🚀 Building a Decentralized Exchange: The Ultimate Guide 🚀

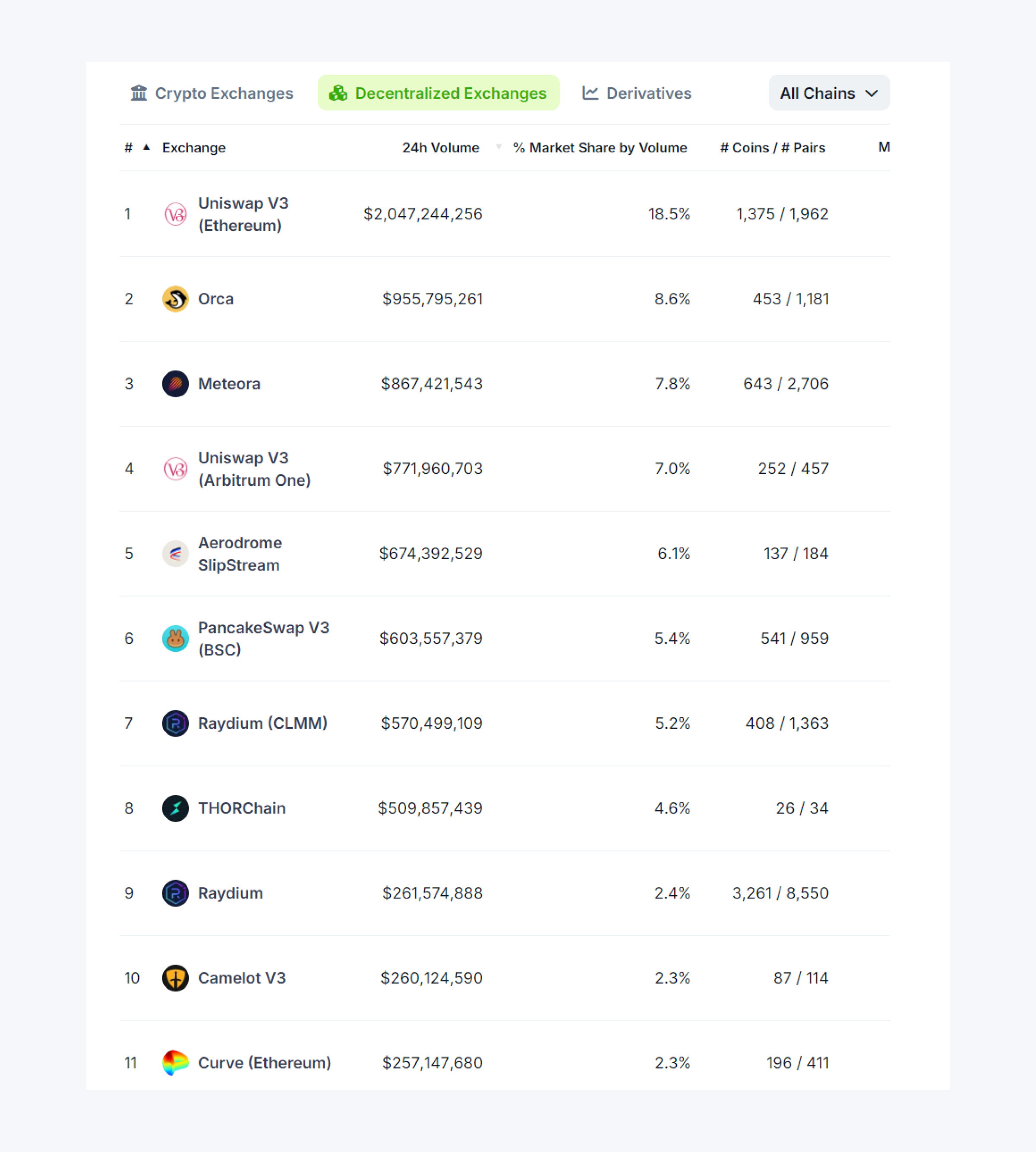

The digital asset industry is changing fast, and decentralized exchanges (DEXs) are taking center stage. In December 2024 alone, DEXs processed $320.5 billion in trading volume, setting a new all-time high and surpassing the previous record from just a month before.

- Peer-to-Peer Trading: Deals happen directly between individual participants, cutting out traditional middlemen.

