- DEEP surged over 550% in its debut week.

- Can the Sui-based altcoin’s uptrend amid mixed signals?

As a seasoned crypto investor with scars from the 2017 bull run and the 2020 DeFi summer, I’ve learned to approach every new project with a mix of excitement and skepticism. The meteoric rise of DeepBook’s DEEP token is certainly intriguing, but it’s also a reminder that past performance is no guarantee of future results.

On October 14th, the highly anticipated third version of DeepBook (DeepBook V3) – a supposedly groundbreaking decentralized exchange (DEX) – was launched on the Sui network for the first time.

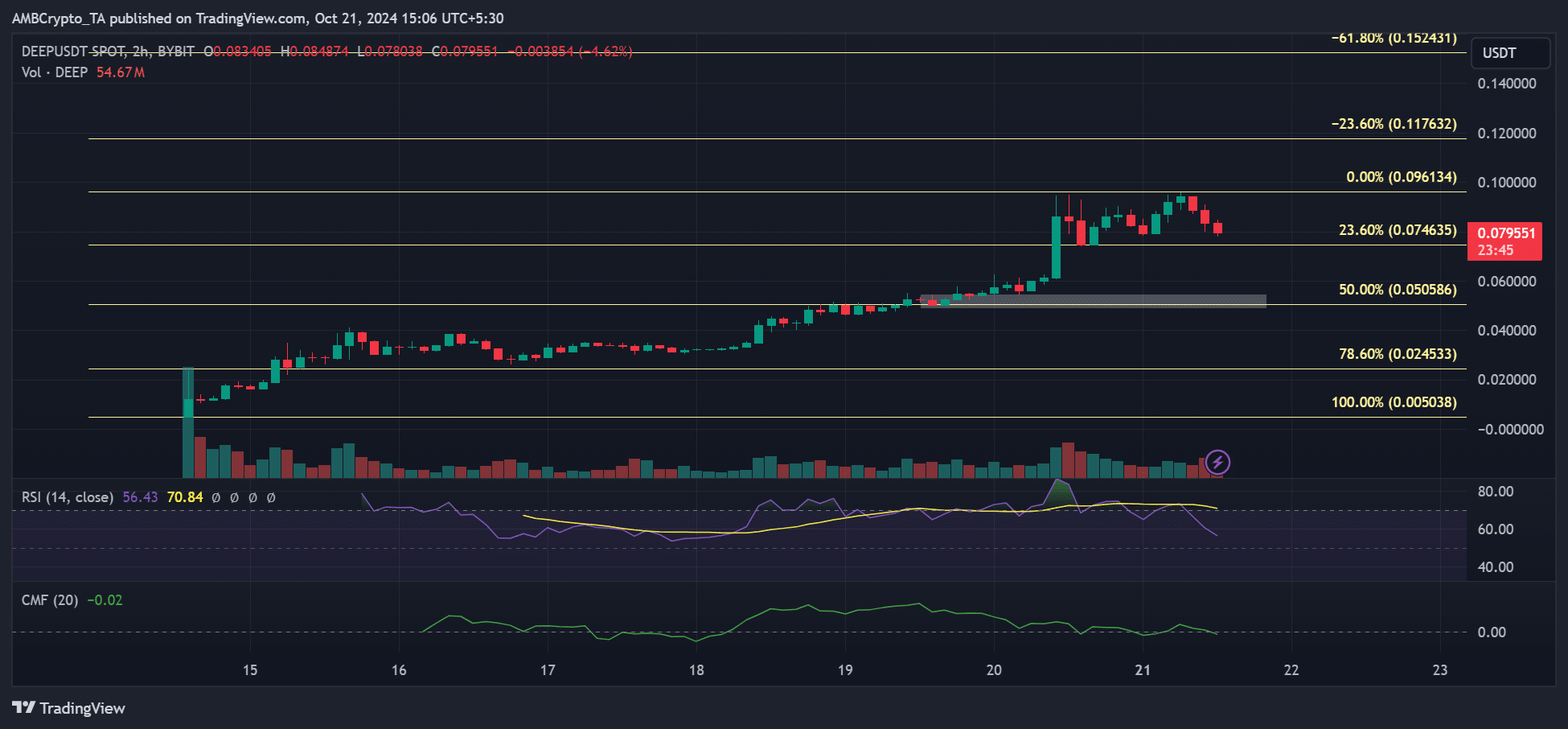

Its native token, DEEP, was also launched on the same day and gained over 550% last week. The altcoin jumped from $0.016 to $0.09, a wild 5x rally, but was defending $0.08 at press time.

As per the team’s statement, one potential factor driving up DEEP’s price could be its extensive application within the Sui DeFi platform.

It’s the protocol’s governance token but can also be staked for rewards and trading fee rebates.

DeepBook allows payment of trading fees, offering reduced costs for frequent traders as an encouragement. This mechanism boosts user engagement and improves efficiency by increasing liquidity in the process.

In addition, the DeepBook DEX utilizes a central limit order book (CLOB) system to maintain low fees, taking advantage of Sui’s efficient architecture.

Per the team, this rivals common DEX, which leverages AMM (automated market makers) like Uniswap.

Automated Market Makers (AMMs) provided DeFi with an early advantage, but now, thanks to Central Limit Order Books (CLOBs), we’re enhancing the DeFi experience even further. Built for longevity, our system offers reduced slippage, extensive liquidity, and precision – tailored to your preferences.

Will DEEP’s rally continue?

On October 20th, the token experienced a significant surge of 49%, contributing to its strong initial week’s showing.

Although there’s a minor dip observed currently, the general opinion among investors, as seen on CoinMarketCap, is largely optimistic about the token.

