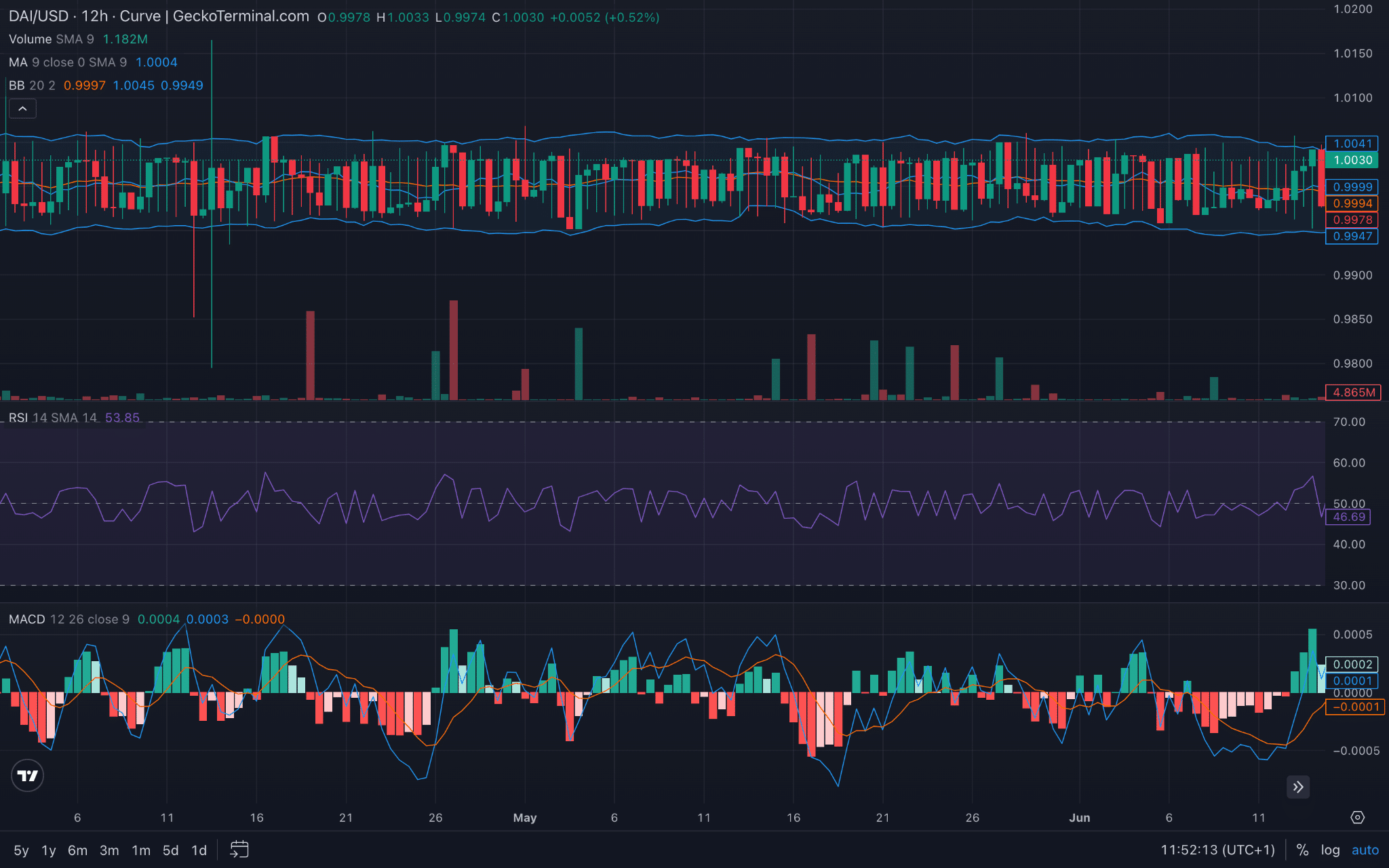

- DAI struggled to maintain its dollar peg, with trading confined within a narrow range of the Bollinger Bands.

- Mixed indicators signaled ongoing stability struggles, without strong trends pushing away from the peg.

As an experienced financial analyst, I’ve closely monitored the recent price action of DAI and evaluated its current market situation based on available data.

Over the past month, DAI has encountered difficulties in keeping its value equal to the US dollar at $1.00, constantly fluctuating instead.

Recent fluctuations have seen DAI’s price deviate between highs of $1.001 and lows of $0.98.

As a researcher observing the market trends, I’ve noticed that DAI’s price movements have mostly remained within the boundaries set by its Bollinger Bands. This suggests that the cryptocurrency’s volatility has been relatively consistent despite any price fluctuations.

The candles clustered around the upper and middle price levels indicated a deliberate effort to keep the price at the $1.00 mark.

Assessing DAI’s future

The volume fluctuations have remained within acceptable limits, implying that significant buying or selling activity has been absent. This absence of extreme market actions helps maintain the peg’s stability.

The RSI was around 53.85 at press time, indicating a balance between buying and selling pressures.

