- Curve Finance’s user base doubled in 2024

- Will CRV reverse its recent losses on the price chart amid strong network growth?

2024 saw a significant increase in the number of users on Curve Finance, effectively doubling its user count. This surge in activity further solidified the impressive 400% growth previously registered by its native token, CRV, during its surge in November.

As per a private 2024 report given to AMBCrypto, the number of unique users on the decentralized exchange significantly increased, rising from 30,000 in 2023 to 60,000 in 2024 – representing a substantial year-on-year growth of approximately 105%.

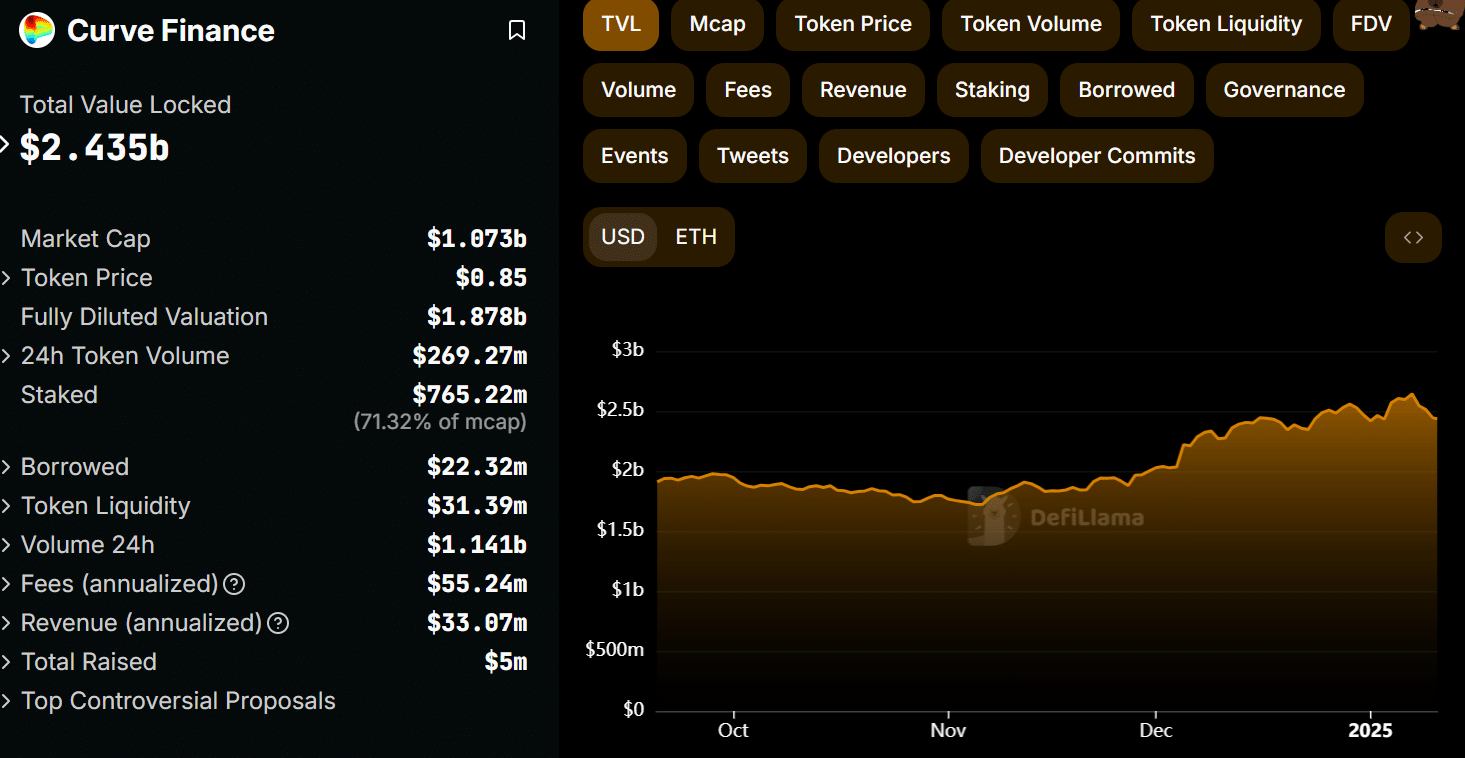

The Total Value Locked (TVL) significantly increased, rising from approximately $1.7 billion in early November to around $2.4 billion in early January. This surge suggests a growing trust and confidence among investors in the Decentralized Exchange (DEX), as an increasing amount of capital was secured within its smart contracts.

