- SHIB’s next price point may be under $0.00002

However, if bullish momentum climbs, the memecoin may exchange hands above $0.00003

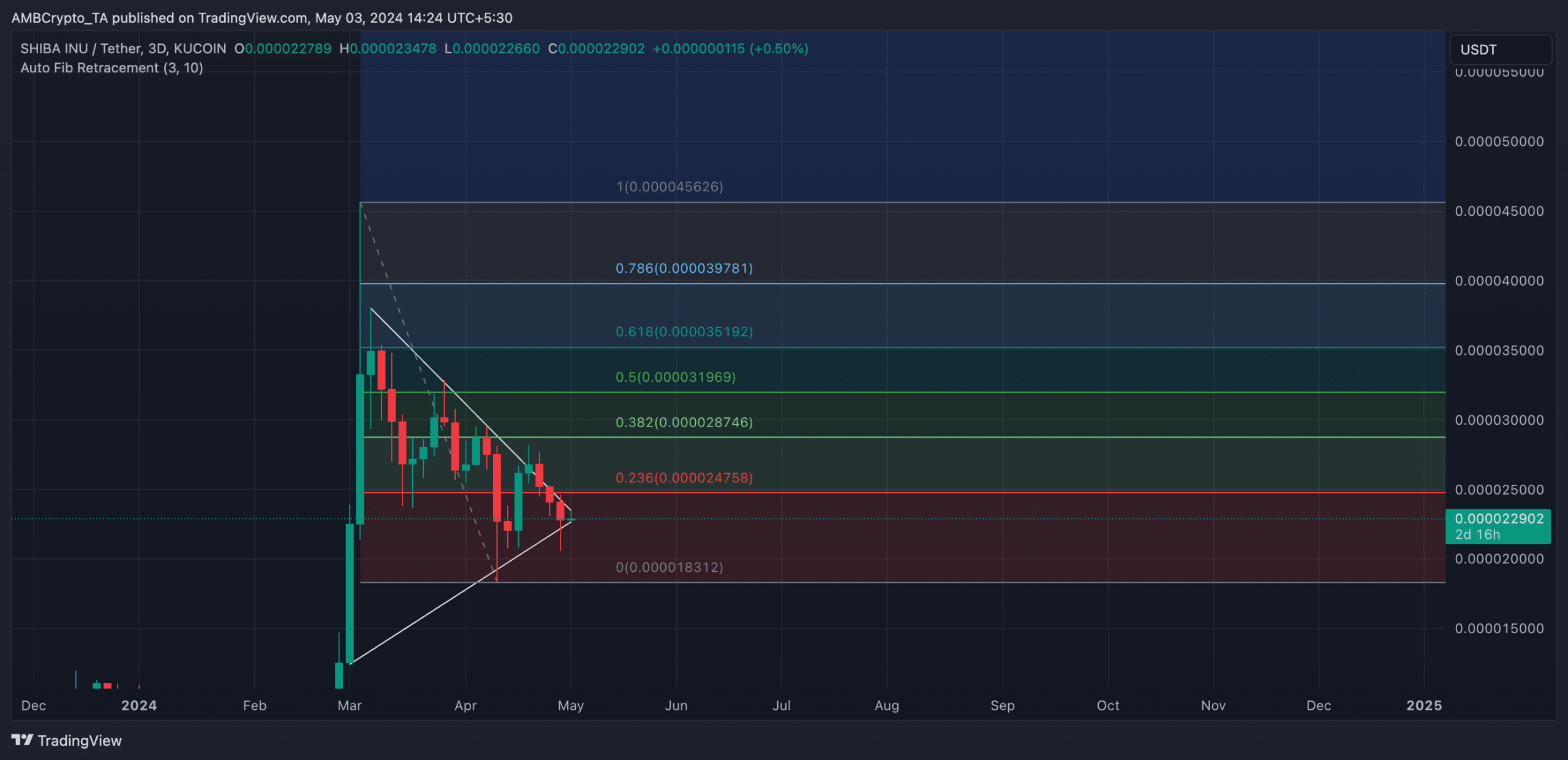

As an experienced analyst, I believe that Shiba Inu (SHIB) is currently facing a significant downward pressure due to various reasons. Based on my analysis of the 3-day chart, SHIB is forming a descending triangle pattern, which could lead to either a breakdown below support or a breakout above resistance.

