- CVX crypto pumped 83% on the 19th of November; will the uptrend continue?

- A notable whale could have triggered the wild upswing, per an analytics firm.

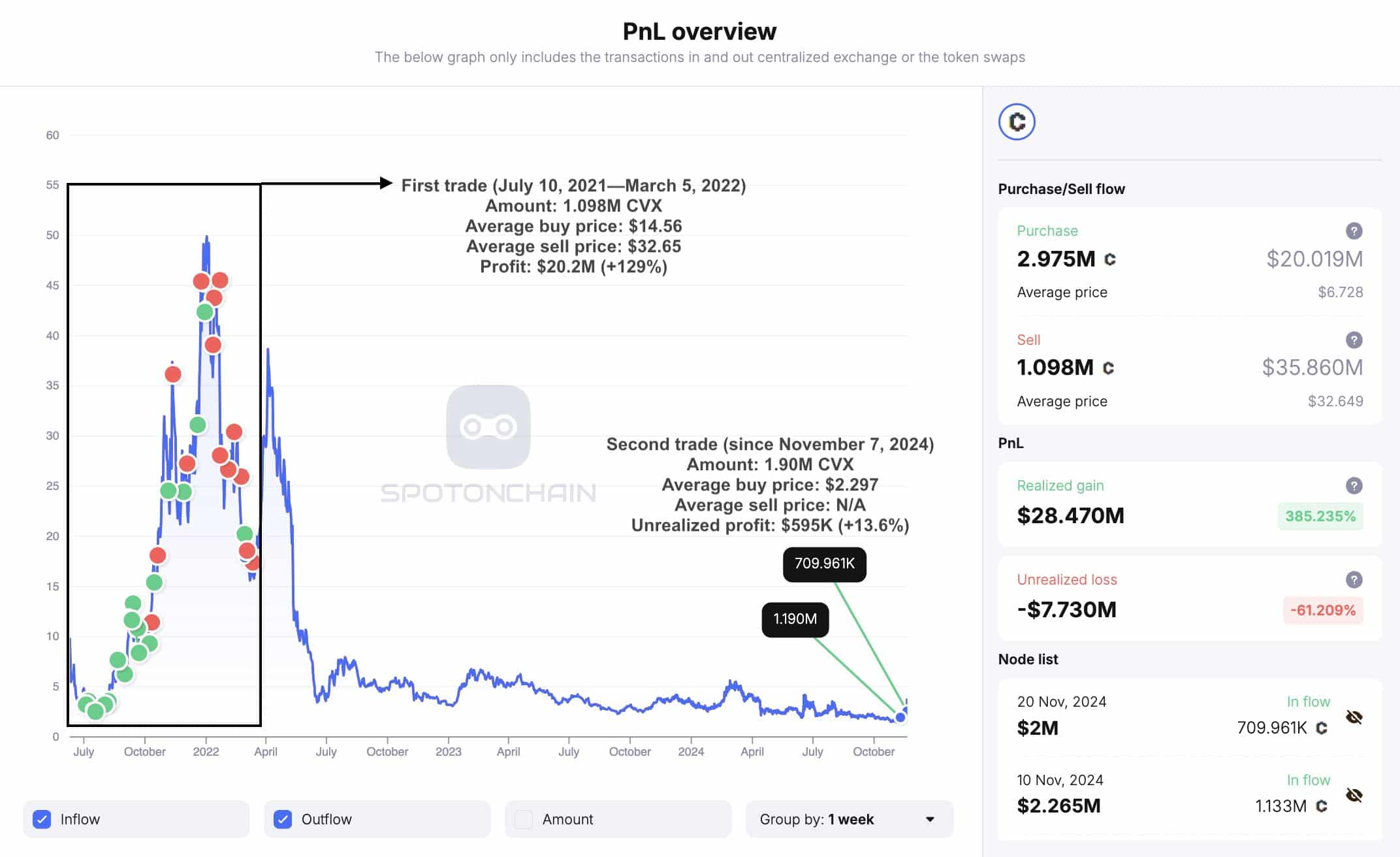

As a seasoned analyst with over two decades of experience in the crypto market, I have witnessed countless instances of whales manipulating prices and triggering massive rallies. The recent 83% pump of CVX is no exception, as it appears to have been orchestrated by a significant whale, according to SpotOnChain’s analysis.

In the last 24 hours, the value of Convex Finance’s native token, CVX cryptocurrency, experienced a notable surge of approximately 20%. This unexpected increase seems to have been caused by a large-scale purchase from a significant investor, often referred to as a “whale.

Based on information from SpotOnChain, a wealthy investor (often referred to as a ‘whale’) in CVX made a lucrative $2 million bid (approximately 709,961 CVX tokens), and the token experienced a significant increase of 61% within a few hours.

