-

STRK’s price resisted a major decline after millions of tokens went into exchanges.

Indicators suggested that the value could drop amid falling volume and rising volatility.

As an experienced analyst, I believe that Starknet’s [STRK] price holding steady despite large token deposits into exchanges is a testament to the strong underlying fundamentals of the project. While indicators suggested a potential drop amid falling volume and rising volatility, the recent approval of Ethereum spot ETFs by the U.S. SEC has injected significant bullish sentiment into the Ethereum ecosystem.

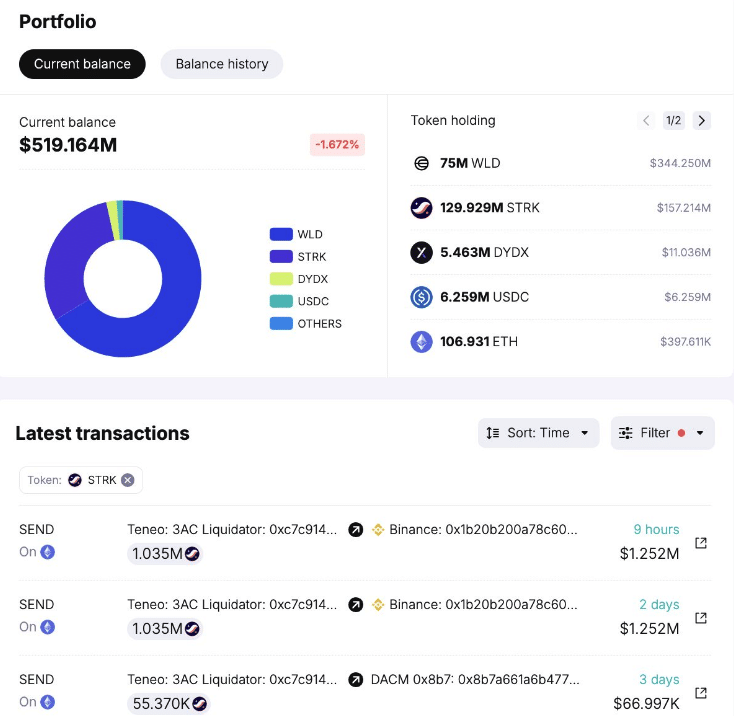

Two major stakeholders in Starknet (STRK) may have potentially influenced the price negatively, but the data indicates that STRK has managed to maintain its position steadily.

As a diligent researcher, I uncovered some intriguing information on the 25th of May. Using Spot On Chain, I identified that Tenoe, acting as a liquidator for Three Arrows Capital (3AC), transferred approximately 2.18 million STRK tokens into Binance.

How ETH secured STRK’s Freedom

The anticipated price drop following substantial deposits into major exchanges hasn’t materialized for Starknet’s token yet.

As I conduct my research at this moment, the value of the cryptocurrency stands at $1.25, marking a 4.06% rise over the past 24-hour period.

Prior to depositing funds into Teneo, Ethereum co-founder Vitalik Buterin received an airdrop of 845,000 STRK tokens, valued at approximately $1.07 million. This event caused the token price to decrease by around 6%.

It appeared that Starknet behaved differently following the US Securities and Exchange Commission’s (SEC) approval of Ethereum spot Exchange-Traded Funds (ETFs). Prior to this approval, ETH, along with the native tokens of Layer-2 projects on its blockchain, experienced price increases.

For the uninitiated, Starknet is one of the notable Ethereum L2s.

The positive outlook towards the ecosystem appeared to be the primary factor preventing STRK from falling after the recent sale.

Where is next? $1.06 or $1.50?