As a researcher examining the current market conditions, I’ve found that this asset exhibits a relatively stable state around its targeted peg. It doesn’t show signs of being either overbought or oversold at this time.

The MACD line was near zero, and the signal line shows small fluctuations around the zero mark.

The price remained close to the target of $1.00, exhibiting small variations yet without a clear deviation from it.

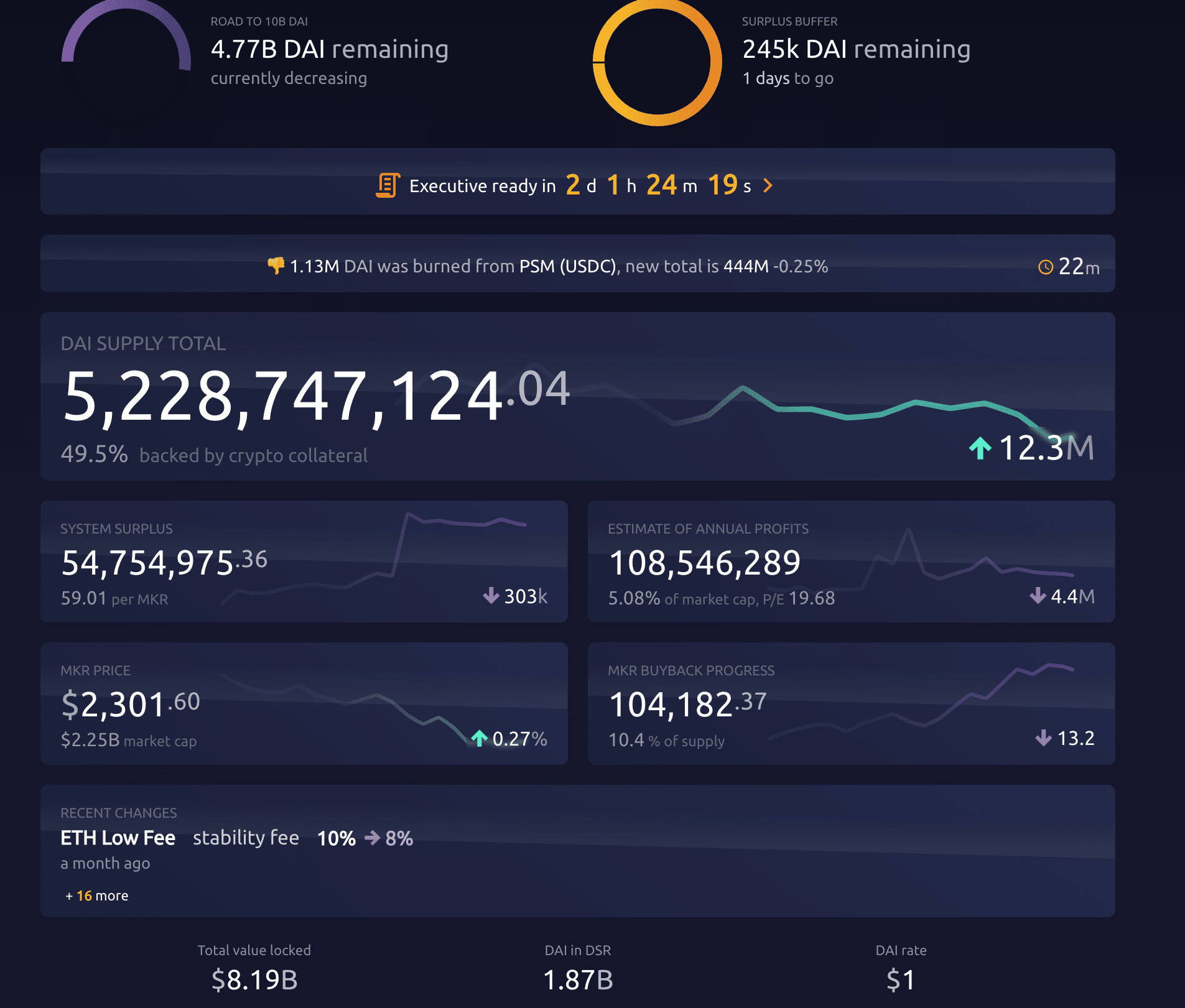

49.5% of the total DAI supply is backed by cryptocurrency collateral.

Approximately half of the DAI supply is backed by other cryptocurrencies. A downturn in their values can impact DAI’s stability and reliability as a stablecoin, and unfortunately, many of them are currently experiencing price drops.

Approximately two-thirds (67%) of DAI owners experienced being underwater with their holdings at the current moment, implying that a large majority obtained DAI at prices different from its present value.

Realistic or not, here’s MKR’s market cap in BTC terms

Large holders control about half of the DAI supply, resulting in significant influence over its liquidity and price stability. Consequently, the decisions made by these few individuals can have a substantial impact on the cryptocurrency’s market behavior.

The difference between the amount entering and leaving exchanges is $2.06 million, with $18.97 million flowing in and $21.03 million going out. This net outflow might alleviate some pressure on DAI sellers, potentially moving it nearer to its peg.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-16 15:03