Part of the analytics firm update read,

From July 2021 until March 2022, this whale conducted a total of 1,098,000 dollars worth of CVX trades, resulting in a profit of approximately 20.2 million dollars (+129%), from the initial trade alone.

After a break of approximately two years, this whale made another investment (purchase), which could indicate further upward potential for CVX.

What’s next for CVX crypto?

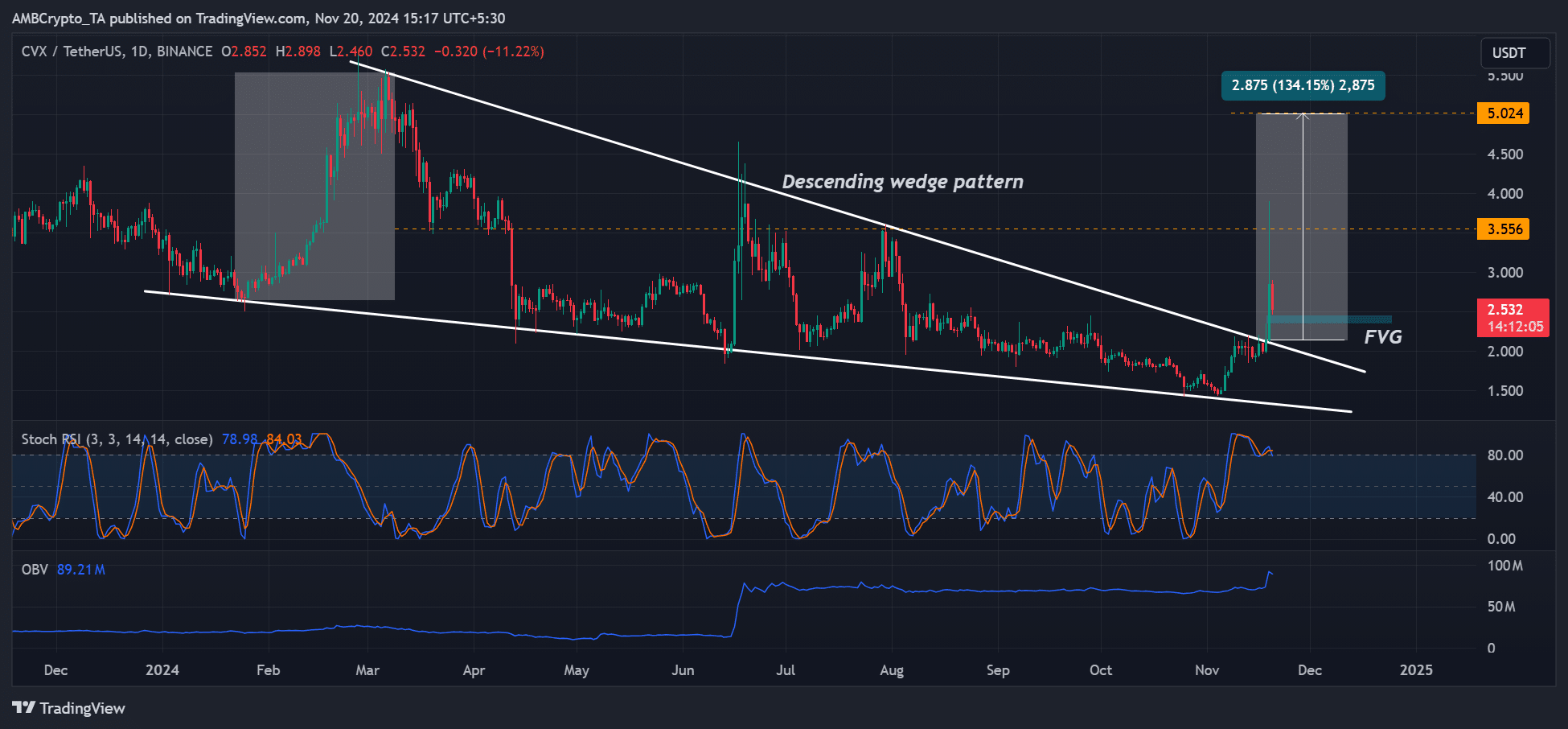

Viewed from a traditional analysis standpoint, CVX exhibited a downward sloping wedge formation in its price movements leading up to 2024. This explosive breakout surge of over 80% might merely serve as a prelude to further gains for CVX.

Typically, when there’s a breakout from the pattern, it often ascends to a height comparable to that of the wedge.

Should the traditional course of events unfold, this could lead to a $5 price point. This equates to a projected 134% increase in value.

In simpler terms, if CVX’s price aligns with its fair value and there’s a significant difference between the two, it might present a substantial buying opportunity when the price dips to that level.

Despite the fact that the price’s momentum remained excessively hot, as suggested by the Stochastic RSI, this suggests that future declines might offer an excellent chance for another potential increase. In other words, these drops could be advantageous buying opportunities.