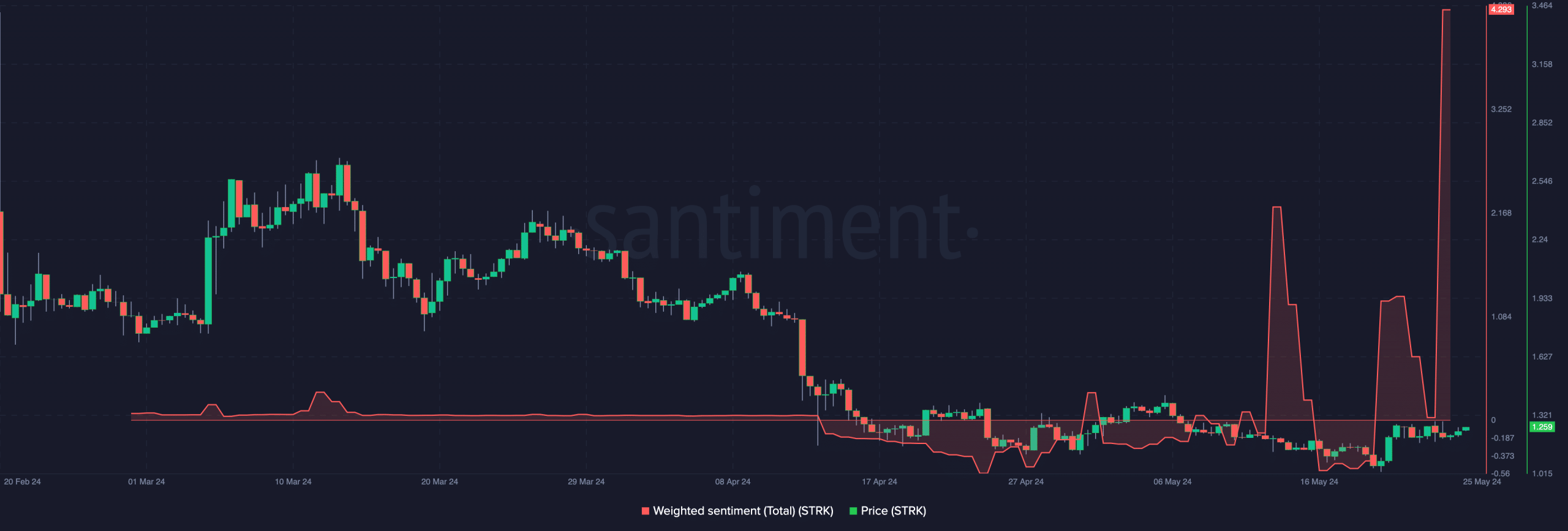

As a sentiment analysis expert, I’ve examined the Weighted Ssentiment score for Starknet. Currently, this metric stands at an impressive 4.293. This measurement reflects the balance of positive and negative comments circulating around Starknet within the crypto community.

As an analyst, I’ve observed that each unfavorable comment about STRK was followed by approximately four positive ones. If this sentiment persists, it could potentially drive the price of the token upward.

If the market takes a very optimistic view, the price of STRK could reach as high as $1.80. On the other hand, if the market turns pessimistic again, STRK may drop down to $1.06.

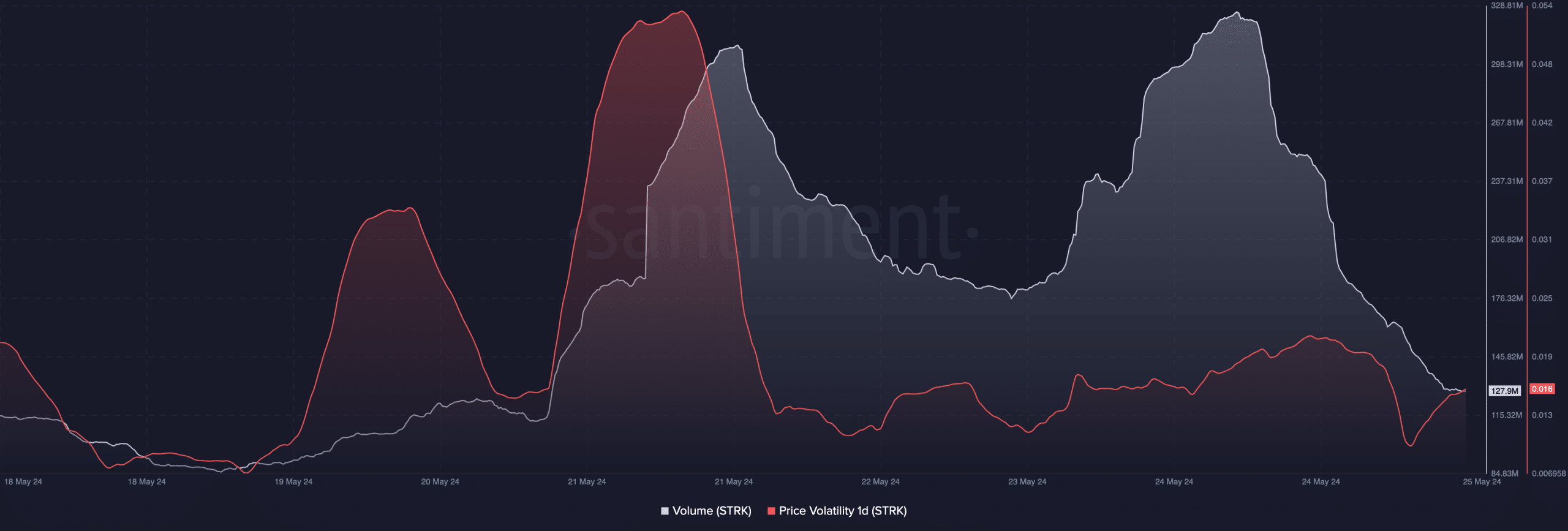

The bullish price forecast for STRK could be called into question based on volume indicators. Currently, the trading volume for STRK stands at approximately $127.90 million.

A significant drop occurred in the data from May 24th. The volume level is often indicative of investor attention towards a particular token or market’s vitality. Consequently, an uptick in trading volume is typically considered a positive sign that can boost the asset’s price.

The drop in Starknet’s trading volume despite its rising price indicates that the price hike may not be sustainable. If this prediction holds true, it could lead to a decrease in the token’s value and bring its price down to $1.06.

Meanwhile, volatility around the cryptocurrency increased, suggesting notable price fluctuations.

According to Santiment’s analysis, the reading suggested that the price increase of STRK above $1.50 several weeks ago may not have been solely driven by it.

Realistic or not, here’s STRK’s market cap in ETH terms

Regardless of the signals on-chain, market participants might need to keep an eye on ETH.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing correlation between Ethereum (ETH) and Starkware (STRK). If ETH reaches new heights, it is plausible that STRK could experience similar growth. However, if Ethereum fails to rally and instead underperforms, STRK might face a challenging time as well. This relationship is reflected in the beta coefficient of STRK relative to ETH.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-26 09:11