- Less efficient miners are beginning to leave the network.

- On-chain metrics flash a buy signal.

As an experienced analyst, I believe that the recent decline in Bitcoin’s hashrate and the subsequent spike in Hash Ribbons suggest that we may be witnessing miner capitulation. This trend is often marked by periods of rapid declines in the hashrate, as less efficient miners exit the market due to decreased profitability.

In a recent analysis, the crypto expert known as Maartunn, who goes by the pseudonym, pointed out that Bitcoin‘s [BTC] hashrate decrease following the halving could be indicative of miner surrender or capitulation.

The 2024 halving event reduced mining rewards from 6.25 BTC to 3.125 BTC, Bitcoin’s hashrate.

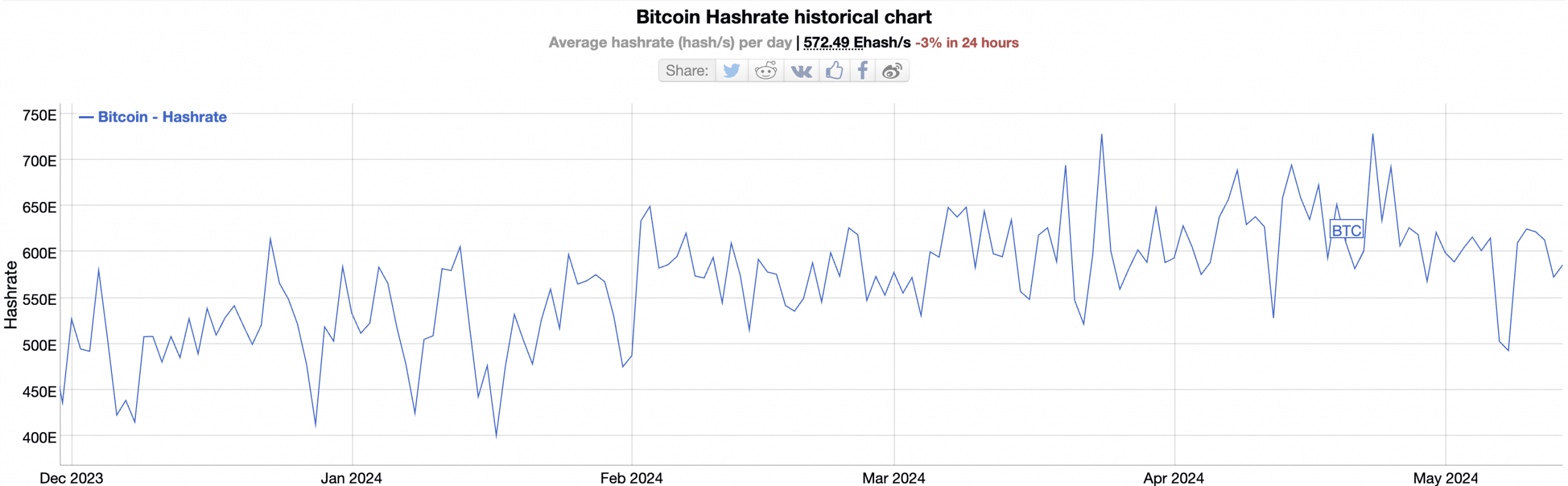

As a crypto investor, I’ve noticed an impressive surge in the network’s mining and transaction processing capabilities. The collective computational power, which includes all the miners and validators on the network, reached a new peak of 728.27EH (exahashes per second) on April 23rd this year. This represents a significant increase from earlier in the year and underscores the growing demand and adoption of our chosen cryptocurrency.

As an analyst, I’ve observed that the decline began when the network’s hashrate reached a peak of 585.7E. Since then, it has dropped by a significant 20% based on data from BitInfoCharts.

According to Maartuun.

As a researcher studying the trends in cryptocurrency mining, I’ve observed that while the current decrease in hashrate might seem insignificant and fleeting, it is noteworthy due to the general upward trajectory of hashrates. This pattern changed after the latest halving event.

