-

OP_NET testnet’s launch is expected to happen on Wednesday

Development expected to push Bitcoin into “programmable future”

As a seasoned crypto investor with a decade-long journey under my belt, I can’t help but feel a surge of anticipation as the OP_Net testnet is set to launch on Wednesday. Having witnessed the evolution of Bitcoin from a digital currency to a potential DeFi powerhouse, I find myself standing at the precipice of another significant milestone.

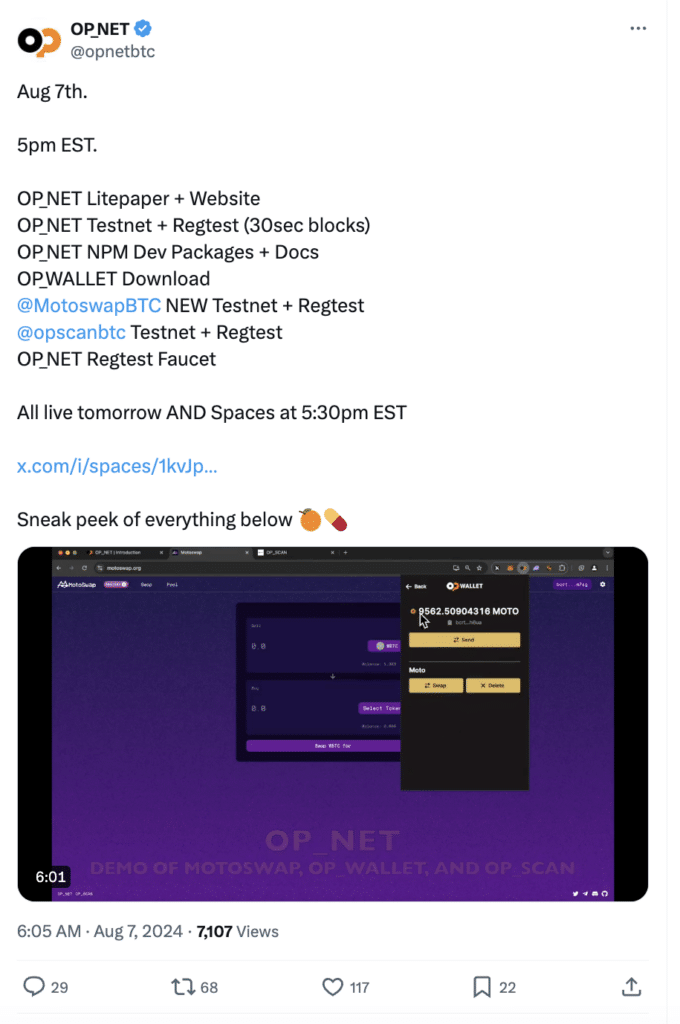

A innovative Decentralized Finance (DeFi) project is about to be introduced onto the Bitcoin blockchain, intending to utilize Bitcoin’s strength for DeFi operations. The OP_Net test network, spearheaded by Co-founder Chad Master and his team of developers, is scheduled to go live on August 7th.

People think that this could push Bitcoin towards a “customizable tomorrow,” providing functions that go beyond its present role as a digital money.

On this test network, we’ve included features similar to the Taproot update – a significant improvement that has boosted Bitcoin’s existing capabilities in terms of privacy and efficiency.

The mainnet launch is expected sometime in late September.

On other DeFi platforms, it’s common to use sidechain tokens for transactions, but with OP_Net, users will transact using actual Bitcoins for transaction fees. Furthermore, the testnet will offer support for both standard and non-standard assets (NFTs), thereby expanding the variety of financial tools accessible on Bitcoin’s blockchain.

In a conversation with Decrypt, Chad Master proposed that the OP_NET virtual machine functions similarly to an Ethereum Virtual Machine (EVM).

It’s important to note that the executive anticipates the possibility of fraudulent activities such as scams and Ponzi schemes due to the characteristics of the protocol. As he states, this is his expectation.

“While we’re not interested in initiating them ourselves, we do require a setting that allows for their deployment.”

The buzz about Bitcoin delving into Decentralized Finance (DeFi) lies in the possibility of building upon earlier triumphs while benefiting from past hurdles. For example, the Taproot update was widely praised as a substantial advancement for Bitcoin, boosting transaction speed and privacy.

As a researcher delving into the realm of cryptocurrency, I’ve observed a blend of success and challenges with innovations like Ordinals and Runes. Ordinals, designed to bolster Bitcoin’s scripting abilities, encountered obstacles in terms of adoption and complexity. The journey of Runes, which facilitated token issuance on the Bitcoin blockchain, hasn’t been smooth either, primarily due to its limited functionality when compared to other robust blockchain platforms.

DeFi’s the next step?

Even with these difficulties, the crypto community continues to be hopeful about Bitcoin’s potential in the realm of Decentralized Finance (DeFi). The robust security structure and global acknowledgment of Bitcoin make it a desirable base for developing decentralized apps.

Indeed, it’s commonly thought that by incorporating Decentralized Finance (DeFi) features directly onto the Bitcoin blockchain, we might create a safer and stronger option compared to existing systems that frequently utilize less secure sidechains or other blockchains.

The excitement is further intensified by the widespread achievement of Decentralized Finance (DeFi) on other blockchains like Ethereum. The DeFi environment on Ethereum has showcased the transformative power of decentralized finance, providing platforms for decentralized lending, borrowing, trading, and farming yields.

If Bitcoin manages to incorporate comparable features, it might attract a large user base that values its security and reputation.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-07 11:03