-

A whale bought 243,198 UNI tokens, signaling potential bullish momentum as Uniswap’s price rebounded from a key support.

UNI targeted a 44% surge, aligning with resistance levels, driven by substantial whale accumulation and market trends.

Based on my analysis as an experienced financial analyst, I believe that the recent whale transaction buying 243,198 UNI tokens is a positive sign for Uniswap’s price momentum. The substantial accumulation by this investor aligns with the potential bullish trend and could lead to a significant surge towards resistance levels.

As a crypto investor, I’ve noticed that Uniswap (UNI) bounced back from a critical support level recently. This recovery came after a significant whale or institutional purchase was detected by Lookonchain. Specifically, a large investor shelled out 2 million USDC to amass 243,198 UNI tokens in a single transaction.

An investor transferred $2 million worth of USDC into a Kraken account, subsequently withdrawing around $1.96 million in UNI tokens, roughly equivalent to the current market value, less than an hour before Lookonchain’s analysis was released.

Furthermore, that very same whale transferred $4 million in USDC to Kraken and retrieved approximately $3.6 million worth of AAVE tokens (withdrawing around 35,983 AAVE tokens) and about $1 million worth of UNI tokens (corresponding to 123,183 UNI tokens).

The significant trades indicated a greater likelihood that UNI would experience a bullish turnaround, as it surpassed important resistance thresholds.

Uniswap: Price and trading volume

At the moment of checking, Coingecko reported that UNI was valued at $8.00. The total trading volume for this coin within the last day reached $146,641,362. This figure represents a 1.50% decrease in price over the previous 24 hours and a 1.18% reduction in value over the past week.

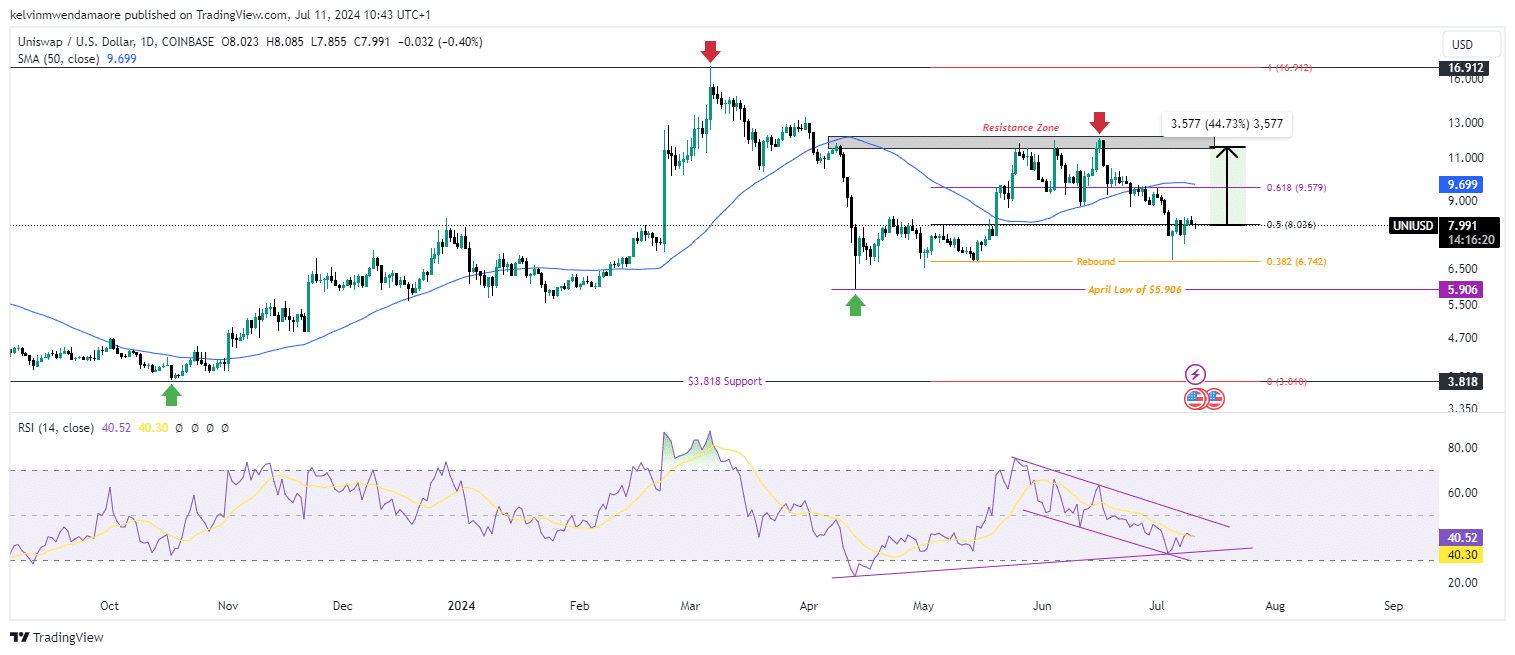

As an analyst, I’ve observed that the price has experienced a downturn lately, but it has remained stuck in a resistance area, fluctuating between around $9.5 and $12. Previously, it had reached a high of approximately $16.912.