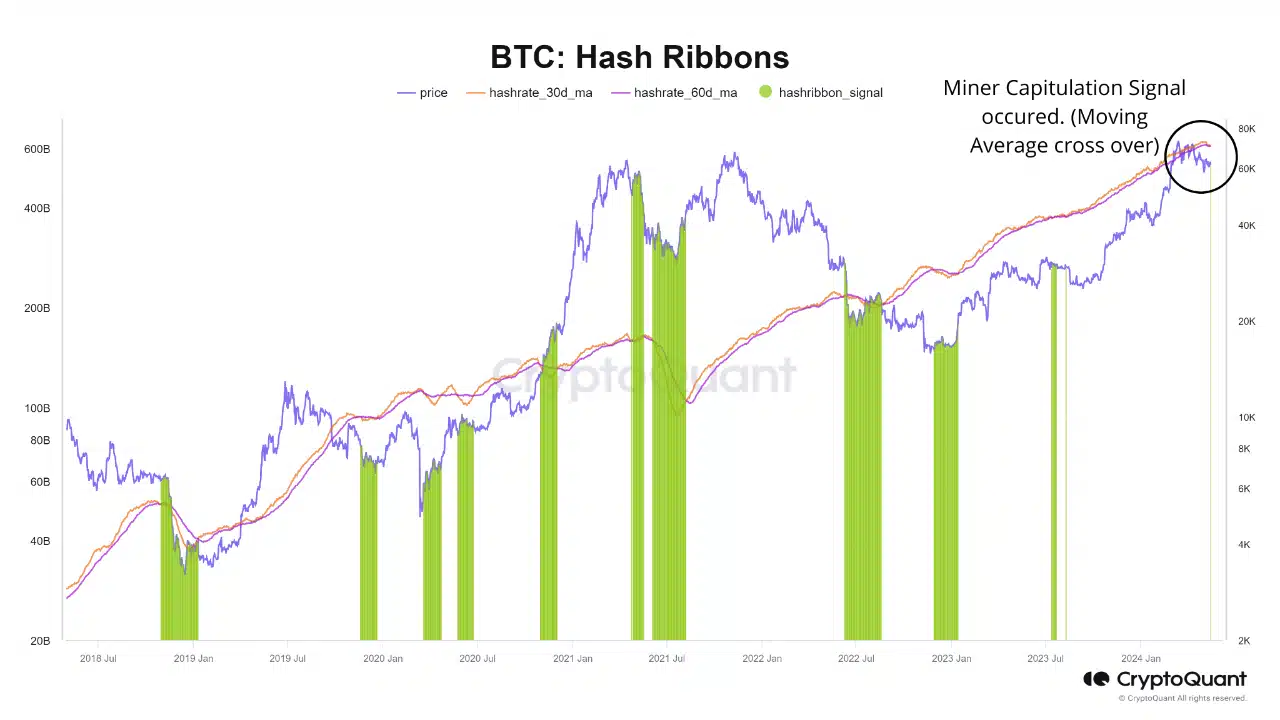

When the hashrate of Bitcoin decreases, it leads to a rise in the Hash Ribbons. These ribbons serve as an indicator in the Bitcoin network, reflecting the connection between the short-term and long-term moving averages of its hashrate.

As a network analyst, I observe that when the Bitcoin network’s mining activity experiences a significant increase, it implies that less profitable mining operations are being phased out. This reduction in mining activity is a natural response to decreased profitability for inefficient miners.

The reduction in Bitcoin’s mining hashrate recently has caused an increase in the Hash Ribbons on the network, indicating a higher probability of miner withdrawals. According to Maartun.

“On the following Bitcoin price chart, you’ll notice drops in hashrate indicated by the green sections. These occurrences can signal miner surrender or giving up on the mining process.”

Mining activity on the Bitcoin network

After the halving event, the reserve of Bitcoins held by associated miners has decreased. This indicator reflects the quantity of coins stored in miners’ wallets. A decrease in this value implies that miners are selling off their Bitcoins.

According to CryptoQuant’s latest data, the Miner Reserve in the network held 1.8 million BTC as of the current moment, representing a 1.1% decrease from its level on the 19th of April.

Additionally, as a result of the decrease in mining rewards from Bitcoin due to the lower number of transactions following the halving event, the proportion of Bitcoin’s total trading volume derived from miner participation has diminished.

Good time to buy?

Based on Maarten’s analysis, the rise in Bitcoin’s Hash Ribbons indicates a potential purchasing point for investors seeking to capitalize on the cryptocurrency’s lower price trend.

