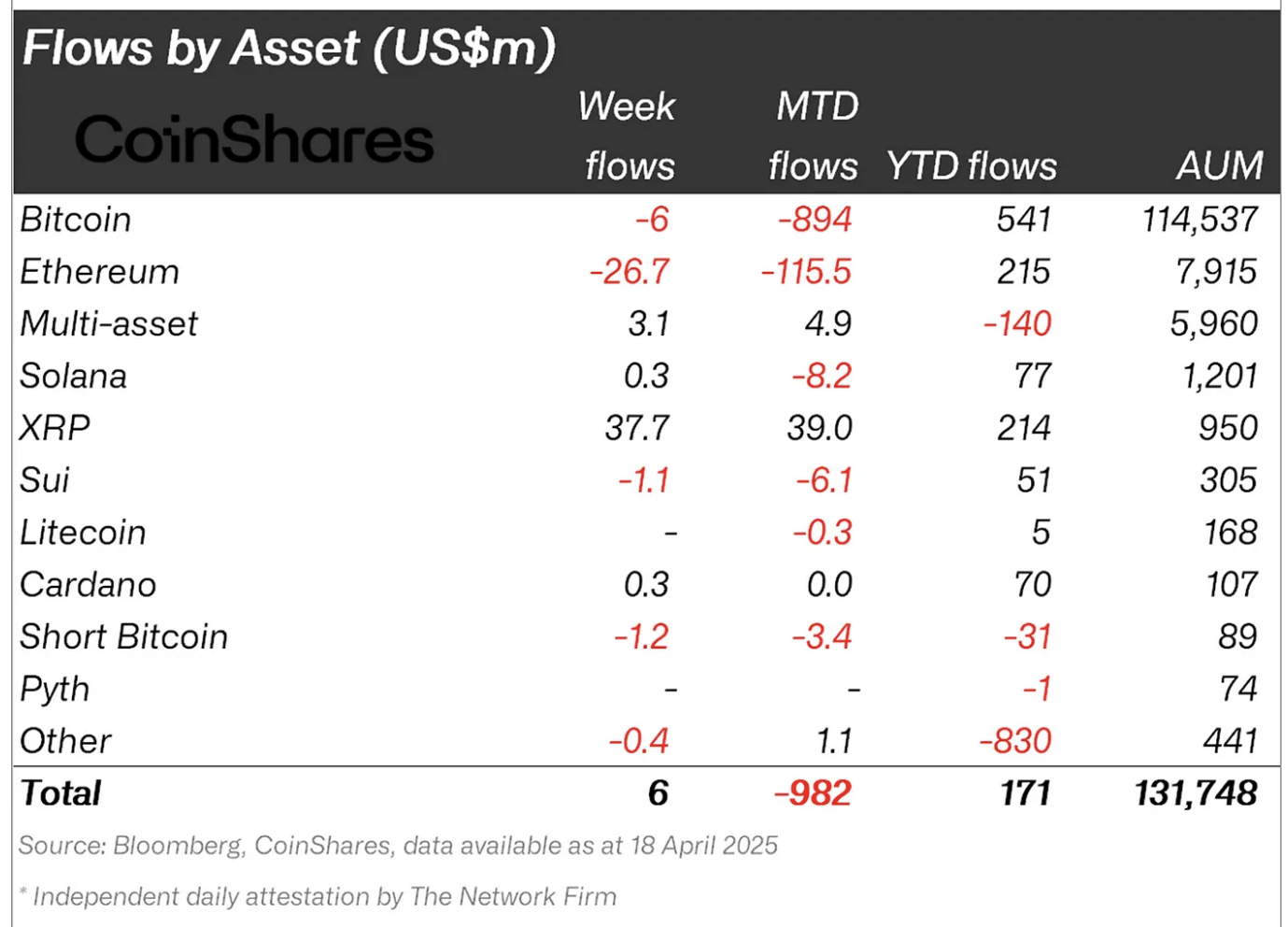

The old king Bitcoin remains the dramatic centerpiece of these financial masquerades, its followers locked in conflict, some retreating quietly with $6 million in outflows, while the ‘short Bitcoin’ believers retreat even more desperately, shedding $1.2 million last week alone.

Seven weeks of evictions from short positions have rendered a cumulative flight of $36 million—an exodus forming nearly 40% of the territory under short Bitcoin’s wary governance.

Ethereum‘s Slow Dance Toward Oblivion, While XRP Smirks and Climbs

Meanwhile, Ethereum trudges on an eight-week descent, bleeding $26.7 million last week, helplessly adding to nearly eight hundred million in outflows that whisper of waning enthusiasm.

Yet stubbornly, Ethereum clings to second place in this year’s fan club, boasting $215 million in net inflows—a curious paradox that could only amuse the seasoned observer of these volatile rituals.

And what of XRP? The cheeky token sashays forward with $37.7 million in fresh funds, crowning it third in the year-to-date fund flow parade, a mere blink behind the mighty Ethereum, summoning $214 million with a grin wide enough to unsettle the cynics and delight the hopeful.

In a market swayed by caprices and catastrophe, XRP’s resilience is a sly joke told at the table, as capital finds shelter in the diversely haunted hotels of crypto portfolios.

Secure your internet browsing with a NordVPN subscription. [Learn more](https://pollinations.ai/redirect/432264)

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- LUNC PREDICTION. LUNC cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

2025-04-23 09:05