-

Uniswap Labs is opposing SEC’s rule change to expand the definition of ‘exchange’

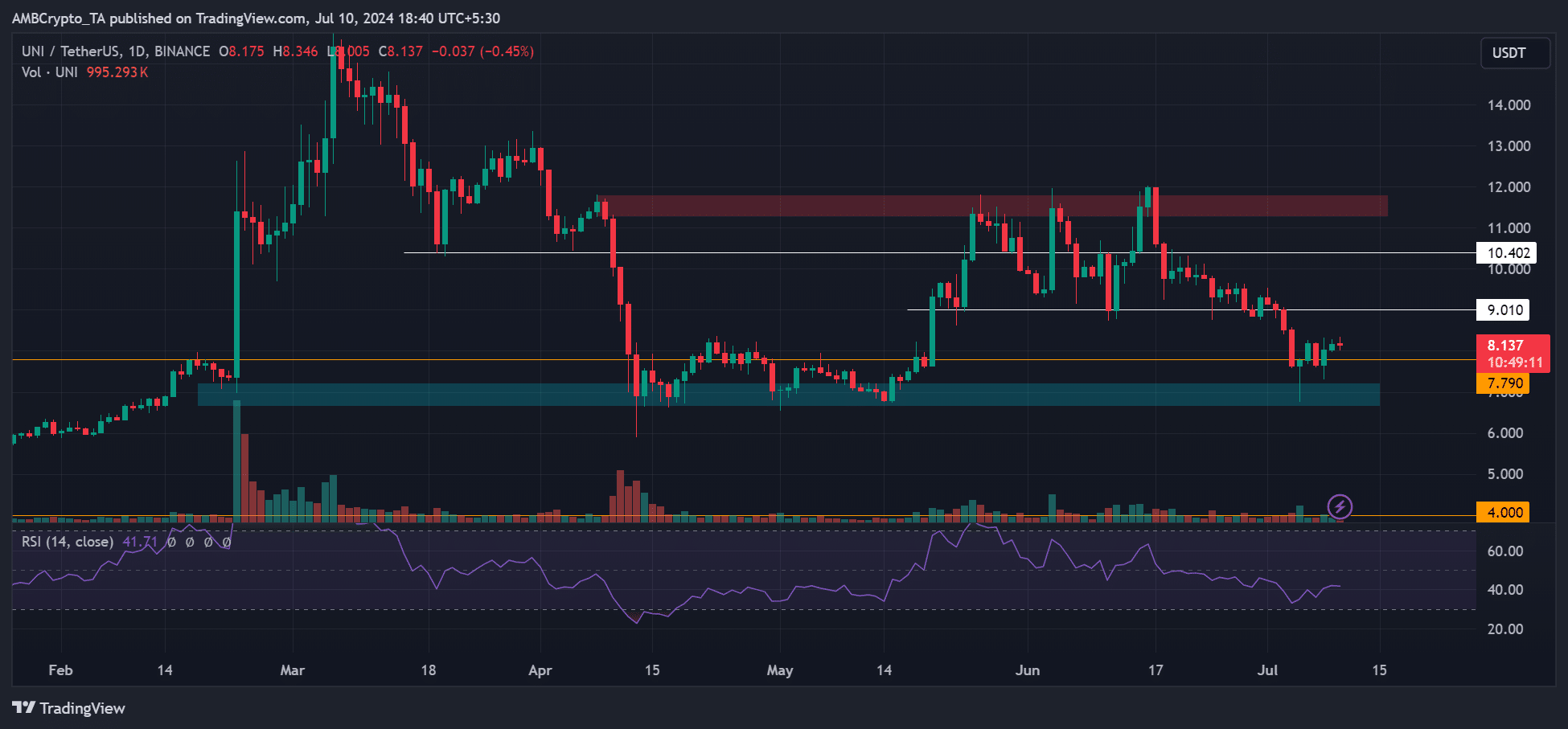

UNI has been swinging between $6 and $12 since April

As an analyst with a background in DeFi and crypto regulation, I’m closely following Uniswap Labs’ stance against the SEC’s proposed rule change expanding the definition of ‘exchange.’ The potential implications for decentralized finance platforms like UNI are significant.

As a analyst, I’d express it this way: Uniswap Labs has voiced concerns about the potential expansions in the U.S. Securities and Exchange Commission’s (SEC) proposed amendments. These changes could broaden the definition of an “exchange” and expand the SEC’s jurisdiction over Decentralized Finance (DeFi).

Providing insight into the SEC’s action, Katherin Minarik, the company’s Legal Officer, commented on behalf of Uniswap’s firm.

As a dedicated researcher studying the dynamic landscape of Decentralized Finance (DeFi), I strongly advocate for the consideration of Uniswap Labs’ perspective. They have recently expressed their concerns to the Securities and Exchange Commission (SEC), urging them to reconsider the proposed rulemaking that aims to expand the definition of an “exchange” in a manner that could inappropriately incorporate DeFi platforms. This expansion, according to Uniswap Labs, could potentially disrupt the current growth trajectory and innovative nature of this burgeoning sector.

As a crypto investor, I’ve noticed that regulatory bodies like the Securities and Exchange Commission (SEC) have been working on broadening the scope of what constitutes an exchange, as outlined in the Exchange Act of 1934. The SEC has expressed intentions to include Decentralized Finance (DeFi) platforms within this expansion, as indicated by their proposed amendments released in April 2023.

As a crypto investor, I understand that the Securities and Exchange Commission (SEC) has proposed an expanded definition of what constitutes a “digital asset exchange.” This would mean that Decentralized Finance (DeFi) platforms, like Uniswap, could potentially fall under the SEC’s jurisdiction. However, in my opinion, this expansion is unnecessary according to Uniswap Labs, as the SEC may not have the authority to make such broad interpretations of the term “exchange.”

As an analyst, I would argue that the SEC and the industry could potentially yield more beneficial outcomes by channeling their resources towards alternative avenues rather than engaging in prolonged litigation over an allegedly unlawful rule.

Lastly, Uniswap Labs argued that this action could enable the SEC to proceed with regulation through enforcement, an idea that has caused apprehension within the crypto sector.

UNI’s price action

After being served a Wells Notice by the Securities and Exchange Commission in April 2024, the value of the altcoin has plummeted by more than 40%. Its price has fallen from approximately $12 to around $6, with the significant support level indicated by cyan.

In the United States, where regulation became clearer, the price surged back up to $12. Nevertheless, a prevailing pessimistic attitude caused it to retreat once more to the demand zone in July.

Hence, the question – Will UNI retest the supply zone (red) near $12 again?

As an analyst observing the charts, I noticed that the Relative Strength Index (RSI) showed improvement. This enhancement is typically indicative of escalating buying pressure. However, it’s important to note that the RSI still hovered below the neutral threshold. Consequently, this condition might prolong the recovery process in the near term.

Additionally, the latest whale transactions may obstruct UNI‘s progress towards recovery and push back the bullish momentum aiming for the $12 price level.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

2024-07-11 07:03