As a crypto investor observing the current market situation, I notice that the Relative Strength Index (RSI) for UNI is at 40.52 as we speak. This indicates that the market might be nearing oversold territory.

In simpler terms, finding a descending triangle formation on the Relative Strength Index (RSI) chart may signal that the market is either preparing for a pause in its decline or is set for more downtrend.

I analyzed the market data and identified a potential increase of around 44%. This surge aimed at pushing the price from $7.991 upwards towards roughly $11.57, which is situated at the upper limit of the resistance zone.

Additionally, the 50-day moving average (SMA) was priced at $9.699 as of the latest update, and the stock has just dipped beneath this level. This could potentially signal a brief downturn in the market trend.

Two significant levels of support for observation are situated at $5.906 and $3.818, whereas the resistance levels can be found approximately at $9.5 and $12.

Based on the price movements and RSI indications, it would be advisable for traders to keep an eye on the market for potential bullish signals if the resistance level is breached, or bearish signs if the support levels give way.

On-Chain activity and market trends

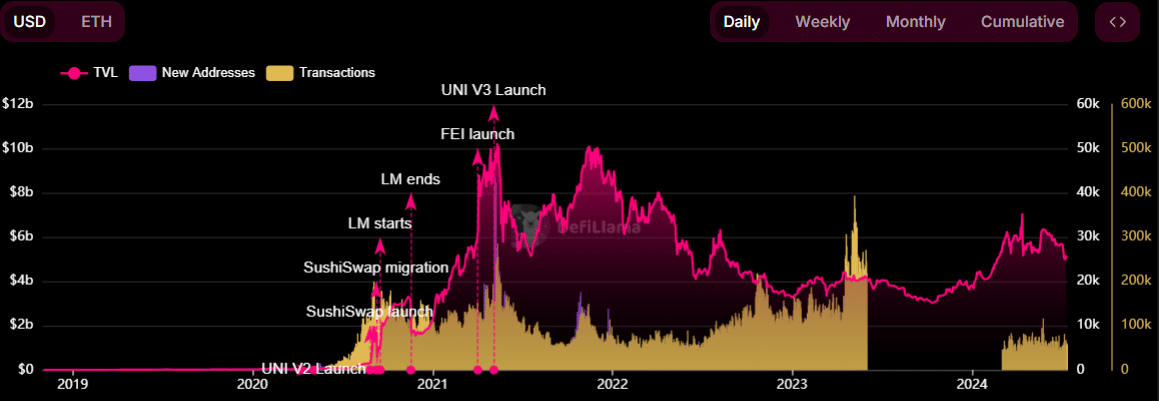

According to DefiLlama, the Total Value Locked (TVL) of UNI was $5.174 billion.

During the monitored timeframe, Total Value Locked (TVL) exhibited variations, attaining significant spikes during pivotal moments like the UNI V3 debut and the FEI initiation, peaking at approximately $9.8 billion.

After these peaks, TVL declined and stabilized at the current value as of mid-2023.

As an analyst, I’ve noticed that the newly added UNI addresses exhibited patterns aligned with significant events. For instance, a noticeable increase in new addresses emerged around the UNI V3 launch, suggesting heightened user curiosity and uptake.

After these occurrences, this trend experienced a drop, coinciding with the general decrease in trading activity across the market.

The trend in transaction amounts closely mirrored Total Value Locked (TVL), showing notable peaks corresponding to key occurrences. A surge in transactions took place during the UNI V3 rollout and the liquidity mining campaigns.

As I delved deeper into the data, I noticed that after hitting peak levels, the volume of transactions began to wane. This suggested a decrease in the number of trades being executed and a corresponding decline in market liquidity.

I, as an analyst, have observed that Uniswap Labs voiced concerns regarding the US Securities and Exchange Commission’s (SEC) proposed amendments. These changes could potentially broaden the definition of “exchange” and expand the SEC’s jurisdiction over Decentralized Finance (DeFi).

This regulatory concern added another layer of uncertainty to the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-07-11 23:04