A closer look at Shiba Inu‘s [SHIB] price action over the past three days reveals the emergence of a descending triangle pattern. This configuration occurs when a stock or cryptocurrency is trapped within a symmetrical triangle formed by a series of lower highs and higher lows on the chart.

The value of an asset may fall below its underlying support level, leading to further decreases, or it could surge past resistance and begin a new upward trend.

What next for SHIB?

As a researcher studying the cryptocurrency market, I analyzed AMBCrypto’s Fibonacci retracement data for SHIB and found that if bears continue to apply pressure on its price and SHIB breaks below its current support level, it could potentially decline by approximately 18%, reaching a low of $0.000018.

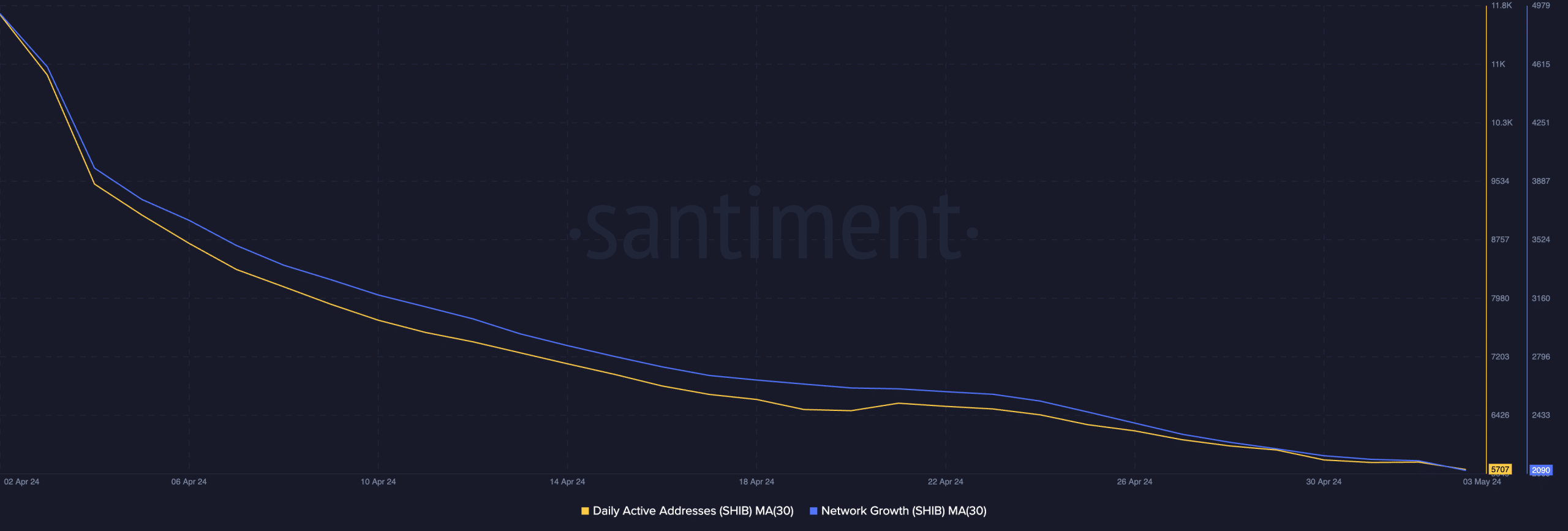

As a crypto investor, I’ve noticed a troubling trend with SHIB. The coin’s demand seems to be waning, and according to Santiment’s data, this is reflected in the daily active addresses. Over the past month, the number of daily active addresses involved in SHIB transactions has dropped by an alarming 56%. This decline could potentially continue as investor interest in SHIB appears to be dwindling.

As an analyst, I’ve observed a significant decrease in the demand for SHIB, as evidenced by a 51% drop in the number of new addresses created daily for trading this memecoin, based on data from a reputable on-chain provider.

As a researcher studying market trends, I have observed that a consistent decrease in the number of active addresses engaged in trading a particular asset can serve as an early indicator of reduced trading volume. Over time, this trend puts increasing pressure on the asset’s price.

The predicted fall below $0.0002 is possible if SHIB continues to record a decline in its demand.