Hash Ribbons believes that bitcoin’s price dips frequently occur during similar market conditions, providing potential buying opportunities when prices are low.

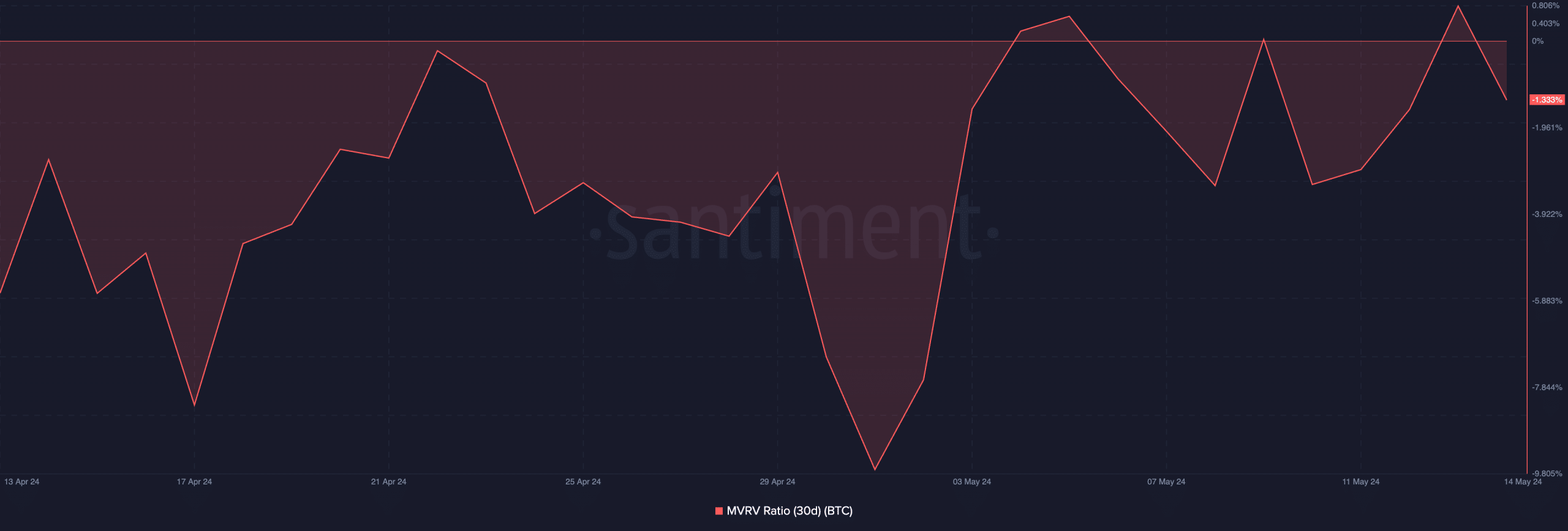

As a crypto investor, I’ve been closely monitoring the market and one indicator that caught my attention is the Market Value to Realized Value (MVRV) ratio for Bitcoin. At the present moment, this ratio has returned a negative value of -1.33%. This means that the current market price is lower than the average price at which previous investors bought their Bitcoins. In simpler terms, the market price is underperforming relative to what earlier buyers paid for their coins. This could potentially indicate a buying opportunity for those with a longer-term investment horizon. However, it’s important to remember that past performance is not indicative of future results and investing in cryptocurrencies involves risks. Always do your own research and consider seeking advice from financial professionals before making any investment decisions.

As a researcher studying Bitcoin (BTC), I examine the relationship between its current market value and the average cost basis of each coin in my portfolio. This metric, often referred to as the “cost basis ratio,” helps me assess the profitability of my BTC holdings by comparing the current price to the price at which I initially purchased each coin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

When the coin’s value is less than zero in the market, it is considered undervalued because its price is lower than the typical cost of acquiring similar coins that are currently circulating.

As a crypto investor, I keep a close eye on the Market Value Realized vs. Realized Profit (MVRV) ratio as it can provide valuable insights into potential buying opportunities. When the MVRV ratio turns negative for an asset, it signifies that its current market value is lower than the total amount I’ve paid for it historically. In simpler terms, this means that I’m currently holding the asset at a loss. However, this situation can also be seen as a buy signal since I’d be purchasing the asset at a discount relative to its historical cost basis.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-05-16 04:08