The value locked in our Decentralized Exchange (DEX) skyrocketed from $1.7 billion in November’s early days to $2.4 billion at the beginning of January, demonstrating a rise in investor trust and confidence. More capital being locked into its smart contracts is a clear indication of this trend.

The report cited new product features and institutional interest as key drivers of the user base.

Indeed, by late November, BlackRock opted for Curve as the platform for their tokenized asset BUIDL’s liquidity and trading operations. This move underscores institutional backing for the Decentralized Exchange (DEX), a fact further reinforced by the price trends on its charts.

Will CRV reverse its recent losses?

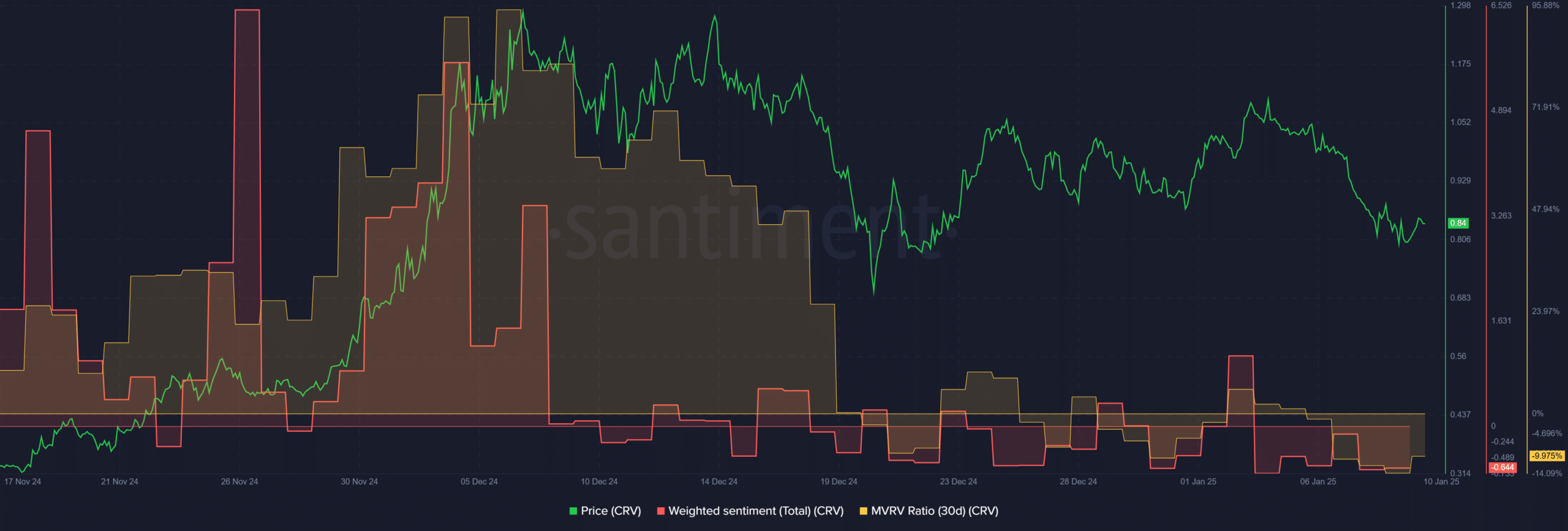

Regardless of the current bearish market trends, CRV managed to retain approximately 280% of its gains from the November surge. After a brief dip, it found support at the demand area between $0.6 and $0.7 (marked in cyan), and the price movements have formed a triangle pattern recently.

If the price experiences an uptrend beyond the established pattern, it might reach the $1.5 mark. Conversely, a downtrend beyond the pattern could reverse recent gains, potentially driving the price down to $0.26.

Given this context, it appears that when considering the subdued mood and the MVRV value for CRV over the past 30 days being negative, we can infer that CRV might have been undervalued at its current market price.

30-day Market Value to Realized Value (MVRV) showed a decrease by 10%, suggesting that, on average, investors who purchased the coin within the past month have experienced an unrealized loss of 10%. Meanwhile, the 60-day MVRV was up by 12%, implying that those who bought the coin two months ago have, generally, made a profit of 12% on their investment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-01-11 10:16