Read Shiba Inu (SHIB) Price Prediction 2024-25

As a researcher studying the cryptocurrency market, I’ve noticed that Shiba Inu (SHIB) has a significant Market Value to Realized Value (MVRV) ratio. This means that the current market value of SHIB is higher than the average price at which its coins were bought by investors. Consequently, there is a risk that investors who purchased SHIB at lower prices may choose to sell their holdings, leading to increased selling pressure on the asset.

At the current moment of reporting, SHIB‘s MVRV ratio stood at 38.28%, signaling an upward trend. When an asset exhibits a positive MVRV ratio like this, it is considered overvalued. Consequently, a substantial number of investors are in profit, leading to a strong incentive to sell and realize those gains.

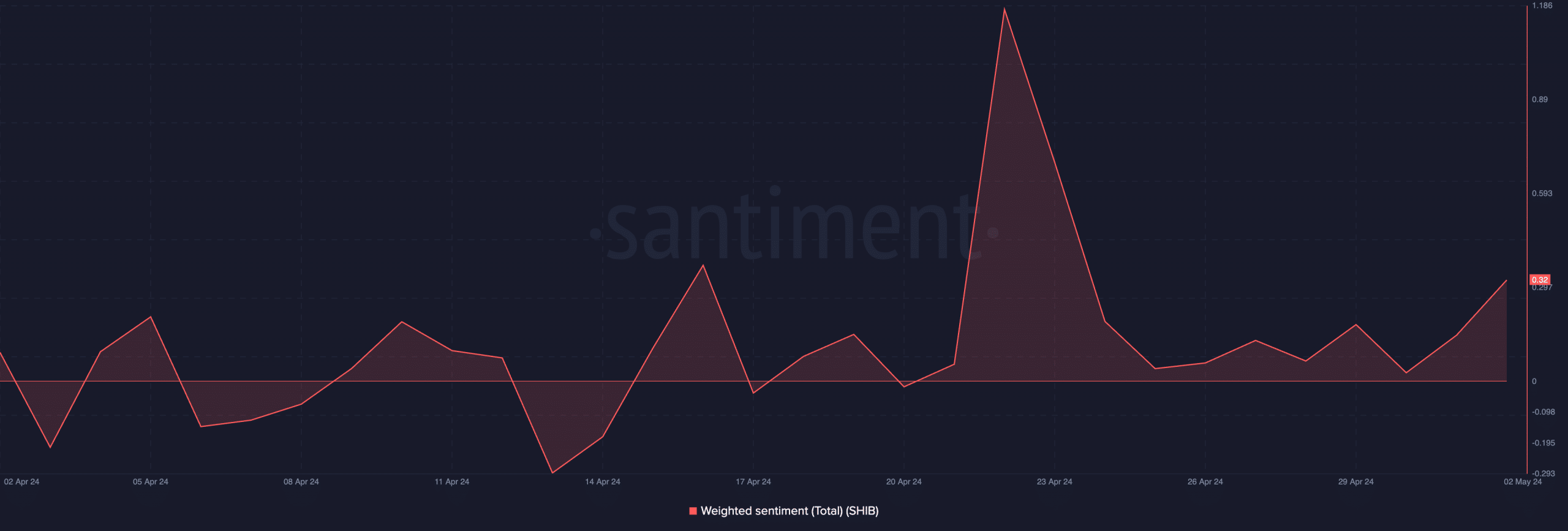

Despite a recent drop in SHIB‘s value, there has been a resurgence of optimistic feelings among investors. For example, the coin’s net sentiment has been positive as of the latest update, and this trend started around April 30th.

As a researcher studying the Shiba Inu (SHIB) cryptocurrency market, I’ve noticed a bullish trend emerging. If this sentiment continues, SHIB’s price may shatter its current trading range and surge towards $0.00003 on the charts.

Read More

- BRETT PREDICTION. BRETT cryptocurrency

- PHB PREDICTION. PHB cryptocurrency

- ADA PREDICTION. ADA cryptocurrency

- RBN PREDICTION. RBN cryptocurrency

- MFER PREDICTION. MFER cryptocurrency

- 6-month low Ethereum fees suggest altseason is inbound: Santiment

- GMEE PREDICTION. GMEE cryptocurrency

- ZKasino scam suspect arrested, $12.2M seized by Dutch authorities

- AVAX PREDICTION. AVAX cryptocurrency

- GFT PREDICTION. GFT cryptocurrency

2024-05-04 08:07