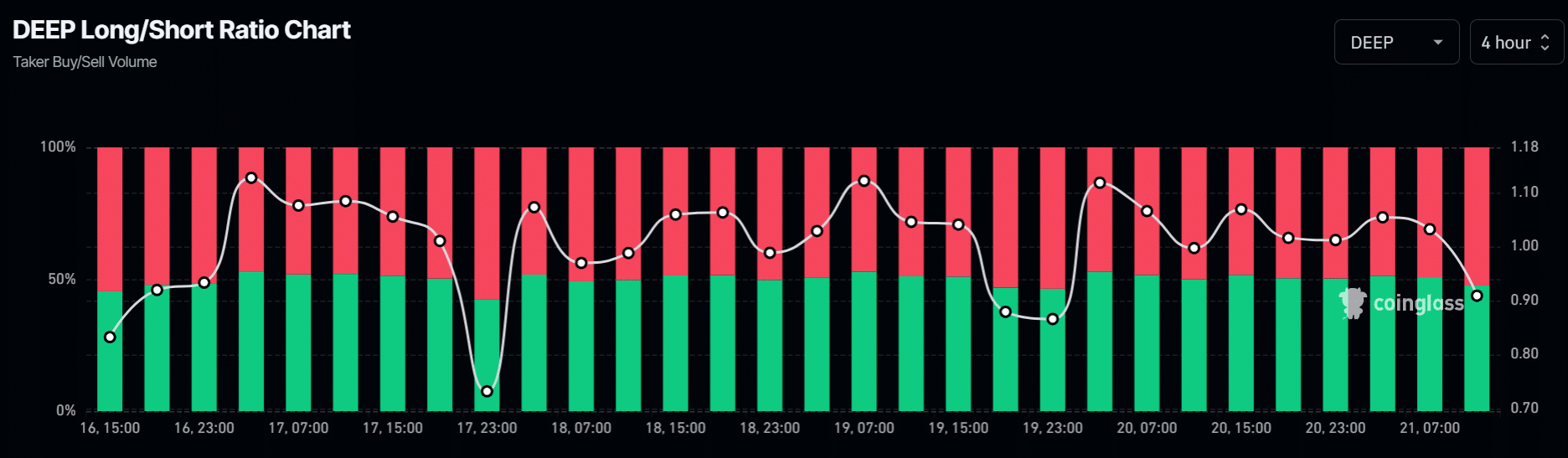

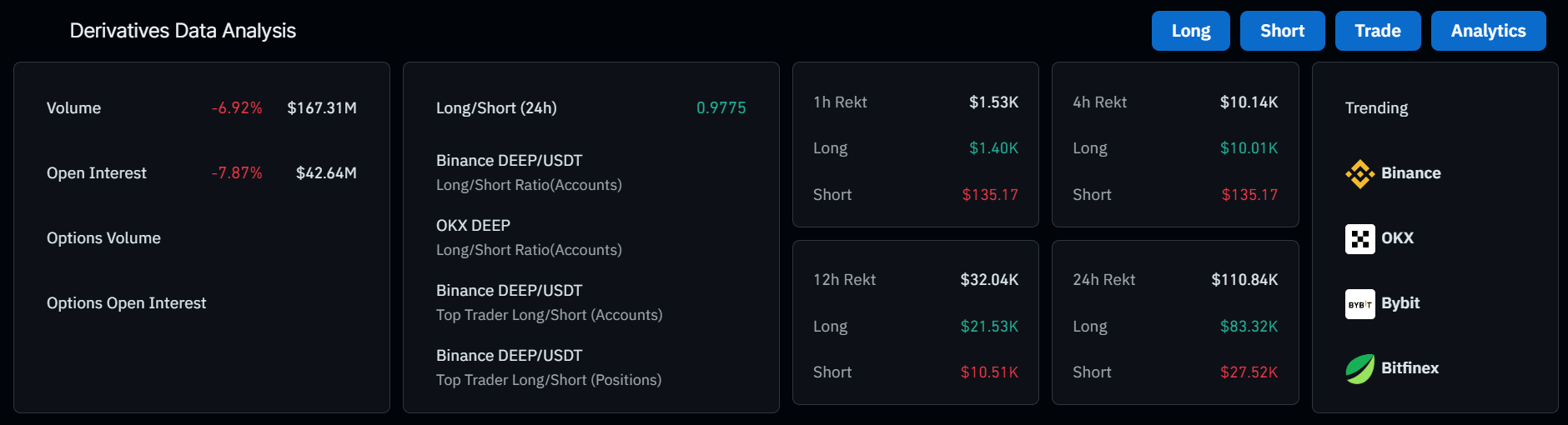

However, traders’ positioning showed significant speculators were shorting the asset. Per Coinglass’s Long/Short ratio, 52% of positions were shorting DEEP, reinforcing a slightly bearish tilt.

A similar short-term bearish sentiment was evident, as seen by a decline in Open Interest (OI).

It was down nearly 8%, reinforcing the capital outflows from the DEEP Futures market.

In essence, when the Open Interest (OI) decreases, it often indicates that speculators are losing enthusiasm for the asset. This decline in interest might accelerate the downtrend, potentially causing the DEEP price to drop further.

Furthermore, there were more instances where long positions were closed out than short ones, which strengthens the temporary bullish negative perspective.

Read DeepBook [DEEP] Price Prediction 2024 – 2025

If the downward trend continues for a while, the price of DEEP might decrease toward $0.05, which is a significant 50% Fibonacci retracement level. This could happen more significantly if DEEP falls below $0.08.

Should this market continue its upward trend, I anticipate we might reach approximately $0.11. Therefore, it’s crucial to keep a close eye on the $0.05 and $0.11 price points in the near future as they could significantly impact our short-term outlook.

Read More

2024-10-21 23:04