But a drop back to the wedge pattern could invalidate the bullish outlook.

Spot market demand dominates

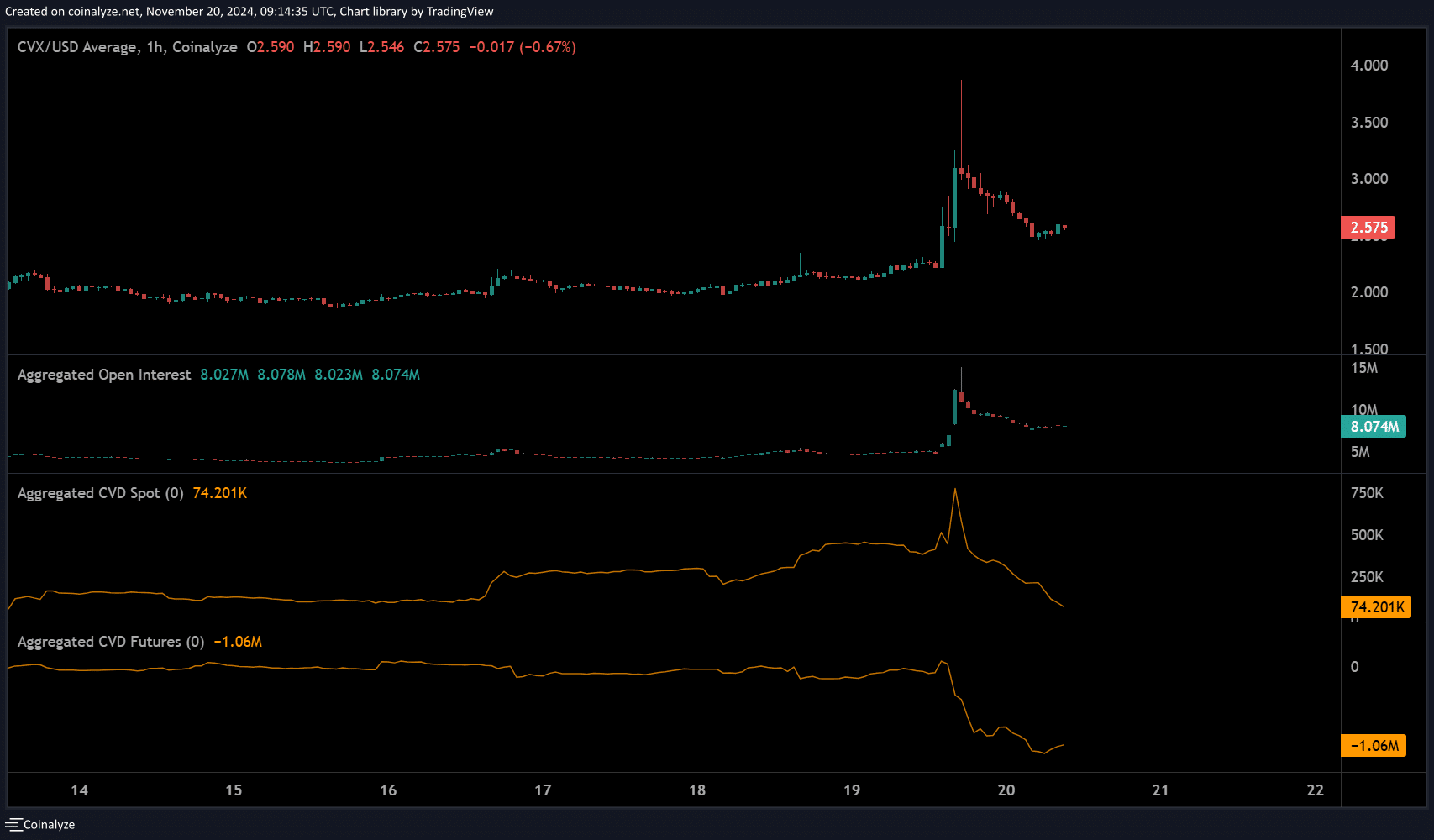

The latest price pump was massively driven by spot market demand, as illustrated by the CVD (Cumulative Volume Delta) Spot. The CVD gauges the difference between bid and ask volumes across exchanges.

In simpler terms, during the period when prices were rising (price pump), the number of people buying in the current market (spot) was significantly higher than those selling, resulting in a greater incidence of cardiovascular diseases in that market compared to the futures market.

Read Convex Finance [CVX] Price Prediction 2024-2025

At the moment of reporting, it was noticeable that short sellers held significant control over the market, a trend evident through the downward flow observed in Certificate of Deposit (CVD) transactions.

Nevertheless, the bulls’ protection of the breakout point on the wedge formation might signal a potential bullish reversal that is worth monitoring closely.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-11-21 05:11