- Smart Contracts: Automated code enforces trading logic—like order matching or liquidity pooling—right on the blockchain.

- User Custody: Traders control their private keys fully, which significantly reduces hacking risks compared with centralized exchanges.

The concept of a decentralized exchange emerged alongside the rise of smart contract platforms. The earliest DEX attempts used on-chain order books—though they struggled with low liquidity—until the Automated Market Maker (AMM) model helped drive mainstream adoption.

🤝 Why Build a DEX? 🤝

The decentralized finance (DeFi) revolution is in full swing, and decentralized exchanges are at the forefront of this transformation. So, what makes building a DEX a compelling business move for today?

- Security & Trust: No Single Points of Failure

Centralized exchanges hold billions in user assets in hot wallets, making them prime targets for cyberattacks. And history has shown that even industry giants are not immune.

A notable example is the recent $1.5 billion theft from ByBit, the largest crypto heist to date. In contrast, DEXs operate on a non-custodial framework, allowing users to maintain control over their assets and significantly reducing the risk of such large-scale breaches.

- Regulatory Flexibility: The DeFi Legal Gray Area

Crypto regulation is tightening worldwide, with governments enforcing AML (Anti-Money Laundering) and KYC (Know Your Customer) rules on centralized exchanges. However, DEXs are decentralized, which makes it harder to regulate them, as these platforms do not custody assets, control trading, or process fiat transactions.

In 2023, Binance faced lawsuits from US regulators, forcing it to exit multiple jurisdictions and pay multi-billion-dollar settlements. Meanwhile, major DEXs have continued operations unimpeded, thanks to their smart contract-driven, permissionless design.

- Lower Operational Costs: No Overhead, Just Smart Contracts

Running a centralized exchange requires massive infrastructure, including:

- Data centers and servers for order matching

- Custodial security to prevent hacks

- Compliance teams to meet global regulations

- Customer support staff for user management

All of this translates into high operational costs—which are often passed on to users via trading fees.

- Community Governance: Users Shape the Future

Unlike centralized exchanges, which are run by corporations, many modern DEXs are governed by their communities. Governance tokens allow users to propose and vote on platform changes, ensuring decentralized decision-making.

In 2020, Uniswap launched UNI, a governance token that gives holders the power to vote on protocol upgrades, fee structures, and liquidity incentives. Since then, many liquidity incentives and protocol adjustments have been approved by the community.

📚 Fast Fact:

For businesses, partnering with a decentralized exchange development company can accelerate entry into this booming sector. Such firms typically offer end-to-end DEX development services, from conceptualization to deployment and ongoing maintenance.

🌐 Approaches to Decentralized Exchange Development

So, how do you actually build one? The road to launching a DEX isn’t one-size-fits-all—there are multiple approaches, each with its own trade-offs.

🌈 Building from Scratch

If you’re looking to break new ground in the DEX market, developing a platform from scratch is the ultimate way to build something unique. This means creating custom smart contracts, a bespoke user interface, and original trading mechanisms—all tailored to your vision.

Pros:

- Full customization—control every aspect of the platform, from UI/UX to liquidity models

- Unique branding—establish a distinct market presence

- Innovative feature integration—implement groundbreaking functionalities

Cons:

- High development costs—requires a team of experienced blockchain developers

- Longer time to market—custom platforms can take months or even years to fully launch

- Smart contract risks—new code needs extensive security audits to prevent exploits

For instance, dYdX started as a completely independent derivatives-focused DEX, developing its own off-chain order book and perpetual contract trading mechanism. Unlike simple swaps, its unique infrastructure has made it a standout name in DeFi.

📈 White Label Crypto Exchange

For projects looking to enter the market quickly and cost-effectively, white-label solutions offer a ready-made exchange infrastructure with the option to tweak branding and some features. Instead of developing everything from scratch, you customize an existing platform.

Pros:

- Rapid deployment—get to market much faster

- Lower costs—no need for an in-house development team

- Pre-tested architecture—reduces technical bugs and vulnerabilities

Cons:

- Limited customization—restricted by the provider’s framework

- Third-party reliance—updates and security depend on an external team

- Less brand differentiation—platform may resemble others using the same template

Many corporate-backed DEX

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2025-03-21 12:48